Posted on 04/17/2011 6:08:36 PM PDT by SeekAndFind

The fastest way to make the tax-averse incensed is to tell them that nearly half of U.S. households end up owing no federal income tax when all is said and done.

But like most statistics, it is often misunderstood -- and, in the case of those trying to stir political outrage, misrepresented.

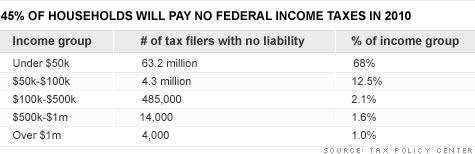

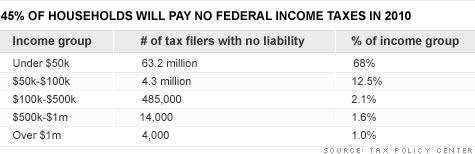

For tax year 2010, roughly 45% of households, or about 69 million, will end up owing nothing in federal income tax, according to estimates by the nonpartisan Tax Policy Center. Some in that group will even end up getting paid money from the federal government.

That does not mean such households end up paying no taxes whatsoever. For instance, those in the group still pay other taxes such as state and local income taxes, as well as property and sales taxes.

And the group doesn't necessarily get off scot-free when it comes to payroll taxes -- which support Social Security and Medicare.

More than two-thirds -- or 49 million of the 69 million households -- pay payroll tax. Of those, 34 million end up paying more in payroll taxes than they get back on their federal return. The other 15 million pay payroll tax but they get enough refundable credits to offset what they paid.

Contrary to what many assume, membership in the group isn't restricted to the poor.

It's true that the vast majority of the 69 million households make less than $50,000 -- with very heavy representation among households making less than $30,000.

But nearly 5 million households in the group make somewhere between $50,000 and more than $1 million.

Very high-income households can fall into the non-payer group if they get their income from tax-exempt bonds or overseas sources for which they get foreign tax credits, according to Roberton Williams,

(Excerpt) Read more at money.cnn.com ...

So how will you get some revenues out of ‘em? Send ‘em to the rendering plants and pet food shelves for government employees to buy, perhaps?

Oh...forgot. Government employees, bigger revenues in, littler taxes out.

BTTT

It worked. I’m incensed!!!!!!!!!!!!!!!!!!!!!

We do not pay any income taxes, but when we purchas anything we pay taxes on that. Our income is va & ss disabality, both are non taxable.

Didn't happen to me thankfully, but it's been an incredible year ~ never thought my deductible medical costs would be as high as they are! I'd normally done my taxes late in the previous year then make a calculated decision about paying any excess early or late depending on the adantage.

This year I couldn't even read the IRS booklets until late February and there was all sorts of new stuff that I still haven't sorted out in my mind. Following the advice of other blind folks I've asked IRS some specific questions ~ in the meantime going ahead and filing.

So, who are the blind? Well, the deal is that your best vision in your best eye can't be better than 20/200 even corrected ~ and I was there for most of a year. Then, they cut off the medications and my best actually got down to 20/15 ~ and even my worst, under my tightest control, and moving my eye back and forth, I can pass a driving test ~ no doubt you all want me on the road eh!

Bwahahahahaha

The Internet lets me blow the words up to where it's better than any lens I can buy ~ and is my prosthetic letting me into the real world beyond the darkened living room.

Looking over stories on the net it looks like there are hundreds of thousands of folks with decent incomes who turn up blind ~ permanently ~ every year ~ and even they don't stop paying taxes ~ this nation taxes blind folks.

The deal seems to be to encourage those with impaired vision to get hired help.

Most interesting ~ not the policy I thought it was, but what else could it be?

I'm pretty sure Hannity is targeting blind people in his rants about people not paying income tax.

He's building up a very large supply of negative kharma. Wouldn't get too close to him just in case he gets some early blowback.

In reality, payroll taxes are exactly the same thing as income taxes; money taken from the the individual that disappears into a black hole, never to be seen again. But to admit this obvious fact, in defense of those paying no income taxes, is to admit that a good portion of their world view is fantasy or fraud.

My S.S. is taxed.

There's nothing equitable about our tax system.

You don't want to be limited to VA and SS disability payments.

You don't want to be blind either, but I bet you forgot that one. This morning you see. This evening you don't. Nobody trains you for that.

if only it were that easy

It’s ok, I paid enough for 3 or so households this year...

Ummm SS disability is taxable by the Feds. Apparently you just don’t have enough income overall to pay taxes.

I don’t buy this argument that people are being simply demonized because “they don’t pay any income taxes”.

So they pay Social Security taxes and a few other things. So do I. And so do many, many other people.

But I pay a boatload of INCOME tax beyond SS and other such things, while they do not. How does that make it anything other than redistribution?

(Very high-income households can fall into the non-payer group if they get their income from tax-exempt bonds or overseas sources for which they get foreign tax credits)

I can’t believe they mention the foreign tax credits as if it’s a loophole! For the record, I don’t get any of my income that way. However, the US is one of the few countries that taxes worldwide income. If a citizen from another country works in the US, that person only pays US taxes. If an American citizen works overseas, they get taxed by the IRS anyway, net of the taxes they paid overseas (there might be a certain amount shielded from income as well). If they change that “loophole”, and Americans can’t get away from the taxman even if they leave the country, these citizens will have to make a decision as to whether the US citizenship is even worth it. The IRS would then get nothing.

Sounds to me like the W4s were properly filed.

A big problem. These people are not overtaxed, although they may think so.

Democrats/Socialists will always be able to go to these voters and say: “Republican’s plan will make you pay more” when talking about proposed budget cuts like Medicare. This group will always (generally) see the wisdom of ‘tax increases on the rich’.

And they are still 'entitled' to Medicare and Social Security.

And, by the way, my disagreement was not with you personally, since I do think it is fair to keep in mind that people who don’t pay any Federal Income Tax do pay sales tax and other such taxes.

The problem is, income tax is obviously the major chunk of money going to the federal government. Everyone needs to pay, because as many people have pointed out, when people are free of that burden of having to pay anything, the exercise of voting for people who will increase taxes on the “other” people to pay for benefits “they” get takes on a completely different dynamic, even IF those people DO pay some kind of taxes.

So 45% have no skin in the game.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.