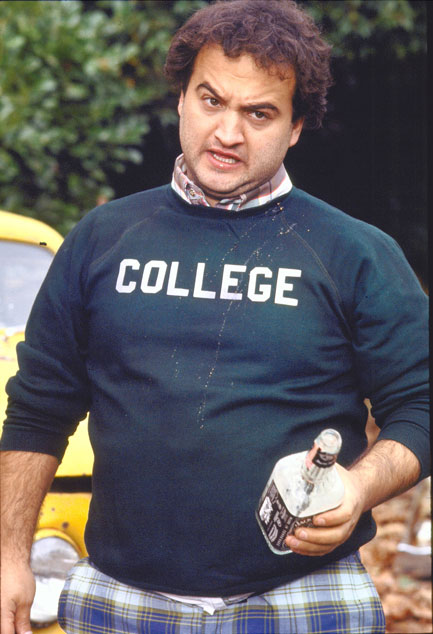

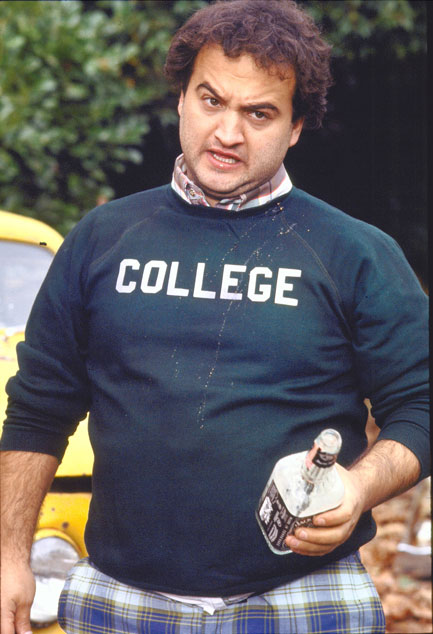

Was it over when the Germans bombed Pearl Harbor?

Posted on 10/25/2007 8:12:27 PM PDT by Philistone

To read the MSM headlines (which I try not to) the falling dollar is the end of the world. Maybe Wall Street should get a Noble Prize for their work in "Global Dollar Cooling". But seriously, what are the effects of a weak dollar?

1) Increased exports. Last month's exports were among the highest on record. Trade deficit? What trade deficit? Boeing, Caterpiller, Microsoft, Apple, etc. all with surges in foreign export sales.

2) Outsourcing? What outsourcing? All of the sudden it becomes cheaper to employ an American technician than one from Bangalore.

3) Cost of living? (I love this part!) Since China has pegged the Yuan to the Dollar, everything we get from China costs exactly the same! Maybe this will convince them to unlink the Yuan. Then we'll REALLY see who's the best producer.

4) Buhh... buhh... buhh... but foreigners will stop buying American Treasuries! What? In order to buy Russian ones? Chinese ones? Venezualian ones? Give me a break.

A weak Dollar equals: more exports, more jobs, more tourists (spending money) and the same or higher standard of living.

Bring it on!

“You’re absolutely right, it is indeed the quarterly earnings reports that rule the day for most. I think you made your point, I just knew I’d get a lot of mud on me if I defended it :)”

It wasn’t worth defending. When I reread it, even I was mortified : )

Just keep reposting it until it sinks in.

The timing does seem to be conspicuously incongruous as we head into the traditionally slow sales period.

I have also noted that they keep retroactively making adjustments to the seasonal adjustments as well.

The erosion of any statistical base-line of what their purported numbers mean, is the end of their utility.

The theory of Rational Expectations predicts that the the actors of the economy will wise up, and discount those kinds of policies, inclusive of policies of domestic disinformation, and take correspondingly countering personal actions to discount their effects where possible.

:) Ammunition...don’t ever give them ammunition (lol)

Especially the liberal ones. LMAO!!

I’ve saved this thread and that post. It really is just that simple. I need a gumball...got any change? :)

*everything* will be more expensive. welcome to the brave new world...

It’s actually been the ‘compassionate conservative’ types that really took the lead with some of this crap...

Sorry, but my compassion is not with the Bolivian people. My heart is with the United States.

I haven't seen any conservatives posting (and agreeing with) links from EPI.

Sorry, but my compassion is not with the Bolivian people.

Trade benefits both sides, even Bolivians.

My heart is with the United States.

Mine too. And trade helps America. Despite what your union buddies say.

And to that point, also, if you give ToddsterPatriot a lemon, he won’t make lemonade; rather, he will squeeze the lemon juice into you eyes (lolol). Viscious I tell ya :)

What did I miss? Did this kid travel all the way to Europe to buy three gumballs?

The key to success must be we devalue until our currency equals Bolivias

“I haven’t seen any conservatives posting (and agreeing with) links from EPI.”

Have you ever actually seen a conservative? In real life?

“Trade benefits both sides, even Bolivians.”

Sometimes, not always. And of course, one man’s benefit is another man’s loss. Depends on which side your on. I would think you would be on the Bolivian side :)

“Mine too. And trade helps America. Despite what your union buddies say.”

LOL...you’re too much :)

I need a perspective check first, as I don’t recognize your moniker? Do you subscribe the the Economic Degrees of Freedom Index? It’s best I know this first, please.

Was it over when the Germans bombed Pearl Harbor?

Yea, dennisw...good to see a rational person :)

Sometimes, not always. And of course, one man’s benefit is another man’s loss. Depends on which side your on.

Ahhh, the old zero sum game. Or better yet, people buying things that don't benefit them.

Have you ever actually seen a conservative?

Not when I look at you.

I would think

I wish you would think, there's a first time for everything.

Todd basically told me that articles from the Foreign Affairs and the Wall Street Journal were not good references on another thread. He is the classic “only I know what is going on” type of thinker. I have given up trying to discuss anything with him as it is a waist of time.

“The key to success must be we devalue until our currency equals Bolivias”

That indeed is stated goal.

Careful, Paul Ross. Jedward took grief for posting links from an other than conservative organization.

But, it is a very good article, isn't it? :-)

The dollar's decline has been stalled by the federal government's appetite for new money from overseas. To finance large budget deficits, the federal government borrowed money from international investors, particularly from central banks in Asia. The result has been a rising demand for dollars from overseas investors which has kept the dollar comparatively high despite the gaping U.S. trade deficit.

. . .

. . . Eventually, foreign investors will worry about the impact of large U.S. government budget deficits on economic growth. Nobody expects deficits to rise without an effect on interest rates. To compensate for the loss of value that slower growth would mean for their investments in the U.S., they may demand higher interest rates to keep their money here. . . .

The policy responses are clear. The federal government's irresponsible dependence on international capital flows has helped to bring the U.S. economy closer to the brink of either a financial crisis or a prolonged economic slowdown. To reduce this possibility, federal budget policy needs to be put on a course towards fiscal responsibility.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.