Posted on 02/26/2009 8:52:36 AM PST by george76

The release of US Durable Goods Orders and Initial/Continuing Jobless Claims ...proved to be highly disappointing today, leading the US dollar to initially spike higher on demand for safe-haven assets.

Taking a look at the data, Durable Goods Orders failed to improve for the sixth straight month as they fell more than expected at a rate of 5.2 percent during January.

Transportation led the decline in the overall index, contracting a whopping 13.5 percent, but even excluding this component orders were down 2.5 percent.

Furthermore, by looking at the results from a longer-term perspective, conditions appear incredibly bleak as Durable Goods Orders are down 26.4 percent from a year earlier while non-defense capital goods orders excluding aircraft – a gauge of business investment – tumbled 5.4 percent during the month and 20.2 percent from a year ago.

All told, the declines suggest that the US economy is suffering at the hands of waning demand on both the consumer and business level.

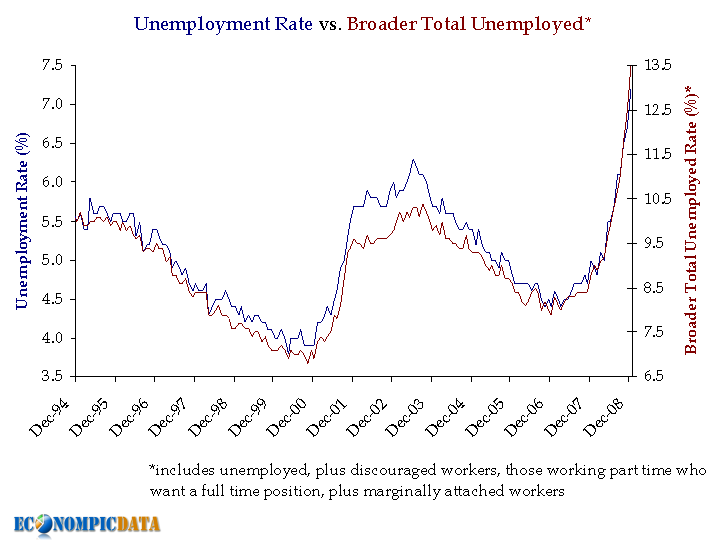

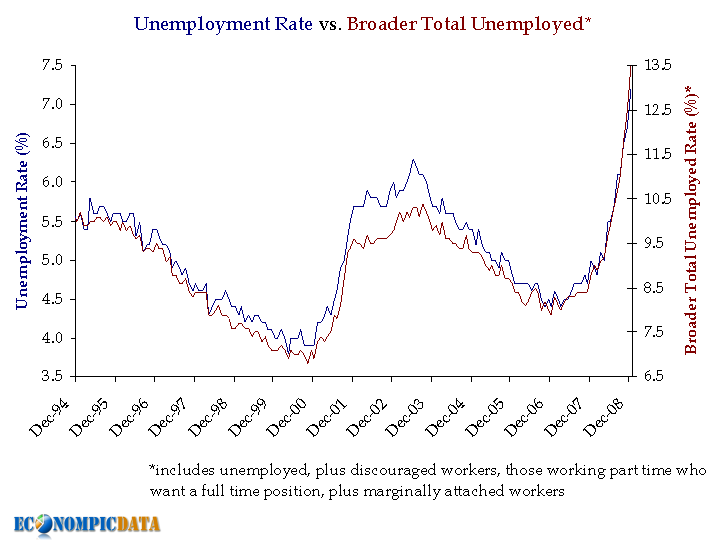

Meanwhile, Initial Jobless Claims rose by 36,000, or 5.7 percent, during the week ending February 21 to a more than 26-year high of 667,000.

Perhaps even worse, Continuing Jobless Claims increased by 114,000, or 2.3 percent, to 5,112,000, the highest level since recordkeeping began in 1967.

(Excerpt) Read more at finance.yahoo.com ...

Bummer.

More stimulus money must be needed! /sarc

It’s what America voted for.

Chairman MAObama will make sure that those “rich” earning over $250 K. will pay over 35% in taxes. Looks like these private business owners will not be spending their extra profits or money on hiring, expanding or luxury spending. Nor will they be building that new dream home.

So, watch unemployment hit double digits before this year is out.

Full-blown depression, here we come.

See number 4 above.

U-6 is over 13 percent now.

Headed over 20 percent soon.

Some technically “fully employed” are taking salary cuts or bonus freezes .

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.