"DON'T GOTSTA WORRY 'BOUT NO MO'GAGE.....OBAMA GONNA TAKE CARE O' ME...."

No surprise to me, WHATSOEVER...

THIS is what it's all about now, Amerika....

Posted on 08/05/2010 6:39:02 AM PDT by Daisyjane69

Edited on 08/05/2010 6:53:02 AM PDT by Admin Moderator. [history]

I think there are enough armed Patriots in this country to ensure that won’t happen.

And your kids and your grandkids and ......

An owner is only underwater if they are trying to sell their property. If they are current in their payments then why bail them out...

LOL see post # 121 it is a democratic ruse to shell out more money for banks to sit on.

The good news is the democrats/independents that voted for him *he is trying to win back* will see HARP/the directives/rules and know the road he is promising is more of the same old lies.

If he TRULY cared about recovery he would give a payroll tax free ride for 2 years so people can afford to pay their healthcare premiums that are robbing their paychecks to 0 because they went up 2% in prep for Obama taking over.

I literally know two women that just got cancelled because they got cancer.

Will Obama save them when they are dead? I heard this is because of ObamaCare incentives that the horror is worsening.

The only CHANGE this cat brings is homelessness and out of work.

.

Sure, there are laws against overinflating an appraisal...it is called frauding the lender.

Exactly. Maybe I did not explain well enough. The ones that ARE underwater,jobless, are getting NO HELP or assistance.

The program in which Obama is throwing out to MAKE IT LOOK like he IS SAVING all-TO APPEAL TO SOME LOST VOTERS- is only if you are FHA/FM/FM AND you are current on your mortgage.

They cannot nor will bail out jobless folks. Even he cannot make the monopoly money to do this. We are past the point of no return of spending.

see post #121, If you can get it go for it, Good luck! :)

Inflation has really hit the vote market under Obomba.

"DON'T GOTSTA WORRY 'BOUT NO MO'GAGE.....OBAMA GONNA TAKE CARE O' ME...."

No surprise to me, WHATSOEVER...

THIS is what it's all about now, Amerika....

“buying overpriced property during the bubble or refinancing during the bubble, then watching the value get cut in half or in third. It is still irresponsible behavior and should not be bailed out.”

Not irresponsible, just a gamble. It always was a gamble and, whenever we choose to gamble, we need to ensure we can afford to absorb even a complete loss of our investment. This is the place from which I think Free America52 is coming, that is, I’m not demanding a solution to my problem but if one is available, I might be willing to take advantage of it.

My problem isn’t with folks who try to make the best of their situation, but the notion, fostered by Dems in particular, that the housing market should have private gains but public losses. I have no respect for those demanding that public monies be used to bail them out when they were perfectly willing to keep whatever winnings they got from the investment. If it was to be private gain, it should be private loss.

Here’s a perspective from somebody not underwater...but in trouble.

I have alot of equity in my house...around $40,000, according the the county appraiser. BOA seems to know this too...and they have been VERY aggressive with me. I am two payments behind, and I estimate it will take me four months to catch up completely. I have got three letters with foreclosure filing dates...and have called them and begged for delay...but I just got another one yesterday. They clearly see a foreclosure which would not lose them money...and obviously my mortgage is flagged in their system that way.

I know I haven’t kept up my part of the bargain...and I have been charged lots of penalties as a result...and BOA has the right to foreclose...but I am slowly creeping back to where I need to be.

I am not eligible for any of the past and likely future assistance plans however, because I have too much equity (almost 25%). This is the result of saving for 5 years to make a large down payment. Yes, I could sell...but the end result would be the same - my family will not have a house to live in.

I’ve got to be honest...it does not make me happy to know that I may lose my house...while simultaneously paying taxes to bailout people who paid too much, without a down payment.

As a side note, my house is very modest. Every time the nightly news has an ‘underwater’ expose on a poor family in trouble, the house is 2-3 times as expensive as mine, and they made no down payment....it just makes this pill more bitter to swallow.

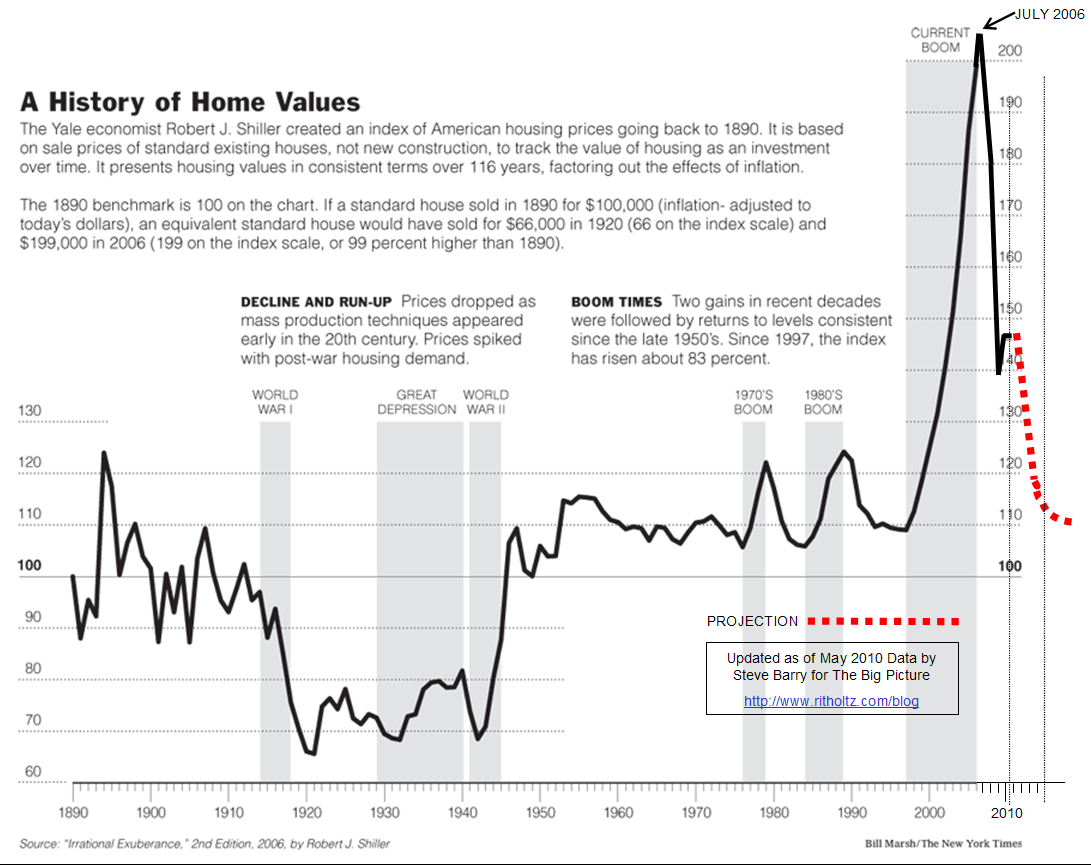

The american tax payer footed the bill for most of the first part of the correction with the Freddie, Frannie, TARP, AIG slush fund to bailout other domestic & foreign lenders/brokers, and other bailouts. Now were going have to foot the bill for the second part of the correction (more funds to Freddie, Fannie, and mortgage principle modifications)

Another means to buy votes for the DemoncRATs. If you cannot or chose not to honor the contracts you sign the government will come and bail you out. All those who honor the contracts they sign get screwed again because now you end up paying for and your neighbors mortgage though higher taxes, government fees etc...

Good. That will really win the hearts and minds of the far more numerous voters who are not behind on their mortgage or have actually paid it off.

This would be where we should draw guns. How much theft are you willing to put up with? If these lowlife a%%holes came through the front door and tried to cart off your television, jewelry, and wallet, you'd shoot them in a second. But yet, they tout the same theft from the position of "government" and all we spineless twits do is sit and whine.

>>This would be where we should draw guns. How much theft are you willing to put up with?<<

The answer to your question may lie in the two MP3’s here:

US far worse off than ancient Rome -

http://www.freerepublic.com/focus/f-news/2563601/posts

As far as I know, the POTUS doesn’t have the Constitutional authority to order such action. Fannie and Freddie are funded by the US Taxpayer (and the Fed’s printing press) and monies MUST be allocated to account for this $800bil forgiveness.

We should let the government set all prices because then nobody would ever be under water again!

It’s a bit ironic that this report refers to the expected announcement for August 17th...

If you want some history, go back and look at what was happening on August 17, 2007:

http://money.cnn.com/2007/08/31/news/economy/bernanke/

I remember the stock market was tanking with the first shocks of the housing crisis starting to come into focus. Bernanke’s surprise announcement on Aug. 17, 2007 (cut in the discount rate, adjustments to discount window policies, etc.) righted the ship and the stock market took off on a two month run before hitting its peak on October 12th I believe. That was the top.

GDP went negative in 1-Q-2008 and then the financial/credit markets seized up that spring and much more in Sept 2008 (just as the GOP started to make it competitive in the presidential race). Then it was lights-out for Republicans. Let’s blame it all on Bush.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.