Oh, a tip of the hat to Daniel Pipes, who referred to this article on his essential blog.

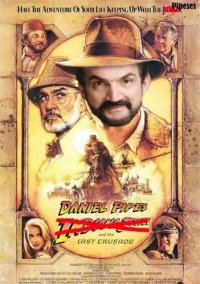

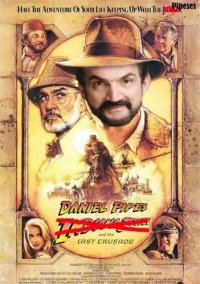

Oh here is a pic, which according to Pipes, was created by Islamists to insult him! I wish I'd get insulted this way.

Posted on 03/12/2005 8:23:15 PM PST by Land_of_Lincoln_John

Oh, a tip of the hat to Daniel Pipes, who referred to this article on his essential blog.

Oh here is a pic, which according to Pipes, was created by Islamists to insult him! I wish I'd get insulted this way.

Someone call Texas and clue Perry and the Texas Leg. in on this.

Stupid jackassed feds. First, they never should have put high taxes on cigarettes. Second, they never should have sued the tobacco companies. Stupid jackassed feds.

Drug prohibition fuels terrorism.

Get the products out of the hands of the gangs and into legitimate companies and let the quality be controlled, the businesses taxed and the consumers informed. Just as we do with alcohol and tobacco.

Same logic applies to the War on Some Drugs.

Same logic applies to the War on Some Drugs.

Anytime you have a commodity whose price is set artificially high due to illegality, cartel, or unusually high tax, it becomes a natural locus of criminal activity. The more artificial the price, the greater this phenomenon. Cocaine, diamonds, petroleum, and now tobacco are some examples.

PING

Sounds like they are setting the stage for a uniform state tax which will raise the law states via a federal excise.

Can you say prohibition boys and girls?

I knew you could! (We all know where that went.)

Hiking cigarette taxes will have the same effect: i.e., none that's of any use. Tax revenues will level off at some point and will not go any higher no matter what rates the states or feds set.

Hint: see "Law of supply and demand."

Corrected: Sounds like they are setting the stage for a uniform federal tax which will raise the tax states in low tax states charge via a federal excise.

Kentucky's tobacco is supposed to go up 30 cents this

June. I suppose I'll write a thank you letter to Gov.

"fly your plane over the White House" Fletcher.

"P.C." taxes, makes me ill!

The states desperately need money because, at the same time that they continue to spend at an irresponsible level, revenues are down due to offshoring: they used to enjoy taxes from production line workers at $25 an hour; now they are getting taxes from fast-food workers at $7 an hour. Big difference.

Umm, how about identifying and deporting (or better yet, hanging) Islamofacists dealing in funneling finances to our enemies? That way, cigarette smuggling could be a venue reserved for honest American crooks.

They're probably all hiding out some where smoking cigarettes they purchased from some online source.

![]()

Dear Governor,

As a smoker and tax-paying citizen of this state, I am joining a nationwide smokers strike to inform the Governors of the states that smokers will no longer accept excessive and punitive taxation. Nor will we accept unnecessary restrictions and regulations any longer.

Until that day comes, I will not purchase another pack of cigarettes manufactured by Phillip Morris, R J Reynolds, Brown & Williamson or Liggett - including any of their sub brands – I will no longer support the Master Settlement Agreement. Instead, I will buy brands made by non-MSA companies

Smokers will willingly pay a fair rate of taxation:

Every smoker, and everyone who knows a cigarette smoker will enlist their support to boycott the Master Settlement Agreement cigarette brands until taxes are fair and reasonable.

I smoke and I vote!

Name: ______________________

Address: ____________________

City: _________________

Zip Code: _________

21st Century Boston Tea Party: Holding the States' MSA Payments Hostage

|

The "I Quit" Letter |

click here to download "I Quit" Letter

click here to download Non-Smoker's I Quit Letter

Illinois Smokers:

A public yahoo group for anyone who wants to talk about the Illinois ban situation.

Illinois Smokers Alliance:

A smokers ban discussion group from IL. A public group but moderated against posts made by anti-smokers.

Illinois State Page:

Facts, Press Releases, Visiting, Government, and more.

IDPH Online:

Illinois Department of Public Health

535 West Jefferson Street

Springfield, Illinois 62761

Illinois's excise tax collection for the

fiscal year ending June 2002: $471,551,000

Sales tax on tobacco products: 6.25%

Local tax on tobacco products: $60,605,152

Federal excise tax per pack of cigarettes: $0.39

Total federal excise tax collections in fiscal year 2002: $7,512,700,000

Click here for the Cigarette Tax and Payment Table for all states.

|

click for larger view

|

Number of six-packs of beer that must be sold in Illinois to produce the same state excise tax revenue generated by one carton of cigarettes: 94.2 |

|

click for larger view

|

Number of bottles of wine that must be sold in Illinois to produce the same state excise tax revenue generated by one carton of cigarettes: 67.8 |

| Smokers Pay Excise Taxes2 | $ | 653,697,000 |

| Smokers Pay Local Excise Taxes | $ | 160,325,000 |

| Smokers Pay Sales Taxes2 | $ | 58,000,000 |

| Smokers Pay Tobacco Settlement Payments3 | $ | 339,495,000 |

| $ | 1,211,517,000 |

| Illinois smokers' median household income | $ | 36,720 |

| Illinois nonsmokers' median household income | $ | 45,942 |

34% of Illinois smokers had household income LESS THAN $25,000

16% of Illinois smokers had household income EQUAL TO or GREATER THAN $75,000

The impact of smoker payments on the incomes of working families was more than THREE TIMES the impact on higher income smokers. Those who can afford it least pay a disproportionate percentage of their hard-earned income in smoker payments.

| Total average paid per Illinois smoker in excise and sales taxes | $ | 415 |

| Cost per Illinois smoker for settlement payments to Illinois | $ | 161 |

| Total annual payments to Illinois per smoker | $ | 576 |

| Total annual payments to Illinois per nonsmoker | $ | 0 |

I don't know where they get their numbers, but they would have to give me better than $30 with each carton for me to sell one at that markup here (ND).

Most class A brands are selling around $30 now. I buy 'cheapies' for about 16 bucks a carton.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.