Posted on 08/11/2010 8:56:16 PM PDT by jiggyboy

If Cramer is right about a sell-off coming early on Thursday, then that could be “your dream come true” to buy gold.

See, according to US Global Investors—“the best source on gold that I know of,” Cramer said—the gold stocks have jumped an average of 8.34% each September for the past 17 years, making right now a great time to buy in.

Investors always want at least some gold exposure in their portfolios, as it protects against inflation and overall market instability. But there’s another reason that Cramer’s bullish on the precious metal right now: scarcity.

Most of the world’s gold reserves have already been discovered. That’s why Kinross Gold [KGC 15.24 -0.43 (-2.74%) ] was willing to pay $7 billion for RedBack, a gold company with mines in Western Africa. The same West Africa that is home to Mauritania, Cramer said, which has endured two coups in the last five years and human slavery is still in widespread practice. Most likely Kinross would never risk such an area if gold could be found anywhere else.

And believe it or not, but that $7 billion Kinross is paying might not be enough. Cramer said there is speculation that even higher bids are possible, which is another sign that gold is scarce.

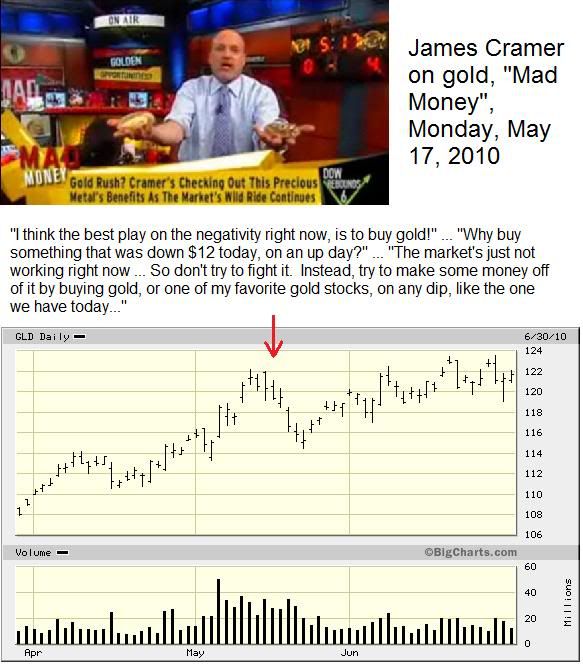

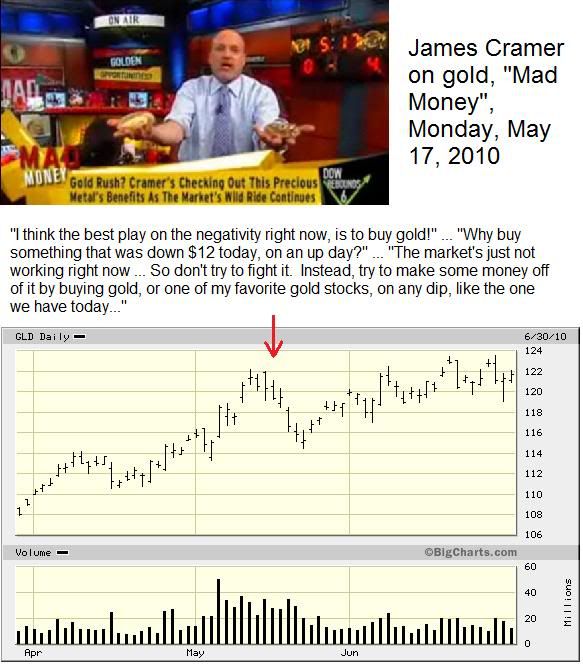

So how do you play it? In this order, Cramer said: the SPDR Gold Shares ETF [GLD 117.34 -0.39 (-0.33%) ], gold coins, bullion (if you can afford the depository bank) and high-quality stocks like Agnico-Eagle Mines [AEM 60.30 -0.56 (-0.92%) ].

This confluence of events—the scarcity, seasonality—as well as what Cramer sees as a growing demand for gold by the middle classes of developing nations like China and India, could push the price per ounce to $1,300 in September, he said. That’s up from $1,190 where it closed today, a sizable jump for anyone who wants to play the trend.

“I think the clock is ticking before gold's next big run,” Cramer said. “Use tomorrow’s pending ugliness to buy some if you haven't already.”

Absolutely.....now you go to the head of the class....

You and I apparently think somewhat alike regarding investment income....

I offer just one more item....what if there is a real economic calamity? ....if it happens, it will happen overnight, so quickly that most will be caught without even a loaf of bread and 6-pack in the fridge.

Should this occur, at first gold and silver will likely be the basis of barter...after that....chaos, theft, violence, etc.... Self protection would be the primary responsibility of each day. Only the prepared will have a chance. Dividends will no longer arrive....

Never lose sight of Maslow's Hierarchy of Needs......

My view is that dividends are good as long as they last, but nothing lasts forever. If we were to be hit with an economic apocolypse, I think guns and ammo would be just as valuable as gold and silver.

Absolutely....go to the head of the class....

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.