Skip to comments.

Top 11 Secrets of a National Retail Sales Tax

Various

| 6-10-05

| Always Right

Posted on 06/10/2005 11:13:37 AM PDT by Always Right

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 581-600, 601-620, 621-640 ... 1,241-1,246 next last

To: AzaleaCity5691

You simply ignore all the empirical data on consumption being more stable than income throughout history. Odd tactic.

To: FreedomCalls

Is THAT what the states do now with income/withholding taxes??

If so perhaps what you envision is reasonable; otherwise (and I've heard of no such instances of that happening) what you project is nonsense. Why would they suddenly start??

602

posted on

06/11/2005 6:52:33 PM PDT

by

pigdog

To: UnbelievingScumOnTheOtherSide; Blood of Tyrants

First, it's an N

RST. THere's a big difference. Second, the drug dealer will pay more of his taxes under the nrst.

Today, the drug dealer only pays a portion of his tax burden, the part embedded in prices (he pays none of his income tax nor any of his FICA.) But under the nrst, ones full tax burden is paid thru purchases for retail consumption...the drug dealer begins paying his full burden via consumption. Under the income tax, the dealer only pays a portion of his taxes, under the nrst the dealer pays all his taxes. Hence the drug dealer pays more tax under the nrst.

To: Principled

leprocy is hughly series -- nearly as bad as leprosy

To: expatpat

To: Principled

This analogy is hyperbole. First of all, we don't have terminal illness with the IT - more like toothache. If the possible side effects are that his gonads may fall off, he's right to turn down the sanke-oil medecine.

To: expatpat

To: expatpat

....and snake. I guess I'll have to type slower -- or use the spell checker.

To: Principled

But under the nrst, ones full tax burden is paid thru purchases for retail consumption...the drug dealer begins paying his full burden via consumption. Which is total crap, unless he remits sales tax on his gross receipts which he will not. Unless the sales tax captures this part of the economy the arguement is false.

To: AzaleaCity5691

Please go read #580 (again). I responded to your credit card question.

I've also asked you to read the bill which you have obviously not done - nor the extensive economic information of the FairTax website. Please do read those before continuing.

610

posted on

06/11/2005 7:27:58 PM PDT

by

pigdog

To: Always Right

That's not what ws said, Rongie. It was "... thru purchases for retail consumption ...".

Nothing was said about his illegal income. You SQL guys are always trying to dredge up illegal income to say "... see, see. it doesn't capture his illegal income ...". No one (EXCEPT YOUSE GUYS) ever said it did. Illegal income by definition isn't taxed directly under any tax system. In fact, that's why they call it illegal income.

The FairTax does capture tax revenue from the illegal income when it is spent for retail consumption on taxable items.

611

posted on

06/11/2005 7:35:28 PM PDT

by

pigdog

To: Principled; Fido969

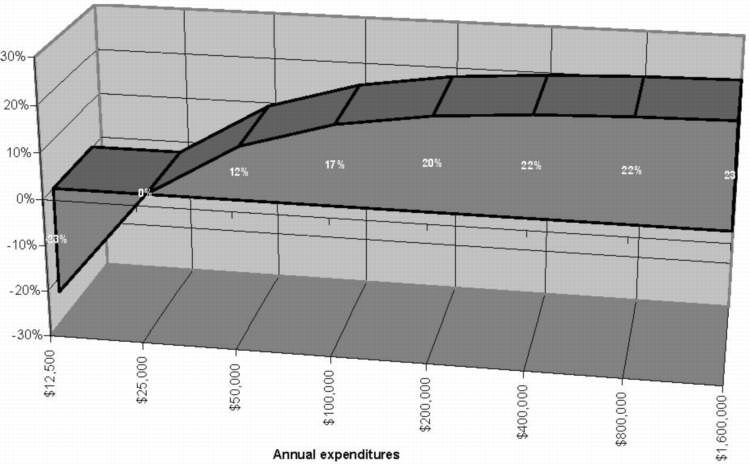

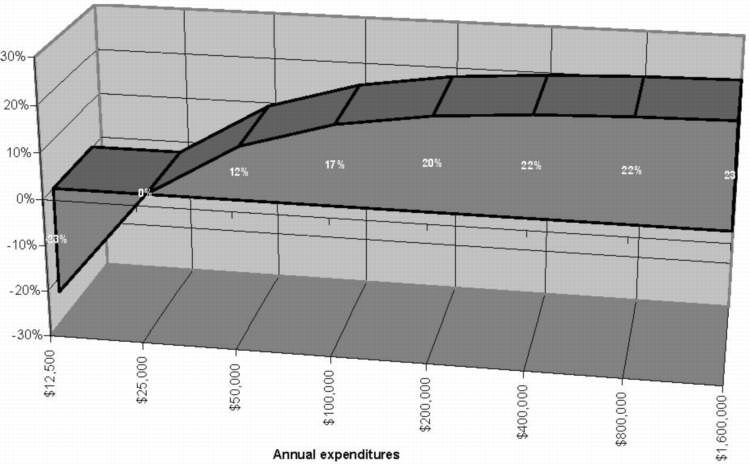

You could give to charity and pay less tax... maybe ancient_geezer would post a graph illustrating effective rates by $ spent...?

Ohhh, I suppose that might be possible ;O)

Refer FairTax FAQ #45:

Figure 5: Annual expenditures vs. FairTax effective tax rates, for a family of four

612

posted on

06/11/2005 7:40:11 PM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Principled

That is what I have been trying to get across to "Always Right". Plus, I do believe that the drug dealer, having no legal job, would not get a monthly rebate check, either.

613

posted on

06/11/2005 7:45:37 PM PDT

by

Blood of Tyrants

(G-d is not a Republican. But Satan is definitely a Democrat.)

To: Principled; ancient_geezer; Always Right; All

Today, the drug dealer only pays a portion of his tax burden, the part embedded in prices (he pays none of his income tax nor any of his FICA.) Which brings up a point. I haven't been following this thread to any great degree so if you guys have addressed this earlier, my apologies. Under the NRST, how do we determine SS benefits? Currently, the benefits accrue based on money paid in from earned income. A drug dealer who reports no earned income has accumulated no SS benefits. Under a NRST he/she will be entitled. How will it be determined?

614

posted on

06/11/2005 7:45:44 PM PDT

by

groanup

(our children sleep soundly, thank-you armed forces)

To: justshutupandtakeit

Not true, jsuati!! The 23% tax inclusive will be on every receipt you get for a purchase under the FairTax.

It is clearly spelled out as tax inclusive along with the price of the thing itself and the amont of the tax as well as the tax-inclusive rate.

615

posted on

06/11/2005 7:58:03 PM PDT

by

pigdog

To: groanup

Under the NRST, how do we determine SS benefits?

By reporting wage income to the Social Security Administration, as is required under the Title II of the Social Security Act.

Currently, the benefits accrue based on money paid in from earned income.

Strictly speaking they don't, they accrue on the basis of reporting of wages only, not by taxes paid.

The tax that is collected actually is paid into general revenues, from which is made an annual appropriation for Social Security Accounting under 42 USC 401 on the basis of total reported wagebase.

Specifically benefits are based on reported wages for the individual however.

A drug dealer who reports no earned income has accumulated no SS benefits.

Under a NRST he/she will be entitled.

Only if they have an SSN & report wages or "self-employment?" earnings to the Social Security Administration.

Wage earnings are reported to SSA by employers, or by self-employment reports to the SSA for benefits purposes.

H.R.25

Fair Tax Act of 2005 (Introduced in House)

http://thomas.loc.gov/cgi-bin/query/z?c109:H.R.25:

`CHAPTER 9--ADDITIONAL MATTERS `SEC. 903. WAGES TO BE REPORTED TO SOCIAL SECURITY ADMINISTRATION.

`(a) In General- Employers shall submit such information to the Social Security Administration as is required by the Social Security Administration to calculate Social Security benefits under title II of the Social Security Act, including wages paid, in a form prescribed by the Secretary. A copy of the employer submission to the Social Security Administration relating to each employee shall be provided to each employee by the employer. `(b) Wages- For purposes of this section, the term `wages' means all cash remuneration for employment (including tips to an employee by third parties provided that the employer or employee maintains records documenting such tips) including self-employment income; except that such term shall not include--

`(1) any insurance benefits received (including death benefits); `(2) pension or annuity benefits received; `(3) tips received by an employee over $5,000 per year; and `(4) benefits received under a government entitlement program (including Social Security benefits and unemployment compensation benefits).

`(c) Self-Employment Income- For purposes of subsection (b), the term `self-employment income' means gross payments received for taxable property or services minus the sum of--

`(1) gross payments made for taxable property or services (without regard to whether tax was paid pursuant to section 101 on such taxable property or services), and `(2) wages paid by the self-employed person to employees of the self-employed person.

|

616

posted on

06/11/2005 8:05:10 PM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Your Nightmare

It's not a wash at all. Many drug purchases are made with stolen money, not earned income and so your argument fails.

In fact, you have no basis for the statement at all since it is just as likely as not that the John & drug buyer paid little or no in the way of income taxes. That asumption is equally as valid as to the flight of fancy you came up with.

Under that assumption none of the 4 paid much or any income taxes so the government got nothing whereas with the FairTax they will derive much more tax revenue. There is no "wash".

617

posted on

06/11/2005 8:06:21 PM PDT

by

pigdog

To: Blood of Tyrants

Plus, I do believe that the drug dealer, having no legal job, would not get a monthly rebate check, either.

Actually he could qualify for a monthly rebate check if he has a SSN and is willing to provide an address to government send the check to. At a $180/month I suspect most will forgo the benefit of giving government an address for something that will be taken away from them if found guilty of a crime and incarcerated. Folks in jail don't collect it.

618

posted on

06/11/2005 8:17:20 PM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Always Right

"This utopia promised by the Sales Tax faithful is no different than the disasters promised by the fear-mongering global warmers. It's all based on unrealistic assumptions and faulty computer modeling rigged to produce the desired result." It's called the 'foot in the door.'

Just like the "introductory rate" of a variable interest mortgage, which is usually at least a full point below the rate that would be generated by the formula in the contract. A national sales tax would be a disaster for our economy, and a huge reduction in our personal freedom.

.

619

posted on

06/11/2005 8:32:06 PM PDT

by

editor-surveyor

(The Lord has given us President Bush; let's now turn this nation back to him)

To: ancient_geezer

620

posted on

06/11/2005 9:00:49 PM PDT

by

groanup

(our children sleep soundly, thank-you armed forces)

Navigation: use the links below to view more comments.

first previous 1-20 ... 581-600, 601-620, 621-640 ... 1,241-1,246 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson