Skip to comments.

The People Must Demand The Fair Tax

GOPUSA ^

| August 28, 2007

| By Doug Patton

Posted on 08/28/2007 4:39:18 PM PDT by Bigun

The People Must Demand The Fair Tax

By Doug Patton

August 28, 2007

Last year, during the United States Senate race in Nebraska, Republican challenger Pete Ricketts suggested that every option must be considered when looking at ways to reform our federal tax system. Among the list of alternatives Ricketts said should be on the table was a national sales tax known simply as the "Fair Tax."

The Democrat incumbent, U.S. Sen. Ben Nelson, launched an attack on his opponent that was, at best, distorted and condescending, at worst, irrational demagoguery. One would have thought that Ricketts had suggested stealing all the assets of the poor and handing them over to Warren Buffet and Bill Gates.

Recently, the panel of pundits on ABC's "This Week with George Stephanopoulos," discussing the apparent rise in popularity of former Arkansas Governor Mike Huckabee's presidential campaign message, scoffed at Huckabee's unabashed promotion of the Fair Tax.

George Will, the token "conservative" on the panel, brushed it aside with the disbelief of an elitist who cannot understand the burden of the average worker who would love to take home his or her entire paycheck, as the Fair Tax would allow him or her to do. Will opined that Huckabee's second place showing in the Iowa straw poll was even more amazing given the fact that "he supported a national sales tax of thirty percent, which means that if you buy a one million dollar house, you'll be writing a check to the government for three hundred thousand dollars." Of course, the others on the panel readily agreed.

The elites of this country, who buy those million-dollar homes, are not enamored with the Fair Tax. They would be if they took the time to understand its appeal.

The Fair Tax would replace all federal income taxes. No more federal withholding. No more Social Security withholding. No more Medicare withholding. No more stealing from the paychecks of American workers before they even see it and then pretending to give them a refund, without interest, at the end of the year. No more saving receipts for tax deductions. No more IRS audits. No more April 15th.

Instead, the Fair Tax would put us in control. All consumer items would be taxed. Business purchases would not. By allowing us to make the determination about what we buy and when we buy it, the ability of our legislators to manipulate our behavior is eliminated. That is why the elites don't like it. They can't control the public's spending habits under such a system.

The current federal tax system is broken. It cannot be fixed. Since the inception of the federal income tax with the passage of the 16th Amendment in 1913, federal corruption and control have turned it into a Frankenstein monster that torments the people and serves the special interests. A tax on a person's income is a tax on production, and as Ronald Reagan once said, "Whatever you tax, you get less of."

Because the poor are forced to spend a disproportionate percentage of their resources to cover the tax on necessities, the Fair Tax hits them the hardest. That issue can be addressed by simply issuing a "prebate" check each month to every household in the country. Unlike disingenuous tax credits, deductions, exemptions and other loopholes in the current income tax code, a prebate check is a clean, honest method of covering the sales tax on food, clothing and shelter - up to the poverty level.

Of course, removing the income tax on corporations will reduce the cost of everything we buy, since corporations don't pay taxes. They simply pass them along to consumers. The Fair Tax plan calculates that removing the corporate income tax will result in a reduction in the cost of virtually every consumer item on the market. In fact, it will just about offset the tax on those products. Imagine paying the same price for something but having your entire paycheck to buy it.

And then there are the billions of dollars that flow untaxed through our economy today: drug dealers, prostitutes, pornographers, foreign tourists. Imagine how much revenue could be raised simply by taxing the things those people consume.

There would be no more audits, no more justifying deductions, and April 15th would become just another spring day. But only if the people stand up to the elites and demand it.

TOPICS: Business/Economy; Constitution/Conservatism; Culture/Society; Government

KEYWORDS: fairness; fairtax; freedom; reform; tax; taxes

Navigation: use the links below to view more comments.

first previous 1-20 ... 421-440, 441-460, 461-480 ... 581 next last

To: gondramB

Sounds alot like ‘tax cuts increase goverment revenues’, doesn’t it? Yet it is a fact.

Do you know why tax cuts work to increase revenues to the government? Because if you understand this then you will have an idea for how the FairTax works.

441

posted on

09/01/2007 5:37:21 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: Hostage

>>Do you know why tax cuts work to increase revenues to the government? Because if you understand this then you will have an idea for how the FairTax works.<<

That’s one of those things that will have to work one time before I believe it - so far all it gets us deeper in debt and more beholden to the Chinese.

442

posted on

09/01/2007 5:38:38 AM PDT

by

gondramB

(Preach the Gospel at all times, and when necessary, use words)

To: gondramB

This (and other fair tax pushes) sounds an awful lot like free money.Not free money at all. Just bringing what is currently hidden into the light so it can be seen by those who actually pay it tin the first place.

443

posted on

09/01/2007 5:45:50 AM PDT

by

Bigun

(IRS sucks @getridof it.com)

To: gondramB

The US government publishes revenue collection figures. Those collections have greatly increased. Are you saying these figures are lies?

The current deficits are due to the War on Terror and irresponsible spending.

The ‘beholdeness’ to the Chinese is due to their cheap labor advantage, not our minor tax cuts.

444

posted on

09/01/2007 5:48:20 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: Hostage

>>The US government publishes revenue collection figures. Those collections have greatly increased. Are you saying these figures are lies?<<

Nope. I am saying that under both the Reagan and Bush43 revenue was less than if taxes had not been cut.

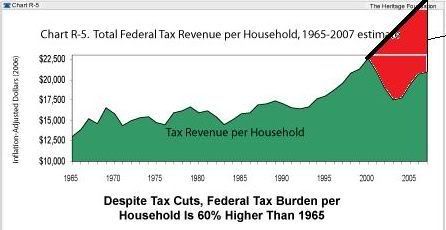

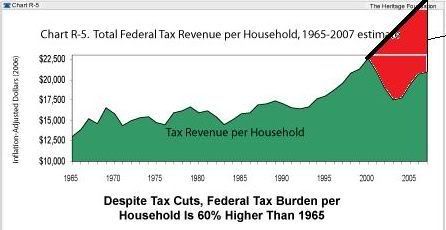

Look at the growth trend in revenues until the 2000 tax cuts - there is no reasonable way to claim the tax cuts increased revenues. The red area is reduced revenue.

445

posted on

09/01/2007 5:53:11 AM PDT

by

gondramB

(Preach the Gospel at all times, and when necessary, use words)

To: SALChamps03

"Everyone is eligible. There is no determination. It is based on family size."Correct. It's equal to the Fair Tax times the poverty rate for a family of different sizes. A family of four, for example, would pay no Fair Tax on the first $19,000 or so of what they spend.

But let's take a family of four where the wage earner makes $18,000 at McDonalds. This is a family in poverty. Today, he pays no taxes. That entire $18,000 is disposable income. A loaf of bread costs him $1 today.

Under the Fair Tax, he still has $18,000 of disposable income. We're told that prices won't rise, meaning that a loaf of bread still costs $1. (We've eliminated the hidden and embedded taxes and the tax is now visible.)

Why does this guy need a prebate? A prebate to offset ... what? He makes the same, he spends the same, he receives exactly the same in goods.

Why are we giving him (and everyone else in the country) $500 per month?

To: Bigun; gondramB

It’s really the exact opposite of that - it hides the current onerous taxation and idiot spending levels in the retail price of everything, and creates a few million new federal tax collectors. Only true economic Marxists could love that.

447

posted on

09/01/2007 5:56:42 AM PDT

by

xcamel

(FDT/2008 -- talk about it >> irc://irc.freenode.net/fredthompson)

To: gondramB

Photo editing? Colored in a block of red over the title. What a liar chart! No one makes a chart like that and publishes it, least of all the Heritage Foundation.

Both Reagan and Bush came into their first term on the heels of a recession.

Do you not remember Carter’s malaise of 1980? Or the dot-com and market collapse of 2000?

448

posted on

09/01/2007 6:01:08 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: Hostage

Wow - you just really don't like the numbers.

The fact is that that Americans are not dissauded from working by the current tax levels. So when taxes are cut revenues go down.

I wish it weren't that way but calling people names doesn't change the numbers.

449

posted on

09/01/2007 6:05:03 AM PDT

by

gondramB

(Preach the Gospel at all times, and when necessary, use words)

To: xcamel

Only a twisted mind could come up with these lines.

*****The FairTax ‘hides’ taxation levels and is loved by Marxists.*****

This is poorly crafted disinformation on your part.

You’re losing it here. I can guarantee you are going nowhere with the FairTax is a communist plot or the FairTax hides the true level of taxation. Try again.

The only way I could give credit to your statements here is to treat them as comedy satire!

450

posted on

09/01/2007 6:08:15 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: Hostage

Remember to reconnect your brain to your fingers before you start typing... you’re embarrassing yourself.

451

posted on

09/01/2007 6:14:19 AM PDT

by

xcamel

(FDT/2008 -- talk about it >> irc://irc.freenode.net/fredthompson)

To: xcamel; gondramB

BZZZZZZ!! 15 yard penalty for outright lies!

Nothing is hidden with the FairTax! Nothing!

In fact, the FairTax would REQUIRE that a detailed receipt, showing where ALL the money is going, be issued with every purchase.

452

posted on

09/01/2007 6:15:42 AM PDT

by

Bigun

(IRS sucks @getridof it.com)

To: Hostage

"You did not tell the truth about Nike's profits."You have got bigger issues to worry about that Nike profits. Other posters on this thread a ripping you a new one and you cannot counter their claims (other than by calling them names). Hell, you refuse to counter mine - all you got it is, "You were wrong on Nike's profits" when that has nothing to do with the argument.

"To overcome the objection of leftists that the poor pay disproportionately more for necessities."

So what? They're paying -- what did you say in your post #272 -- 32% in embedded taxes today and I don't see you pushing for a prebate. Hypocrite!

"'Everyone' is not paying embedded taxes. Many of the poor are currently subsidized, for example with food stamps which today are doled out as debit cards."

I don't care how they're paying for a loaf of bread. When they buy a loaf of bread today, they're paying 32% in embedded, hidden taxes and tax costs, according to you. We all are, right?

"But under the Income tax, socialists believe only the poor should receive handouts."

And under the Fair Tax, the poor receive handouts AND the prebate! Who's the socialist? Actually, you want everyone on the dole. Who's the socialist?

Or are you saying that the poor will no longer receive welfare, food stamps, WIC, AFDC, and all the other programs and will only receive the prebate?

To: gondramB

Your previous post showed a chart that was obviously doctored. And you posted it as fact!

All you’ve shown in your current chart and statements is an inability to read what is in front of you. The chart shows revenue from households averaged over the number of households. And it shows the Clinton tax hikes extracted more from households.

What is does not show is the revenue from businesses.

Lucky for Clinton he had the internet revolution occur under his watch and that was largely facilitated by the Republican telecommunications legislation. He also had the dot-com bubble form under his watch which greatly increased revenues from capital gains.

In any event your attempts to prove the unprovable have failed. Don’t try again for the sake of your own embarassment.

454

posted on

09/01/2007 6:20:26 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: xcamel

So you also think the FairTax hides taxation levels and is a communist’s dream?

What was that about ‘connecting brain to fingers’? Embarassing oneself?

455

posted on

09/01/2007 6:28:33 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: Hostage

>>All you’ve shown in your current chart and statements is an inability to read what is in front of you. The chart shows revenue from households averaged over the number of households. And it shows the Clinton tax hikes extracted more from households.

What is does not show is the revenue from businesses.<<

We were talking about whether tax cuts increase revenue. We’ve had two Presidents cut taxes and both times revenues went down.

That’s all I’ve discussed in this thread - the effect of tax cuts under the current American outlook. Tax cuts do not increase revenue.

456

posted on

09/01/2007 6:30:45 AM PDT

by

gondramB

(Preach the Gospel at all times, and when necessary, use words)

To: robertpaulsen

You have got bigger issues to worry about that Nike profits. Other posters on this thread a ripping you a new one and you cannot counter their claims (other than by calling them names). Hell, you refuse to counter mine - all you got it is, "You were wrong on Nike's profits" when that has nothing to do with the argument. Is that a fact? (Grin)

I refuse to counter yours? Your what? Your lies?

The rest of your post is garbled dementia. I am not qualified to assist you.

457

posted on

09/01/2007 6:33:06 AM PDT

by

Hostage

(Fred Thompson will be President.)

To: robertpaulsen

I have a question. If the GDP is 16 trillion and there is 32% embedded taxes then shouldn’t the government already have revenues of $5 trillion dollars?

But we actually have revenues half that including all the income tax. Wouldn’t that suggest the embedded tax rate is 10% or less?

458

posted on

09/01/2007 6:45:32 AM PDT

by

gondramB

(Preach the Gospel at all times, and when necessary, use words)

To: Bigun

"Nothing is hidden with the FairTax! Nothing!"The overall size of taxation and spending is "hidden" and minimized by the Fair Tax.

Let's say an item on the shelf under the Fair Tax is priced at $100 and next year we see that the same item is priced at $105. What's your initial reaction?

Well I would imagine it would be, "It's only 5 bucks more." Or, "It's inflation and the manufacturer increased his price by 5%."

Not until you got your receipt would you see that the price of the product remained at $77 but the NRST went from $23 to $28. What looked like a 5% price increase from the manufacturer was really an enormous across the board 22% tax increase!

Oh sure. You can say it's not "hidden". It's right there for everyone to see. Printed right on the receipt. Plus, the tax increase was in the news.

But the average shopper will see a $5 increase, not a 22% tax hike. The overall impact is "hidden" and minimized. What looks like 5% is really 22%

States do it all the time. If they want to raise the sales tax fron 4% to 5%, what do they say? A one-cent increase. That's all. Just a penny more.

When in reality, it's a 25% tax increase!

To: gondramB

460

posted on

09/01/2007 6:51:04 AM PDT

by

Hostage

(Fred Thompson will be President.)

Navigation: use the links below to view more comments.

first previous 1-20 ... 421-440, 441-460, 461-480 ... 581 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson