This might:

Posted on 06/27/2010 7:54:16 AM PDT by STARWISE

A congressman's proposal to appoint an inspector general to examine bank-bailout deals for political pressure -- a measure aimed at the politically connected ShoreBank Corp. on Chicago' South Side -- was killed in negotiations on Friday.

ShoreBank has received commitments totaling $165 million from major banks such as JP Morgan, Goldman Sachs and Bank of America, and is awaiting approval of another $75 million in federal bailout money.

Rep. Judy Biggert (R-Hinsdale) introduced the amendment earlier this week amid reports that the White House had asked other financial institutions to help ShoreBank. The White House denied any interference.

In a statement, ShoreBank spokesman Brian Berg said on Friday, "This is a step in the right direction."

Sachs + Schakowsky + ShoreBank = Shakedown

Excerpt:

Today it was reported that Goldman Sachs CEO Lloyd Blankfein has been calling Wall Street friends to cough up $125 million to save ShoreBank, which faces federal closure next week. Rep. Jan Schakowsky suggested in January that Illinois taxpayers foot the bill. That would have been the first state-led bank bailout in U.S history. The idea was abandoned–so it appears the government is shaking down Goldman Sachs instead.

~~~~

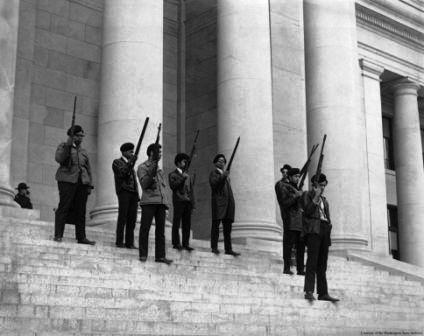

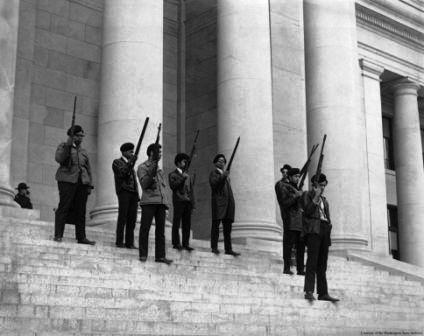

Wednesday, June 09, 2010 Tea Party Chicago protests Shore Bank Bail Out

Excerpt:

About fifty protesters stood in front of troubled Shore Bank’s LaSalle Street branch this afternoon to protest the impending rescue this politically-connected institution. Sponsored by Tea Party Chicago, the rally featured congressional candidates Joe Pollak and Isaac Hayes as well as new WIND radio personality Bill Kelly.

The speakers ran through a litany of Shore Bank’s shortcomings and the actions of its political patrons.

This provided convincing evidence that the bank is receiving exceptional treatment from its peers, regulators and especially its political protectors. Taking these charges at face value— and the same information has been widely reported in the mainstream media— generates more than a few question about why this institution is even being considered for a bail-out.

~~Surprise .. not!

Tea Party protestors! Yeah! Thanks STARWISE.

If we manage to win back Congress in November, we had better investigate every abuse of power, dereliction of duty, high crimes and misdemeanors of this administration and democrat controlled congress or it truly will be time for a third party. I can’t wait to see these pirates walk the plank!

And the rats know that could be their future,

so the manic fury to pass all these travesties.

We need to be watchful that they don’t pass stealth

laws which absolve their personal corruption ..

especially for those who will surely lose.

God knows what they’re scheming now.

At this point a SECOND party would be nice... instead we seem to have a 1.5-party system.

OMG you are so right. I haven’t even thought of that possibility yet. If they can figure out how to absolve themselves with some legislation, they surely will. It might already have been done in the over 2000 page ‘finanacial reform’ bill just passed by Barney and company. No-one knows what is in it yet..just like the Deathcare bill.

The republicans have been very quiet of late. We have outrages after outrages going on(especially with this spill) and they are strangely silent on it all(or worse, supportive like Barbour has done). It might be time for an organized phone call drive to our reps and senators this week. Enough is enough!

This might:

True.

I actually think the phone calls and tea parties have done alot of good with steering our party back to a conservative course. The republicans have done a pretty good job of hanging together and against the marxist bills being handed down by the regime. They don’t have the power to do much to stop it right now. I am just noting their odd silence on Obama and company’s criminal negligence on this spill in particular.

ShoreBank still in running for TARP funds despite end of program

By Paul Merrion

July 01, 2010

(Crain’s) — Congress didn’t pull the TARP out from under Chicago’s ShoreBank Corp. this week when lawmakers killed the $700-billion bank bailout program to help pay for Wall Street reform legislation.

A high-ranking administration official who asked not to be named said Thursday that banks with applications filed before June 25, the congressional cutoff date, would still be eligible for help from the Troubled Asset Relief Program, despite some fears to the contrary

http://www.chicagobusiness.com/cgi-bin/printStory.pl?news_id=38754

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.