"No so fast... we are gonna have to take this economy away from you for the common good!"

Posted on 05/25/2006 5:50:54 AM PDT by Brilliant

WASHINGTON (AP) -- Emerging from a year-end rut, the economy dashed ahead in the opening quarter of this year at a 5.3 percent pace, the fastest in 2 1/2 years. The new snapshot showed gross domestic product was even stronger during the January-to-March period than the 4.8 percent annual rate first estimated a month ago, the Commerce Department reported Thursday.

Gross domestic product measures the value of all goods and services produced within the United States and is considered the best barometer of the country's economic fitness.

The upgraded reading on GDP, based on more complete information, mostly reflected stronger U.S. exports and better inventory building by businesses.

Economists, however, were predicting an even bigger upgrade to the first-quarter reading. Before the release of the report they were forecasting economic growth to clock in at a 5.8 percent pace. Even though the revised figure fell short of that, it nonetheless made clear that the economy had snapped out of its end-of-year lull.

In the final quarter of 2005, the economy grew at a feeble 1.7 percent pace. Fallout from the Gulf Coast hurricanes, including high energy prices, prompted people and companies to tighten their belts.

Consumers and businesses regained their appetite for spending and investing in the first quarter, a major factor underpinning the brisk pace of growth logged for the overall economy.

Their appetite, though, was a tad less hearty than initially estimated.

Consumers boosted their spending in the first quarter at a 5.2 percent pace. That was the strongest since the third quarter of 2003, but was slightly less than the 5.5 percent pace first estimated.

With spending outpacing income growth, the personal savings rate -- savings as a percentage of after-tax income -- dropped to negative 1.3 percent in the first quarter, the worst showing since the third quarter of 2005.

Business spending on equipment and software, meanwhile, zoomed ahead at a 13.8 percent pace in the first quarter. That was the best showing since the third quarter of 2004, but wasn't as robust as the 16.4 percent growth rate for such spending initially estimated a month ago.

The report also showed that companies continued to fatten their profits.

One measure of after-tax profits in the GDP report showed profits increased by 8.8 percent in the first quarter, following a 13.8 percent rise in the prior period.

Economists predict economic growth in the April-to-June quarter probably slowed to a pace of around 3 percent to 3.5 percent, which would still be a healthy performance. One of the things the Federal Reserve will be keeping close tabs on is the extent to which a less energetic housing market crimps consumer spending and thus weighs on overall economic activity.

Another thing policy-makers will be monitoring is whether high energy prices feed into the costs of other goods and services and spread inflation throughout the economy.

An inflation gauge closely watched by the Fed showed that core prices -- excluding food and energy -- rose 2 percent in the first quarter. That was unchanged from an initial estimate and actually marked a moderation from a 2.4 percent rise in the fourth quarter.

The inflation reading, however, was taken before oil prices shot up to a record high of $75.17 a barrel in late April. Oil prices are now hovering above $69 a barrel.

Energy prices are a wild card for the economy.

Rising energy prices drive up inflation. Or, they can hobble economic activity by forcing consumers and businesses to cut back spending on other things. Or, high prices can result in both scenarios, which would be doubly bad for the economy.

To fend off inflation, the Federal Reserve on May 10 boosted interest rates for the 16th time in two years. Some economists believe another rate increase is in store when the Fed meets next, June 28-29. Others, however, think the Fed will take a pause in its rate-raising campaign.

Fed Chairman Ben Bernanke told Congress on Tuesday that he and his colleagues will be relying heavily on what incoming data says about inflation and economic activity to shape its rate decision.

Even though economic activity is solid, high energy prices and worries about the direction of the housing market have weighed on consumers' confidence in the economy.

President Bush's standing with the public also has sunk. Bush's job-approval rating stood at 33 percent in early May, the lowest in AP-Ipsos polling.

The "Lou" fans around here are single issue people who like the way he talks on the border.

Don't count on them being fans of the whole 'package'

5.3% growth is not inflationary it's in the healthy ranges of growth. If and when we hit 6% or higher in the next few consecutive quarters then I would worry about over heating of the economy. Fed interest rate hikes have been keeping inflation in check and has been cooling the economy slightly as well.

Five years ago, anyone predicting that the U.S. economy could achieve a GDP in excess of 5% with oil prices around $69/bbl would have been branded delusional and ignored. The strength of the U.S. economy is astounding considering current energy prices and the geopolitical shocks it has weathered.

I guess that means in the 90s, Clintoon did what it took to make the economy grow. Or weren't folks back then saying the president doesn't affect the economy that much?

At least they waited until the fourth paragraph to toss in the "however."

B, I generally like your posts, but once I again I feel compelled to address the question of illegal immigration & the economy.

GDP growth is a function of productivity growth and real population growth. If we let in 10m workers (legal or otherwise), and all are employed, then yes, the economy will grow by a comensurate amount.

That's why proponents of illegal immigration say it's 'good' for the economy. To a certain extent that is true as is evidenced by lower inflation (primary a function of wage competition), GDP growth & unemployment (illegals create demand for goods & services that effect the overall economy).

However, and this is BIG however, these are all nominal P&L accounts; that is, they only measure the effect today, not the accrued liabilities that are being pushed into the future. It's the balance sheet accruals that are the 'under the waterline' costs. These are of course what are being incurred by the various levels of government.

So, in a nutshell, businesses profit from the short-term nominal effect, while governments (taxpayers) suffer from the long term effects. One more point - since there's more demand for gov't provided services by low-skill workers, government also grows. This, of course, is a boon to Dem politicians and union leaders.

Combine the short-term advantages and long-term costs, and who benefits? That's who supports illegal immigration.

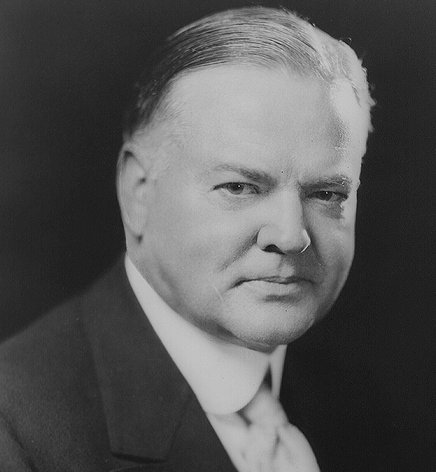

HOOVER !~

Clinton's economy was sluggish in the early 90s and had high interest rates. It wasn't until people started throwing capital down a black hole (dot com) that the economy got a lift from a very dangerous and false bubble which broke 10 months before he left office.

Bush's economy is based on solid growth across all industries, i.e. healthy.

See my #27.

Plus there was a y2k scare..

.

There are a lot of factors that have fueled this economy, immigration being one. But then there is also the tax cut and the war.

And there is also the fact that Bush has so far resisted the Dem's demands for oil industry regulation and protectionism, and has been slow to increase the minimum wage and socialize the health care industry.

Their bias is never ending.

You could not in all honesty call the stock market bubble a good economy. It was based on media lies and gross manipulation by Rubin and his ilk.

I think most economists would agree that one of the biggest drivers has been illegal immigration. They drive up demand for goods & services (especially housing) and suppress inflation (wages & interest).

The history of economic growth of the US is a combination of tech advances (real productivity growth) and population growth. Right now, we're in brute force mode. If there's another med/bio/hi-tech leap, then we'll be on fire.

REAL STATS versus FAKE POLLS - YOU DECIDE

I don't think that Clinton really proved that tax cuts don't matter. His economy was fueled by record low oil prices. When you've got $14 a barrel oil, you can absorb a lot of other bad news.

Not to mention defense cutbacks. I guess the bottom line is that outside very broad macro components, such as a functioning legal system that protects private property, capitalism is left up to the market. Since innovative people don't like sitting around, they are left to creating new gadgets, entertainments, etc. Demand by others creates money supply growth, and viola, we're off to the races...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.