Posted on 10/16/2025 10:06:24 AM PDT by delta7

Wall Street’s power brokers are using a gold revaluation to rewrite the rules—turning massive silver losses into multi-billion windfalls overnight and signaling a seismic shift in the global financial….

That’s exactly how JP Morgan Chase is playing the metals market today. The bank has been hammered on its sprawling silver short—dozens of holes down, figuratively speaking. But instead of folding, it’s hit the most audacious “press” in modern finance: going long gold. By championing the narrative of $10,000 gold, the institution is resetting the game mid‑round, leveraging the new bet to erase the sting of the old one. If the gold run succeeds—and if they pivot to long silver as physical supply evaporates—they’ll not only recover their losses but rewrite the scorecard entirely. Like a hustler turning a miserable front nine into a record‑breaking back, JP Morgan is betting that one well‑timed press can transform defeat into dominance.….

For years, JP Morgan has played the bullion markets like a tenacious, sometimes reckless golf hustler. The bank, infamous for mammoth short positions in silver futures, placed calculated bets on lower silver prices—reportedly controlling tens of thousands of contracts, enough to sway prices and suffocate rallies. This strategy fueled profits—until now, as the world’s insatiable demand for real physical metal and cratering vault inventories exposed the dangers of overplaying the short side.

With silver markets on the verge of an historic short squeeze—where tripled prices could trigger catastrophic losses and even bank failures—JP Morgan stands on a knife’s edge. Massive short exposure has left the institution exposed to billions in potential margin call losses, and no longer can they count on cheap, abundant supply to rescue them from disaster. The cost of borrowing SLV ETF shares for shorts has exploded, vault withdrawals surge, and every tick up in silver threatens a full-blown systemic reckoning.…

IBTG

IBTS

This is one theory of what’s happening, but its full of holes

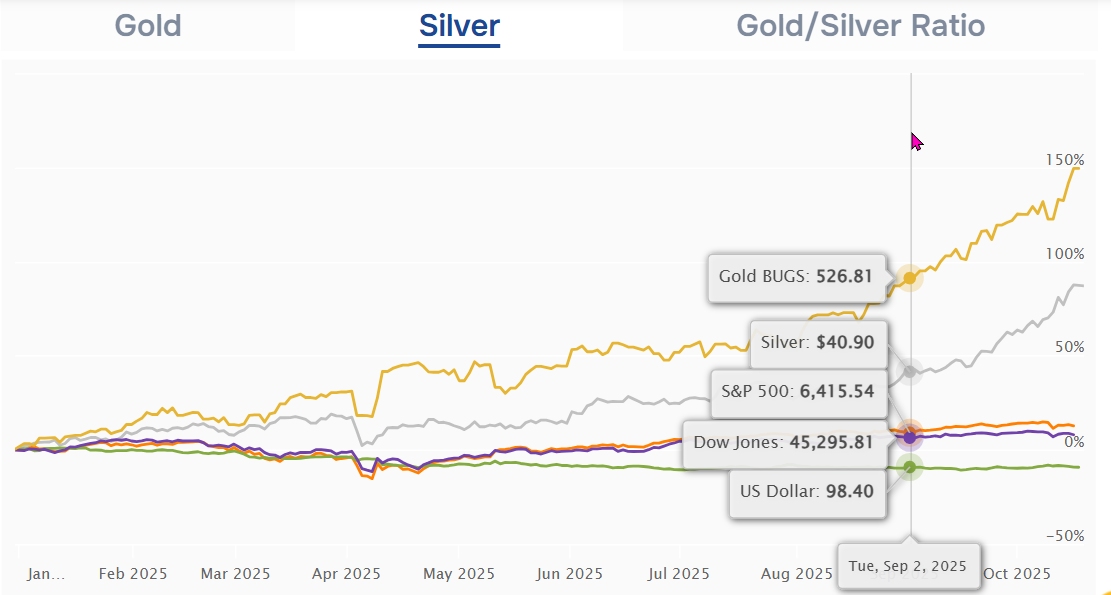

What they say JP Morgan is doing is effectively a spread - short silver, then long gold. JPM are betting, in effect, gold rises more than silver

But presumably, this spread was put into effect over the last several years, when Gold Price -Silver Price ratio has been 80-100 - already very lopsided in gold’s favor.

To make money, they need Gold-Silver to go >100. It seems highly unlikely in a precious metals bull market like we’re in now.

Sad

Your friends:

Delta7/Armstrong

Ergo,

Putin

Xi

What type colossal ass shorts a precious metal with an obvious oncoming inflation train racing straight towards us?

I’m a small fry investor- not too many years ago I bought two rolls of silver Eagles at $375 each. I gave one to one of my daughters who needed the money. I’m glad to say she still has it. I have the other one. Not a bad return…..

Going short on silver was monumentally stupid in this market.

To make money, they need Gold-Silver to go >100. It seems highly unlikely in a precious metals bull market like we’re in now.

xxxxxxxxxxxxxxx

especially since historical Gold-Silver ratio is more like 60-70

Indian “RS 3000 premium” is 34.09 in USD

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.