Posted on 05/03/2005 12:39:32 PM PDT by Reaganghost

A Million Bucks; and

What Do I Have to Show For It?

I have meticulously tracked my finances in Quicken ever since I got my first computer in 1995. A few days ago, I shared my recent telephone bill experience with the members of FreeRepublic. This article provides a more in depth review of taxes circa the United States, 1995- 2004.

The table below summarizes my experience, but a few explanations are helpful. As a retiree for the entire period, I have not had any debt for more than twenty years, so debt service is not part of this experience. I track all of our spending as taxes, consumption or investment. Years in which our consumption deviates significantly from the mean usually reflect the years in which we purchased cars. My average property taxes run in the neighborhood of 15-20000 per year. On the advice of our CPA, I lumped the property tax payments into a single year so that one year I can itemize and the next year I take the standard deduction. Our 2002 taxes reflect an extraordinary capital gain that was to be married to an extraordinary capital loss, but it turned out that I did not qualify to take the loss at that time. Here is the table:

| Year | Consumption | Taxes |

| 1995 | 28696 | 34938 |

| 1996 | 32261 | 44082 |

| 1997 | 31010 | 25686 |

| 1998 | 27987 | 47914 |

| 1999 | 39002 | 23521 |

| 2000 | 26437 | 47550 |

| 2001 | 24514 | 24156 |

| 2002 | 45737 | 81352 |

| 2003 | 21423 | 35297 |

| 2004 | 24773 | 58475 |

| Totals | 301839 | 422971 |

| Average | 30184 | 42297 |

All of the data is rounded to the nearest dollar. The totals for the chart do not total the million bucks that was advertised, but trust me, the totals in my quicken report for consumption versus taxes totals more than a million. I limited the chart data to the past ten years to make the math simple and the relative percentages do not differ materially.

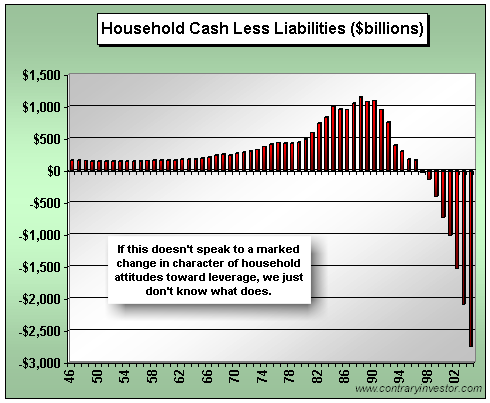

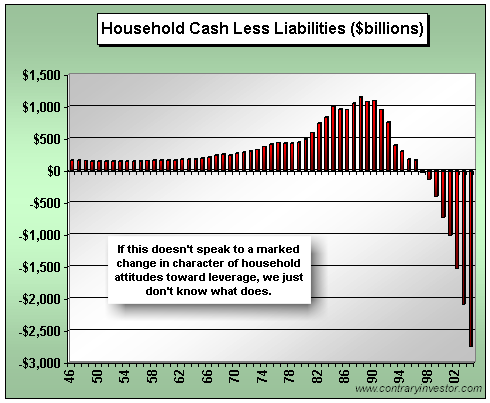

Over the past ten years, governments have taxed me 140% of my average annual consumption. Precisely who are the beneficiaries of the fruits of my productivity, my family or the politicians that use the tax dollars to buy the votes of voters who live at the expense of others? I admit to being rich when measured by commonly used parameters. If you think this is just my problem, here is a terrifying graphic that reflects the experience of all Americans:

Click here to do something about it. Read more about the Reagan Renaissance to find out how you can play an instrumental role in restoring our Constitutional freedoms. President Reagan said, "You and I have a rendezvous with destiny. We will preserve for our children this, the last best hope of man on earth, or we will sentence them to take the last step into a thousand years of darkness." Socialism sent the Soviet Union to the Ash-heap of History where it belongs. The Reagan Renaissance can prevent the United States from suffering the same fate. The collapse of Rome plunged the world into the Dark Ages. Do you remember the old adage about "nothing new under the sun since the Greeks?" Plutarch warned, "The real destroyer of the liberties of the people is he who spreads among them bounties, donations and benefits." The same factors that led to the downfall of Rome are the same ones that led to the fall of the Soviet Union and are now threatening the United States. How about it Freepers, can the "Information Age" prevent us from repeating the mistakes of the past?

booked

This is why MANY politicians do NOT want a flat tax. The ability to control all aspects of our lives rest in the tax code. It is evil above all and our number one problem. If people actually had one number that they could see in the payment of all their taxes they would first vomit, second they would revolt.

We are being held as slaves to a system that serves few on the backs of many and the elected are happy with it.

This is why MANY politicians do NOT want a flat tax. The ability to control all aspects of our lives rest in the tax code. It is evil above all and our number one problem. If people actually had one number that they could see in the payment of all their taxes they would first vomit, second they would revolt.

We are being held as slaves to a system that serves few on the backs of many and the elected are happy with it.

Interesting.

Sorry for the double post. But every Freeper has a stake in this. Ping them and give them a chance to decide for themselves.

What does he have to show for it? Well, he has a pretty good armed services, roads that he can drive on, a food supply that is safe, police/fire departments, air traffic controllers, a stable business environment in which to invest his money, a more or less well-managed economy, and a host of other services that he no doubt uses but feels are somehow lavished on him for free.

One of the most egregious and pathetic examples is the insistence the Social Security is in some bizarre way a 'Successful' program. Successful in what way? I never see any backup to these blind pronouncements. Medicare/Medicaid are other examples of Gov'ts zeal to control no matter the financial and social costs - As long as the control is maintained. IMO They will eventually swamp Social Security as examples of Gov't waste and corruption and in the not-too-distant future.

I could go on and om with examples but your illustration says it all - As a larger proportion of GDP falls under the purview of the Pols the amount of true freedom available to both payers and recipients decreases in direct relationship. Unfortunately, there appear to be too many individuals and entities who are self dealing the system to their own advantage and it is they who have the power. Therefore I don't see a reversal of this trend and in fact see just the opposite.

You pay $20,000 per year in property taxes? God Bless America!

What part of Illinois are you in? This is the time to rebuild the party on top of the the Edgar/Ryan/Baar-Tapinka ruins. E-mail me if you like.

Just curious what you are paying taxes on. You are retired so you don't have payroll taxes. You noted that $15,000 to $20,000 is from property taxes. Your consumption would indicate that sales and excise taxes would not be that large. Is the remainder primarily from capital gains?

BTT!!!!

BTTT!!!!!!

You think emailing it to Rush is going to fix it? LOL! Sorry - I just don't see it happening.

$20k in property taxes per year - on your home property? What percent of the property value are you at? Your in a (estimating here) $20 million home? If you have that much moola, what do you care about a few grand? Just curious.

I must echo the question others have asked; if you pay 20K in property taxes, yet have been debt free for 20 + years, you have to be sitting on one hell of an asset.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.