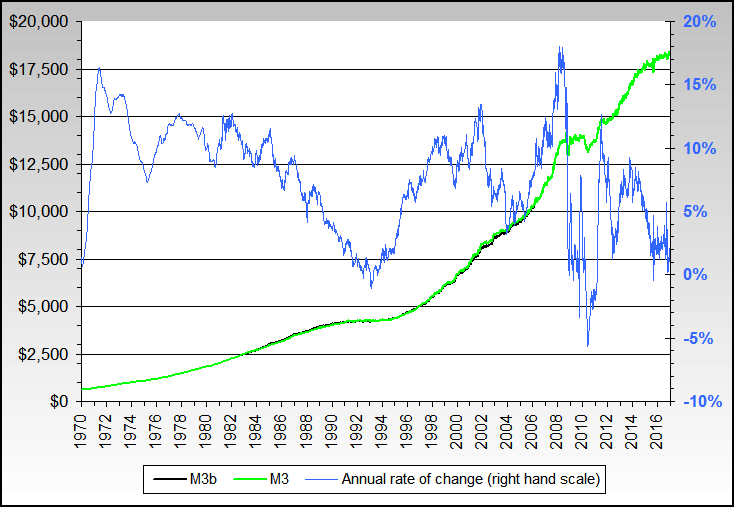

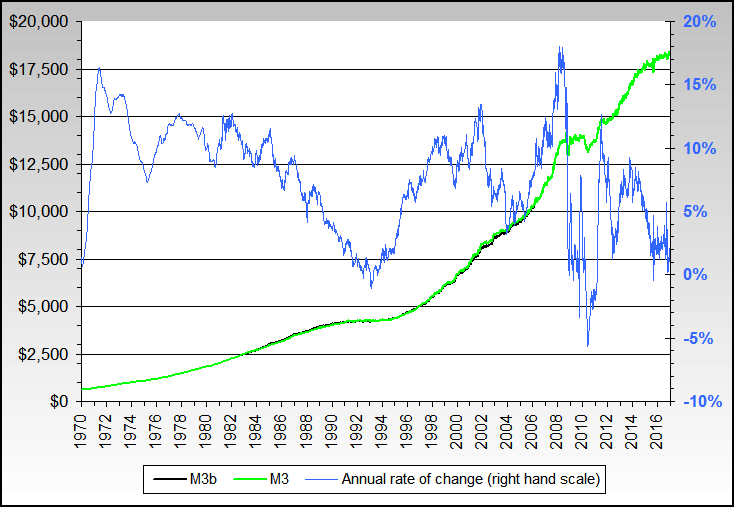

Where we are at is at the upper end of a federal reserve money printing cycle. The Federal Reserve discontinued reporting M3, broad money. Here is why:

Despite what you might call high interest rates, credit has been expanding rapidly

Posted on 09/17/2007 1:32:01 AM PDT by OneHun

Econ 101: The Problem with Bailouts by Gary Wolfram (more by this author) Posted 09/17/2007 ET

The difficulties in the subprime lending market are beginning to generate a chorus for a bailout of the mortgage industry. The media emphasize stories of people losing their homes to foreclosure and potential panic as adjustable-rate mortgages are adjusted up. Yet a bailout, however structured, would be a bad idea.

As Sherlock Holmes told Dr. Watson in “Scandal in Bohemia,” one problem is that we see but do not observe. For every homeowner who loses his home and moves into a smaller home or a rental, there is another homeowner who moves into that home and out of a smaller home or rental.

When someone defaults on a mortgage and that home is foreclosed, bulldozers do not show up the next day and plow the house into the ground. For every seller there is a buyer.

It would be interesting if the media began doing stories on how much more affordable it is for people to move from rented apartments into owner-occupied homes. The house that used to cost $280,000 and was out of the reach of the young family is now $220,000 and becomes affordable.

It seems that when housing prices are high, the view is that we have a problem with affordability, and when housing prices fall we have a problem with declining homeowner equity. Actually, we just have a situation where prices move up and down in response to demand and supply conditions. Some people bought high and will now sell low, and some people will be able to buy low and will sell high at some point in the future.

(Excerpt) Read more at humanevents.com ...

” For every seller there is a buyer. “

This has got to be one of the most stupid things ever written by a supposed ‘finance expert’.....

If this is truly what the experts - or, worse, the policy makers - truly believe, then we are really in the soup.....

Holy crap! This guy’s an idiot!

Gary Wolfram’s primer on free market economic priciples, as applied to real estate loans, is wasted on the likes of respondents such as Uncle Ike and durasell(!). The response to Wolfram’s citation of Friedrich Hayek, mentor to Milton Friedman, “Holy crap! This guy’s an idiot!”

For them, government intervention into the sub-prime mess will “fix” everything. Lenders who courted unqualified borrowers at high rates, flippers who gambled on realizing unending appreciation of speculative properties, and buyers who foolishly overextended themselves with “interest only” variable rate mortgages in order to consume the “good life” all qualify for taxpayer largesse.

Rather than permit the consequences of default to be meted out by market forces, these two apparently prefer some loan commissar as arbiter. For them, supply and demand are pearls before swine.

There is, of course, another free market option not mentioned by the author, which is that the holders of mortgage notes could see the futility, legal expense and carrying costs involved in repossession and attempting to resell, and negotiate the loan balance and interest rate with the current occupant.

If you are a proponent of free markets then you should have an issue with the way the Federal Reserve uses interest rates to manipulate the economy.

Sort of like pushing on a string - the FED seems to follow interest rates more than set them in effect and I question just how much they can effect monetary manipulation in todays global economy. The demand for dollars is not unlimited.

Yeah, there’s also that pesky secondary market on Wall Street that’ll see tens of billions go up in smoke, not to mention the tens of thousands thrown out of work etc. etc.

Likewise here, by definition, a sale requires a buyer and a seller. Otherwise it is not a sale. My father taught me early that something is only worth what someone else will pay. Other ideas are just fantasy.

In your second example the same principles apply with the mortgage holder becoming the seller and the holder the buyer to renegotiate.

First off, for every seller there isn’t always a buyer. It depends on what is being sold. Some things can’t be sold for a variety of reasons.

Secondly, even if there is a buyer, the important element isn’t just the transaction, but the price at which the transaction is accomplished.

Someone who does not sell is not a seller. Around here there are many houses with sales signs, just in case a sucker shows up, by chance. If you make an offer, you find out that the house is not really for sale. In order to become a seller someone has to get real and come to terms with a buyer. It is a matter of definition. Anything else is a misuse of terms. As to your second point, price is what they negotiate to transact a sale. It must change until terms are reached, otherwise no sale and no buyer or seller.

This guy should take up another profession. Financial writing isn’t his forte. A foreclosed house isn’t necessarily a boon for a renter moving up. As the rustbelt shows, the house can sit empty indefinitely, a home for squatters, pimps, and termites. Or it could be bought by someone forced out of their even more expensive foreclosure. Destruction isn’t always creative.

If there are more forclosures than buyers in the market, those houses become bank property. The banks will sell them off for a song to get out from the liability.

The buyer will either have to make it a rental or sell it at a profit. To SELL it there has to be a buyer, but a lot of those are going into the foreclosure loop. So where does that leave the rest of us?

Picking up the defaults.

Here's an idea, lower the FED, that drops the prime for owners who are in good standing. Offer them a lower refinance, no points, lower rate, etc. This will free up monies for some of those who went sub-prime to get into a fixed loan at a higher rate than the good standing owner, at least double the rate. Not all of the owners getting foreclosed will survive, but those savvy enough to manage their monies will.

This will reduce the number of foreclosures and actually increase monies available for lending and return the loaning institutions enough to survive the storm of unsold houses.

I do.

We’re obviously at the upper end of a rate raising cycle, therefore rates should be lower than they are now in order to be neutral with respect to the economy.

That's wrong.

The only possible way that something can be sold by someone, is when someone else to buys it. OK, sure it's possible for someone to make an offer, but nothing is ever sold unless someone else buys.

This should not be hard to follow.

Things are offered “for sale” all the time and find no “buyer.”

Real estate, of course, is a little different since the buyer can walk away from the sale before the complete amount is paid. This most frequently happens when the amount paid doesn’t equal a new, adjusted value, i.e. Why pay off a $300,000 mortgage on a $175,000 house?

Where we are at is at the upper end of a federal reserve money printing cycle. The Federal Reserve discontinued reporting M3, broad money. Here is why:

Despite what you might call high interest rates, credit has been expanding rapidly

Why indeed? But this does not invalidate the point. There was a buyer when loans no doc no downpayment 1.75% ARMs were being handed out. The buyer got "cheap rent" until the interest rate reset. Now he discovers that he cannot actually afford what he paid, nor can anyone else.

That does not mean the house cannot be sold at a price, just not a price that will keep the previous owner or the bank that foreclosed happy. They should have thought of that before.

But I don't only blame them. I blame Greenspan. The policy of rapid money expansion (see the graphs above) was his doing and no one else's. He cannot claim that he didn't know what to do about a bubble, when he was blowing the hot $$ into the market that caused it in the first place.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.