Posted on 08/31/2006 6:51:58 AM PDT by InvisibleChurch

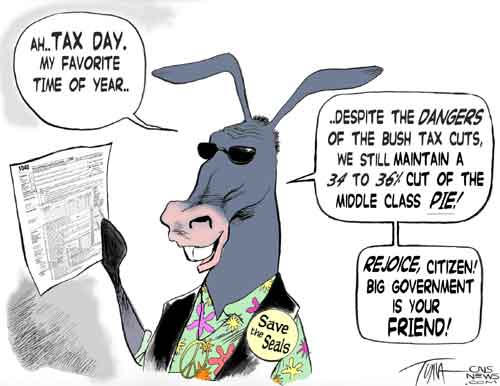

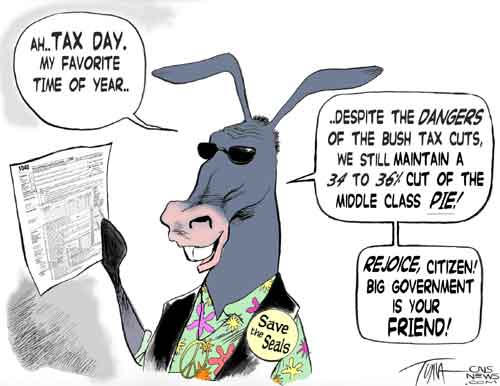

SOAK THE POOR The Treasury Department recently issued a news release showing that the very people opponents of the Bush tax cuts purport to be so concerned about will see their tax bills go up if the tax cuts are not made permanent, says Investor's Business Daily (IBD).

If the tax cuts lapse, the tax bills for many Americans who can use the relief will rise in 2011, including:

A family of four with two children making $56,300 in 2011 will be hit with a tax bill that's bigger by $2,092, a 132 percent hike. That same family making $67,600 a year — still not rich — would see its tax bill go up by $1,858, an increase of 58 percent. Women will see an average hike of $1,970, affecting around 84 million taxpayers. Single women with children will see a $1,062 rise in taxes. Small-business owners will pay an additional $3,637 in taxes. The untold story of the Bush tax cuts is the fact that they wiped millions of poor and low-income Americans off the income tax rolls, says IBD. A large block went from paying small tax bills to paying no income taxes at all. As many as 43 million Americans, nearly a third of all taxpayers, now have no income tax liability.

The myth that the Bush tax cuts boosted the rich at the expense of the poor and middle class has been proven false, says IBD. The reflexive opposition to tax cuts to incite jealousy among economic classes is as harmful as it is outdated.

Source: Editorial, "Soak The Poor," Investor's Business Daily, August 31, 2006.

For text:

http://www.investors.com/editorial/editorialcontent.asp?secid=1501&status=article&id=241830154680219

For more on Taxes:

http://www.ncpa.org/sub/dpd/index.php?Article_Category=20

Income tax SOP strikes again.

If anyone would like to be added to this ping list let me know.

John Linder in the House(HR25) & Saxby Chambliss Senate(S25) offer a comprehensive bill to kill all federal income, SS/Medicare payroll, and gift/estate taxes outright replacing them with with a national retail sales tax administered by the states.

H.R.25,S.25

A bill to promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national retail sales tax to be administered primarily by the States.Refer for additional information:

Maybe I should include the ping list??? :O/

| Effective Federal Tax Rates and Shares Under 2000 Tax Law, 2001 to 2014 Based on 2001 Incomes, by Income Category, http://www.cbo.gov/showdoc.cfm?index=5746&sequence=1&from=0#table3 extacted from Table 3:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Thanks for the post. It almost looks like the Individual Income Tax Rates do not include payroll withholdings.

Throw in Federal SS/Medicare payroll taxes, as represented in that total Federal tax rate, it is obvious everyone who works takes the hit.

Only in D.C. would they figure a great way to fund government is by taxing the he'll out of one's productive contribution to the nation's economy.

Yes, indeed - that's our "tax dollars at work"...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.