Margin Call: Leveraged Failure, Taxpayer Bailout

Sep 21st, 2008 | By Jonathan Golob | Category: Economics, Featured ArticlesVia the Wall Street Journal:

Deleveraging started with securities tied to subprime mortgages, where defaults started rising rapidly in 2006. But the deleveraging process has now spread well beyond, to commercial real estate and auto loans to the short-term commitments on which investment banks rely to fund themselves. In the first quarter, financial-sector borrowing slowed to a 5.1% growth rate, about half of the average from 2002 to 2007. Household borrowing has slowed even more, to a 3.5% pace….

Hedge funds could be among the next problem areas. Many rely on borrowed money to amplify their returns. With banks under pressure, many hedge funds are less able to borrow this money now, pressuring returns. Meanwhile, there are growing indications that fewer investors are shifting into hedge funds while others are pulling out. Fund investors are dealing with their own problems: Many have taken out loans to make their investments and are finding it more difficult now to borrow.

The Wall Street Journal is right about one thing: the massive deleveraging of the whole global financial system is at the core of our present crisis.

What is leveraging? Investing with borrowed money.

When you’ve gotten those “Low Introductory Rate!” credit card offers, maybe you’ve been tempted to get the card, max out the cash advance, take that money and put it somewhere safe. Say the card has a 3% interest rate. You put the money in a 5% a year high-yield savings account. When the credit card rate is about to jump up, you take the money out of the savings account, pay off the card and pocket the difference. That’s leveraging.

If you’re mid-scheme, and the card’s rate unexpectedly jumped, you’d be doomed. Particularly if those low rate card offers are much harder to find. That’s deleveraging.

Our bailout of incompetence in the financial industry (otherwise known at the overcompensated kids who cheated off you in science and math classes) so far has three big parts:

1. Stop short selling of only certain favored stocks.

2. Buy up “toxic” debt, like the impossible to value mortgage-backed securities, at something like 40-cents to a dollar. We might be getting a good deal, or we might get hosed. Nobody, and I mean nobody, knows which is the case. You can shiver now.

3. Throw up to $50 billion of taxpayer dollars into Money Market funds, hoping to shore them up.

Last week, I wrote about a Money Market fund breaking the buck.

While there are many kinds of Money Market funds, the ones suffering the most (so far) lent money to the very oldest of investment banks. These were viewed as “safe” investments, due to the age and “respectability” of banks like Lehman Brothers.

Well, what will our fifty billion dollars be covering? Leveraged investment schemes, of course! What follows is a grossly simplified scheme of the sort of leveraged investment strategy Lehman Brothers, Bear Stearns and the ilk did with borrowed money from a pool declared to be super safe. In truth, many times the actual places this borrowed money went were more hideous, more dark and less responsible.

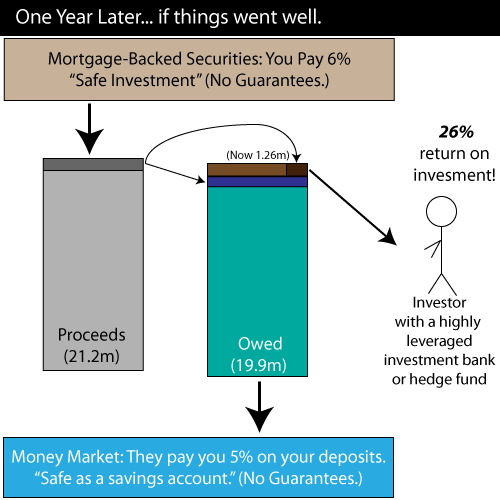

The favored investors come to an investment bank, or hedge fund, and ask you to take their million dollars and make it big, with minimal risk. The investment bank uses their good credit to borrow money from clueless investors at a low rate–from investments made into Money Market funds. These funds pay low interest rates to the investors, because they are “safe” investments. We’ll say for this example, 5% a year.

The bank then takes the investor’s $1 million, with a borrowed $19 million–or $29 million, or $39 million or whatever. $19 million in this example–and invests the pool of $20 million and lend it out–buying up mortgages that pay 6% a year, in this example.

If everything goes well, since the mortgage holders are paying you 6%, there is a tidy return (the dark gray) to be split. Part goes to pay the 5% owed (the dark blue) to the Money Market fund investors. The rest goes to the holder of the original $1 million–to the tune of a whopping 26% annual yield (the dark brown.)

Well, what if the mortgages don’t pay as well as hoped? The bank’s original pool of $20 million invested ($1 million of the investor, $19 million borrowed) is now less than the start.

This is a huge problem, as the Money Market people must be paid back both the principle and interest–or the bank’s credit rating, and access to this pool of money to borrow from, will be lost. So, when this is rare, the investment bank covered the difference itself, making it appear to the Money Market investors that their money was not lost.

The higher the leveraging–the more money borrowed to that collected from an investor–the greater the chance that the money borrowed cannot be paid back. From the Great Depression to the late 1990’s, this ratio was strictly regulated, and kept low. Gramm–the architect of McCain’s economic plan–was key in getting rid of any limit on the ratio.

Well, what if many of these schemes all fail at once, like happened this month? The banks ability to make up the difference would be overwhelmed. The Money Market managers would have to be told their money was gone. The bank’s credit would be trashed. The whole system crashes and burns. Deleveraging.

What to do? Should these banks–and what real social benefit is being done by these schemes?–be bailed out by the taxpayers, their losses covered?

This weekend–after a brief detour through the responsible path and the collapse of Lehman Brothers–the answer turned out to be yes.

Our wallets are being raided, to the tune of about a trillion dollars. To put this in perspective, the entire economic output of the United States, for one year, is about ten trillion dollars. One tenth of an entire year’s work is being poured into the crumbling foundations of Wall Street. And, this possibly will be insufficient to do more than temporarily slow the cascading failure.

Can anyone tell me why banks like this deserve to be saved?

Why highly leveraged schemes like this are in any way desirable?