Posted on 08/06/2009 4:56:11 PM PDT by Xenophon450

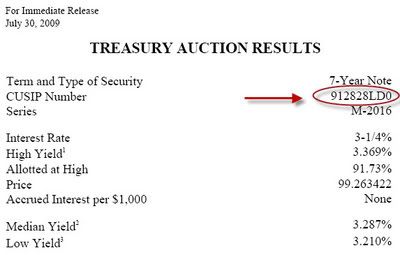

In a brilliant piece of investigative reporting, Chris Martenson (original article here) has uncovered that the Fed, merely a week after issuing $28 billion in 7 year bonds (which Zero Hedge discussed previously) via its puppet, the US Treasury, of which $10 billion ended up being purchased by primary dealers, has turned and bought 47% of the primary allocated bonds in Open Market Purchases. This is undisputed monetization removed simply via one primary dealer and less than 5 days of temporal separation in order to leave no easy trace. As Martenson points out:

"A more honest and open approach would have been for the Fed to simply buy them outright at the auction but this way, using "primary dealers" and "POMOs" and all these other extra steps the basic fact that the Fed is openly monetizing US government debt is effectively hidden from a not-too-terribly inquisitive US press and public."

The question is did the Fed implicitly tell the primary dealers they are merely holding the treasuries for a flip, and that it would acquire them immediately. Absent this $4.8 billion in effectively monetized bonds, what would the Bid To Cover have been for the primaries? Would this have been the second practically failed auction for USTs after the deplorable 5 year auction results a day prior? One wonders if there would have been 62% indirect interest in these bonds (which the day before had a measly 32.5% indirect bid) if the purchasers were aware of the Fed's immediate prompt monetization of a large part of the directs' balance.

It is truly a sad state of affairs when the Fed has to manipulate public and media perception in this way, and has to cover up for the complete lack of interest in US Treasuries.

Here is the evidence Martenson dug up:

Martenson's conclusion needs no elaboration:

"The speed of the shell game is accelerating.

This immediate repurchase of newly auction bonds by the Fed tells us that demand for these bonds is not nearly as high as advertised, and that things are not quite as strong as represented.

And oh, by the way, don't expect any stock market weakness while so many billions are being shoveled out the Fed and into the pockets of the primary dealers. They'll have to do something with all that freshly minted cash....."

Zero Hedge salutes CM for this brilliant piece of sleuthing: now if only the MSM would have the guts to demonstrate the pyramid scheme that the US Bond and Equity markets have become.

cue the fiddle

Bump :-P

When no one will buy your debt, you just print money.

This is just the crooked way to do that. The problem is, the shortfall is so big, I doubt it will last.

Hyper inflation is the only answer to doing what we are doing. It might take 2-3 years to materialize, but it will.

A numbers game to hide the stark reality. I’m no expert on this, but isn’t this behavior inflationary (on the consumer end) when they simply print money to pay themselves?

So if I understand this correctly, we are buying our own debt to mask the worse economy?

“It is truly a sad state of affairs when the Fed has to manipulate public and media perception in this way, and has to cover up for the complete lack of interest in US Treasuries. “

What a sadder state of affairs when our watchdogs in the media are so worshiping of a man that they report “Economy getting better! Obama said so!”

I think I heard it all when a governor says hearing Obama walk is like ‘hearing a symphony’.

AIG will need more funds soon!!!

Yes. It would explain the rather ludicrous rally in stocks with no good news in sight. All the while, the dollar index continues to make new yearly lows. If we get below 72, watch out.

Somehow this sounds more serious than health care, carbon dioxide emissions or CAFE standards.

wait till china sees this all hell going to break loose!!!

Well, time to turn on American Idol.... :-D

Someone phone the “mob”. Anybody figure out who’s in charge of the “mob” so that someone can phone them?

I saw this earlier today and yes, it is.

The "Primary Dealers" participate in the U.S. Treasury auctions and buy up some percentage of any particular offering. What normally happens if the government offering is not totally bought up is that the Fed buys the balance. The split between the Primary Dealers and the Fed is a closely watched parameter. If most of the bonds are being bought by the primary dealers that is considered a good thing: there is a market for U.S. securities and the interest rate is acceptable to the buyers.

What appears to have happened here is that the Fed didn't buy some large chunk of the government securities at auction - they waited 5 days and bought them from the Primary Dealers. On the face of it this looks like they were attempting to hide the fact that the government sale was a failure by the normal measures that apply. This is extremely significant. It was widely predicted that Obama's huge borrowing binge might not be sustainable at current interest rates. More demand for money always results in higher interest rates. This appears to be happening. The market is not there at the interest rate the government wants to pay. Push, let me introduce you to Shove.

Why do we care? Because the Fed just creates credit when they buy government securities. That is the exact equivalent of printing money and it is inflationary - more money in circulation (and in the hands of the Government) chasing the same amount of goods causes prices to rise. So what we have here is Obama borrowing huge amounts of money while the Fed attempts to hold down the interest rate that he has to pay. To do so the Fed prints money and this results in inflation which in turn causes people to demand even higher interest rates on their investments. That's positive feedback and it can run away from you. It did in the late 70's and I think it is going to happen again.

Ive been posting about this - we are on the precipice - the bankers have looted the American people and the politicians are the willing accomplice. For years the white elitists have divided us and demoralized us for just this moment. The entire market is a scam right now - please freepers be prepared for what is coming and it is coming.

Is there any real way to prepare for the inevitable crash???

We've been buying our own debt during this crisis. That's already known and a big problem. Now it looks like we're buying even more than disclosed, by using third party straw purchasers at the initial Treasury auctions, then buying the notes back from them. But yes, the Fed is buying U.S. debt from Treasury. Printing money to lend to ourselves. This won't end well.

The best advice I have heard is summed up as follows:

Guns, Gold, God, Gardens and Groceries. Not nessecerily in that order.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.