Skip to comments.

The Crisis Is Over: Bank Of America Is Set To Begin Foreclosures Again

Business Insider ^

| 10/18/10

Posted on 10/18/2010 1:41:10 PM PDT by earlJam

The Crisis Is Over: Bank Of America Is Set To Begin Foreclosures Again

Joe Weisenthal | Oct. 18, 2010, 3:27 PM | 1,658 |

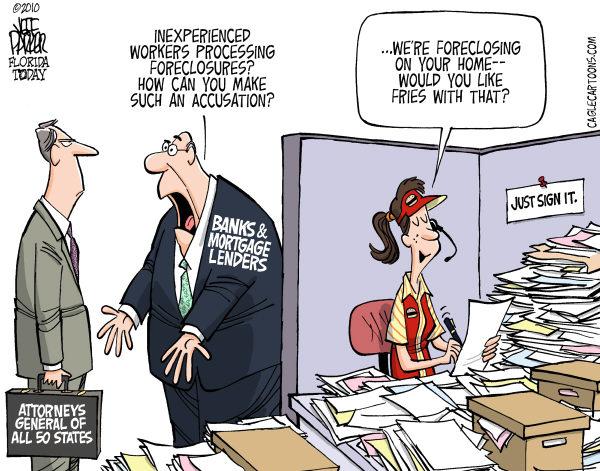

Bank of America says it plans to start re-submitting foreclosures in 23 states next week, and that all in all the foreclosure-gate stuff will affect about 30,000 mortgages. A spokesperson told WSJ that it had not found a single case of a foreclosure without justification, which is key.

(Excerpt) Read more at businessinsider.com ...

TOPICS: Breaking News; News/Current Events

KEYWORDS: boa; fannie; fdic; foreclosure; foreclosuregate; freddie; jpmorgan; mers; remics; robosignergate; tarp; tarp2

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-79 next last

To: fortheDeclaration

For all the money that the Banks received in bailouts, every debt in the nation should be removed from the books.Agreed 100%.

21

posted on

10/18/2010 2:09:17 PM PDT

by

pnh102

(Regarding liberalism, always attribute to malice what you think can be explained by stupidity. - Me)

To: earlJam

8 MILLION homes foreclosed....Crisis isn’t over, it hasn’t even started yet.

And Obama, Pelosi and Reid...just kickin the can down the road to someone else.

22

posted on

10/18/2010 2:10:24 PM PDT

by

Freddd

(CNN is down to Three Hundred Thousand viewers. But they worked for it.)

To: earlJam

A spokesperson told WSJ that it had not found a single case of a foreclosure without justification, which is key. Apparently it is not "key" to the WSJ for banks to follow the established laws of property assignment.

To: AdmSmith; Arthur Wildfire! March; Berosus; bigheadfred; Convert from ECUSA; Delacon; dervish; ...

Thanks earlJam.

all in all the foreclosure-gate stuff will affect about 30,000 mortgages

24

posted on

10/18/2010 2:57:53 PM PDT

by

SunkenCiv

(The 2nd Amendment follows right behind the 1st because some people are hard of hearing.)

To: fortheDeclaration

25

posted on

10/18/2010 3:03:41 PM PDT

by

FromLori

(FromLori)

To: Voter#537

26

posted on

10/18/2010 3:07:31 PM PDT

by

RonDog

To: earlJam

27

posted on

10/18/2010 3:13:55 PM PDT

by

Fred

(Suspend All Immigration Until Unemployment is Reduced to 5%)

To: earlJam

I can’t believe that anyone actually still uses Bank of America. I use a small local bank for most of my banking. I actually get a live voice on the phone when I call there and they know me.

28

posted on

10/18/2010 3:15:57 PM PDT

by

mojitojoe

(Caractacus..or Bob if a boy & Boudicca if a girl....such hard decisions for dearie Snidely)

To: WebFocus

I am willing to bet that less than 1% of those who have been faithfully paying their mortgage would be foreclosed on......and your nick is WebFocus? Please focus on the tremendous amount of info on the Web-Focus.

Foreclosure is NOT the issue here.

29

posted on

10/18/2010 3:48:24 PM PDT

by

houeto

("You know, I actually believe my own bullsh_t," --- BHO)

To: Palter

explain this statement please?

30

posted on

10/18/2010 3:51:45 PM PDT

by

STD

(Witnessing Another Greek Tragedy as Our Chief Executive Implodes.)

To: Palter

31

posted on

10/18/2010 3:53:56 PM PDT

by

STD

(Witnessing Another Greek Tragedy as Our Chief Executive Implodes.)

To: 2ndDivisionVet

It’s not really over...

There will be lots of lawsuits snippet

Analysts differ in their cost estimates. Compass Point Research and Trading LLC’s Chris Gamaitoni estimated in August that lenders may suffer as much as $179.2 billion in losses tied to soured mortgages they will be forced to repurchase from mortgage-bond insurers and investors. Last week, Mike Mayo, an analyst at Credit Agricole Securities USA in New York, estimated a cost of $20 billion for repurchases when including government- sponsored entities Fannie Mae and Freddie Mac. Goldman Sachs Group Inc.’s Richard Ramsden said a worst-case scenario would be $84 billion, while Paul Miller, an analyst at FBR Capital Markets in Arlington, Virginia, said it could cost the banks as much as $91 billion.

‘A Lot of Uncertainty’

“There’s a lot of uncertainty surrounding what the eventual cost of mortgage repurchases will be,” Deutsche Bank AG analysts led by Matthew O’Connor wrote in a note last week. “The bad news is we (and the banks) won’t know the answer for some time. The good news is the banks should have time to absorb the losses.”

Bank of America, JPMorgan and Wells Fargo have the most at stake, O’Connor wrote.

Citigroup today said third-quarter profit rose to $2.17 billion, beating analyst estimates, as it reduced loan-loss reserves. The New York-based bank set aside $322 million to repurchase mortgages, compared with $347 million in the second quarter. Bank of America, which has halted foreclosure sales in 50 states, is scheduled to report third-quarter results tomorrow, and San Francisco-based Wells Fargo will announce results Oct. 20.

‘Messy Process’

http://www.bloomberg.com/news/2010-10-18/u-s-bank-earnings-face-mortgage-scrutiny-as-49-billion-in-value-vanishes.html

Oh and about the citi fraud profit not so much

Citigroup: Essentially ZERO Actual Profit

http://market-ticker.org/akcs-www?post=169494

I can’t stand citi knowing how they paid off obama

Citibank Top Donor to Obama Inauguration:

http://nalert.blogspot.com/2009/01/citibank-top-donor-to-obama.html

http://online.wsj.com/article/SB123146096981566339.html

Of course jp morgan’s been his buddy for years in Chicago

http://www.nytimes.com/2009/07/19/business/19dimon.html

This is why you won’t see obama do anything lol $$$

http://www.noquarterusa.net/blog/2008/09/21/baracks-wall-street-problem-is-now-americas/

This is so he can look tough

U.S. stakes out ‘robo-signing’ strategy

No moratorium, but problem servicers will face ‘full force of the law’

http://www.inman.com/news/2010/10/18/us-stakes-out-robo-signing-strategy

32

posted on

10/18/2010 3:54:53 PM PDT

by

FromLori

(FromLori)

To: FromLori

33

posted on

10/18/2010 4:07:52 PM PDT

by

fortheDeclaration

(When the wicked beareth rule, the people mourn (Pr.29:2))

To: earlJam

Wait, no armageddon??? And I was all dressed up for it.

Oh, btw, earlJam, you yadda-yadda’d over the best part! You don’t have to excerpt BusinessInsider. If you don’t mind posting it all here, it’s much easier to read without all the flash.

To: earlJam

To: 2ndDivisionVet

They’re trying to claim they reviewd all their foreclosures in progress since this story broke?! And they think someone believes this?! Smells a little fishy. And as I understood it, the issue was not so much that the foreclosures were justified, but that BOA did not follow proper legal procedure. That being the case, it seems to me that BOA would have to redo each foreclosure following this proper procedure. That certainly hasn't happened in this length of time.

36

posted on

10/18/2010 4:57:01 PM PDT

by

ChildOfThe60s

( If you can remember the 60s....you weren't really there)

To: abbyg55

If BOFA pulled their head-out, they could start with identifying families that could pay their mortgage with simple re-financing help. I believe there has to be a good percentage of homeowners who would desire to stay in their home and keep their credit in good standing and make faithful on-time payments but need their ARM converted to FIXED 30 year mortgage.

This would be WIN-WIN for both.

Bottom line, BOFA and others have AIG insurance backup covering their A!! and could care a less about America’s homeowners who are seeking help.

So, people are strategically walking away and don’t care about credit problems. They are at the end of the rope and will re-build again.

In the meantime, they don’t care about deficiency judgment, they just want to walk away from the OVERHEAD RIGHT NOW and worry about whatever else may come down the road.

37

posted on

10/18/2010 5:09:50 PM PDT

by

TheDailyChange

(Politics,Conservatism,Liberalism)

To: earlJam

To: earlJam

It seems very obvious that nothing has changed except the tanking of BAC stock and what that implies.

BAC best choice is to defy the various states Attny Gen’ls and they have now been given the green light that no matter how unpleasant, Uncle Sugar will legislate them out of yet one more box its criminal behaior has created.

To: 2ndDivisionVet

“Hahahaha! They’re trying to claim they reviewd all their foreclosures in progress since this story broke?! And they think someone believes this?!”

I’m not saying I believe them or not, but they probably did a sample of the mortgages, to see how severe the title and paperwork problem was...

40

posted on

10/18/2010 5:54:49 PM PDT

by

SeattleBruce

(T minus 15 days to SMACKDOWN - Tea Party like it's 1773! Pray 2 Chronicles 7:14!)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-79 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson