Posted on 06/06/2010 3:27:34 PM PDT by blam

Top 5 Graphs Show Emerging Markets Lead the Global Recovery

by: Econ Grapher

June 06, 2010

This week we look at the surging growth in the Indian economy, continued improvement in the GDP results from Australia, a strengthening recovery in the Canadian economy, and monetary policy decisions by Australia and Canada, and finish up with a look at the US nonfarm payroll figures which showed strong census hiring and not much else.

The main theme we see is global growth being led by emerging markets, with a select few developed economies in close pursuit, while other developed economies continue to dawdle as the gradual fragile global economic recovery continues.

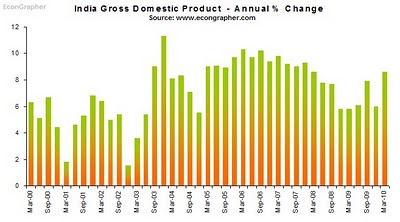

1. India GDP India's economy grew 8.6% year on year in the first quarter of this year, cementing a trend of strong economic growth in emerging markets. The figure compares to 6.5% in Q4 2009, and was slightly below consensus 8.8%. The figure puts India on a similar path to its neighbour and fellow economy, China, and places it in a similar predicament on the monetary policy front, with India having already increased its interest rate 25bps in April. In terms of the outlook, the Indian economy seems to be relatively strong at this point, echoing the trends of the other big emerging markets like China, Brazil, Indonesia, etc. The IMF noted in its World economic outlook that it expects the Indian economy to grow 8.8% in 2010 and 8.4% in 2011.

[snip]

That’s where all the cheap labor is (and unions aren’t).

duh

More importantly, that’s where the Governments actively promote policies that free capital and encourage manufacturing and profitability. Business growth is encouraged.

It’s not just labor costs that make manufacturing go overseas; in fact, the savings in labor is really quite small (if any) when you factor in shipping and duties. It’s the lower cost of doing business from a regulatory and tax basis that moves companies to these emerging markets, not the cheap labor.

Their unions are pretty strong. And the labor isn’t that cheap anymore. Most of the GDP growth in India is due to them manufacturing and selling stuff to themselves, i.e. internal consumption is driving their growth, not exports. Hence they have an intrinsically stronger economy than the export driven economies.

India’s labor force is still largely undeveloped. We are talking about 1.2 billion people with a national GDP of south Korea. So some 500 million people are living on a dollar a day. 900 million people lives on 2 dollars a day.

This is a colossal waste of good human resources.

Now if the Indian government improved the country’s primary and secondary education systems and built up it’s infrastructure, then it would be a different story.

So you can get rich by selling to yourself?

Tell me more...

That is the recipe for sustained poverty.

To get rich, you have to sell to others and invest the profits into your own country. Like the US did in the 19th century.

Yeah I had that figured out but the post I was replying to was saying something directly opposite.

Yes, if you can realise the difference between a market and a person.

Read this, and remember it very well:

The Economy Is NOT A Zero-Sum Game.

A lot of these are unskilled. you’re right that India needs to do a lot more.

That's called inflating the money supply, (and unless you up the goods output along with the money supply you get price inflation) and "selling to yourself" is not the way to wealth it is "part" pf the equation. A market economy needs trade, especially in the USA because like it or not we do not have all of the resources need to produce everything we need. (for instance Natural Graphite is not mined in the USA and that is just one item on a list of hundreds we need for production from Uranium to Bananas.)

The myth of corporation outsourcing to avoid paying union labor costs is one of the boogie men rolled out by the "Buy America" union robots using the "sell to yourself" gambit as the way to wealth. Again this is part of the equation BUT the Union/Progressive crowd forget that heavy Government intrusion into the market has chased much manufacturing out of the USA. (From ridiculous EPA Regs [Can't log here the spotted owl is nesting] to moronic Union sanctions [we will pay people NOT TO WORK because a machine made their job redundant] to overcautious safety regs [you need three men to dig a ditch while using a backhoe, yes I am not exaggerating our local city has to deal with that particular idiocy over some arcane health rule the local union dug up to pad the Union job roles].

So when I see the "sell to yourself" gambit bandied about as the way out of this particular mess I am quick to question both the motive and the implementation of said gambit.

If you want to go about such by repealing the layers of government regs that caused the mess count me in. If you wish to go about it by some half-assed union ploy to pad their paychecks using even more government regulations to force companies to deal solely in the USA in order to override the "unintended consequences" the previous government regulations caused (A.K.A. Throwing Gas on the fire in attempt to put it out) then not only am I not for it I am going to actively oppose it.

Nuff said...

Next Argument...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.