Posted on 05/17/2008 4:31:23 AM PDT by expat_panama

I’m watching houses sell all around us at higher prices than comparable houses sold for last year, so the higher sale prices ARE solid. Since we’re remodeling our house to sell it, I’ve been watching the market carefully. I just don’t buy into the doom and gloom, and thankfully, it seems more folks are rejecting it, as well.

You can use whatever delusional terms you want to use.

Call it a “correction” but prices have dropped in 43 of 50 states. The national median has dropped which is unprecedented in modern times.

Blame the media all you want. You have your head in the sand. You refuse to acknowledge tightened credit, consumer debt, foreclosures, home equity withdrawls as all contributing to this massive “correction”. You refuse to acknowledge that sales continue to plunge NATIONALLY along with prices.

You can’t handle the truth.

As for “now is as good as it gets”, you and the other NAR type polyannas have been saying that for 2 years. If I took your advice and bought a Sacramento area home 2 years ago, I would have lost about 20% of the value. If I put 20% down, my equity would be wiped out. Instead, my home down payment is sitting safely in cash, while the houses I’m looking at continue to sit on the market and continue to go down in value.

I live in Yuba City, CA, about an hour north of Sacramento. Last winterI found a house I really loved.

2000 SQFT Tudor, nicely landscaped and really cared for. Asking price last November was $345,000. Asking price today is $270,000 and STILL sitting. I like the house. I still won’t pay $270,000 for a home that’s worth maybe $210,000 and sold for $145,000 in 1998.

If I had bought that house for $345,000 or $170/Sq.Ft. and assuming it finally sells at $270,000 or $133/Sq.Ft., then I would have lost, at this time, fully $75,000 on my purchase. 20% down would have been $69,000 so I would be $6,000 upside down if I took your misguided advice last November that “now is the best time to buy”.

Typical correction, right?

Your son’s Boston condo must be right next to the state house or maybe it has an oil well in the backyard.

How about “Massachusetts single-family home sales had their worst January in at least 21 years, according to a report from the Warren Group, a Boston company that tracks New England real estate data.”

http://www.boston.com/business/ticker/2008/02/mass_home_sales_6.html

Best... time to buy... ever! Right SuziQ?

Oops, forgot the link to the page with the above graph showing that in Massachusetts it is the BEST time to buy EVER!

http://www.bostonbubble.com/forums/viewtopic.php?t=1076

Looks like the bottom was long ago and we are bouncing up fast now, SuziQ!

As Rush is so frequently able to point out, the economic "experts" are often surprised when the economy is better than expected.

You’ve convinced me! No national housing crisis in sight. All is well. Just a widdle bitty cowwection... It’s not like prices declined in 43 of 50 states. Oh wait. YES IT IS!

I am familiar with the beginnings of the downturn in 2007, I'm curious as to what you saw during 2006 that made you aware of the 'market crash'! Did you go short at the time?

Given Bill Gross’ recent actions in buying up Mortgage Securities for his Total Return Fund, it’s possible that not everyone shares your pessimistic view of the future of housing in this country! I do agree that Europe isn’t done writing down Mortgage securities yet, tho’.

Absolutely! Clearly, the drumbeat may continue 'til November (as a form of BDS), or until the Supreme Court reacknowledges individual property RIGHTs again, whichever comes first.

Clearly for the last year or so that has been a valid strategy. I (and others) am simply pointing out that New Home Builders inventories are down, and New Home prices (at least by the premium builders like Toll Brothers) have firmed and are beginning to rise in many places. You will continue to find bargains in existing homes, and some new developments, but the new bargains are thinning rapidly. Condos another thing entirely, but we've gone thru that cycle many times in the past.

I'm seriously considering being one of those people today. I might buy a digital camcorder, then fill up on the way home complaining about the $3.80 a gallon I'm pumping.

I told you that the entire state wasn’t affected the same way. Our son lives in Somerville, which is NOT an affluent area. He bought there, because Cambridge was too expensive when he went looking. One of the reasons he bought where he did is because of the plans for a T stop to be built 1/2 block from his place, which will immediately boost it almost 10% in value. Now that won’t happen for a few years, but he wasn’t planning on flipping the place, anyway.

Whatever. You can keep bitching and moaning, if you like. I don’t plan to participate in the pity party.

If a Democrat is elected, you can be sure that the media will proclaim that the economy has rebounded overnight, and it’s all because of the Democrat coming to save us.

Not stock market. I was talking about the housing market crashing. That paragraph discussed only housing.

FWIW, I moved my entire 401(k) from equities to cash only in late 2006 on the expectation that house deflation and exorbitant consumer debt would tank the economy and equities. I only later learned of the deep liquidity crisis caused by the glut of easy money irresponsibly lent.

Friends I tried to warn have been dollar cost averging and have lost a few percent in their equities. In the meantime, I’ve lost nothing and have been getting 3% or so in my cash funds for a year and a half. Not much, but beats losing money.

I feel we may be in a secular bear and while there will be many bear rallies to come, I think the trend is down. I’m thinking S&P 11,000 at least. We’ll see...

Predictions are for house prices to continue to fall most everywhere.

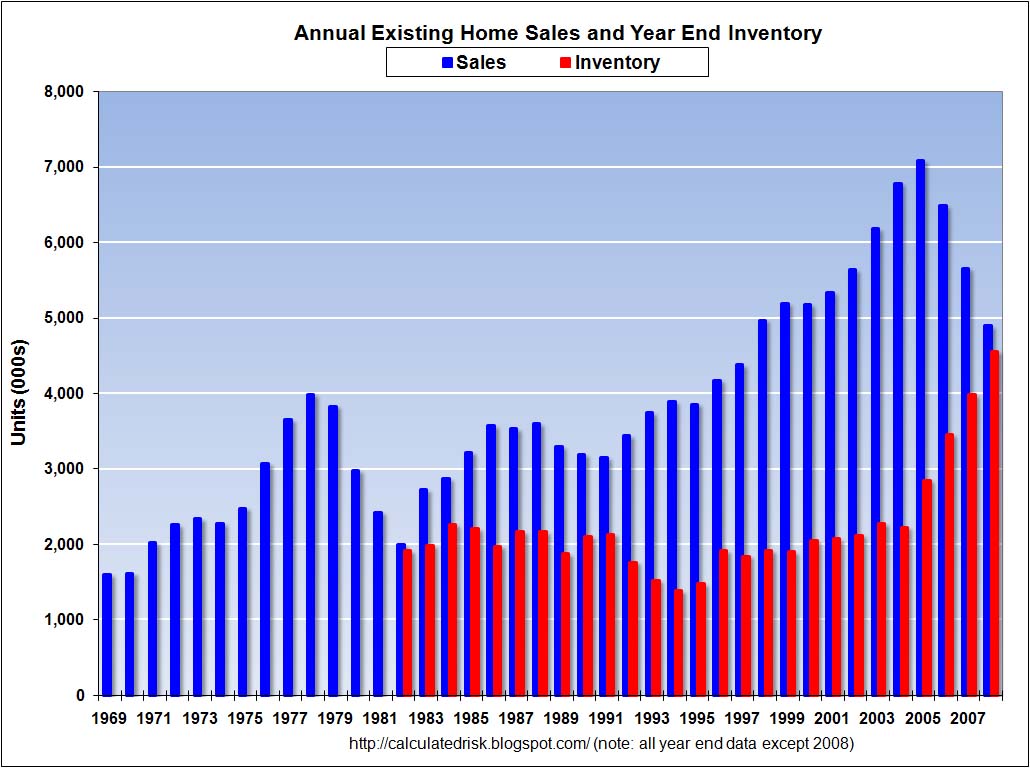

You state new home builder inventories are down. I would appreciate a link to that data, although you likely know your facts in this regard. But I can assure you existing home inventories are way up, both in numbers of units and in months of supply.

You say prices of new homes have firmed and are going up. Again, I am sure you are right in some locations. Are you claiming that is true nationwide? Don’t get me wrong, some new homes here around Sacramento were being blown out at fire sale prices, so you may be right that prices are up. But when a desperate store raises their sale prices from 50% off to 40% off, while an improvment, it doesn’t mean they don’t need sales prices to dump their goods.

You say the “bargains are thinning rapidly”. I’m sorry, I just can’t believe that. Are you trying to say that house prices have bottomed and are going up.

Where are you? How old are you? Do you remember the last housing downturn in 1990? I do. In the 1990 downturn, it took 5 years for home prices to finally bottom out. RE stayed flat another 3 years after that. Price appreciation for the next few years following the flatness was very modest.

Yet you are telling me the bargains are thinning out, which doesn’t agree with current predictions and doesn’t agree with my own previous experience. You have your opinion, but I believe the bargains will continue AT LEAST another year, possibly 2 (prices will continue to fall for 1-2 more years at least), and then prices will flatten out for 4-5 years.

So I believe I have 2 years to get bargains and another 5 years get very decent deals, while eliminating the risk I will lose all my equity in a house by not buying now.

We just disagree on our assessment. You think houses have bottomed today and that prices are going up. I think houses will bottom in 2 years and won’t beginning go up until about 2015.

Who knows which of us will be right. I know this. I’ve been right for the past solid year while the pro-RE folks here have been saying “its the best time to buy ever”, “i’m buying and getting deals”, etc.

I don’t see any posts from those Freepers who were saying last summer what a perfect time it was to buy deals and how they made out on their homes they bought. I DO know that the Sacramento area has gone down 20% since then. I do know that a house I wanted went down in asking price from $345,00 to $270,000 since last fall. The bottom is not in here. I know that.

Sorry, I forgot to post the source link...

http://calculatedrisk.blogspot.com/2008/05/historical-housing-graphs-months-of.html

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.