Posted on 12/21/2007 4:46:27 PM PST by Cagey

The family of a California teenager who died awaiting a liver transplant said they would sue the insurer whom they blame for their daughter's death.

Nataline Sarkisyan, a 17-year-old from Glendale, Calif., died Thursday just a few hours after her insurer, Cigna HealthCare, approved a procedure it had previously described as "too experimental."

Attorney Mark Geragos said that Cigna "maliciously killed her" and that he hopes to press murder or manslaughter charges against Cigna HealthCare for the death of Sarkisyan.

District Attorney spokeswoman Sandi Gibbons declined to comment on the request for murder or manslaughter charges, saying it would be inappropriate to do so until Geragos submits evidence supporting his request.

"They took my daughter away from me," said Nataline's father, Krikor, who appeared at a news conference with his 21-year-old son, Bedros.

Cigna appears to have reversed its decision to deny the transplant after about 150 teenagers and nurses protested outside its Glendale office Thursday. "Protestors are here, the war is here," Hilda Sarkisyan, the girl's mother, told the group hours before her daughter's death. "We have a war here."

The Sarkisyan family claims that Cigna first agreed to the liver transplant surgery and had secured a match weeks ago. After the teen, who was battling leukemia, received a bone marrow transplant from her brother, however, she suffered a lung infection, and the insurer backed away from what it felt had become too risky a procedure.

"They're the ones who caused this. They're the one that told us to go there, and they would pay for the transplant," Hilda Sarkisyan said.

Geri Jenkins of the California Nurses Association said the Sarkisyans had insurance, and medical providers felt comfortable performing the medical procedure. In that situation, the the insurer should defer to medical experts, she said.

"They have insurance, and there's no reason that the doctors' judgment should be overrided by a bean counter sitting there in an insurance office," Jenkins said.

Doctors at the UCLA Medical Center actually signed a letter urging Cigna to review its decision. Nataline Sarkisyan was sedated into a coma to stabilize her as the family filed appeals in the case.

During the middle of Thursday's protest, Hilda Sarkisyan fielded a call from Cigna alerting her that her daughter's procedure had been given the green light. Cigna released a statement announcing the company "decided to make an exception in this rare and unusual case and we will provide coverage should she proceed with the requested liver transplant."

Know what you are talking about, see my post #41.

This is a tough one. I don’t trust Geragos or the insurance company.

Lots of folks want to bash the insurance company. What do you think it will be like when we have single payer health care and the equivalent of a clerk at the DVM decides who gets what treatment?

I hear ya. There are insurers like this.

They figure that it’s cheaper to deny claims, because most folks will go away, and the ones that won’t might just die before they get treatment. In the case of organ transplants, a little delay goes a long way, since folks who get transplants are often not far off from death due to the failure to get the organ.

And how many folks are going to sue?

Lifetime care of a young person with an organ transplant can easily cost well over a million dollars. If they deny bunches of these folks, and one family sues and wins $10 million, the insurer is ahead by tens of millions of dollars.

As an employer who “eats his own dog food” (meaning, I take the same benefits as my workers), I’m pretty careful about who we sign up for our health insurance. There are insurers who seem to try to do the right thing (and often succeed) and insurers who just don’t give a damn. Unfortunately, people who get their insurance from their employer often don’t have much of a choice in the matter, and if the employer picks poorly, this can be the result.

sitetest

I don’t know all the facts in this case, but I do suspect that it is common for ins company bean counters purposely stall sick patients in the hope they die before the company has to provide the costly care needed to save them.

“The insurance company did not deny treatment. They denied coverage.”

That’s a good one! LOL!

I rate the ethics of insurance companies slightly lower than the ethics of politicians, democrat politicians at that.

I ditched them more than a decade ago and will never, ever, go back. I didn’t have the wherewithal to take up the challenge of contesting their denials at the time (which they were probably counting on as part of their business model). They can go to hell as far as I’m concerned.

From what I get in the article, the family paid for insurance, the procedure was approved, then denied (for reasons unnamed [MONEY]), then re-approved when the insurance company got caught NOT honoring their CONTRACT.

It’s not as if the family didn’t have coverage. From what I see, and I’ll admit freely I don’t have all the pertinent information, the insurance company reneged on its obligations, and the insurer’s drone made a decision that was a rather draconian “bottom line” choice.

The folks paid thir premiums, and expected the insurer to keep up its end of the agreement. Lawsuit for breach of contract, and probably culpable for untimely death in a civil suit.

It’s NOT the tort system ths time, but a series of REALLY poor decisions and unfortunate developments that ended up breaking a contract and contributing to the death of a young lady.

Quite sad, really. For ALL parties involved.

Why didn’t the family just tell the hospital they would pay for the liver, by selling their home if necessary?

You can bet that is a large part of their business model. I just became obsessed that they weren't going to cheat me like they had several of my friends. It was really a quest on my part and I didn't care what it cost or what effort it took, I was damn mad.

too bad. if anyone needs brought down a notch, it's the insurance industry.

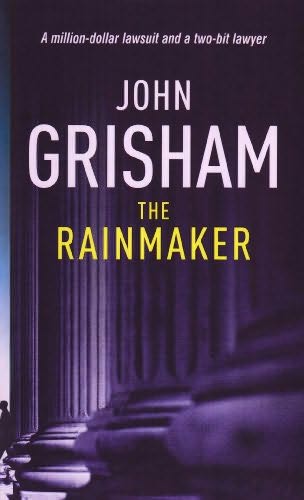

Sad. This reminds me of that movie with Matt Damon and DeVito where the insurance company would deny deny deny claims relying on folks to give up on their claims through attrition.

You win the thread

Perhaps you need to spend some time in the medical insurance industry. Although I do not doubt that the medical insurance industry has unscrupulous behavior, I have never seen any data to suggest that ethics of insurance companies are any lower than other industries. Certainly ethics of insurance companies are much higher than your typical rat politician who directly votes to steal money every year.

Medical insurers are put in a difficult position. They are in a profit business in which many demand free medical care. Medical contracts and procedures can be very complex. I am not convinced from my limited knowledge of this case that the insurers were wrong to deny coverage. Even if a court does find the insurers at fault, I do not think that they were being unethical to deny coverage. I am not sure that the procedure would have helped the poor girl.

I suspect there's more to this story than meets the eye.

And they will always decide in their own favor. They are a government protected racket that make their living screwing people. IMHO they are the only entity lower that a slip and fall lawyer.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.