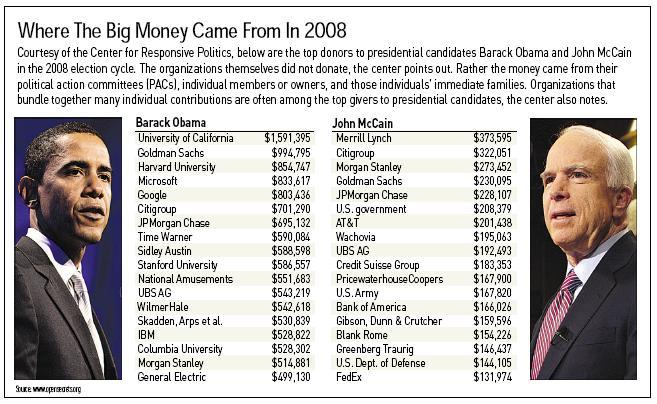

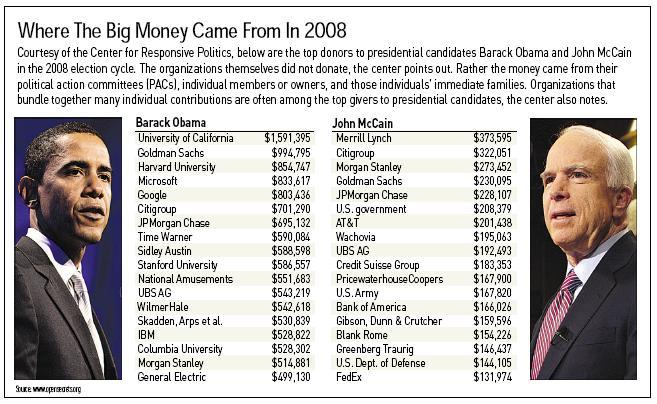

Right. GS donated four times as much to O's campaign.

Posted on 04/23/2010 6:30:48 AM PDT by SeekAndFind

WHEN Goldman Sachs went public in 1999 its prospectus began: “Our clients’ interests always come first. Our experience shows that if we serve our clients well, our own success will follow. Our assets are our people, capital and reputation. If any of these is ever diminished, the last is the most difficult to restore.” Only the most naive investor read that as a commitment to do-goodery rather than calculated self-interest. And only the most priggish today would argue that financial institutions are obliged to be fluffy.

That nuance matters, now that Goldman is embroiled in a scandal about mortgage securities (see article). In the court of public opinion it faces three charges. The first is that it was unkind to its institutional counterparties who bought a security that it helped arrange, and which plummeted in value when house prices fell. But it has no legal obligation to be kind, and the idea of willing counterparties, with full and accurate disclosure, each seeking to profit from the other’s inferior grasp, is central to financial markets. And if Goldman sullied its reputation, its customers can always go elsewhere.

The second charge is that Goldman helped the client on the other side of the trade profit from falling house prices. That is no crime, however, and even judged by the yardsticks of morality and economic stability, those who puffed up the housing market have more to answer for than those who bet against it.

It is the third accusation that really matters. The Securities and Exchange Commission says Goldman misled two clients by failing to give adequate disclosure. At the urging of a hedge fund, Paulson, it enlisted an insurance firm, ACA, to select (with Paulson’s input) a pool of mortgage instruments upon which the security’s price would be based. The SEC alleges that Goldman misled ACA into believing that Paulson would co-invest with it. In fact Paulson was betting that the security would decline. The SEC also claims that IKB, a German state bank with a seemingly inexhaustible capacity for self-harm, was not told of Paulson’s role in helping pick the mortgages, a role the SEC argues was material.

Broken dealer? Both of these possible offences are serious. Goldman denies the first outright, and on the second it argues that Paulson’s role was not material. The arguments appear finely balanced: the investigation has gone on for more than a year and the SEC’s top brass was divided over whether to proceed. It is impossible to second-guess the case’s outcome. But Goldman is already viewed by many as guilty. That fits a broader narrative in which it manipulated the bail-out and profited from economic misery. For those interested in accurate history, this is unfortunate. Some of Goldman’s links with the government were uncomfortably close. But the real story of this financial crisis, like many others, was not about one firm but near universal risk-taking, stupidity—and possibly widespread fraud.

History says that banks bounce back from legal problems. Goldman, however, will continue to be beaten up in public, whatever the outcome of this case. In one way, rightly so. No firm has combined such red-blooded dedication to profit and high pay with so little appreciation of the state’s generosity, in saving it from following Lehman and in propping up finance with subsidies and guarantees (which are now being reconsidered—see article). Many at the firm might wish it could go private again and recover its capitalist vim. But after a decade of huge success it is now too big to do that. It is also so dedicated to trading that it cannot go back to being a normal, boring bank. Greed and success, let alone a guilty verdict, have already pushed Goldman Sachs into a kind of prison.

Interesting read.

Right. GS donated four times as much to O's campaign.

Talk about a bad investment. :)

Actually, the media has been perpetuating the myth that Wall Street and the moneyed give more to the Republicans than Democrats in order to give the impression that the GOP cares only for the rich.

Of course the evidence shows the OPPOSITE. Wall Street gives MORE to the Dems that the GOP.

Rush’s take is probably right, that GS is just play-acting the part in hopes of future goodies.

Right after the Nov. '08 election Investor's Business Daily pointed out that most investors voted O. Imho that's probably going to be different with Nov. '10...

Goldman misled clients by failing to give adequate disclosure,just like Obama did and yet they get nailed for it.

When one deals in stocks one must understand you are at risk of a loss.

It’s difficult to fathom that IKB relied on a representation that Paulson was long on the CDO to decide it was a good investment. If that’s really what happened, then the malfeasance IKB’s officers perpetrated on its shareholders is far more grievous than anything Tourre did.

If the GOP is so pro-business, why would that be?

Maybe firms like Goldman Sachs aren't really for open and honest business policy's, but rather for regulation that favors them and their clients.

A broker I knew would call that a stick with shit on both ends.

What do you feel they failed to disclose?

lol!!!! —nothing like the English language for conveying so much thought with so few words....

Stocks are like keno it’s a gamble no matter how much you know about the odds it’s a risk.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.