Posted on 10/03/2010 9:12:09 AM PDT by SeekAndFind

These charts will be historical references in the future. Clasical patterns, almost perfect.

SOME THOUGHTS:

* Don’t ignore the fact that the Euro is presently being debased at a slightly lower rate than the US dollar is. We have COMPETITIVE CURRENCY DEVALUATION GOING ON. That can’t be good for paper currency.

* The charts only show 6 months. HOW ABOUT THE LONGER TERM?

Yep. Those are right out of the textbook.

When gold spiked last, before the crash, that was the beginning, the first wave. I'm not a wave guy but this is probably what they'd call a "B" wave. Whatever, it is, it's a wave, and it's not the third one.

XAU is a miner index, it is not bullion.

Right now the miners are under performing bullion gold.

Kitco has charts of the different currencies in USgold. It is a very busy site, click on the link under Top Five Performing Gold Equities. The link is in green that starts with the title “Live currency charts.” There are a variety of currencies and time lengths up to 10 years.

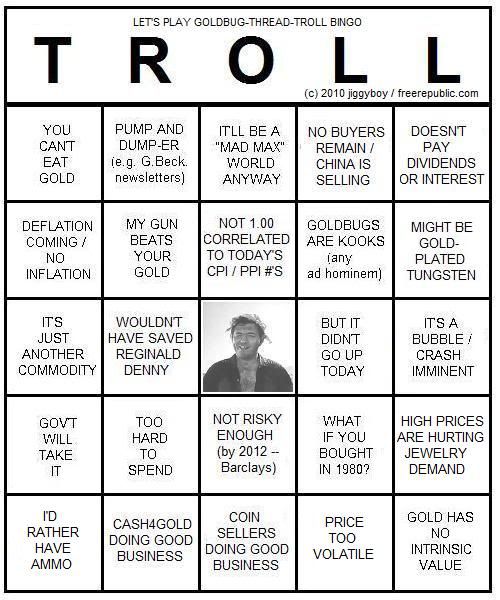

j, your ‘grid’ raises some good points. I have never understood the almost magical belief that gold is somehow inttrinsically valuable. It is our perception of its value that makes it a valuable commodity. One does not ‘invest’ in gold; one buys it to speculate that it will go up in value. To all: read the grid; most of the statements are true.

Maybe the more knowledgeable may want to pipe in but I think gold is just a hedge against paper currency losing value It is not so much that gold is going up but the dollar is going down.

Gold and other commodities are also needed in industry. Copper, platinum, palladium, gold, etc.

Keep watching TV cause the 6 Networks own all the channels and they all support Islam and Obama. Including Prince Al Waleed’s = Fox, CNN and ABC/Disney.

Gold is a terrible investment, and it's worse for speculation.

But neither of those are reasons to own it.

Gold is a transnational and time-forward storage form for wealth.

It can go where you go (as can diamonds), and it can be turned into currency anywhere, any time.

As pure storage, gold (and diamonds) are without peer.

All I know is that “Gold ben berry berry gud to me!”

Only a few of the statements are indeed true, but they are also canards.

“You can’t eat gold”, but you can’t eat real estate, dollar bills, or stock certificates either. “It doesn’t pay dividends or interest”, just like most tech stocks and savings accounts don’t. “No intrinsic value”, but except for oxygen, water, food, and possibly a used bearskin in the northern latitudes, little else has “intrinsic value” to a human being.

A handful are provably false, and a few are included because they directly contradict one another.

I don’t see how anyone can say that gold is a terrible investment when a year and a half ago it was $980. Today it’s $1320. A 35% profit.

It's done to boost their self esteem.

They are trying to justify their lack of 'nads to plunk down cash for a few pounds of yellow metal two, four, six, or ten years ago. Now they feel like losers.

Besides this guy fills his gravy bowl by trading currencies. No wonder he wants to pump his product.

And people complain about gold sellers being pumpers. At least they have something more than a government promise to sell.

So THAT’S what’s wrong with my portfolio!

Instead of speculating in gold I should have been speculating in foreign currencies.

Over the past year gold is up 30.85% against the dollar and up 39.52% against the euro.

Diamonds arent in the same class as gold. They are flashy in Bond movies, but the supply is immense compared to gold. The deBeers system is designed on them holding a huge supply, and releasing them slowly to artificially prop up a price.

deBeers will probably never flood the market, (though they could) but the system isnt designed to take diamonds back into the system. That diamond is forever thing, they literally meant keep it forever.

If you buy a diamond today, try to sell it 10 minutes later. You can only get fire sale prices.

Up to 1971 the gold standard was $35 an ounce.

Well stated

This recovery is false when you consider that it is measured in dollars. What about measuring GDP in units of gold? I saw a recent chart of the stock market valued in gold and it was not pretty.

When the next moron states that we have a recovery because of a barely positive GDP, consider what it would be in gold units. Even in dollars, the GDP is barely keeping up with the rise in population, so the dollar GDP per capita is stagnant.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.