Skip to comments.

China's Prices Undercut U.S. Tire Makers, Causing Plant Closings

Newhouse News ^

| 8/8/2006

| Thomas W. Gerdel

Posted on 08/09/2006 8:54:06 AM PDT by Incorrigible

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 201-220, 221-240, 241-260 ... 341-346 next last

To: justshutupandtakeit

Great Britain's economy collapsed because of WWI not its Free Trade policies.Bartlett's revisionism.

In fact, it was under Free Trade that it came to dominate the world economy.

Only so long as there were no real peer competitors who played by the same rules. They soon didn't. Just like China isn't now, and never will, but will give free trade only lip-service.

Adam Smith showed the means by which Free Trade INCREASES the Wealth of Nations. You should read it sometime.

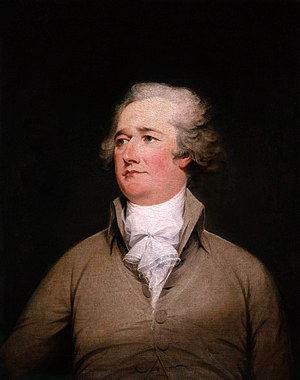

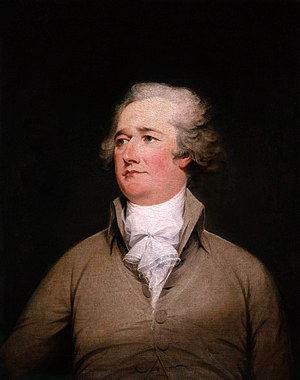

Probably read and digested it long before you. But it was never a definitive work for the U.S. Alexander Hamilton's Report on Manufactures was.

Even his enemies largely concede the economic edifice we have today is largely one that Hamilton and those who followed the resulting "American System" of Henry Clay and later of Lincoln and all Republicans can take credit for.

221

posted on

08/10/2006 9:52:24 AM PDT

by

Paul Ross

(We cannot be for lawful ordinances and for an alien conspiracy at one and the same moment.-Cicero)

To: justshutupandtakeit

The chart was REAL wages i.e. wages after inflation is factored OUT. Roooight. Using Xlinton's CPI.

222

posted on

08/10/2006 9:53:31 AM PDT

by

Paul Ross

(We cannot be for lawful ordinances and for an alien conspiracy at one and the same moment.-Cicero)

To: Toddsterpatriot

Sorry Paul, you aren't getting off this one so easily. Sorry Todd, you're projecting at delusional levels again. And here is the proof: It is curtains for your side. The evidence is in. You lose.

You already lost, from revisionist history by Bruce Bartlett, to failure to look at the history of Bananna Republics and Great Britain.

If you were an honest debater you would rethink your whole position vis-a-vis trade.

Projecting. You need to become an honest debater...then you would be the one to "rethink" your whole position vis-a-vis trade.

223

posted on

08/10/2006 9:56:43 AM PDT

by

Paul Ross

(We cannot be for lawful ordinances and for an alien conspiracy at one and the same moment.-Cicero)

To: Alberta's Child

Agricultural subsidies are rather small and often go towards preventing growing crops. So I would say that they RAISE the price more than they artificially lower it.

American agricultural efficiency and productivity are higher than those of anywhere else in the world Australia and Canada possibly excepted.

What nation produces crops at a lower price (or cost) than ours?

224

posted on

08/10/2006 9:58:08 AM PDT

by

justshutupandtakeit

(If you believe ANYTHING in the Treason Media you are a fool.)

To: Paul Ross

T'sk, t'sk, t'sk. So now you try to wriggle off the hook like a worm.

225

posted on

08/10/2006 10:02:53 AM PDT

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Paul Ross

The evidence is definitive that the decline wasn't caused by abandonment of free trade policies...but had already happened while the British were fully under the sway of free trade zealots who infested the bureaucracy.. Nice tap dance. Let's look at how badly that sway of free trade impacted the British economy before the protectionist zealots killed the economy. This is from historian Paul Kennedy (PhD from Oxford and author of The Rise and Fall of Great Powers).

"Between 1760 and 1830, the United Kingdom was responsible for around two-thirds of Europe’s industrial growth of output, and its share of world manufacturing production leaped from 1.9 to 9.5 percent; in the next thirty years, British industrial expansion pushed that figure to 19.9 percent, despite the spread of new technology to other countries in the West. Around 1860, which was probably when the country reached its zenith in relative terms, the United Kingdom produced 53 percent of the world’s iron and 50 percent of its coal and lignite, and consumed just under half of the raw cotton output of the globe. With 2 percent of the world’s population and 10 percent of Europe’s, the United Kingdom would seem to have had a capacity in modern industries equal to 40-45 percent of the world’s potential and 55-60 percent of that in Europe. . . . It alone was responsible for one-fifth of the world’s commerce, but for two-thirds of the trade in manufactured goods. Over one-third of the world’s merchant marine flew under the British flag, and that share was steadily increasing. It was no surprise that the mid-Victorians exulted at their unique state, being now . . . the trading center of the universe."

Yeah, all that free trade was just killing them before they became of bunch of ignorant protectionists. If Thatcher and her free market reforms hadn't saved them, they'd still be the basket case of Europe.

226

posted on

08/10/2006 10:12:23 AM PDT

by

Mase

To: Paul Ross

You clearly have no idea of how the bond market works. Treasury bonds are sold FOR dollars and redeemed IN dollars and the premiums are paid IN dollars. US government debt has been the safest in the world from the moment Hamilton reorganized it after the Constitution became operative.

It did not default or miss a payment during the Civil War, WWI, or WWII. Nothing as drastic as those times is on the horizon.

Actually we have already seen. However, those who believe that the Treasury has to worry about convertibility of its payments in foreign currency may never see.

227

posted on

08/10/2006 10:14:56 AM PDT

by

justshutupandtakeit

(If you believe ANYTHING in the Treason Media you are a fool.)

To: Paul Ross

History demonstrates that Free Trade was England's strength and it was the abandonment of it which helped cause a decline. Though it was more a case of the relative economic power of the US and Germany growing rather than a collapse of England.

China cannot indefinitely keep the Yuan low or its wages low when the economy is booming. It has no power to repeal the laws of economics. And supply and demand will eventually change the relation in effect currently.

Japan is instructive in this regard. For years it was the world's leading producer of electronics because of price advantages. No longer now those products have been shifted to other lower price producers because the Japanese wage rates and costs have risen enough to remove the profit of making them in Japan. China will see the same result in the years to come.

Alexander Hamilton's system was NOT protectionist. It was a REVENUE tariff with rates averaging about 15%. He intended to encourage domestic manufacturing through a system of bounties, prizes and subsidies NOT a protective tariff.

In fact, when the Congress became overtly protectionist and enacted the Tariff of Abominations it provoked the South into a near secession.

Trying to tie Hamilton to your lame theories is revolting. He would have preferred Free Trade as his economic writings illustrate but for the need to 1) correct the distortions imposed upon the American economy by the Colonial policy of England and 2) the lack of a viable alternative for Federal revenues.

I would bet that you reject the other principal pillar of his financial system, the National Bank.

228

posted on

08/10/2006 10:29:30 AM PDT

by

justshutupandtakeit

(If you believe ANYTHING in the Treason Media you are a fool.)

To: Paul Ross

So use nominal wages instead if it makes you happy but it will show the same thing. BTW the Bureau of Labor Statistics does not cook the books to please the Administration any way. But nice try at a dodge.

229

posted on

08/10/2006 10:31:17 AM PDT

by

justshutupandtakeit

(If you believe ANYTHING in the Treason Media you are a fool.)

To: Mase

I just finished reading that book. Interesting and informative but too pointed at showing a US decline being published in the mid-80s Johnson likely wanted to use it to knock Reagan.

230

posted on

08/10/2006 10:33:35 AM PDT

by

justshutupandtakeit

(If you believe ANYTHING in the Treason Media you are a fool.)

To: Paul Ross

My, my, my, you are flummoxed. Where is your proof for that hand-waving assertion?

231

posted on

08/10/2006 10:33:36 AM PDT

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: justshutupandtakeit

Agricultural subsidies are rather small and often go towards preventing growing crops. The 2002 Federal Farm Bill was a $190 billion farm program. That's not small by any measure.

An accurate measure of U.S. farm subsidies would also have to include all Federal regulations that artificially raise the demand for an agricultural product. The Federal clean air requirements for the use of ethanol in motor fuel is a good example of this.

What nation produces crops at a lower price (or cost) than ours?

It depends on the crop. I think you've taken American efficiencies in grain production and assumed that this applies across the board. Argentina and Brazil both serve as major suppliers of various agricultural products to the U.S. (beef, citrus crops, sugar, etc.), so their production costs must be somewhat lower than ours for those products (since the cost of transporting across a long distance must be offset somehow).

232

posted on

08/10/2006 10:54:39 AM PDT

by

Alberta's Child

(Can money pay for all the days I lived awake but half asleep?)

To: Alberta's Child

Don't just focus on the government-expenditure side of the Farm Act. If you include the net increase in ag-product prices passed along to the consumer, then the cost of our subsidy program is astronomical.

To: justshutupandtakeit

BTW the Bureau of Labor Statistics does not cook the books to please the Administration any way.They already did. Remember Bill Clinton? He introduced a raft of changes to the CPI to "fix" the "overstating" of inflation...here is a short discussion of the problems...which Bush was asked to undo...but he refused:

Hedonic adjustments and geometric weighting are the most obvious distortions in the cpi calculations. for example, health care, notable for major price increases in recent years, is 14% of gnp but only 7% of cpi. computers are ever cheaper, but quality [i.e. computational capacity] grows so that each computer is treated as if it should cost much, much more, so computer technology changes drive down the cpi. if the price of steak goes up, it is assumed you substitute chicken. and if the price of that goes up, I suppose you can go to dogfood.

There is a service, at the website below, that calculates cpi on the historic, pre-Clinton administration basis.

www.shadowstats.com

or

http://www.gillespieresearch.com/cgi-bin/bgn/ Here's a summary:

Walter J. (John) Williams, has a B.A. in Economics and an M.B.A., both from Dartmouth. He serves as an economic consultant, both to private individuals and Fortune 500 companies. What Williams does (and few others bother to do) is read the fine print. The government "is very honest in terms of disclosing what it does. It always footnotes the changes and provides all the fine details." It is in those details--no surprise--that the devil lies.

"What has happened over time," Williams says, "is that the methodologies employed to create the widely followed series, such as ... the GDP, the CPI, the employment numbers, all have had biases built into them that result in overstating economic growth and understating inflation."

"Real unemployment right now--figured the way that the average person thinks of unemployment, meaning figured the way it was estimated back during the Great Depression--is running about 12%. Real CPI right now is running at about 8%. And the real GDP is probably in contraction. I venture that if you talked about those numbers now with the average person, they would say that they seem reasonable ... my work shows that the economic perceptions of non-professionals actually have some real validity; there are in fact reasons for the disconnect between official statistics and what the populace is feeling."

According to Williams, government realized as long ago as the Kennedy administration that Americans would rather hear good news even if it's false, and so the manipulation of data began. Unemployment was easy. First they created the "discouraged worker" category (those who've given up on finding a job) and counted them separately. Then, under Clinton, they quit counting them at all. Upwards of five million out-of-work people were suddenly no longer "unemployed."

Consumer Price Index? Since Jimmy Carter, every administration has messed with it. In order to make it look decent, Alan Greenspan and Michael Boskin, former head of the Council of Economic Advisors, came up with the "substitution" concept. Williams: "The whole purpose of the CPI [was] to measure the change in the cost of a fixed basket of goods over time ... What Boskin and Greenspan argued was, 'We should allow for substitution because people can buy hamburger instead of steak when steak goes up.' The problem is that if you allow substitutions, you aren't measuring a constant standard of living. You're measuring the cost of survival."

Who gets squeezed by this? Fixed-income people. "The difference that it makes is significant: if the same CPI were used today as [under Carter], Social Security checks would be 70% higher."

An adjunct to substitution is "weighting," adopted under Clinton, whereby the Bureau of Labor Statistics changed from a straightforward arithmetic to a reality-challenged geometric method, a move Williams calls "a pure mathematical game." The gist of the change is this: now, if something goes up in price, it gets a lower weighting in the CPI, and vice versa. Voilà. Down comes inflation.

There's also hedonics. Simply summarized, this means that if a product is "improved," then it is deemed to have come down in price, even if you're paying more for it.

Gross Domestic Product? "If you adjust the real GDP numbers that the government releases for the myriad revisions and redefinitions that have been applied to the measure with increasing frequency since the mid-1980s, you find that there's a happy overstatement of growth of about 3% on a year-over-year basis ... it's important to realize that if inflation is understated, then reported 'real' growth will be overstated."

Yet "manipulations of the CPI ... pale next to the impact of imputations in the GDP." Talk about insidious. To the government, "[any] benefit a person receives has an imputed income component." Thus, for example, if you're a homeowner, forget that backbreaking monthly mortgage payment, you're considered to be paying yourself rental income on your home! No kidding. It's called "imputed interest income," and it's the fastest-growing segment of citizens' personal income.

Not only does this phantom cash jack up GDP, it also inflates average household income, which is actually dropping. This we can all see in the explosion of personal debt because, as Williams says, "without growth in income you just can't support growth in personal consumption on a healthy basis, so you do it on an unhealthy basis. You borrow money."

Just like the government.

And while the amount the government admits it is borrowing may look horrifying enough, the reality is far, far worse. What follows is not for the faint of heart.

Williams says that the feds take a stab at reporting their accounts according to "generally accepted accounting principles," or GAAP. Although the numbers include "all sorts of disclaimers," and exclude Social Security, Medicare, Medicaid and similar accounts, "They at least do put out a financial statement. It's the best they can come up with."

However, "The budget deficit numbers you hear announced at White House press conferences are from accounts kept on a cash basis, with no accruals made for monies owed by or due to the government in the future."

What's the difference? A lot. In 2004, the deficit was reported at $412 billion. The official GAAP-based number published by the Treasury Dept. was $616 billion. Add in the net present value of the underfunding of Social Security and Medicare, and what you get is $3.4 trillion. Yes, trillion. And that's if you ignore a one-time spike from the setting up of the new, utterly unfunded Medicare drug benefit.

The true GAAP-based deficit has been holding steady in that range. $3.7 trillion in 2003, $3.4 in 2004, $3.5 in 2005.

"[T]otal federal obligations at the end of September were $51 trillion," says Williams, "over four times the level of GDP. It is unprecedented for a major country to have its actual obligations so far out of whack."

Williams's conclusions about what comes next are grim. "The Fed will back the system with every dollar it can print. But of course that would go on top of what is already an uncontrolled federal deficit. The end result, when it does all come together, will be something akin to a hyperinflation, but at the same time you'll have also a very depressed economy. So there'll be an inflationary recession, which I think we're already beginning to get into."

Despite his dire research findings, "I am an optimist at heart," Williams admits, "If you're able to somehow protect your assets and liquidity through the very rough times ahead, you're going to have some of the greatest investment opportunities that anyone has ever seen."

You should know that it isn't just Williams saying this. Note that Robert Novak also reported that Commerce and BEA were engaged in statistical skullduggery:

Clinton/Gore Cooked the Books

Robert Novak's column from 2002 proved, using the Commerce Department's revised numbers, that the economic books of the country were cooked in 1999 and 2000. Clinton-Gore lied about how much profit the government took in by almost one third so they could help Gore hold the White House. The Washington Times reports that Clinton-Gore claimed the economic growth rate on Election Day 2000 was 4.4%, but revised (read: truthful) numbers show it to have been less than 2.7% - and it fell to an abysmal 1.1% during the fourth quarter – when the Democrats were screaming at Bush for talking about an economic slowdown.

A 1.1% growth rate around Election Day 2000 is key, because in the first three-quarters of 1992 it averaged 3.6%and rose to 5.4% during the fourth quarter that year. You'll remember how the Clinton-Gore team bashed the Bush 41 economic record without us reminding you. The revisions to the supposedly record levels of corporate profits for 2000 are even more shocking. We now know pre-tax profits for non-financial domestic industries peaked in 1997.

Now, there's no paper trail proving that Clinton-Gore guided this deception, but no one at the Commerce Department would do this on their own - and we think we know who might have. While Donna Brazile was in fact Gore's campaign chair of the failed Algore 2000 campaign, the "honorary chairman" was Bill "Bugsy" Daley, Clinton-Gore's Commerce Secretary! There's a reason you put a vote-stealing, win-at-any-cost man without scruples at the head of a cabinet department. So Gore had to know what was going on.

These numbers will keep being revised to subtract Enron, WorldCom, Tyco, Adelphia, Global Crossing, etc., because those companies inflated profits in the last two years of Clinton-Gore. Now, if you tell the IRS you underestimate your income by 30%, and therefore you underpaid your taxes by 30%, you can't get away with saying, "Whoops." We shouldn't have ever let Clinton-Gore crowd off the hook so easily either. They lied and overstated all their economic numbers. There was no real Clinton boom, and whether they knew about the inflated numbers then or not, they know now, so it's time to stop perpetuating the lie.

Unfortunately, that doesn't seem to be in the cards with the current crowd of RINOs.

234

posted on

08/10/2006 11:02:38 AM PDT

by

Paul Ross

(We cannot be for lawful ordinances and for an alien conspiracy at one and the same moment.-Cicero)

To: justshutupandtakeit; Toddsterpatriot; Paul Ross; expat_panama

Help me out here with my figures: the graph I posted in my #170 shows an approx. 9% increase in real wages from 1994-2004. Is this correct?

Now, help me again: if inflation is being understated to the degree Paul Ross suggests (let's say everybody out there is simply treading water), then that 9% should be added to our average 10 year inflation rate. So let's say the "true" inflation rate is 9% + 3.5% = 12.5% (is 3.5% the proper figure? help me).

Wouldn't that mean that consumer prices have more than doubled during this ten year period (as everyone's treading water), and no one but Paul Ross has noticed?

DISCLAIMER: The views contained in the above comment do not represent a working familiarity with mathematics.

To: Mase; nopardons

I forgot to ask your help in my #235.

To: 1rudeboy

Help me out here with my figures: the graph I posted in my #170 shows an approx. 9% increase in real wages from 1994-2004. Is this correct? Yes.

Now, help me again: if inflation is being understated to the degree Paul Ross suggests (let's say everybody out there is simply treading water), then that 9% should be added to our average 10 year inflation rate.

9% would be added to the total inflation rate. 3.5% over 10 years is 41%. Add 9% to get 50%, or 4.14% a year.

237

posted on

08/10/2006 11:29:29 AM PDT

by

Toddsterpatriot

(Why are protectionists so bad at math?)

To: Toddsterpatriot

So what is the "true" inflation rate, if that 9% real increase over ten years is evaporated to the point we're breaking even? Anybody know if the 3.5% figure I used is accurate?

To: Mase

Yeah, all that free trade was just killing them before they became of bunch of ignorant protectionists. If Thatcher and her free market reforms hadn't saved them, they'd still be the basket case of Europe.It was a philosophy that was deployed after they had attained those heights. And then they drank their own poison too much...they believed it. Ha Joon Chang, (PhD and Professor Economics from Cambridge University, UK and author of Kicking Away the Ladder: Policies and Institutions for Economic Development in Historical Perspective Chang pops your balloon of revisionist history, when he observed:

Almost all of today’s rich countries used tariff protection and subsidies to develop their industries. Interestingly, Britain and the USA, the two countries that are supposed to have reached the summit of the world economy through their free-market, free-trade policy, are actually the ones that had most aggressively used protection and subsidies. Contrary to the popular myth, Britain had been an aggressive user, and in certain areas a pioneer, of activist policies intended to promote its industries. Such policies, although limited in scope, date back from the 14th century (Edward III) and the 15th century (Henry VII) in relation to woollen manufacturing, the leading industry of the time. England then was an exporter of raw wool to the Low Countries, and Henry VII for example tried to change this by taxing raw wool exports and poaching skilled workers from the Low Countries.

Particularly between the trade policy reform of its first Prime Minister Robert Walpole in 1721 and its adoption of free trade around 1860, Britain used very dirigiste trade and industrial policies, involving measures very similar to what countries like Japan and Korea later used in order to develop their industries. During this period, it protected its industries a lot more heavily than did France, the supposed dirigiste counterpoint to its free-trade, free-market system. Given this history, argued Friedrich List, the leading German economist of the mid-19th century, Britain preaching free trade to less advanced countries like Germany and the USA was like someone trying to “kick away the ladder” with which he had climbed to the top.

List was not alone in seeing the matter in this light. Many American thinkers shared this view. Indeed, it was American thinkers like Alexander Hamilton, the first Treasury Secretary of the USA, and ...economist Daniel Raymond, who first systematically developed the infant industry argument.

Did you get that?

Great Britain didn't even adopt the doctrine of Free Trade until 1860. Your blather from Paul Kennedy admits...that 1860 was their comparative industrial economic height:

Around 1860, which was probably when the country reached its zenith in relative terms, the United Kingdom produced 53 percent of the world’s iron and 50 percent of its coal and lignite, and consumed just under half of the raw cotton output of the globe...

You have been busted by REALITY. This revisionist posture you concocted...by taking the half-truths and misreading Kennedy... notwithstanding, this argument goes decisively towards the conservative position...

As for Thatcher, she beat inflation, stopped the confiscatory punishing income and savings and investment, and focussed taxation instead on consumption, and restored internal market freedoms, fighting the impediments of overly stultifying trade unions, and campaigned for less state interference which was preventing entrepreneurial activity. That is what really was their salvation.

She was right. Real conservatives usually are.

239

posted on

08/10/2006 11:43:14 AM PDT

by

Paul Ross

(We cannot be for lawful ordinances and for an alien conspiracy at one and the same moment.-Cicero)

To: 1rudeboy

According to this

CPI calculator , $1274.63 in 2004 was worth $1000 in 1994. Looks like 2.46% annually. Adding 9% would bring it up to 3.16% annually.

240

posted on

08/10/2006 11:43:31 AM PDT

by

Toddsterpatriot

(Why are protectionists so bad at math?)

Navigation: use the links below to view more comments.

first previous 1-20 ... 201-220, 221-240, 241-260 ... 341-346 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson