Posted on 10/03/2009 8:48:14 AM PDT by SeekAndFind

The Chinese government is in a massive resource grab in Africa, which has huge ramifications for natural resource prices, not the least of which will be the cost of imported oil to the U.S., and ultimately the stock market and economy.

Beijing's latest foray is trying to buy 6 billion barrels of oil that is already spoken for via leases to Exxon, Chevron , Royal Dutch Shell, and Total SA. The Nigerian National Petroleum Corp. presently leases 16 oil blocks on what remains of the oil industry's dominant Seven Sisters.

It's a monster development, and a dramatic signal of how far behind the U.S. China is in building its crude oil reserves. As the fastest growing nation on the globe, China has recently been frustrated by Libya's veto of a $462 million bid by China National Petroleum Corp., or CNOOC , for Verenex Energy and Angola's state owned Sonangol. Libya wants to block the sale of an oil field stake to CNOOC Ltd and China Petrochemical Corp.

In a sign of China's desperation, a Chinese state bank just loaned $30 billion to Petrochina , the largest company in the world measured by stock market capitalization. Petrochina, which recently paid $1.7 billion for interests in oil sands projects in Canada, along with its brethren, CNOOC and Sinopec, have pledged to step up acquisitions of energy reserves and refineries overseas to take advantage of oil prices that are less than half of what they were at the 2008 peak. Chinese and Russian oil companies have also pledged to invest $36 billion in Venezuelan oil properties the next five years.

Wake up, America! China is already the number-one importer of oil and gas from Iran, and it has begun to show considerable interest in Iraqi oil fields as well.

(Excerpt) Read more at forbes.com ...

bump

China has strategies for the future unlike B.Hussein. They say the next world war will be over resources.

But... but solar and wind power are the future.

oilgae may be. Plants have no problems runnning on solar especially undesireable plants.

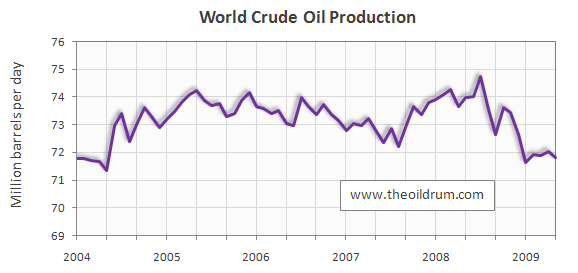

The chart you posted does not seem to jive with the chart taken from Forbes ( see Post #1), which chart is to be believed ?

Anyone have a long term chart of like a DOW energy index chart. I guess a long term Yahoo Finance chart of Exxon might work. Yahoo on exxon goes back to about 1970. Looks like in 1970 it was $3 to 4 which is worth $66.58 today not including dividends. So you would have increased your money about 16 times over a 40 year period with probably an avg dividend yield of 2.5% as icing on the cake.

I would think long term - energy would be better than gold. Holding something like SPDRs Energy ticker XLE.

One is China specific

One is world wide

Ahh, I see. Thanks.

Prices are good right now. China’s been buying commodities across the board they have massive amounts of foreign reserves just sitting there otherwise. Looks like three options for them. demand increases and they make a killing, massive internal bank defaults on the widespread speculation, or armed conflict. Considering the massive influence they have on dollar denominated commodities, the rush to purchase them could be taken as widespread belief in dollar weakening. Probably a sound bet IMO.

Because we need energy to light and heat our homes - gold only lights up our eyes and hearts except in the rare cases it gets used in electronics.

Death to ChiNazi

It's pretty clear the US needs to:

1) slash the size of government 40%,

2) forget about cap-and-trade, dem-style immigration reform and "health care reform"

3) reduce taxes and incentivize job-creating investments,

4) drill for our own oil and push back on the Chinese oil grab.

Can it happen under this Congress? Of course not.

HF

4) drill for our own oil and push back on the Chinese oil grab.

Although I'm in favor of offshore drilling and opening ANWR, I don't think those effort (even if enacted) will be sufficient.

We need to develop transportation infrastructure that is less petro-dependent.

And I'm not talking about dinky little hybrid Obamamobiles or junk science hydrogen vehicles.

We need to build more nuclear power plants to supply electrically powered mass transit systems (light rail, high-speed rail and Maglev) to service our more densely populated regions and urban areas.

It's not a panacea, but it will definitely reduce our dependence on Oil.

Eh, every barrel more of oil produced is one more barrel of oil on the market.

If we’re too d@mn stupid to look around to boost production, then we shouldn’t be b@tching when someone else fills our shoes.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.