Posted on 06/09/2010 6:38:40 PM PDT by blam

Stock Market On the Edge of Something Very Big, Crash?

Stock-Markets / Financial Markets 2010

Jun 09, 2010 - 07:02 PM

By: Anthony Cherniawski

U.S. stocks lost their gains Wednesday as Federal Reserve Chairman Ben Bernanke voiced cautious optimism about the economy and the central bank's Beige Book also noted modest improvement.

"Everything is universally moving in the right direction, but we already knew that," said Jeffrey Kleintop, chief market strategist at LPL Financial of the Fed's June report, which noted improvement across all 12 districts.

Backlash at BP

The cost to protect BP Plc’s bonds against default soared to a record, more than nine times the level before one of its wells exploded in the Gulf of Mexico, as pressure on the company to suspend its dividend intensified.

Credit-default swaps on BP climbed 126.1 basis points to 386.9 basis points, according to CMA DataVision prices. More than 40 U.S. lawmakers called today for the London-based company to suspend its dividend and Interior Secretary Ken Salazar told a Senate committee that “significant additional” safety requirements will be imposed on oil and gas companies drilling in the Gulf.

Why Did The U.S. Refuse International Help on The Gulf Oil Spill?

(ZeroHedge) Despite the vow by President Obama to keep the Gulf oil spill a top priority until the damage is cleaned up, 50 days after the BP rig exploded, a definitive date and meaningful solution is yet to be determined for the worst oil spill in the U.S. history.

So, you would think if someone is willing to handle the clean-up with equipment and technology not available in the U.S., and finishes the job in shorter time than the current estimate, the U.S. should jump on the offer. But it turned out to be quite the opposite.

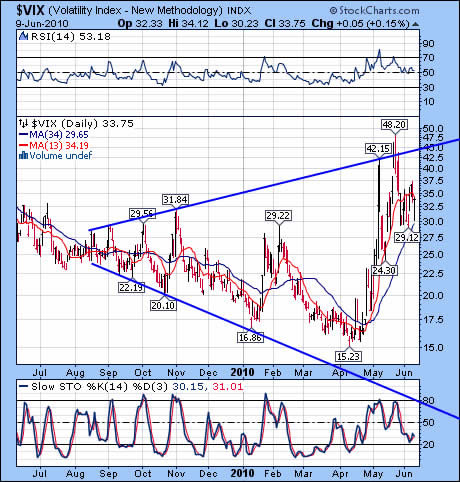

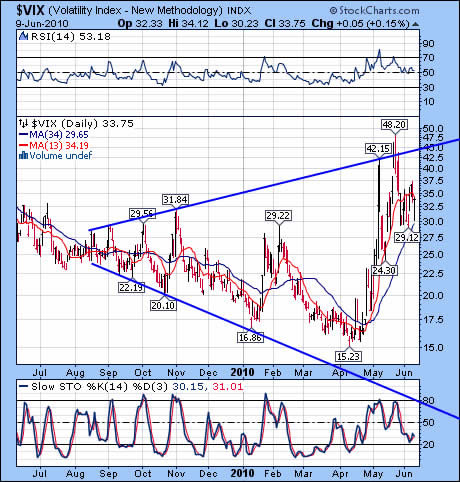

The VIX tested intermediate-term Support.

-- All of the see-sawing in the VIX confirms the uptrend, even though it closed below short-term Trend Support at 34.19 today. The rally in stocks that completed today was at a smaller-degree than the rally which topped on May 12th. However, the VIX is giving this pause in the decline a higher-degree pullback. This is something that I have only observed for the first time, and suggests a very strong move is about to happen.

The CBOE Put-Call Ratio for equities ($CPCE) stayed neutral at .92 today. The pros have increased the $CPCI to 1.62 (more bearish) at the end of the day. The 10-day average is still 1.52. The NYSE Hi- Lo index closed down 32 points today to -108. The Hi-Lo index remains in bearish territory. Bullish territory starts at 95.

SPY retested short-term Resistance.

Action: Sell/Short/Inverse -- The saying goes, “The markets always rally before a crash.” SPY is no different as it approaches the Head and Shoulders Neckline illustrated in the chart. This will be the third attempt to break 104 since the Flash Crash in May. It may just be the charm.

The probability of some event causing the market to gap through support overnight is very high. The H&S pattern sets up a target of 86.64, which is very close to the July 8 low of 85.77. My model suggests that we may see the markets meet their downside targets early next week.

QQQQ makes its lowest close since February.

[snip]

That is a truism most of the time.

Right now though this is a false market being manipulated by big government players in the arena. Nothing is at it appears to be and some players that look solid can and will be taken out of the game overnight.

Even a true contrarian doesn’t gamble on such huge ambiguities.

“I think Obama seizing BP or forcing them to divest all their assets to insure the “welfare” of the Gulf region would do it.”

I know of no legal way for him to accomplish that. I’m sure he would like to, though.

He’d like to appoint Van Jones as CEO. Use your imagination from there.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.