Skip to comments.

And Now Presenting:Amazing Satellite Images Of The Ghost Cities Of China[64M Vacant Homes]

businessinsider ^

| | Dec. 14, 2010, 4:15 PM

| Chandni Rathod and Gus Lubin

Posted on 12/14/2010 5:02:01 PM PST by fight_truth_decay

The hottest market in the hottest economy in the world is Chinese real estate. The big question is how vulnerable is this market to a crash.

One red flag is the vast number of vacant homes spread through China, by some estimates up to 64 million vacant homes.

We've tracked down satellite photos of these unnerving places, based on a report from Forensic Asia Limited. They call it a clear sign of a bubble: "There’s city after city full of empty streets and vast government buildings, some in the most inhospitable locations.

Click here to see the ghost towns

(Excerpt) Read more at businessinsider.com ...

TOPICS: Business/Economy; Culture/Society; Extended News; News/Current Events

KEYWORDS: china; chineserealestate; chna; ghost; ghosttowns; housing; prc; realestate; realestatebubble; towns

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-65 next last

To: lacrew

....the vast amounts of new stimulus money injected into the Chinese economy have been channeled, initially at least, into tangible assets rather than consumption, fueling skyrocketing prices for real estate, jade, fine art, fine wine, rare tea, etc. The price of gold, of course, is determined by global markets, that surging Chinese demand — consistent with the asset inflation – was contributing to the 27% run-up in gold prices this year.

Read more: http://www.businessinsider.com/a-crackdown-on-chinese-real-estate-will-push-all-that-liquidity-into-gold-2010-12#ixzz189HRLRFP

China imported 209.7 metric tons of gold in the first 10 months of the year, a fivefold increase compared with the same period last year. That surpassed purchases made by ETFs and surprised analysts, who until now had no clear insight into the size of China’s buying …

“Everybody in the gold market knew there was a surge in investment demand, but they didn’t know it was China,” said Jeff Christian, managing director at CPM Group

To: Michael Barnes

China’s emerging middle class sees real estate as a store of value. To many, buying an apartment in Shanghai or Beijing is like buying a bar of gold. And many — “too many,” Chanos says — have kept on buying as prices have gone up in the past five years.

Read more: http://www.businessinsider.com/a-crackdown-on-chinese-real-estate-will-push-all-that-liquidity-into-gold-2010-12#ixzz189IU8HfI

Unless they already possess offshore funds, Chinese citizens have limited investment choices: they can gamble on an unstable domestic stock market, buy low-yielding government bonds, or stash their cash in even lower-yielding bank deposits. By contrast, real estate—occupied or not—offers them a visibly reassuring place to park their money, sheltered from inflation … For them, an empty condo is a store of value, much like gold, another asset that performs no practical function besides retaining its worth.

To: fight_truth_decay

43

posted on

12/14/2010 8:15:23 PM PST

by

Quix

(Times are a changin' INSURE you have believed in your heart & confessed Jesus as Lord Come NtheFlesh)

To: Rebelbase

People need to go where the food is to live - not the buildings.

Scary and freeky pictures though.

Bet I could make a hell of a movie in one of those places.

44

posted on

12/14/2010 8:20:52 PM PST

by

AGreatPer

(Voting for the crazy conservative gave us Ronald Reagan....Ann Coulter)

To: The Comedian; Quix; Carry_Okie

Almost as if they are expecting a contagious disease to come through their country and they built these homes for the non contaminated.

Does China have an Agenda 21 program?

45

posted on

12/14/2010 9:18:55 PM PST

by

B4Ranch

(Do NOT remain seated until this ride comes to a full and complete stop! We're going the wrong way!)

To: B4Ranch

I don’t know if China has one of their own, or not.

I would assume that SOME of their most elite leaders are in on the globalists plans.

Some assert that the globalists have engineered a DNA specific pathogen or more than one . . . for killing off all noncaucasian races.

You can bet that the Chinese are working on the obverse of that.

What a wicked era we live in.

46

posted on

12/14/2010 9:22:26 PM PST

by

Quix

(Times are a changin' INSURE you have believed in your heart & confessed Jesus as Lord Come NtheFlesh)

To: B4Ranch

Have queried my China friend but I’m sure he won’t be clued in about any agenda 21 stuff. He might have some interesting comments on the empty towns.

47

posted on

12/14/2010 9:34:41 PM PST

by

Quix

(Times are a changin' INSURE you have believed in your heart & confessed Jesus as Lord Come NtheFlesh)

To: B4Ranch

Does China have an Agenda 21 program? Every nation on the surface of the planet has an Agenda 21, even if the current figureheads don't know it.

500 million total Earth population doesn't leave a lot of Chinese survivors.

Frowning takes 68 muscles.

Smiling takes 6.

Pulling this trigger takes 2.

I'm lazy.

48

posted on

12/14/2010 9:48:55 PM PST

by

The Comedian

(Government: Saving people from freedom since time immemorial.)

To: The Comedian; Quix

I don’t think will have an Agenda 21 program functioning by the name of Agenda 21. It should be named something else that accomplishes the same tasks.

49

posted on

12/14/2010 10:30:33 PM PST

by

B4Ranch

(Do NOT remain seated until this ride comes to a full and complete stop! We're going the wrong way!)

To: B4Ranch

Of course . . .

I’m wondering . . .

Has the oligarchy already clued China in as to which population centers are going to be nuked in the coming war?

Are the new empty towns . . . all ready for the survivors to move into?

Interesting conjectures possible with such raw material.

50

posted on

12/14/2010 10:35:47 PM PST

by

Quix

(Times are a changin' INSURE you have believed in your heart & confessed Jesus as Lord Come NtheFlesh)

To: B4Ranch

Does China have an Agenda 21 program? You betcha.

51

posted on

12/14/2010 10:49:24 PM PST

by

Carry_Okie

(The environment is too complex and too important to manage by central planning.)

To: fight_truth_decay; 444Flyer

What’s the life expectancy of these buildings? The row in the photo has a distinct dominoes kind of vibe to it. Maybe they are death chambers er education facilities built to certain... earthquake specifications.

52

posted on

12/14/2010 11:15:21 PM PST

by

Ezekiel

(The Obama-nation began with the Inauguration of Desolation.)

To: Ezekiel

The Palestinians are looking for a state? SOLVED! Move them from Gaza and the West Bank and give them some of China's ghost cities. They can have a city state like Singapore.

If they still want to act like psychos, the Chinese know how to deal with Muslim psychos

53

posted on

12/14/2010 11:37:56 PM PST

by

MasterGunner01

(To err is human; to forgive is not our policy. -- SEAL Team SIX)

To: Quix

To: WilliamofCarmichael

".....the banking sector is dominated by state-owned banks that can lend at will at low cost certainly has its advantages, and is a prime reason why China's economy may be expected to continue to grow in the 9-10 percent range for the coming decade and beyond."

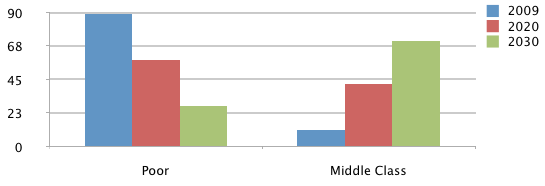

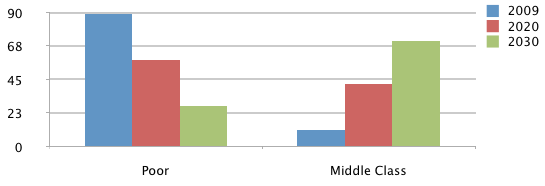

".....the banking sector is dominated by state-owned banks that can lend at will at low cost certainly has its advantages, and is a prime reason why China's economy may be expected to continue to grow in the 9-10 percent range for the coming decade and beyond." "Another reason is that China's population is becoming wealthier -- and not just in the country's coastal cities. A 2010 report by the Brookings Institution says that China's middle class is poised to rise significantly not only because of the country's economic growth rate, but because more Chinese are continuing to break out of the ranks of poor. It is estimated that consumer driven domestic consumption will account for up to 50 percent of GDP by 2015, up from 33 percent last year. That is a guarantee of high growth going forward."- Hufffington Post, 12-15-10

To: MeganC

Overbuilding is not a prime concern in China. Some call it an economic strategy.

This is a nation of spanking new office towers and hotels and luxury apartment complexes, many built on spec, many financed with state-subsidized loans, or on state-subsidized property, or with low-cost steel from mills built with state subsidies. Many are more empty than full.

According to Colliers International, a real estate firm, Beijing’s central business district offices will stand roughly 38 percent vacant this year. That’s 12 points higher than the figure for San Bernardino, Calif., which the advisory firm REIS says was the worst major office market in America in the last quarter of 2009.

Yet what seems awful in San Bernardino is the norm in effervescent Beijing. Real estate speculation here is rampant, many experts agree that housing and finance are riding bubbles, and everyone expects a big reckoning somewhere — a year? two? — down the line. But there was a reckoning after the Asia panic in 1999, and another reckoning in 2004, and both times the government bailed out the big state-owned banks, and the boom went on.

Indeed, the government forgave the Agricultural Bank of China $120 billion in sour loans just last October without a peep of public protest.

If you build it, the feeling is, they will come. Eventually, in a nation this large, someone will fill the convention center and the water park. And if not, well, build it anyway. Building creates jobs, and feeds prestige, and pumps up the GDP. Here in the nation that is too big to fail, as long as the bad loans don’t overwhelm the good, the waste is tolerable.

“That, to me, is the essence of the Chinese strategy,” Eswar Prasad, a Cornell University professor and a former head of the International Monetary Fund’s China division, said in a recent telephone interview. “Just keep the machine going fast enough.”

http://www.nytimes.com/2010/02/07/weekinreview/07wines.html

To: B4Ranch; The Comedian; Quix; Carry_Okie

To: wheresmyusa

58

posted on

12/15/2010 12:12:47 PM PST

by

B4Ranch

(Do NOT remain seated until this ride comes to a full and complete stop! We're going the wrong way!)

To: fight_truth_decay

RE: "consumption will account for up to 50 percent of GDP by 2015, up from 33 percent last year"

Great for the 400 million or so.. but what about the per capita consumption of the 800 million rural citizens? Things are going swimmingly and no more civil unrest?

.. and what happens to the rural poor when they go to work in the cities? I think they've about had it up to here.. and who are the wealthy in Red China? "factory owners are mostly privileged children of party officials -- 90 per cent of China's billionaires are the children of senior cadres"

The day China's sweatshop workers rose up in mutiny and looted the plant

BTW, "consumption will account for up to 50 percent of GDP by 2015," if it had been say 1990 that Deng's "Socialism with Chinese Characteristics" had that kind of domestic consumption and Red China proved that it had some advantages way beyond mere cheap labor then things would be a lot better vis-a-vis Red China and the rest of the world. IMO. For one thing they would not have had to steal and extort western intellectual property.

59

posted on

12/15/2010 2:13:29 PM PST

by

WilliamofCarmichael

(If modern America's Man on Horseback is out there, Get on the damn horse already!)

To: WilliamofCarmichael

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-65 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson