Skip to comments.

Q3 GDP: Obviously Fictional

Seeking Alpha ^

| November 08, 2009

| Seeking Alpha

Posted on 11/08/2009 12:12:43 PM PST by Son House

There was no surprise with the announced third-quarter GDP for the U.S. economy (+3.5%), however, there was some personal disappointment for me. The disappointment relates to the fact that few, if any, commentators were willing to speak up and exclaim that “the emperor is wearing no clothes.”

The reason that this is such a big disappointment is that the “official” number for U.S. Q3 GDP cannot withstand the slightest analytical scrutiny. So, allow me to analytically dissect this obviously fraudulent number.

Let's start with the big picture. At the end of 2008, official GDP was -6.4%. This was also likely an understatement, but for the sake of argument let's treat it as “fact”. Move ahead to the Q3 2009 reading of +3.5% and we see a swing of 10% in U.S. GDP – in merely the span of nine months. The only factor in the U.S. economy pushing against this massive contraction (and debt implosion) is the “Obama stimulus package”. However, using the Obama regime's own numbers, less than $300 billion of true “stimulus” would reach the U.S. economy over the course of this entire year.

This means that as of the end of Q3, only about $200 billion of true stimulus has entered the U.S. economy. If anyone actually believes that this $200 billion could create a 10% shift in U.S. GDP, the following points will quickly dispel that fantasy.

Regular readers will recall that I have pointed out on a number of occasions that the U.S. economy has lost roughly $2 trillion in spending-power from the peak of the housing bubble. This is comprised of roughly ½ reduced credit, and ½ lost income. On the credit side, at the peak of the bubble, U.S. homeowners extracted $840 billion in (temporary) “equity” in 2006 alone. That source of credit has virtually disappeared – along with billions in other categories of “consumer credit”.

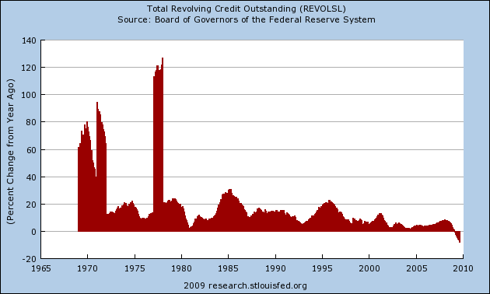

The following graph from the St. Louis Fed helps to illustrate this more clearly.

As you can see, for the first time in the more than 40 years for which this data has been kept, U.S. consumer credit is steadily contracting. This 40-year period also marks the era in which the U.S. economy has become totally dependent on ever expanding debt/credit. Clearly, a mere $200 billion in stimulus could do little more than slow down the U.S. economic collapse – and certainly not reverse it.

With the U.S. economy now burdened with $60 trillion in total public/private debt, it already spends trillions each year simply paying the interest on this debt. Thus, this Ponzi-scheme economy now requires a steady, significant rise in credit merely for this economy to “tread water” (i.e. zero growth). By itself, contracting credit is a powerful downward force on the U.S. economy. The following point will make this even more obvious.

As I have recently stated, the U.S. government can never afford to voluntarily raise interest rates again. A mere 1% increase in interest rates would result in $600 billion per year in added interest payments (on top of the existing trillions per year in interest payments). I observed that, by itself, this $600 billion extracted from the U.S. economy would be equal to roughly a 5% drop in GDP.

I also added that the total drop in U.S. GDP would be greater than 5% because of the spin-off (or “multiplier”) effect of that withdrawal of cash. This begs the question: how large a multiplier effect would be a reasonable estimate?

If we look at the Obama stimulus package, and the purported gain in U.S. GDP, we are supposed to believe that a mere $200 billion could cause a 10% shift in GDP. If that was true, then a 1% increase in U.S. interest rates, which would lead to a subtraction of $600 billion from the economy (three times the amount of Obama stimulus) implies a drop in U.S. GDP of 30%. If anything, a 1% increase in interest rates would cause an even larger collapse in the U.S. economy – since this additional push would be working with the existing downward momentum, not against it (like the Obama stimulus package).

If I wrote a piece claiming that a 1% increase in U.S. interest rates would cause a 30% drop in U.S. GDP, would anyone believe that? Yet, if you refuse to believe those numbers, then you can't possibly place any credence on the GDP number which the U.S. government fabricated for the third quarter.

However, denouncing this ridiculous farce isn't dependent on logic, alone – we also have our “smoking gun”. In order to fabricate a number as wildly inaccurate as Q3 GDP, the U.S. government had to also fabricate additional data – most notably the “GDP deflator”.

For those who haven't had this explained to them before, every GDP estimate must be “deflated” (by the prevailing inflation in the economy). If this wasn't done, then the “raw” GDP data is totally invalid – because there is no separation of how much of that “growth” was a genuine increase in economic activity, and how much was merely higher prices.

For the third quarter, the U.S. government used a “deflator” of less than 1%. Again, it is easy to demonstrate that this number has no connection to the real world. As we have all heard, the entire world is engaged in a game of “competitive devaluation” of their currencies. Obviously “devaluing currencies” is identical to “rising prices” (i.e. inflation) since by definition it requires more units of a devalued currency to purchase goods.

In a world of devaluing currencies, the U.S. dollar has managed to fall much farther than almost every other currency in the world. Again, as a matter of logical necessity, this means that the U.S. economy must experience more inflation than other economies – not less. Yet other governments are beginning to withdraw monetary stimulus from their economies, precisely because of growing inflationary pressures.

As a further rebuttal of the ridiculous inflation numbers of the U.S. government, we have the well-respected John Williams, and his own web-site: shadowstats.com – which calculates U.S. economic statistics using the same methodology which was used a generation (or two) ago, before the U.S. government added all of its “techniques” for manipulating those same statistics. Williams pegged Q3 U.S. inflation at roughly 7% - a huge gap from the less-than-1% the U.S. government used to “deflate” its raw GDP data.

In short, any commentator who removed his/her “blinders” to take a close look at the latest U.S.GDP number would have to reject it as being inaccurate to the point of total irrelevance – assuming one is capable of performing simple arithmetic. The fact that even critics of U.S. official “statistics” refuse to denounce this number as fraud is a regrettable demonstration of their own timidity.

“The emperor is wearing no clothes,” and I'm not afraid to explicitly state this. We will all be better off when other commentators who are not part of the corporate propaganda-machine will cease their own self-censorship and explicitly denounce the endless stream of fraudulent “statistics” of the U.S. government.

TOPICS: Business/Economy; Front Page News; Government; News/Current Events

KEYWORDS: economy; fictional; gdp; obviously; q3

Navigation: use the links below to view more comments.

first 1-20, 21-29 next last

I think there is also some economic data that comes out in November in which they use to revise the GDP, be on the look-out for more fiction

1

posted on

11/08/2009 12:12:44 PM PST

by

Son House

To: Son House

I’ve tried telling my husband this, although I could not articulate what I was trying to say. I basically said that this administration is in FULL CONTROL and FULL PROPAGANDA mode for all information regarding GDP, jobs, economy, housing figures, etc.

Have you noticed the totally conflicting reports in the news DAILY about home sales up, down, etc.?

And how in the heck is the stock market gaining with all of the ANTI-capitalist, anti-industry, anti-business policies being enacted on a daily basis?

I’m convinced it is all being controlled and manipulated.

2

posted on

11/08/2009 12:23:52 PM PST

by

Muzzle_em

(just say NO to O!)

To: Son House

It’s a sad thing to have to live through and see happening before our eyes.

I don’t see any way out of a collapse either.

3

posted on

11/08/2009 12:28:25 PM PST

by

No!

To: Son House

The rise of 3.5% in the last quarter GDP is *not* fictional. He's making up facts. GDP is a calculation based on a specific formula: GDP = private consumption + gross investment + government spending + (exports − imports) That 3.5% was not due to the stimulus bill, but rather because of Cash for Clunkers and First Time Homebuyer grants that went directly into the economy in that quarter. There will be a reckoning when the GDP falls back to the previous level next quarter after these one-time events have run their course, but not for the reason he states. The GDP increase was real, but entirely based on the "G" component - government spending. There has been no increase in consumer spending or business investment, the other two components of the calculation.

4

posted on

11/08/2009 12:34:53 PM PST

by

bigbob

To: Son House

This is ignorant nonsense. The change is not a "10% swing in GDP in 3 months", those -6.5 and +3.5 figures are annual rates. The total decline in GDP, peak to trough, was only 3%, and 1% of it has come back. This is perfectly normal.

GDP ran at a $14.547 trillion annual rate in the 3rd quarter of 2008. It bottomed at a $14.151 trillion annual rate in the 2nd quarter of 2009, 3% below that level. In the 3rd quarter of 2009, it was $14.302 trillion, up 1% from the low.

There is nothing surprising in this. The fall was driven by many one-off factors, especially (1) a 25% fall in business investment, letting inventories run off into cash when the bond market shut down, making it impossible for businesses to finance new orders as previously planned and (2) a rise in the savings rate from near zero to 6%, as credit was cut off to weaker borrowers. As each partially reverses, does the fall in GDP each caused.

Nor is there any mystery about how households afford it. One, personal income was maintained throughout, in nominal terms. Taxes fell dramatically and transfer payments increased, entirely independent of special "stimulus" payments. The swing in consumer spending funded an increase in the saving rate, it was not forced by a reduction in after tax income. Two, US households are asset owners not just wage earners. The biggest hit in fact was to real estate equity and to stocks and other financial assets, to wealth rather than current income. But that stopped in March when the markets turned.

Already in the 2nd quarter, the US household sector saw the value of its assets increase by $2 trillion from higher financial market prices - and that continued in the 3rd quarter (we get the final figures on that in mid December, but it will be up $2-3 trillion, probably).

5

posted on

11/08/2009 12:41:38 PM PST

by

JasonC

To: Son House

I remember two or three years ago, many good people were warning us all of the Ponzi scheme our “prosperity” was. They were often insulted and called “doom and gloomers” and “chicken littles”. I’d like to know where those people are today with their insults.

Do they believe these dubious GDP numbers? LOL

What are their plans to get out of this. Should we open more fast food restaurants and movie theaters?

6

posted on

11/08/2009 12:44:48 PM PST

by

KoRn

(Department of Homeland Security, Certified - "Right Wing Extremist")

To: Son House

With the U.S. economy now burdened with $60 trillion in total public/private debt, it already spends trillions each year simply paying the interest on this debt. Any figure I've seen that big includes the unfunded liability of Medicare and Social Security in addition to real government, corporate and private debt, which doesn't require interest because it isn't debt yet.

7

posted on

11/08/2009 12:55:09 PM PST

by

KarlInOhio

(Any similarity between V and the Obama admin is just that of Obama and any other totalitarian regime)

To: bigbob

You are wrong. Personal consumption expenditure bottomed in April at an annual rate of $9.968 trillion, and has since risen to $10.167 trillion. That is a $200 billion annual rate increase, or 2%. Consumption has must definitely rebounded.

Disposable (after tax) personal income did not fall in nominal terms to start with, unless measured against rebate-check peaks in the months of May, 2007 and 2008 both. Instead tax receipts fell, business investment fell, both by double digit amounts. The fall in consumption allowed a rise in the personal savings rate from near zero late last summer (2008) to highs of 6% early this summer (2009). In the latest quarter the savings rate has fallen again slightly, funding the increase in personal consumption.

It also reflects a reversing wealth effect. By far the biggest impact to the household sector was a drop of $12 trillion in the value of assets owned, split over real estate values, stocks owned, and indirect financial claims (pension funds, retirement account mutual funds, etc). That stopped when the markets bottomed back in March, and since then asset values for the household sector have been rising $2 trillion *per quarter*.

The initial fall in asset values led to a drop in consumption and an increase in the savings rate, and a shift of asset preference out of risk and into cash. That processes finished by the end of March, and the risk assets have outperformed since then (without inducing any reverse shift out of cash BTW - the average person remains very risk averse after last year's bear market).

Analysts looking at this stuff continually make the mistake of treating the American people as wage paupers living hand to mouth. They flat aren't. The modest portion of the population in that situation do not drive consumption, it isn't where the money is. Americans own $52 trillion in net assets, and swings in the value of their assets outweight anything that happens to their income, in the short term.

GDP swings are tracking and trailing by about 3-6 months the swings in asset values. There is nothing fake about it, nor anything complicated. Doom mongers are just wrong. They claimed all the banks would go to zero as recently as the March lows, and it was balderdash.

It is called the cycle for a reason. But every downswing, in market values or GDP, doom mongers will not be lacking who will scream the sky is falling and it is different this time and this time everything goes to zero forever and stays there. But they are mere hysterics and belong on the streetcorner in a washboard selling bibles.

8

posted on

11/08/2009 12:55:59 PM PST

by

JasonC

To: KarlInOhio

Also, it is an asset. Anybody think social security benefits can be paid out without somebody collecting them? Didn't think so...

9

posted on

11/08/2009 12:56:57 PM PST

by

JasonC

To: Son House

Not fictional, just annualized and measured in dollars. In the quarter when, dollar denominated, the GDP grew by 0.87% (which annualizes to 3.5%), the dollar went from about 93 yen to about 90 yen. Measure in yen, the U.S. GDP shrank by 2.38% in Q3 2009, which annualizes as contraction at a rate of 9.52%.

If you don’t like Japanese yen, you can do a similar calculation in Euros or ounces of gold.

10

posted on

11/08/2009 1:03:39 PM PST

by

The_Reader_David

(And when they behead your own people in the wars which are to come, then you will know. . .)

To: JasonC

Does “asset value” contribute directly to GDP, whether positive or negative? I am sure it contributes indirectly (e.g., the wealth effect) but does, for example, the value of homes or the value of our businesses or the value of our stock portfolio find itself into the GDP equation?

To: bigbob

3.5 percent at the start of a recovery is very anemic.

The GOP platform for 2010 will be jobs, jobs, jobs. All of the enacted and proposed policies of this juvenile Administration have already or will destroy jobs. Allowing the Bush tax cuts to expire will destroy still more jobs. This economic climate is going to make the 1994 tsunami look like walk in the park for the RATS.

12

posted on

11/08/2009 1:57:15 PM PST

by

mwl8787

To: KoRn

“What are their plans to get out of this. Should we open more fast food restaurants and movie theaters?”

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Don’t be silly! In a downturn this severe we need to open more suntan studios and florist shops.

13

posted on

11/08/2009 2:02:45 PM PST

by

RipSawyer

(Trying to reason with a leftist is like trying to catch sunshine in a fish net at midnight.)

To: Muzzle_em

And how in the heck is the stock market gaining with all of the ANTI-capitalist, anti-industry, anti-business policies being enacted on a daily basis?

^

Rumor, fact, guess, prediction, herd, ect. There are a lot of Democratics who work in positions of change, change, change. Just look at how they say all these jobs are saved or created, yet the unemployment numbers shows we are losing Jobs

14

posted on

11/08/2009 2:40:38 PM PST

by

Son House

(The penalty for Conservatism will be high.)

To: Muzzle_em

To: Son House

But Obama said that the recession (Bush recession) has ended and the Obama recovery has started. So if the recession starts up again wouldn’t it be the Obama recession?

When does the “Blame Bush” end and the Obama Presidency begin?

16

posted on

11/08/2009 4:12:26 PM PST

by

Mike Darancette

(Obama: Grasping at Straw Men _ Not a Public Option It's a government mandate.)

To: Mike Darancette

Good point, only the State Run Media knows, but we could guess that answer

17

posted on

11/08/2009 4:14:54 PM PST

by

Son House

(The penalty for Conservatism will be high.)

To: JasonC

This is a dumb article that JasonC has made the major points on.

I would only add the following. The swing from annual -6.4% to +3.5% is actually a quarterly growth of -1.6% to +0.9%, which for a 3 trillion dollar economy per quarter is a -48 billion drop to a +27 billion increase. doesn’t seem so outlandish now does it?

I don’t credit the Obama stimulus package with anything. Most of it has not even been spent yet. What is happening is the normal cyclical recovery that happens in every cycle.

Investors are (rightly) skeptical of Wall Street “buy-side” biased articles. In this case, this author is selling gold based on a “dooms day” scenario for the US economy and investors should be equally skeptical of his motives.

And frankly, none of this author’s articles hold up to much scrutiny. If you don’t believe in US government statistics or corporate earnings (like this author) look at the trade data. Imports cannot be faked because they are some other countries exports. Imports are up, the economy is recovering.

18

posted on

11/08/2009 5:57:39 PM PST

by

Reverend Wright

( Hussein Obama is truly post-partisan: It's all about him.)

To: Son House

Good Lord, you’re a retard.

To: Reverend Wright

One quarter does not make a trend, so a recovery is yet to make progress at best case scenario. Guessing one quarter shows a trend may bring serious heartbreak.

Two obvious; the consumer confidence is not back; Jobs, which is purchasing power, is still trending negative. I can tell you right now 1st and 2nd quarters are slow. We don’t have 3rd quarter numbers finalized, and if 4th quarter auto sales really just happened 3rd quarter because of cash4clunkers, Edmunds gets a big thanks for keeping us grounded.

I see Government Jobs are being sold as real growth, when we know it takes a real private sector tax collection from a producer to pay for that temporary growth.

No, I am not a doomer, I want recovery, jobs across all sectors, not Government spending. 100% in the market 401k, IRA, ect. I do think the author didn’t make points well, but not at the price of discard

20

posted on

11/08/2009 6:30:47 PM PST

by

Son House

(The penalty for Conservatism will be high.)

Navigation: use the links below to view more comments.

first 1-20, 21-29 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson