Skip to comments.

Mortgage Woes Hurt Dow, Small Stocks Hit Bear Market

Wall Street Journal ^

| 17 January 2008

| PETER A. MCKAY

Posted on 01/17/2008 1:34:10 PM PST by shrinkermd

Matters went from bad to worse as the stock market suffered its worst loss of 2008, already a year that hadn't been shaping up as a highlight for investors.

Stocks reeled and long-dated Treasurys jumped following a fresh round of hefty write-downs by banks and signs that bond insurers' credit ratings may be slashed.

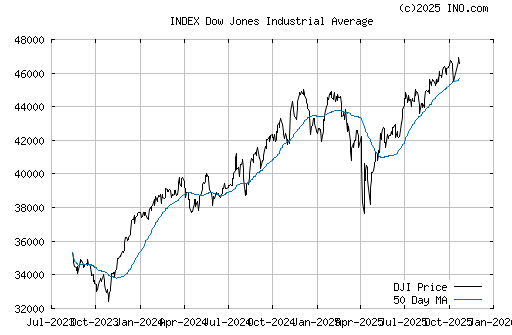

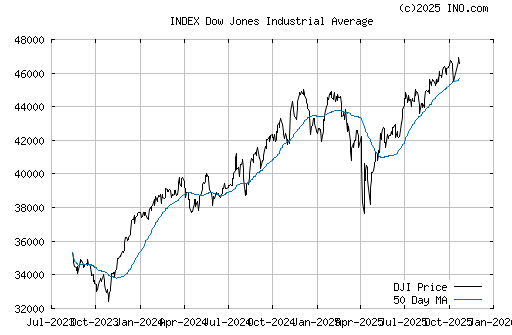

The Dow Jones Industrial Average plunged 306.95 points Thursday, down 2.5%, at 12159.21. All 30 of its components ended lower. The Russell 2000 was off 2.8%, or 19.34 points, at 680.57. The small-stock indicator, which includes many companies that rely heavily on a robust U.S. economy, is now off more than 20% from its July highs, the traditional threshold defining a bear market.

Prices for 10-year and 30-year U.S. government debt soared as investors sought safe havens. Traders said it appears investors are shuffling money directly from stocks into bonds.

...The Standard & Poor's 500 was off 2.9%, or 39.95 points, at 1333.25, including declines in all its sectors. In previous selloffs, traditional safe-haven categories like healthcare and utilities sometimes eked out gains within the broad index. But on Thursday, investors exchewed stocks bets almost across the board.

The technology-focused Nasdaq Composite Index was down 2%, or 47.69 points, at 2346.90

(Excerpt) Read more at online.wsj.com ...

TOPICS: Business/Economy; Extended News

KEYWORDS: bearmarket; housing; mortgages; stocks

Navigation: use the links below to view more comments.

first 1-20, 21-35 next last

To: shrinkermd; ex-Texan; stephenjohnbanker

"Bartender, I'll have 'nother credit stim-u-lus package. Just put it on my tab."

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

“Several brokerage houses tumbled; blue-sky investment companies formed during the happy bull market days went to smash, disclosing miserable tales of rascality; over a thousand banks caved in during 1930, as a result of marking down both of real estate and of securities; and in December occurred the largest bank failure in American financial history, the fall of the ill-named Bank of the United States in New York.”

~~"Only Yesterday: An Informal History of the 1920’s" by Fredrick Lewis Allen

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

"Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump."

"True, governments can reduce the rate of interest in the short run. They can issue additional paper money. They can open the way to credit expansion by the banks. They can thus create an artificial boom and the appearance of prosperity. But such a boom is bound to collapse soon or late and to bring about a depression."

"Credit expansion is not a nostrum to make people happy. The boom it engenders must inevitably lead to a debacle and unhappiness."

"What is needed for a sound expansion of production is additional capital goods, not money or fiduciary media. The credit boom is built on the sands of banknotes and deposits. It must collapse."

"If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders."

~~Ludwig von Mises, dean of the Austrian school of economics

2

posted on

01/17/2008 2:04:46 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: shrinkermd

All the while FRC Bernake is giving testimony before Congress to endorse a stimulus package.

He isn't forecasting a recession, instead a slow down in economic growth. Supposition? Who the hell knows. I hope this guy hasn't fallen "behind the curve."

3

posted on

01/17/2008 2:12:49 PM PST

by

w_over_w

(Give not from the top of your purse but from the bottom of your heart.)

To: Young Scholar

Ping

4

posted on

01/17/2008 2:16:54 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: w_over_w

A credit “stimulus package” is the same now as giving another shot of heroin to an addict. Yes, it may take away the immediate pain, but it does not cure the addict. It only puts off and worsens his ultimate day of reckoning.

5

posted on

01/17/2008 2:18:38 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

And then there’s “The subprime situation is contained.”

6

posted on

01/17/2008 3:00:05 PM PST

by

coloradan

(Failing to protect the liberties of your enemies establishes precedents that will reach to yourself.)

To: coloradan

Do you have the full quote? I'm collecting them. Like this one.

"We're not about to go into a situation where (real estate) prices will go down. There is no evidence home prices are going to collapse."

~~Alan Greenspan, May 21, 2006

7

posted on

01/17/2008 3:41:27 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: shrinkermd

Only took a year with the dem’s running the house and senate for this to happen.

8

posted on

01/17/2008 3:55:31 PM PST

by

edcoil

To: Travis McGee

We did everything we could to warn folks to preserve their capital before the big downturn. I don’t know what else you or I or Hydroshock or several others could have said to warn numerous folks here. I’m no financial genius, but the writing was very plainly on the wall.

All we got was slammed and called liberal supporters and doom and gloomers trying to help the media elect Hitlery.

Oh well. Those of us fully vested in cash are sleeping great these days. I am sure there will be a parade of praise for dollar-cost-averaging over the past month, we’ve hit bottom on stocks and housing, yada, yada...

To: edcoil

Had ZERO to do with the Democrats in office. Had everything to do with the natural business cycle. The speculation-induced housing bubble ran its course in good time, leaving a nice hang-over in its wake. I hate the LibDems myself, but they had NOTHING to do with this economic downturn. We had a great economic expansion caused by consumers going in debt up to their receding hairlines and the party had to end some time. Now the same woefully indebted party-ers are getting the bill, with interest.

To: Hydroshock

pingy, since I called your name...

To: Freedom_Is_Not_Free

You didn’t warn me. Where was my warning?

12

posted on

01/17/2008 6:46:20 PM PST

by

durasell

(!)

To: Freedom_Is_Not_Free

Lots of suckers will be catching falling knives, that’s for sure.

13

posted on

01/17/2008 6:48:57 PM PST

by

Travis McGee

(---www.EnemiesForeignAndDomestic.com---)

To: Travis McGee

14

posted on

01/17/2008 7:10:47 PM PST

by

coloradan

(Failing to protect the liberties of your enemies establishes precedents that will reach to yourself.)

To: Freedom_Is_Not_Free

I know that - what do we have to put a /SARC in everything.

However it is also not just business cycle there are a lot of issues, the republicans interfering between two private contracts in a credit card agreement doubling minimum payments. They had no business being there, states spending and across the country talk of raising taxes.

Yea, it goes both ways.

15

posted on

01/17/2008 7:11:46 PM PST

by

edcoil

To: edcoil

Sorry for taking you seriously. There is such a wide spectrum of both opinions and intellect on any electronic bulletin board, I often have to read between the lines. I haven’t read enough of your posts to know how you generally come down on these issues and took your post at face value. That with no ability to see body language or hear vocal inflections. Sorry again.

To: durasell

Sure I warned you, loud and clear. I warned anybody who would listen. You and many others just weren't listening.

This is just the latest warning I made and this was with AMPLE time to adjust your portfolio. I can lead a Freeper to water, but I can't make him think...

I’ll speak for myself. I am not excited by the worsening economy, merely cautioning of it. Maybe even help a few Freepers. The economy and stock market is going to do what it is going to do. You and I can’t make it move one way or the other. I’ve got my money completely out of equities and risk where it is safe. I’m sure many people here see the sell off as nothing more than a buying opportunity. I don’t think so, and have tried to tell others to put your money in safe investment, and return to equities after the bear market and recession are over.

I’ve tried to tell others, this is not the time to be spending and getting over-extended. Pull back, watch spending, save your pennies, shun risk and wait a year when you can get equities and real estate at lower prices than today.

Most laugh at me and scream “doom and gloom, the sky is falling”. Whatever. I won’t be the one with the 25% haircut from stocks.

There is no joy in spotting the tornado’s approach, just an obligation to herd people toward the seller. You repeatedly state that we like the coming recession. I don’t like it at all. I’m just trying to protect myself from it and warning others to do the same, in complete futility. Those who refuse to see that the real economy is getting worse deserve what they get, but it gives me no pleasure to watch it.

Source: http://www.freerepublic.com/focus/f-news/1930784/posts?q=1&;page=51

durasell -- unless I recall incorrectly, you were one of the stronger detractors to my posts, but I can't recall if it was to my posts about the market, about housing or about both. I couldn't make you listen. I wish I could have made you and others here listen. Oh well.

To: Freedom_Is_Not_Free

18

posted on

01/17/2008 7:46:42 PM PST

by

edcoil

To: Freedom_Is_Not_Free

Actually, I was one of the defenders of you and ex-texan.

That said, I still haven’t received my warning.

19

posted on

01/17/2008 7:46:50 PM PST

by

durasell

(!)

To: Freedom_Is_Not_Free

...and, if I was warned in the past, I would appreciate being warned again.

20

posted on

01/17/2008 7:48:10 PM PST

by

durasell

(!)

Navigation: use the links below to view more comments.

first 1-20, 21-35 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson