I prefer to think of Hydroshock's posts as a dose of reality.

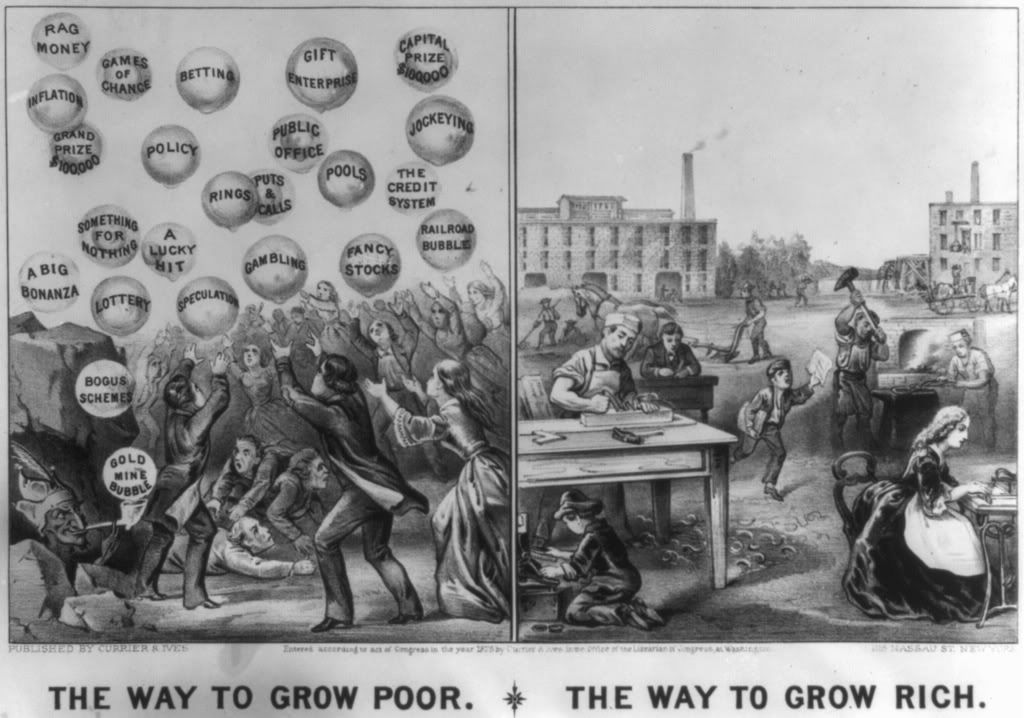

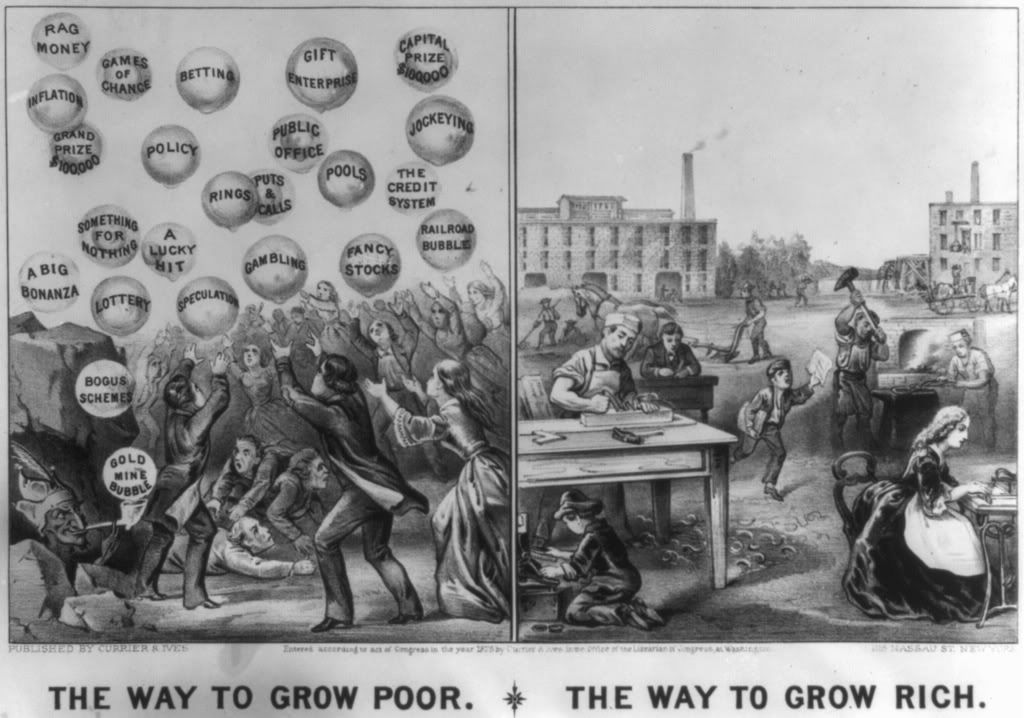

Sorry if it bursts your bubbles...

Posted on 11/20/2007 5:50:36 AM PST by Hydroshock

U.S. home construction starts were up 3 percent in October, the biggest monthly gain in eight months, but building permits were down 6.6 percent to a level not seen in 14 years, a government report on Tuesday showed.

The Commerce Department said housing starts set at an annual pace of 1.229 million units in October from a 1.193 million unit pace in September. It was the biggest monthly increase since February and came after starts tumbled 11.4 percent the prior month. Economists were expecting to see a slight decrease in starts to a 1.17 million unit pace from the initially reported 1.191 million pace.

RELATED LINKS Latest Economic News

Building permits fell 6.6 percent in October to a 1.178 million unit pace. That was the lowest level since July 1993 and well below the 1.200 million unit level economists were expecting.

(Excerpt) Read more at cnbc.com ...

Yes, let rates rise and let the housing mkt go thru it’s correction. People who couldn’t afford buying these homes in the first place will go back to renting, the banks and mortgage co’s, and builders will take the hits, and housing appreciation will return to the historical averages.

30-year fixed mortgage interest rate = 5.9% (bankrate.com)

unemployment rate = 4.7% (bls.gov)

Worst economy since Hoover!/sarc

“Sounds odd. Starts up, permits down??”

Not necessarily. There is this odd phenomenon that slows housing construction on a seasonal basis, especially in the northern parts of the United States. It is called winter.

A house started in October can get finished before winter bites. But permits imply that construction will begin in the near future — November, December, January.

I think what is being seen is a flurry of construction before the start of winter, followed by a seasonal production slump.

Well, if he’s short Freddie Mac he’s up about 25% today. Freddie claims they need additional capital and wants to cut its divvy in half.

Last Trade as of 10:06 AM ET 11/20/07

Freddie Mac’s loss more than doubles; firm may halve dividend

Marketwatch - November 20, 2007 9:51 AM ET

Related Quotes

Symbol Last Chg

FRE Trade 28.30 -9.20

Real time quote.

NEW YORK (MarketWatch) — Freddie Mac’s shares sank about 30% Tuesday morning, plunging as its third-quarter loss more than doubled and as the company raised the possibility of cutting its dividend in half.

Shares of the McLean, Va.-based mortgage investor (FRE) fell about 28% to $27.29.

The wider third-quarter loss came about as mortgage prices collapsed and credit tightened, sparking additions to Freddie’s loss provisions.

“Weakening house prices and deteriorating credit have hurt Freddie Mac’s results, as well as those of other participants in the mortgage market,” said Buddy Piszel, chief financial officer, in a press release. “You can see the impact of these trends in our credit results and throughout our financial statements.”

It will take time for the mortgage market to turn around and improve, according to Freddie.

For the year to date, Freddie’s recognized $4.6 billion in net credit-related items on a pre-tax basis, Piszel said.

Freddie’s third-quarter loss grew to $2.03 billion, or $3.29 a share, from a loss of $715 million, or $1.17 a share, in the same period a year ago.

“The increased net loss, year-over-year, was primarily due to higher credit-related expenses and mark-to-market losses on the company’s portfolio of derivatives and credit-related items,” Freddie said in a press release.

Freddie said the fair-market value of its net assets fell by $8.1 billion in the quarter, adding added that it’s taken steps to address the challenges continuing to confront in the mortgage market.

Specifically, the firm said it has hired Goldman Sachs and Lehman Bros. to study capital-raising options. Freddie’s been having problems with its capital levels, like many other firms hit by the mortgage market’s problems.

“Capital constraints during the quarter limited Freddie Mac’s ability to take advantage of purchase opportunities for the retained portfolio,” Freddie said.

Sizable mark-to-market adjustments

In September, the company sold about $20 billion in unpaid principal balance of retained portfolio assets with an eye to regulators’ 30% mandatory target capital surplus.

Also during the latest quarter, the company recorded mark-to-market losses totaling $2.7 billion, wider than $1.5 billion in the third quarter of 2006.

The mark-to-market losses during the third quarter of 2007 were about evenly split between widening credit spreads on the value of the company’s credit guarantee activities as well as the impact of declining long-term interest rates on the value of the company’s derivatives portfolio.

If it’s unable to raise adequate capital, the company said that it may consider such measures in the future as limiting growth or reducing the size of Freddie’s retained portfolio, slowing purchases into its credit guarantee portfolio, issuing additional preferred or convertible preferred stock and issuing common shares.

Haven’t seen any of those things.

But houses are moving, there are many people with cash and good credit who have been waiting.

That to me is a good thing.

But then again I am not one of the “hoping for Armageddon” crowd.

I believe in the soundness of the US economic system, and of the ability of the free market to correct imbalances when they occur.

Staying with the metaphor...and go where?

I prefer to think of Hydroshock's posts as a dose of reality.

Sorry if it bursts your bubbles...

Point was for the home builders to get off their backsides and use innovations to get their backlogs to the people. In spite of the same doom'n'gloom rhetoric big three autos are selling in most areas of this nation.

But houses are moving, there are many people with cash and good credit who have been waiting.

Cash and 820 credit ratings shouts, "I've got a better offer with... . Can you do better, or do we need to walk on from y'all?"

>> I believe in the soundness of the US economic system, and of the ability of the free market to correct imbalances when they occur.

That’s cool. I do to.

I also note that begging for a rate increase — just another form of government bailout — is NOT allowing the “free market to correct imbalances”.

>> I believe in the free market but I also see the need for some govt help, guardrails at times.

Of course, the guardrails ought to be built around MY ox, to keep it from getting gored, and to hell with your ox.

Right? :-)

lead and lag, think, it takes months to start a large project and secure financing, etc. That is why houses are still being pumped out even though there is a glut on the market. Rough but you get the idea.

From another article:

http://biz.yahoo.com/ap/071120/economy.html?.v=10

“all of the strength came in the volatile apartment sector, which jumped by 44.4 percent. Construction of single-family homes fell for a seventh straight month, declining by 7.3 percent in October compared to September.”

Somebody is betting all the folks that lose there homes are going to want to find a place to rent.

Probably a good bet.

Doubtful. They are probably building on older permits.

>>30-year fixed mortgage interest rate = 5.9% (bankrate.com)

unemployment rate = 4.7% (bls.gov)

Worst economy since Hoover!/sarc<<

Like I said, the positive news comes with playing creative with numbers.

Your post is like a guy that is living off credit cards, has maxed out all but one, and is within ten percent of max on that one, saying “I’m making all my payments and we have more stuff than ever!”

Get back with me in a few months.

Or, in the case of our current economy, the few months are up.

>>Staying with the metaphor...and go where?<<

Debt free.

See post 33

“Well actually I am seeing just that happening in the past 3 weeks.

Seeing a bunch of people who have been waiting; are now buying houses.

They are getting the deals they want and are buying.”

Same thing is happening locally. It’s really picked up the last month. In our subdivision of about 200 houses, there are 6 or 7 new starts and 3 existing sold....

>>Point was for the home builders to get off their backsides and use innovations to get their backlogs to the people.<<

Maybe there are more homes than are needed right now. Sometimes you can’t get rid of inventory if you give it away.

Well gotta have “plywood” (money) to do that.

And rent, utilities, and other things still must be paid for a lot of people.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.