Posted on 09/14/2008 8:05:20 PM PDT by bruinbirdman

Three of the biggest names on Wall Street - Lehman Brothers, Merrill Lynch and AIG - poised to buckle under the seismatic credit crunch pressure.

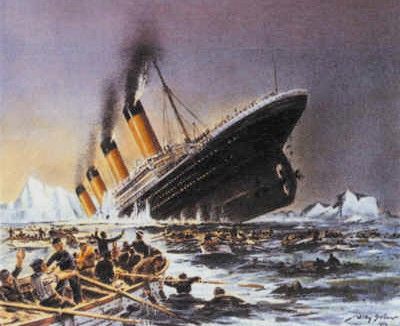

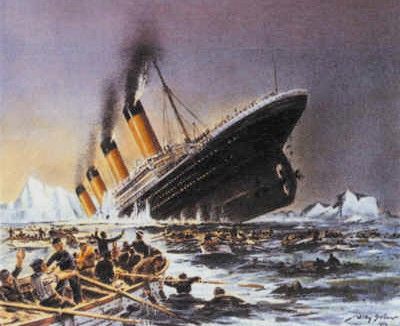

The global financial system faced its biggest test in at least half a century this morning after some of the world’s leading firms took drastic emergency action in America in the face of a worsening international economic crisis.

Lehman Brothers, one of the world’s biggest investment banks, was on the verge of collapse after a weekend of talks to find a willing buyer ended without success.

Hank Paulson, the US Treasury Secretary, led the efforts to identify a buyer but the British bank Barclays walked away from a deal. Lehman Brothers was last night being prepared for bankruptcy.

Merrill Lynch, another investment bank, appeared likely to be bought by Bank of America in an attempt to save it from a similar fate. Discussions on what would be a $200 billion (£110 billion) merger were at an advanced stage last night.

Meanwhile, American International Group, the world’s largest insurance company, was planning a radical restructuring of its business, which would see it sell its aircraft leasing arm and raise $20 billion from new investors.

The impact on stock markets was expected to be severe. If Lehman crumbled, it would be the first collapse of a major bank since the credit crisis began 13 months ago, and would stand as one of the biggest banking collapses in history.

Coupled with the moves by other Wall Street giants, it would wipe billions of pounds worth of value from pension funds and other investments.

Alan Greenspan, the former chairman of the US Federal Reserve and a leading economic expert, warned: “Let’s recognise that this is a once in a half-century, probably once in a century type of event.”

(Excerpt) Read more at telegraph.co.uk ...

paulson said no to more fed rescues like bear stearns.

Going to be a tough day tomorrow. DOW futes -315, S&P -42.

The Democrats are responsible. It’s their fault.

I wonder what impact a Stock Market Crash will have on the election?

I don’t think there will be a crash. That is the sucker’s bet right now, IMO.

I forget. Who was Chairman of the Fed from 1987 to 2006?

Probably need to let a few of these crumble..it will be better in the long-run for the American economy.

Sad they were trying to sell off Lehman to a foreign company...no US company would touch Lehman...I guess more globalist wealth-redistribution planned.

Wall Street probably gonna run to the govt like a welfare queen three days before the check comes in

That is what Herbert Hoover said.

latest article I saw said Dow futures down 211. So maybe things looking up.

The Democrats are responsible. It’s their fault.

No. Everyone in a position of financial authority, including policy makers in the District of Corruption is to blame. Somewhere, there was a dramatic change from being risk-averse to unbridled greed-is-good in the minds of Wall Streeters.

You know, it is a good question to investigate. Could the trauma of 9-11 have created a mindset in Wall Streeters that set the stage for making sub-prime mortages, et. al. so attractive. Did this crisis create a more speculative outlook?

I was quoting from Bloomberg, on tv, so it was current. Actually, it went from -312 to -315 while I was typing my reply.

Normally, I would agree with you, however, I don’t think anyone really knows what will happen tomorrow until it happens. Reason being, the unwind of counterparty defaults at Lehman could cause an atomic chain reaction in the worldwide banking system that can’t be quantified at this point.

The bigger story, in my opinion, is AIG, desperately calling on the Fed to give them a bridge loan to sell assets just so they can try and convince private equity to give them $40 billion! That’s an incredible INCREDIBLE story! That the Federal Reserve might even CONSIDER making direct loans to the private sector like a quasi-discount window is unthinkable. If they bail out AIG, they’re going to have to bail out all the other insurers, the big three automakers, the airlines, and, hell, if they’re going to do all that, why didn’t they bail out Lehman??

Bear Stearns was one company in trouble putting many at risk. This is about MANY companies in dire trouble and driving the international system to the brink of collapse. The Fed can’t bail everyone out unless they flood the market with treasuries (to raise cash) and drive the interest rate to a big fat ZERO. That’s a depression rate in this country. The Japanese were savers. There was money to circulate in spite of the ZIRP. The American consumer is going to be crushed and has nothing left to spend.

"Barclays, the UK’s third largest bank, has been keen to move into the top tier of global financial institutions, but terminated the talks because of the US government’s unwillingness to guarantee Lehman’s assets.

The US Treasury was unwilling to commit taxpayers’ cash to a bailout of Lehman, marking a distinct change in its attitude to coping with the credit crisis.

Mr Paulson went into the weekend discussions insisting that government money should not be used to resolve Lehman’s problems, and that the administration had to draw a line in the sand."

yitbos

Three on the tickets are Senators. And ol' McCain is a market and real estate manipulator from the Keating Five days.

yitbos

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.