Posted on 05/16/2010 3:55:17 PM PDT by blam

The Euro Is Sliding Again And The Week's Barely Started -- Meanwhile Trichet Scoffs At German Inflation Fears

Joe Weisenthal

May. 16, 2010, 6:00 PM

There's still over 2 hours before markets really get going -- Tokyo opens at 8:00 PM ET -- but in very early action the euro is already falling.

Bloomberg reports trades as low as $1.2338 in early Japanese trading.

Expect to hear the word "parity" a lot in the coming days ahead, even though that's a long way off.

Meanwhile, the man at the center of the storm, Jean-Claude Trichet gave an interview with Der Spiegel in which he swore up and down that the ECB was not in fact engaged in quantitative easing (all bond purchases will be "sterilized" via the removal of liquidity elsewhere). But more to the point, he insisted that the ECB remains an independent body.

And to the German audience for whom the interview was intended -- an audience that's both upset about the bailout, and paranoid about inflation -- he was adamant that there wasn't much to worry about.

I fully understand the particular sensitivity of my German friends. But facts are facts: Inflation in Germany has never been as low as it has been over the past 11 years. The German fellow citizens can see that the euro has indeed been a good store of value over time.

Next stop: Explicit quantitative easing.

Now for some perspective, here's a lifetime Euro chart from Calculated Risk:

[snip]

(Excerpt) Read more at businessinsider.com ...

well if the euro is now more or less on par with the dollar

( as far as i remeber the euro was pegged at $1.20 when “invented”)

this is not necessarily a bad thing.

It is. Neither are worth a plug nickle.

Then I’ll trade you plug nickels for your dollars and/or euros...

It isn’t good for American product exporters like me...

It is. Neither are worth a plug nickle

Nickles are worth 6.2 cents in metal value. I will trade you in a few months when a penny is worth over a dollar in copper.

IIRC...the Euro,at launch,was pegged at something like $1.17 per Euro.

Also,IIRC,the Euro fell to about $0.88 per Euro a few years back...can't recall exactly when...or why.

Just make sure the pennies are pre-1983.

It's all there on that chart.

yes i remember a time when the Euro was this low (this was

very short after the launch) but i guess most people in europe (including me) have been to busy to really notice it, because we have been very busy asking us “what the hell has happened to the prices!!!!” because there was a serious rise in prices for just everything.

The Fed just swapped a billion dollars for euros.

Why?

Europeans need/want dollars.

Why? Europeans are hanging on to dollars, and dumping Euros.

What do they know/feel/sense that we don’t know?

Well usually countries (or the EU) buy different currencies

on a large scale to “stabilize” it. So it could be possible that the US doesn´t want that the euro loses any more to the dollar and there for buys it right now.

Stock-Markets / Financial Crash

May 16, 2010 - 06:57 AM

By: Shaily

While none of us predicted the massive crash of May 6 2010, premium readers at Investing Contrarian were fully aware of a S&P fall to 1120 from 1190 which was the day when we initiated short position.

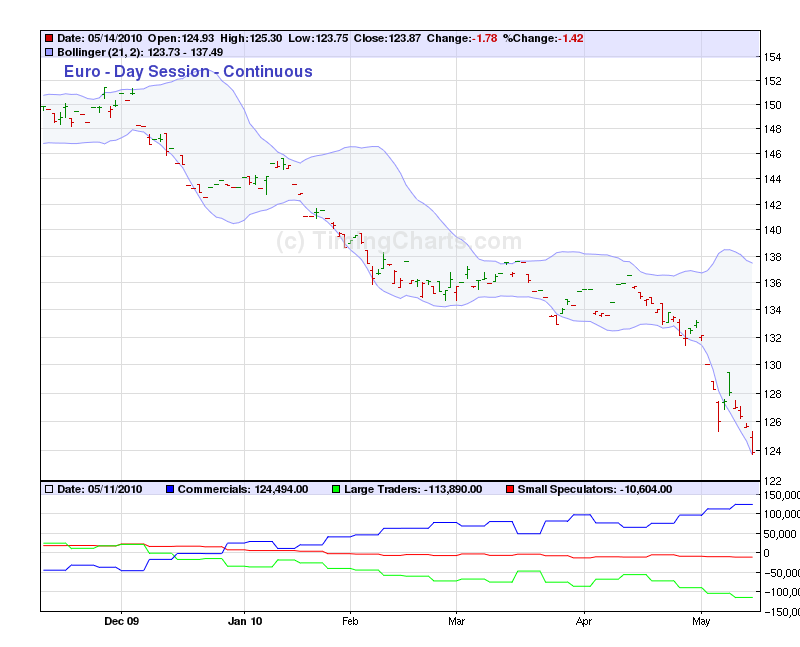

Looking at COT charts this week, we are once again forced to believe that the currency markets are pointing to another crash and this time it could endanger almost every asset class including Gold. The crash expected thanks to new found love for EURO carry and sometime even against the old carry love YEN.

EUR/USD

The EURO positions have now reached an unreal 113k short positions. I have worked in currency markets for over 10 years and I have not seen a more accentuated market in my life. I probably took a while to digest the fact that markets and funds have allowed themselves to short even when the positions outstanding are so massive that any rip could be fatal.

Selling EURO has become the favorite hobby of almost almost entry level analysts and am sure most of them on being asked their favorite trade will reply with the obvious.

Over the last 3 updates of COT, I have again and again stressed that shorting EURO is a dangerous game than shorting even dollar. EURO has a central bank which in the past has taken the brave step of raising rates to kill the shorts when no one expected it. (Ref 2004).

We are firmly off the view, that PIIGS is not a genuine case for EURO breakup but it is a self sustaining vicious move by the funds and institutions who first shorted the EURO during its early stages. The foolish government of EURO zone over reacted by letting the funds take control of the markets.

We do not know how far EURO will fall but the situation as it stands today should make one extremely nervous as EURO shorts are now fueling a dangerous carry trade into equities and Gold. Gold has no reason to find itself standing at 1250 (ignoring the Bugs) except that EURO is being borrowed to invest into Gold and the likes.

We continue to look at the euro fundamentals and we believe that the situation in Dec 2009 was no different than May 2010. There 5 countries with bloated deficit nos but the banks within these countries continue to have ample liquidity (except Greece which too became a problem only in April, a good 4 months post Dec 2009).

There is now a real possibility that PIIGS may be asked to stand out of the EURO and let their own currencies to trade while the ECB may help them tide over the debt refinancing for a fixed period. If such a proposal is executed, we believe that will be bullish for the EURO.

Not withstanding the proposals, we believe, the current EURO shorts are now stretching the system to a point of breaking. Either the EURO goes, or it snaps back with a speed that can take straight to 1.5 before falling back to 1.4. In the ensuing system restoration, we could easily see a correction in S&P and Gold.

EURO carry is the new buzz and it is poisonous the least to say.

[snip]

Someone is lying and it isn't the market. There's a reason it's tilted toward shorting.

" With about 14 hours to go before opening bell in NYC, US futures are already heading lower."

http://www.zerohedge.com/article/local-gold-inventories-depleted-panicking-german-dealers-stage-run-krugerrands

With Local Gold Inventories Depleted, Panicking German Dealers Stage Run On Krugerrands

With Local Gold Inventories Depleted, Panicking German Dealers Stage Run On Krugerrands

Submitted by Tyler Durden on 05/16/2010 13:40 -0500

Last week we noted that several prominent Austrian and German gold dealers had run out of inventory and were no longer transacting with a European population that has suddenly discovered gold religion. As a result, dealers are now focusing procurement efforst outside of Europe, with South Africa receiving the brunt of Europe's panic for physical precious metals.

As the FT reports, "At the Rand refinery in South Africa, the phone has not stopped ringing this week." Just imagine what will happen when the gold bug goes airborne and jumps across the Atlantic...

More from the Financial Times:

Panicking German dealers and banks have been desperate to get their hands on krugerrands, the world's most popular gold coin.

[snip]

Sun May 16, 2010 8:07pm EDT

Elaine Lies

TOKYO, May 17 (Reuters) - Japan's Nikkei average fell 1.3 percent on Monday, with Canon Inc (7751.T) and other exporters hit as the yen strengthened amid lingering worries about the euro zone's fiscal woes.

Mizuho Financial (8411.T) jumped 3 percent after Japan's second-largest bank by assets forecast a near doubling of profit this year as the economy recovers.

The benchmark Nikkei .N225 shed 138.19 points to 10,325.37, while the broader Topix fell 1 percent to 927.12.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.