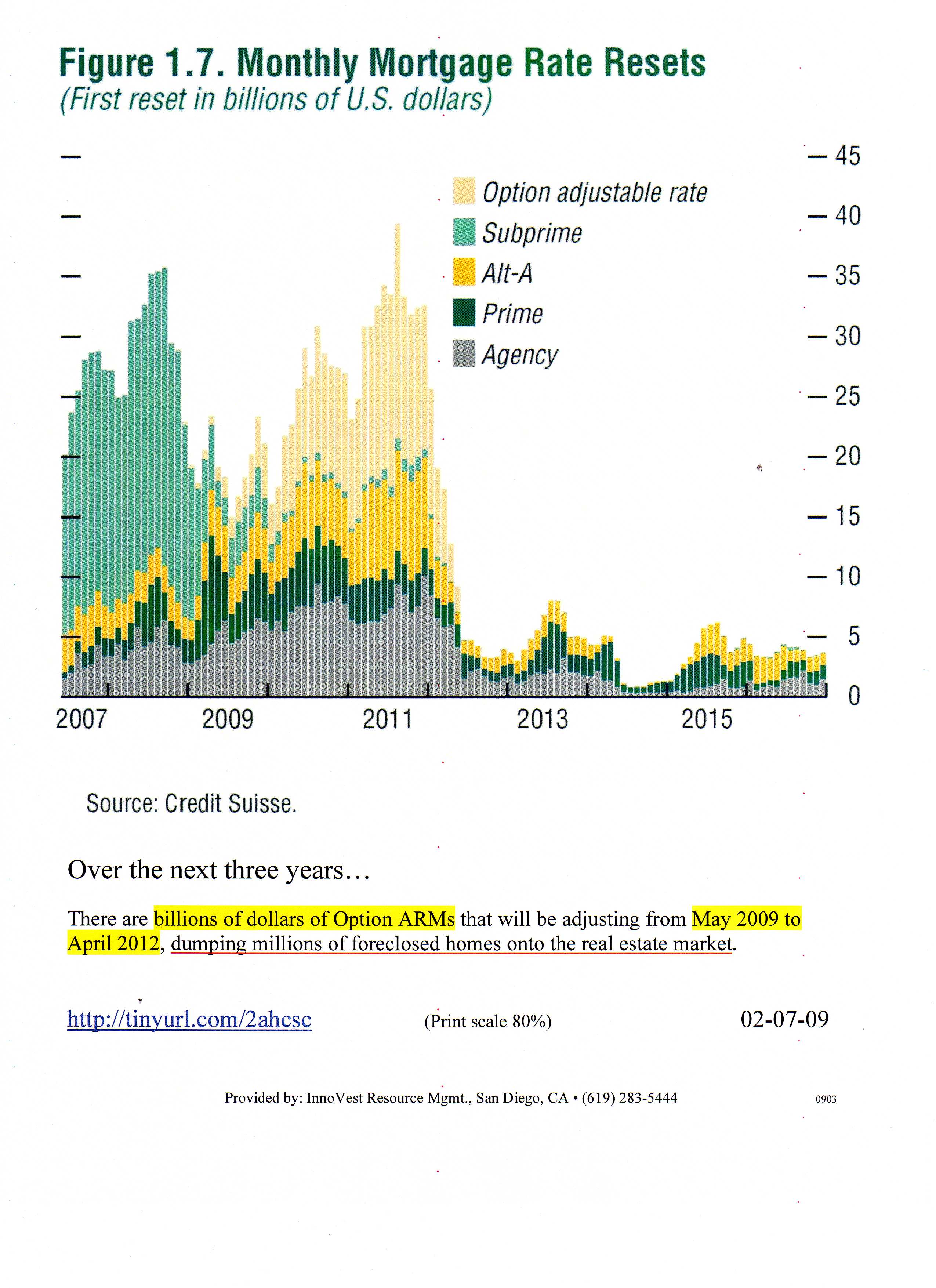

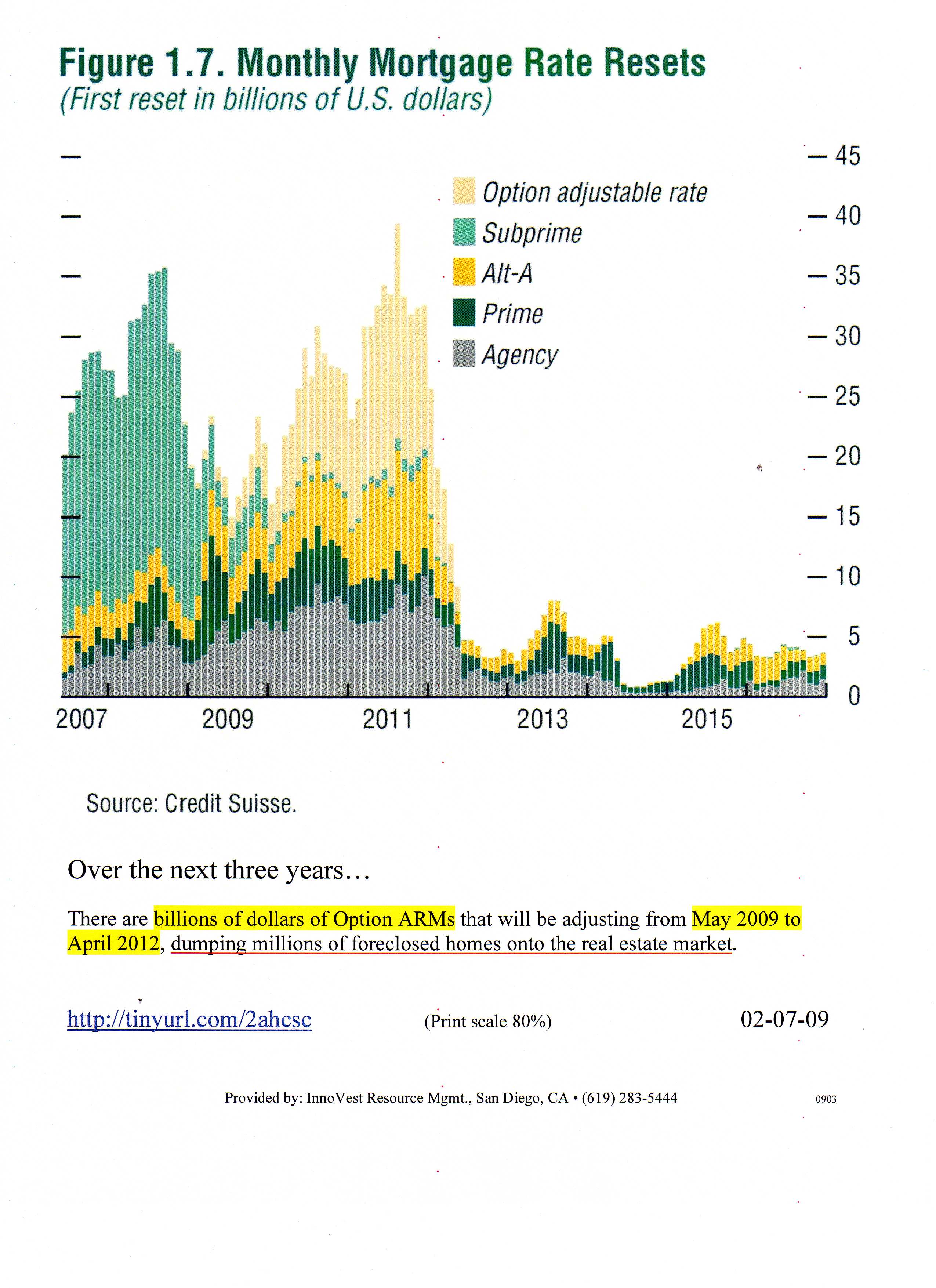

Especially with the coming resets in option ARM's and Alt-A's. We just thought the last round of sub-prime forclosures were bad.

Posted on 06/12/2009 5:55:12 AM PDT by TigerLikesRooster

Mortgage rates climb

Treasury yields on a tear help pull rates higher; 30-year fixed mortgage jumps to 5.95%.

By Julianne Pepitone, CNNMoney.com contributing writer

Last Updated: June 11, 2009: 3:03 PM ET

NEW YORK (CNNMoney.com) -- Home mortgage rates jumped in the most recent week, pulled higher by skyrocketing Treasury yields.

The average 30-year fixed rate soared to 5.95% from 5.45% last week, according to a weekly national survey from Bankrate.com.

The 30-year rate is often influenced by the benchmark 10-year bond's yield, which has increased steadily to hover around 4% recently. The yield was 2% just six months ago. Investors worry that this has re-ignited inflation fears and threatens the potential for economic recovery.

(Excerpt) Read more at money.cnn.com ...

Ping!

Supply and demand. obama and Pelosi are sucking up a huge chunk of the available capital. That means there is less available for us little people, and everyone will pay more for their mortgages if they can get them at all. How’s the $1.85T deficit looking to obama voters now?

And with this endlessly printed money will come rapid inflation.

That inflation is going to drive variable rate loans way up.

And that will bring a whole new round of foreclosures and bankruptcies.

They are in the process of causing exactly what they say they were trying to avoid...

All their actions continue to destroy more and more wealth.

These people are dumber than dumb.

I was listening to Street talk live and they indicated this was a temporary spike in rates due to the Fed’s protecting something like 16 of the top treasury bond purchasers ability to make money by spiking the yields at auction time.

What is y’alls take on this?

As they drive interest rates up by making the dollar worthless all these loans are going to become unserviceable and start a whole new round of foreclosures and bankruptcies.

The fed is printing endless money.

People expect the value of the dollar to fall as a result.

Who’s going to buy a bond that doesn’t pay interest at a higher rate than the dollar is expected to fall?

Thats an interesting analysis. I don’t know much about how interest rates are determined/influenced, but a 1/2 point spike in one week is pretty crazy. But 5.95% is still a darned good rate for a 30-year fixed. I’m not big on the prediction business, so I guess only time will tell.

Yup, this spending is going to cause some serious INFLATION and rates are going to go crazy. I myself just closed on a refi at 4.75%. Dont see my butt moving for the next 10-12 years. Probably wont be able to afford to move.

I've notice the rates spike from 4.8 to 5.9% in just a few short weeks........yikes.

I agree though, rates are still low.

The scuttle-bug is that rates are fixin to soar unless the Feds hold the rate down artificially in an attempt to avoid halting what little construction there is.

“I was listening to Street talk live and they indicated this was a temporary spike in rates due to the Fed’s protecting something like 16 of the top treasury bond purchasers ability to make money by spiking the yields at auction time.”

Maybe. But it’s more likely to be related to (1) Bush and Pelosi left a big structural deficit; (2) That deficit has gotten worse as tax revenues have fallen in the recession; (3) Obama added about 1 trillion dollars a year to the deficit; (4) The feds are just starting to borrow money to fund that deficit.

Borrowing money is demand for money. When demand goes up, The price of money goes up (interest rates). We are starting into a period of steadily rising interest rates and (if the fed prints the money) rising interest rates and inflation.

So my suspicion is that the logical explanation for the rising interest rates is the obvious one. I don’t think the feds spiked rates. It’s much more likely that borrowers did it and that, in a year, they will be very sorry they loaned money to the US government at such low rates.

Especially with the coming resets in option ARM's and Alt-A's. We just thought the last round of sub-prime forclosures were bad.

Tell ya what, if I were a country looking for investment yields in the bond market......I sure as hell wouldn't buy U.S. Treasuries.

Hence the artificial spike to perk up selling volume during an auction to finance their monumental fiscal stupidity.

There, I feel better.

Thanks!

“I agree with you, but the logic behind what these fellas were indicating was that there was such a weak demand at the treasury auction that they were attempting to spike the yields to garner foreign purchasing interest.

Tell ya what, if I were a country looking for investment yields in the bond market......I sure as hell wouldn’t buy U.S. Treasuries. Hence the artificial spike to perk up selling volume during an auction to finance their monumental fiscal stupidity.”

But a spike in interest rates caused by low selling volume isn’t in any way “artificial.” The treasury is trying to buy the use of money. Low selling volume means not enough guys are willing to sell at the current price (current interest rate). So prices go up. That sounds like an entirely “natural” result of normal markets in action.

This is the natural result of huge government deficit spending. We will soon see taxes, inflation and unemployment rates like the 1980’s or worse. Of course, Obama will blame the hyper inflation on greedy capitalists.

This phenomenon occurred back in the 80’s and drove interest rates up due to preditory buying and selling....according to these three investment advisers.

I don't pretend to understand it at all, but did make allot of sense.

Apparently the SEC and investment types are on the look out for this to reoccur, thus again, artificially driving interest rates through the proverbial roof.

What's your take? Have you heard of this?

There may be some truth to that, despite all appearances to the contrary. I read something the other day about how 30-year rates actually came in LOWER than expected during the last T-bond auction.

“So if that is true...which I’m sure that it is to some degree, have you heard of bond vigilantes?

This phenomenon occurred back in the 80’s and drove interest rates up due to preditory buying and selling....according to these three investment advisers. I don’t pretend to understand it at all, but did make allot of sense. Apparently the SEC and investment types are on the look out for this to reoccur, thus again, artificially driving interest rates through the proverbial roof. What’s your take? Have you heard of this?”

You always hear of speculators and the like and how it’s all their fault. “Bond Vigilantes” sounds like a similar term. I believe there are only a few parties with enough money to actually drive world interest rates much for very long—China, the Saudi’s etc. If China decided to stop buying treasuries, that would be a big deal—but I wouldn’t really count that as speculation.

Now, if we were talking about a group driving bond prices and rates for an individual company’s bonds rather than US treasuries, then I could see that happening and I’m sure lots of folks have tried it. But I have no specific knowledge of that.

Of course, when speculative fever grabs whole populations, then “speculators” are driving the market in a sense. But then the “speculators” are the guy living next door. And that is self correcting over the long run.

This is most likely bond buyers demanding an inflation premium.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.