Posted on 08/05/2009 11:05:06 AM PDT by FromLori

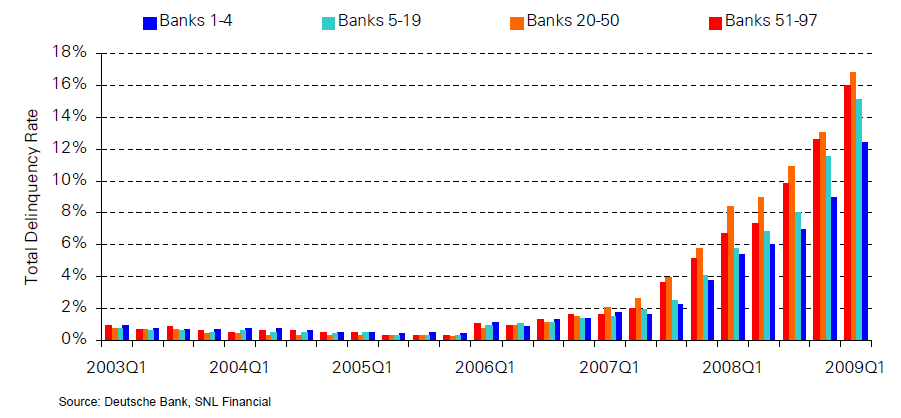

Interesting piece from Deutsche Bank on rapidly deteriorating Construction loans. DB predicts that “construction loans will be the epicenter of bank loan problems”

• By far the riskiest type of loan product in bank portfolios; • Substantial portion represents loans to homebuilders; • Market currently penalizing properties with vacancy issues extremely severely; • Newly constructed (or only partially constructed) properties are the poster children for vacancy problems in CRE; • Values of most newly constructed properties are down massively; • Expect extremely high default rates and extremely high loss severity rates, both likely to be in excess of 50%; • Total expected losses of 25% or more.

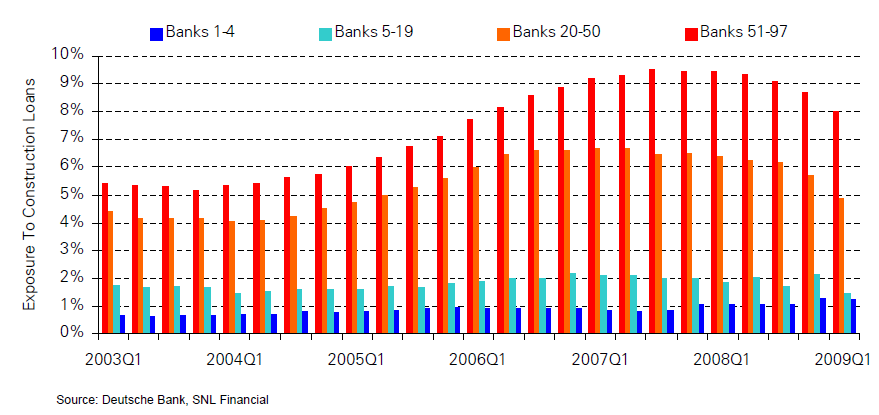

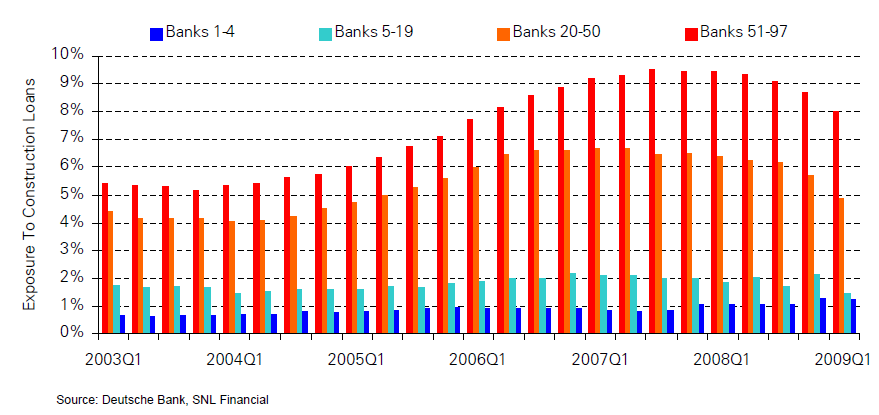

In a reversal of the Residential Real Estate market, the exposure for large money center banks is low — smaller regional and community banks have the highest construction loan exposure.

Construction loans are structured with upfront reserves — meaning that it takes much longer for CRE defaults to occur. Low short-term interest rates also means reserves can last longer — BUT, as DB notes, Once reserves are exhausted, defaults will skyrocket.

Green shoots, green shoots, green shoots!

Just wait until 2010

Yes times this all over the country and omg!

snip

Commercial foreclosures rocket

Valley is ‘at the tip of the iceberg’ for notices, expert says

16 comments by J. Craig Anderson - Aug. 5, 2009 12:00 AM

The Arizona Republic

More than 2,000 commercial properties in Maricopa County have received 90-day foreclosure notices since Jan. 1, representing $6.3 billion in real-estate loans on which the borrowers have failed to make payments.

http://www.azcentral.com/business/articles/2009/08/05/20090805biz-commercialforeclosures0805.html

Can you imagine what it’s like in California?

Only in my nightmares

Already happening. A friend’s home construction company loan was pulled by the bank even though he was current on payments. He said it is happening to many of his freinds who builds homes. These are major builders, too, not just local 1 man shows.

P.S. The FDIC says that of the $7.7 trillion in loans, half are Commercial Real Estate (CRE) and half of those loans are forecast to default.

Yep, that be what I’m talkin’ about, Willis.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.