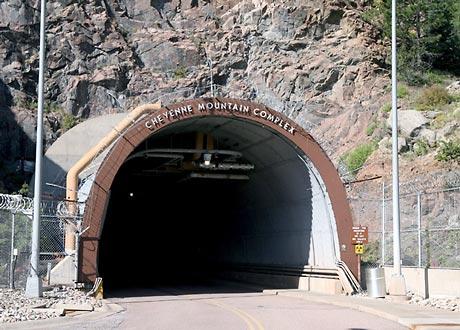

Precisely. One pictures says it all:

Posted on 11/25/2010 7:11:40 AM PST by SeekAndFind

The gold bears continue to come out of the woodwork with every tick higher in the precious metal. This type of speculation appears to be particularly rampant in the professional trading community and among "sophisticated investors." The favored argument against gold is that it has no "utility."

Gold indeed has very little practical utility. This line of thinking, however, completely disregards the fact that gold has been equated with "value" and "money" throughout human history.

While gold is not backed by earnings and dividends, or consumption trends (like oil and food etc.) it is backed by deeply entrenched human psychology. To think that this is going to change anytime soon is ridiculous - it won't. The price of gold may fall, but the yellow metal will continue to be thought of as a substitute for money.

Furthermore, the fact that gold does not earn income like dividend paying stocks, and is not as strictly governed by production/consumption trends like corn, wheat, crude oil and other commodities makes it's valuation a much more subjective endeavor.

In other words, gold's price is determined by human psychology much more than most other investments. The demand for gold, except for its uses in making jewelry, is based on psychological stimuli which are rooted in uncertainty. Therefore, it is exceedingly difficult to accurately say what price is "high" and what price is "low."

This is why it is so baffling to see respected market commentators and participants repeatedly attempt to call the top in gold. Who in their right mind would try to call the top in a 10 year bull market where the valuation of the asset in question is based on human psychology and little else? It makes absolutely no sense.

Furthermore, the reason gold is likely not nearing a top is because of the rampant skepticism about it in the first place. Markets top out when sentiment gets extreme and everyone has already bought in. Fortunately for gold bulls, these conditions currently just don't exist.

The likely end of the long bull market in gold will likely be dramatic and parabolic in nature. When the last bear goes out and buys himself a gold bar, we will have our top, but given the rampant speculation that gold is on the precipice of a steep decline, we are likely nowhere near a top.

Precisely. One pictures says it all:

Just so long as you stay off of airplanes and away from the prying eyes and pliers of the TSA.

As a hedge against inflation and possibly the end of the world, it's second to none, but as an appreciating investment, it's just one of many.

I think we're in a short term bubble and gold will see a correction, but given the state of the dollar, we will certainly see much higher levels later on.

It looks like we might be headed to a short term correction. Volume on this last upswing is lower than the last. Long term is anyones bet.

We are likely nowhere near a top, unless we are.

We are likely nowhere near a top, unless we are.

Tuesday Russia and China said they will no longer use the dollar,wonder what gold go to now?.

The utility of gold?

Well, my gold and silver stock dominated six figure portfolio is up over 100% in 3 months, and 300% in 20 months.

That’s a ‘utility’, so far as I am concerned.

So keep calling the top in gold, experts.

The First Comedian Bank and Trust. Look for a branch near you!

Hmmm.... I'd kind of like to know how to do this. Alchemy 101?

"We'll leave an infrared illuminator on for ya."

The moment the first analyst says, “It’s different this time!”

No. You use a cyclotron to remove a few protons from a lead atom, and presto, you have gold. The only problem is that it's not possible to do it except on an atomic scale, and even then it's enormously expensive. You'd be better off trying to filter it from sea water. There's lots of gold dissolved in the oceans, but there again it can't be done economically or on any sort of large scale.

Maybe genetically engineered sponges could do it for you (credit to Arthur C. Clarke for this idea).

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.