Posted on 10/25/2009 7:15:56 AM PDT by HangnJudge

The charade in NYC and Washington goes on. There is no question that our government is controlled by the unelected that lurks behind the scenes or are appointed as bureaucrats to run our country. It was never more evident than when administrations changed last January. Team A replaced Team B, all of whom just happen to be members of the Council on Foreign Relations, the Trilateral Commission and the Bilderberg Group. There is no debate. There is only one plan and that is for one-world government. These are the Illuminists who will Shepard us into final bondage. This is what our government is all about today and has been since WWII.

The heart of the elitist control mechanism is the Federal Reserve and the Treasury Department. Control of our country emanates from these two entities. They control the purse strings of our nation. They allow us to pay for our own destruction. This is achieved by taxation and debt. The system in place has been used for centuries to keep control over people. The elitists want total power over us and all the inhabitants of the world.

Their plans to bring down the world’s economic and financial structure is well underway. The problem is that the public has begun to discover what they are up too via talk radio, the Internet and publications such as the International Forecaster. That has caused the elitists to accelerate their plans and that has opened the window of opportunity for us.

(Excerpt) Read more at marketoracle.co.uk ...

Thanks for posting....

Unfortunately...the George Soros-inspired Free Trade Globalists on here....they will claim this is all a “conspiracy theory” when in fact it is a reality

These are the same types who claim “CFR does not exist”....yet anyone can read their plans in Foreign Affairs magazine

That the Bush Admin and the Obama Admin are all members of the CFR, Tri-Lats, and Bilderburgers should tell you that what Obama is doing is nothing really new....he is just a little more socialist than Bush

Real Lesson of Japan's Lost Decades

Neither Koo nor Krugman have learned a thing about the Real Lesson of Japan's Lost Decades.

The real lesson is no matter how much money you throw around, economies cannot recover until noncollectable debts are written off. That is why you have “zero interest rates and still nothing’s happening.”

The moment fiscal stimulus stops economies are virtually guaranteed to relapse until the core problem is resolved. The problem is Asset Bubbles, Malinvestments, and debts that cannot possibly be collected.

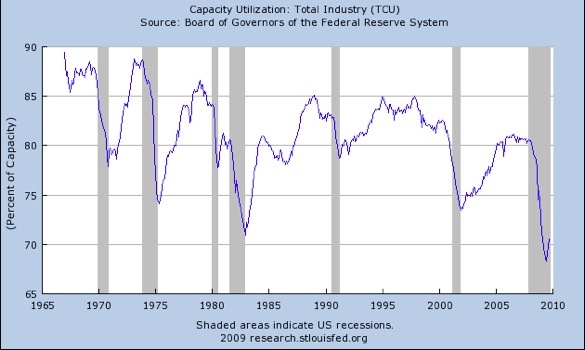

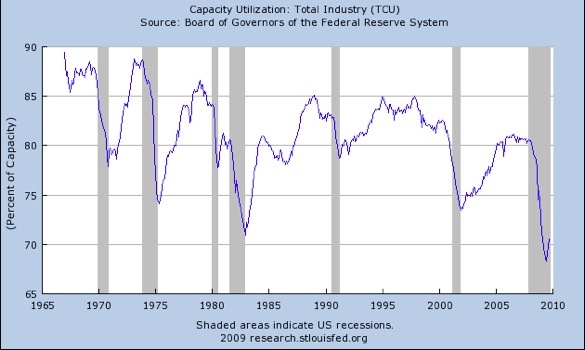

Bailing out the banks did nothing to fix these problems. Consumers are still saddled in debt, in underwater mortgages, with no job. Moreover, there is no driver for jobs given rampant overcapacity in nearly every sector.

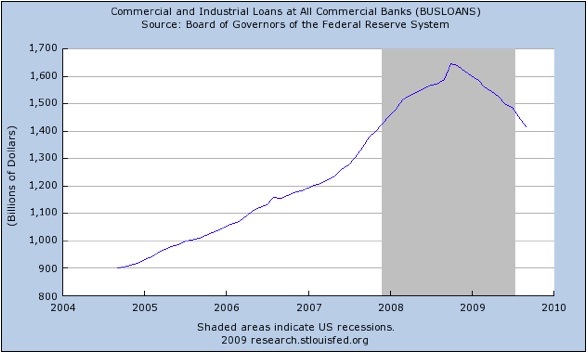

Banks do not want to lend in this kind of environment so they don't. Businesses do not want to expand in this kind of environment so they don't. Meanwhile the Obama administration is making matters worse by increasing taxes on small businesses and proposing everyone pay for health insurance, with businesses forced to offer a plan or pony up part of the cost.

This too is giving small businesses an incentive not to hire. Housing prices are too high yet the Administration and Congress are hell bent on propping up prices. The solution is to let prices fall until they are affordable.

The irony is after all the bitching we have heard and all the "Affordable Housing Plans" out of Congress, we have a golden opportunity for affordable housing and no one wants it.

This proves beyond a shadow of a doubt that "affordable housing" was nothing but a scam for the Fannie Mae, Freddie Mac Congressional slush fund all along.

March 13, 2009

Chaos reigns globally. Respected academics and high ranking politicians call for bank nationalization. CNBC reports of “secret” meetings at Goldman Sachs amid fears Geithner cannot get the job done. US equity indices are down more from their highs than the corresponding period in The Great Depression. Pension funds, 401k plans, endowments, insurance companies, etc., are fully exposed, taking heretofore unimagined losses. With nearly everyone in the country exposed to equities in one way or another, the unthinkable begins to seem increasingly plausible. Insurance companies cannot pay claims; pension funds cannot meet their obligations; universities suspend session; Mr. and Mrs. Smith, told just months earlier an unprecedented $700 billion bank bailout was designed to save them and their neighbors on Main St., stand to lose everything. The Fed, having thrown just about everything in its arsenal at the crisis, appears to be losing control. In the most desperate of times, Hatzius calls for the most desperate of measures:

…Fed officials might need to expand their balance sheet by as much as $10 trillion to make policy appropriately accommodative (pg. 2)…To be sure, “quantitative easing”- an increase in base money beyond what is needed to keep the funds rate at zero- by itself may not be sufficient on its own because Treasury bills become perfect substitutes for base money once short-term interest rates have fallen to zero. But the Fed can engage in “credit easing” by purchasing assets whose yields are still positive, including longer-term Treasuries, commercial paper, mortgages, corporate bonds, and perhaps even equities.5 Five days later, the Fed shocks the world (though not, it seems, Goldman Sachs) with its most aggressive policy action yet, expanding both the size and composition of its balance sheet via increased purchases of mortgaged-back securities, agency debt, and long-dated Treasuries. Spreads immediately tighten; Bonds- both IG and HY- scream higher; equities stage one of the most explosive rallies in history; the debate shifts from bank nationalization to record bank profits and excessive pay; financial collapse, along with the terrifying social, political, and economic consequences associated with it, is averted. The war, we are confidently told, is over.

Mission accomplished.

May 2004

Ben Bernanke and Vincent Reinhart (who until 2007 was Director of the Division of Monetary Affairs for the Board of Governors of the Federal Reserve System) publish “Conducting Monetary Policy at Very Low Short-Term Interest Rates” in The American Economic Review. How, they ask, can a central bank effectively move beyond conventional policy measures when short term rates are at or approaching zero? Bernanke and Reinhart suggest three strategies:

Convince market participants rates will stay low for a period beyond current expectations Change the composition of the central bank’s balance sheet (credit easing) Increase the size of the central bank’s balance sheet to a level exceeding what is necessary to achieve zero short term rates (quantitative easing)

Strategy #2 is radically aggressive insofar as it contemplates altering the composition of a central bank’s assets- which, in non-crisis conditions, consists almost entirely of Treasuries of various maturities- to include other, perhaps even riskier assets. For instance:

As an important participant in the Treasury market, the Federal Reserve might be able to influence term premiums, and thus overall yields, by shifting the composition of its holdings, say, from shorter-to longer- dated maturities. In simple terms, if the liquidity or risk characteristics of securities differ, so that investors do not treat all securities as perfect substitutes, then changes in the relative demands by a large purchaser have the potential to alter relative security prices. The same logic might lead the central bank to consider purchasing assets other than government securities, such as corporate bonds or stocks or foreign government bonds. (The Federal Reserve is currently authorized to purchase some foreign government bonds but not most private-sector assets, such as corporate bonds or stocks.)1

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.