Skip to comments.

California's Real Fantasyland (CA's La-La Budget Situation Alert)

Townhall ^

| 11/29/2010

| Meredith Turney

Posted on 11/28/2010 11:12:29 PM PST by goldstategop

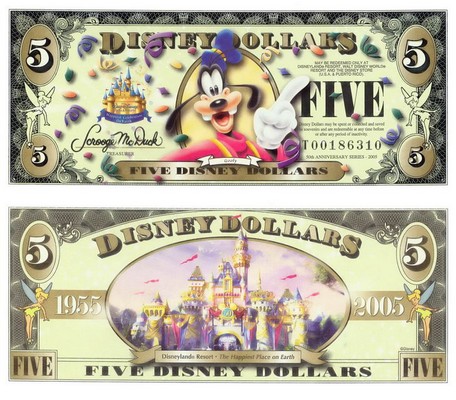

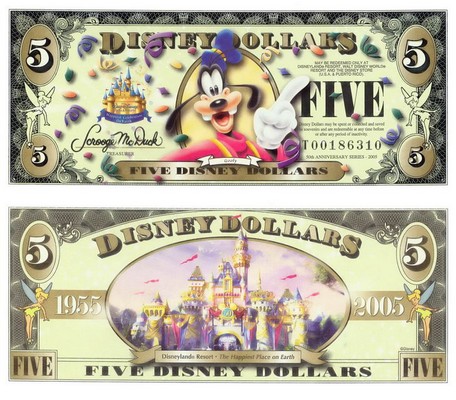

In 1955, Walt Disney opened his first amusement park in Anaheim, California. Disneyland has become the most successful amusement park in the world, with an estimated 600 million visitors since it first opened its gates 55 years ago. One of the most popular parts of the park is Fantasyland. Children and adults alike are dazzled by whimsical rides stretching the imagination, envisioning a blissfully perfect world.

Perhaps that’s why fantasy is such an entertaining venture. For just a few moments, we can set aside the troubles and trials of everyday life and visualize things that defy logic or mask the harsh realities of the real world. Unfortunately, California is trying to set up its own Fantasyland outside Disneyland’s walls, passing fantasy-inspired budgets that defy the laws of finance by spending much more than the state can possibly take in. And the Golden State is about to discover that trying to create a fantasy in the real world has devastating consequences.

A recent Los Angeles Times headline says it all: “Californians want it both ways on budget.” A poll conducted by the newspaper found that voters adamantly oppose tax increases to cover the state’s massive $25.4 billion deficit. Instead, they favor cuts to the budget—but not any of the cuts necessary to actually achieve a balanced budget. In fact, voters oppose cuts, and prefer even more spending, on government programs that make up 85% of the state's general budget.

Californians aren’t willing to cut spending on education or healthcare, but they are amenable to cutting the state’s prison system—which makes up just 10% of the overall state budget. Education and healthcare are important, but when it comes right down to it, the ultimate responsibility of government is to execute justice and ensure public safety through keeping criminals off the streets. Californians still living in Fantasyland don’t seem to understand the ramifications of spending all their money on a failing education system and healthcare benefits at the expense of protecting the public.

The current state deficit doesn’t even take into account the pension tsunami that threatens to wipe out taxpayers. California’s pension liability is estimated to be in excess of $500 billion. A recent study by the Stanford Institute for Economic Policy Research found that local governments’ employment pension plans are underfunded by $200 billion.

California’s Fantasyland is threatening the entire nation now, as the state seeks assistance from the federal government. In 2001, when the state fantasized that its utopia would never end, the legislature voted to double unemployment benefits. Now, with the economy struggling and over 12% of Californians out of work, the state’s unemployment insurance fund is running a $10.3 billion deficit.

In the last two years, the state collected just $9.9 billion in unemployment insurance taxes—but it paid out $20.6 billion in benefits during the same time. California recently had to borrow $8.5 billion from the federal government to pay for the unemployment benefit obligations. If the state doesn’t pay off its loan from Washington, D.C. by 2012, it will owe a $362 million interest payment. That’s an expensive fantasy to finance—and California can’t print Monopoly money to stay afloat.

All three of the major credit rating agencies— Moody's, Standard and Poor's, and Fitch—have given California the lowest credit rating of any state. And investors are increasingly turning away from purchasing California bonds over fears it’s not a prudent investment. If the government can’t solve its deficit, buying the state’s debt is no longer a sound investment. As we’ve seen in Greece, Ireland, Spain and a host other countries, irresponsible spending decimates an economy and can bring a nation to its penniless knees. For some reason, investors believe in pesky things like balanced budgets and returns on investment—things that cannot exist in California’s Fantasyland.

Although Californians still vainly believe they can solve their budget woes with simply cutting waste and fraud, this crisis is the perfect opportunity to look at the bigger picture. During difficult times, it’s appropriate to examine the real purpose of government and what it should or shouldn’t do for the public. Although never pleasant, the pruning process provides greater opportunity for true growth.

Cutting real government programs that have created dependency and fostered an entitlement mentality is critical for trimming the size of government and restoring in the public a sense of independence and self-accomplishment. But such self-examinations and real cuts will necessarily burst the California fantasy of unaccountable, limitless government spending.

California needs to recognize that its real Fantasyland isn’t in Anaheim anymore, it’s in Sacramento.

TOPICS: Business/Economy; Constitution/Conservatism; Editorial; Government; Philosophy; US: California

KEYWORDS: budgetfantasyland; california; fiscalbubble; meredithturney; townhall

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Californians live in a fiscal bubble. They have budgets with expenses that can't be paid for and they've disguised it with a succession of budget accounting tricks and bookkeeping maneuvers that would have made Enron blush. And they refuse to raise taxes to pay for this spending and they don't want to cut the budget to force the state to live within its means. But sooner than later, California's la-la budget situation can no longer be kicked down the road and its fiscal bubble will burst. And then California will have a very painful hangover. The state's a spending addict that has yet to hit bottom.

To: goldstategop

California Legislature is guilty of intentional, criminal malfeasance, and each and every one of them should be sent to jail without possibility of parole until the budget is balanced,, which could be 5 lifetimes!

2

posted on

11/28/2010 11:28:23 PM PST

by

J Edgar

To: goldstategop

California is a failed state...just like Somalia. Being a native Californian I can tell you that most people just want their cake & to eat it too. Any sensible budget suggestion is dumped & fantasy reigns. How about this? 1) Cut all State worker’s salaries by 20%2) Part time legislature only, 3) $300 fine on any illegal alien w/ $150 going to the person who turns ‘em in, 4) A stupidity tax for LA & SF. Everytime you leave the city limits, you have to fork over $10., 5) Cut all state pensions by 40%, 6) End state welfare as we know it, 7) cut the educational budget by 50%, 8) charge anyone entering or leaving CA via Mexico $25 per trip, & 9) any money wired to Mexico or other latin american states is taxed at 30% of what is sent. Sick of this stuff. CA looks & acts like the imbecile state of the union...

3

posted on

11/28/2010 11:31:44 PM PST

by

Bulgaricus1

(Fill your hand you son...)

To: Bulgaricus1

Sounds like a good first step to me.

4

posted on

11/28/2010 11:34:26 PM PST

by

Kickass Conservative

(Obama, Pelosi and Reid, the Axis of Fascism.)

To: goldstategop

In several municipality budgets I’ve seen, over 85% of the budget goes for salary and benefits for the public employees.

If just this ONE figure was published everytime a story was written on budget woes, I think everyday folks would be in an uproar.

5

posted on

11/28/2010 11:56:24 PM PST

by

VeniVidiVici

(What's black and white and red all over? HINT: Think White House)

To: VeniVidiVici

Pension costs are the main driver of the budget deficit in CA. And no one has the political courage to tackle them head on. Jerry Brown isn’t going to do it.

6

posted on

11/29/2010 12:18:47 AM PST

by

goldstategop

(In Memory Of A Dearly Beloved Friend Who Lives In My Heart Forever)

To: Bulgaricus1

The rest of the states need to gang up on California. There is no way the local pols should get away with spending every dime they can imagine (let alone raise), running sanctuary cities, etc. Obviously the State has fewer contributors than takers so the elections only go one way. That’s fine, but the problem needs to be resolved within the state lines. If folks making 500 dollars a week have to start kicking 30 bucks a week to solve the State’s problems, the pols wont spend another dime ever again. It’s easy to vote for Jerry Brown or Barbara Boxer if it never costs you anything personally.

To: goldstategop

Dependency and entitlement mentality will finish the job the lazy,idlers,shiftless and illegals are protected by the sacramento hacks.

8

posted on

11/29/2010 5:34:48 AM PST

by

Vaduz

To: goldstategop; ding_dong_daddy_from_dumas; stephenjohnbanker; DoughtyOne; dools0007world; Gilbo_3; ..

RE :”

A recent Los Angeles Times headline says it all: “Californians want it both ways on budget.” A poll conducted by the newspaper found that voters adamantly oppose tax increases to cover the state’s massive $25.4 billion deficit. Instead, they favor cuts to the budget—but not any of the cuts necessary to actually achieve a balanced budget. In fact, voters oppose cuts, and prefer even more spending, on government programs that make up 85% of the state's general budget. Californians aren’t willing to cut spending on education or healthcare, but they are amenable to cutting the state’s prison system—which makes up just 10% of the overall state budget. Education and healthcare are important, but when it comes right down to it, the ultimate responsibility of government is to execute justice and ensure public safety through keeping criminals off the streets. Californians still living in Fantasyland don’t seem to understand the ramifications of spending all their money on a failing education system and healthcare benefits at the expense of protecting the public.

The current state deficit doesn’t even take into account the pension tsunami that threatens to wipe out taxpayers. California’s pension liability is estimated to be in excess of $500 billion. A recent study by the Stanford Institute for Economic Policy Research found that local governments’ employment pension plans are underfunded by $200 billion.

California’s Fantasyland is threatening the entire nation now, as the state seeks assistance from the federal government. In 2001, when the state fantasized that its utopia would never end, the legislature voted to double unemployment benefits. Now, with the economy struggling and over 12% of Californians out of work, the state’s unemployment insurance fund is running a $10.3 billion deficit. “

Lots of CA posts today. Is the party over? One lib from CA told me the state's had fiscal problems because CA cant just print money like the federal government can. Are these the folks boycotting AZ??

It is kind of nice that Democrats won in CA because you know they wouldnt cut anything if a Republican was governor. Let's watch Jerry Brown, popcorn time. Maybe he will blame it all on Bush.

9

posted on

11/29/2010 5:49:03 AM PST

by

sickoflibs

("It's not the taxes, the redistribution is the federal spending=tax delayed")

To: All

YouTube has a video of a CalPERS actuarial presenting to the Huntington Park City Council on how CalPERS is underfunded and why the cities pension costs will be rising dramatically. Notice in the video how CalPERS keep changing its assumption in different years to hide losses. Because of losses in 2008-2009 CalPERS assets are 50% below what the actuarials expected. California taxpayers are screwed and about to get more screwed.

With CalPERS, the employee contribution amount is fixed but the employer amount varies so the risk to the plan is borne by the employer (city, county, state).

1. CalPERS COSTS TO CITIES SKYROCKETING NEXT YEAR, BONDHOLDERS BEWARE - The current rate of return assumption CalPERS is using is 7.75% compounded annually. However, CalPERS board is working on a new asset allocation policy based on a meeting last week with investment professionals. The new return assumption rate will be lower and announced in February 2011. For every ¼ point CalPERS lowers its investment return assumption, the city or county or state cost will go up 2 % in one of two categories of contributions it must pay into and 4% in the other. In other words, the burden on cities, counties, and the state is about to balloon come Spring. If the rate is lowered to Bill Gross's "new normal" rate of return of 4% that would mean a city or county would have to pay over 22% MORE in contributions. A sum sure to sink many cities and maybe a few counties. If the return assumption gets lowered a tiny amount and the actual returns are close to the "new normal" then CalPERS will just dig a larger hole to be filled down the road.

2. MADOFF WOULD BE PROUD - Compounding the problem is the fact that in 2005 after CalPERS lost 1/3 of its assets in the dotcom bubble it created a "new rate stabilization policy." The new policy changed the Actuarial Value of Assets (AVA), a method of smoothing the asset valuation, from an avg of 3 years to an avg of 15, thus inflating the AVA due to previously strong years. By doing this they masked the downturn in the AVA thinking the following years would allow them to catch up and smooth out the massive dotcom loss. Trouble is, 2008-2009 came along and shot holes in this assumption and not they are more screwed.

3. MADOFF SLEIGHT OF HAND #2 - Then compounding the problem more, after the 2008-2009 losses CalPERS changed their assumptions AGAIN to "smooth" the losses. They then changed the AVA to MVA ratio to 60% to 140% from 70% to 120%. As you can hear the actuarial state o the video, "that means we will defer most of the loss to future years." "This means the city will realize another increase in future years. I hate to bring bad news but those are the facts."

================================

CALI TAX-EXEMPT BONDHOLDERS BEWARE The current rate of return assumption CalPERS is using is 7.75% compounded annually. However, CalPERS board is working on a new asset allocation policy based on a meeting last week with investment professionals. The new return assumption rate will be lower and announced in February 2011.

If Calpers misrepresented financial returns to tax-exempt bondholders, that is prosecutable. The FBI, IRS and SEC should be informed about wrongdoing. The FBI should interrogate Calpers officials with an eye to prosecutions.

For every ¼ point CalPERS lowers its investment return assumption, the city or county or state cost will go up 2 % in one of two categories of contributions it must pay into and 4% in the other. In other words, the burden on cities, counties, and the state is about to balloon come Spring.

If the state, cities, and counties mounted tax-exempt electoral bond issues with falsified data, and is using tax-exempt public monies under false pretenses, that is prosecutable.

------------------------------------------

It's time for the FBI, the IRS and SEC to investigate Calpers.

POSSIBLE CHARGES: illegal conversions of public monies; facilitating govt fraud; official acts prohibited; misuse of funds; abuse of tax-exempt monies, violating public office; misuse of government position; abuse of government power; conflict of interest; influence buying; conspiracy to deceive; misuse of elective office, collusion, conspiracy to collude; falsifying official documents, presenting false federal instruments for filing, extortion, forgery.

REPORT TAX FRAUD AND TAX LAW VIOLATIONS HERE:

IRS TOLL-FREE 1-800-829-0433—-you may remain anonymous when reporting tax fraud.

Report fiduciary negligence; signing off on falsified documents here:

FBI TIP PAGE http://tips.fbi.gov/ (you may remain anonymous)

enforcement@SEC.gov.

10

posted on

11/29/2010 6:11:26 AM PST

by

Liz

To: All

EXCERPT Just how deeply in debt are Cali state and local governments? The answer: No one knows for certain, since debt is scattered through myriad agencies in many forms, but well over a half-trillion dollars is a fair estimate.

Warnings pertained to the state's "general obligation debt," which currently stands at $59 billion, and there are an additional $50-plus billion in general obligation bonds that have not yet been sold. The biggest chunks of debt, however, are the unfunded obligations for pensions and health care of retired public employees. Read more at sacbee.com ...

===========================================

BACKSTORY The government's "money machine" to buy votes was engineered in the 1970s when California's legislature cleared the way for public-employee unions to organize and bargain.

Then-Gov. Jerry Brown signed a crucial bill in 1978 that gave public workers, already protected under civil service, collective bargaining rights on top of that. Such legislation created far more than mere bargaining power. It also gave the unions access to dues money that could be deployed to reward friends in the legislature as well as beating back reform efforts at the ballot box.

"Wasn't my fault," 2010 Candidate Brown told cheering Democrats.

What Calpers failed to disclose, however, was that:

(1) the state budget was on the hook for shortfalls should actual investment returns fall short of assumed investment returns,

(2) those assumed investment returns implicitly projected the Dow Jones would reach roughly 25,000 by 2009 and 28,000,000 by 2099, unrealistic to say the least

(3) shortfalls could turn out to be hundreds of billions of dollars,

(4) Calpers's own employees would benefit from the pension increases, and,

(5) members of Calpers's board had received contributions from the public employee unions who would benefit from the legislation.

Had such a flagrant case of non-disclosure occurred in the private sector, even a sleepy SEC and US Attorney would have noticed. You said just what I was going to say. Sure, Calpers "did not disclose." But 99% of the California legislature sat on their hands and were willing participants in this fraud.

If a huge bill, with a huge price tag, with a huge financial obligation that extends way into the future, gets passed without more than one legislator raising one question about it, what in Hell's Bells are these people being paid to do for a job?

11

posted on

11/29/2010 6:12:28 AM PST

by

Liz

To: sickoflibs

The Cali government's "money machine" to buy votes was engineered in the 1970s when California's legislature cleared the way for public-employee unions to organize and bargain.

Then-Gov. Jerry Brown signed a crucial bill in 1978 that gave public workers, already protected under civil service, collective bargaining rights on top of that. Such legislation created far more than mere bargaining power. It also gave the unions access to dues money that could be deployed to reward friends in the legislature as well as beating back reform efforts at the ballot box.

"Wasn't my fault," 2010 Candidate Brown told cheering Democrats.

12

posted on

11/29/2010 6:13:22 AM PST

by

Liz

To: Liz

Thanks, even better that he is governor and CA hasnt a chance at getting a bailout from the next congress.

13

posted on

11/29/2010 6:19:30 AM PST

by

sickoflibs

("It's not the taxes, the redistribution is the federal spending=tax delayed")

To: sickoflibs

.......even better that Brown is now governor and CA hasn't a chance at getting a bailout from the next Congress............ Yeah-----Brown must be reaching for the Alka Seltzer right about now.

14

posted on

11/29/2010 6:43:43 AM PST

by

Liz

To: sickoflibs; DoughtyOne

“Californians want it both ways on budget.” A poll conducted by the newspaper found that voters adamantly oppose tax increases to cover the state’s massive $25.4 billion deficit. Instead, they favor cuts to the budget—but not any of the cuts necessary to actually achieve a balanced budget. In fact, voters oppose cuts, and prefer even more spending, on government programs that make up 85% of the state's general budget.Substitute Washington DC for California. Same attitude.

To: goldstategop

CA will soon pay their bills with their locally printed currency.

16

posted on

11/29/2010 7:12:32 AM PST

by

Reeses

To: Liz; calcowgirl; MaggieCarta; AuntB

RE :”

Yeah-——Brown must be reaching for the Alka Seltzer right about now.”

I think that he should appoint illegal Nicky to a top spot in CA to find new sources of revenue. After all she was critical in his election campaign. She is an expert at fraud too. Keep that one alive.

17

posted on

11/29/2010 7:15:51 AM PST

by

sickoflibs

("It's not the taxes, the redistribution is the federal spending=tax delayed")

To: sickoflibs

Nicky's had a lot of job offers but has other plans.

"Nicky, whattya say you come work for me. Five bucks an hour,

seven days a week, and all the leftovers you can eat, all tax free."

"Tanks anyway, Missus Allred. But ais makin' a bundle on da US

gravy train wit 5-6 identities. Ais gonna open a frioles food truck."

18

posted on

11/29/2010 9:20:13 AM PST

by

Liz

To: Liz

I thought maybe we had the next Cindy Sheenan in Nicky, Mexican style. She could be the national conscience of unfair and broken illegal immigration 'system' and claim that her illegal parents kidnapped her from Mexico as a child and brought to this country to work as rich people's slaves for $20 per hour. (Even Slaves get paid good in CA.)

‘Dont be blame-en the victim’

19

posted on

11/29/2010 11:22:18 AM PST

by

sickoflibs

("It's not the taxes, the redistribution is the federal spending=tax delayed")

To: ding_dong_daddy_from_dumas

Substitute Washington DC for California. Same attitude. Most people nationwide - especially in CA - think the government is simply lying about how much money they have and that there is really plenty to go around. Perhaps if government officials had NOT been such habitual, lying, narcissistic sociopaths over the last fifty years this attitude would not have become so entrenched.

But some of it is common sense. People look around and say, "We ought to be able to pay to fix the roads (yeah, without all the union featherbedding) and we ought to be able to pay for the education system (yeah, without all the union featherbedding) and we ought to be able to pay for basic services for the poor (yeah, without all the advocates and attorneys getting a cut) with the tax money being collected now." And they are right - but the level of fraud and corruption is so high that average people can't really conceive of it, so it seems like they "want it both ways".

Actually they just want it one way - the honest way - but no California politicians are willing to piss off the unions and trial lawyers enough to do anything positive. Arnold made a half-hearted attempt to use the initiative process and act like Gary Cooper in High Noon...except he got shot in the back by his own townspeople.

20

posted on

11/29/2010 12:03:38 PM PST

by

Mr. Jeeves

( "The right to offend is far more important than any right not to be offended." - Rowan Atkinson)

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson