Skip to comments.

CBDC Anti-Surveillance State Act and the CLARITY Act

Armstrong Economics ^

| 21 July25

| Martin Armstrong

Posted on 07/21/2025 5:45:38 AM PDT by delta7

legislators passed a series of bills last week aimed at targeting cryptocurrencies– the CBDC Anti-Surveillance State Act, the GENIUS Act, and the CLARITY Act. I explained the GENIUS Act in another post. Some believe that the CBDC Anti-Surveillance State Act and the CLARITY Act are the safeguards that will ensure the USD is never digitized.

The CLARITY Act determines who will regulate digital assets and what is considered an asset vs a security. The CFTC was tasked with overseeing digital commodities, while the SEC will oversee restricted digital assets whose value is intrinsically linked to blockchain technology. A token sold under an investment contract may or may not be a security.

Electronic Dollar Digital

The Act defines “investment contract asset” as a token that is recorded on blockchain, is sold or intended to be sold pursuant to an investment contract, and can be exclusively possessed and transferred peer-to-peer without an intermediary. Mature tokens on decentralized networks (e.g., Bitcoin or Ethereum), once they meet these conditions, are not classified as securities even if their initial sale qualified as an investment contract.

Basically, this act states that the token itself is not automatically considered a security merely through the initial contract. This may prevent the SEC from weaponizing securities against innovation, but it also ensures that the government is enabled to oversee digital transactions.

Now, the CBDC Anti-Surveillance State Act is precise as named. The Act prohibits the Federal Reserve from issuing a CBDC DIRECTLY TO INDIVIDUALS. H.R. 1919 ensures that unelected bureaucrats can never unilaterally issue a CBDC or weaponize a digital dollar to erode our freedoms. The bill would prohibit the Federal Reserve from developing or issuing a CBDC without explicit authorization from Congress.”

The wording is crucial here. Congress still has the ability to authorize the creation of a CBDC. I stated at the last World Economic Conference that the central bank would NOT be the one to usher in digital currency. The real threat is the private banks that US intelligence has already weaponized. The private banks, the Bank for International Settlements (BIS), and the global elite have been pushing to gain control over the monetary system.

euro digital electric

The push for digital currencies is coming from the BIS and commercial banks who want to eliminate all paper currency so they can enforce negative interest rates and prevent bank runs. The Fed was not pushing for CBDCs as the Fed was never intended to be the direct banker of the people. They knew it would destroy the existing structure. But the pressure came from international banking elites and the BIS who are trying to force a one-world digital system.

I appeared in the movie “CBDC, the End of Money,” warning that it would have been unconstitutional for the Federal Reserve to create a CBDC. My sources had confirmed that the Fed would not make a CBDC. This is important, as it chalks one up for the people, retaining our freedom.

This new legislation prevents the Federal Reserve from creating a CBDC, but the US Fed was never pushing for this measure. CBDC is not an American idea. The Fed actually resisted the concept, and Trump has been against the creation as well.

But the BIS and the European banking elites are the ones pushing this agenda due to the sovereign debt crisis. The idea is to trap capital to control the inevitable collapse by converting to a digital system. The day may come when the Fed is forced to comply, as we live in a global economy, and the BIS, IMF, and Davos elite are actively working to end banking as we have known it.

TOPICS:

KEYWORDS: cbdc

Navigation: use the links below to view more comments.

first 1-20, 21-30 next last

1

posted on

07/21/2025 5:45:38 AM PDT

by

delta7

To: delta7

2

posted on

07/21/2025 5:47:40 AM PDT

by

delta7

To: kiryandil

3

posted on

07/21/2025 5:48:13 AM PDT

by

SaveFerris

(Luke 17:28 ... as it was in thays of Lot; They did Eat, They Drank, They Bought, They Sold ......)

To: delta7

This is the US. We’re not establishing literal CBDCs, but de facto CBDCs, better termed FBDCs or Fascist Bank Digital Currencies, whereby large banks do the controlling at the government’s bidding.

This is akin to how censorship was implemented through social media companies and NGOs, and it’s what the GENIUS Act just enabled.

To: delta7

The GENIUS ACT:

“The act specifically provides the government with the authority to “block, freeze, and reject specific or impermissible transactions.”

“A permitted payment stablecoin issuer shall be treated as a financial institution [and]…shall be subject to all Federal laws applicable to a financial institution located in the United States including…policies and procedures to block, freeze, and reject specific or impermissible transactions that violate Federal or State

laws, rules, or regulations…”

CBDC Cover

This provision is not intended to protect the world against drug smugglers and thieves. This provision is intended to grant government unlimited control over how people spend stablecoins. The government could have easily frozen the accounts of those who refused the COVID-19 vaccination, for example, and the Biden Administration admittedly weaponized existing financial institutions to spy on Conservative Americans through their payment histories.

“Stablecoins are the bait and switch for direct-issued government CBDCs,” Bitcoin Magazine editor Mark Goodwin said, “Stablecoins can be programmed. Exactly like how we fear CBDCs will be programmed. They’re exactly the same tokenized mechanism… They can be taken out of your wallet. Your wallet can be blacklisted. A lot of the things that we fear about CBDCs are totally available within the tool set of Stablecoins.”

The GENIUS Act has received bipartisan support. Although Republican Hagerty championed the bill, he had bipartisan co-sponsors, including Senators Kirsten Gillibrand (D-NY), Angela Alsobrooks (D-MD), Tim Scott (R-SC), and Cynthia Lummis (R-WY).

I warned that governments would NEVER allow any cryptocurrency or stablecoin to compete with their own currency. I long warned that government was merely tolerating these alternative currencies in the past as they posed no real threat. But now the government needs the ability to tax everything to support its perpetual spending. Every digital transaction is traceable. Every digital currency is controllable—the ultimate power grab.

One of Donald Trump’s main campaign promises was the prevention of CBDC. The headlines are enraged over his failure to release the Epstein files, but the GENUIS Act is a far deeper betrayal of the American people that has the ability to usher in a new monetary system.”

https://www.armstrongeconomics.com/armstrongeconomics101/regulation/while-the-world-was-distracted-by-epstein/

To: delta7

[Electronic Dollar Digital - CBDC]

It's coming - DEMOCRAT Joe Biden EO 14067Mark Carney Is Incredibly Dangerous

https://freerepublic.com/focus/f- news/4315252/posts

Cash is dead. Speech is scored. Freedom is conditional..

...

Mark Carney didn’t rise through politics. He was not elected. He was installed — by the very institutions that profit most from technocratic control and public obedience. Goldman Sachs. The Bank of Canada. The Bank of England. The Financial Stability Board. The World Economic Forum. Bilderberg. The Trilateral Commission. The Council for Inclusive Capitalism.

This is a man who has spent his entire adult life inside the machinery of global finance and elite governance.

Now, he’s running a country. Carney is no fool. He speaks in the hushed tones of central bankers. He uses the sterile vocabulary of “sustainability,” “transition,” and “inclusive growth.” But behind the euphemisms is a blueprint for absolute control.All Along the Road to the Final Destination of NWO / Global Tyranny (Daniel 7:23, Revelation 13, Revelation 14, Revelation 20:4)

...

At the center of that blueprint is the Central Bank Digital Currency (CBDC).

...

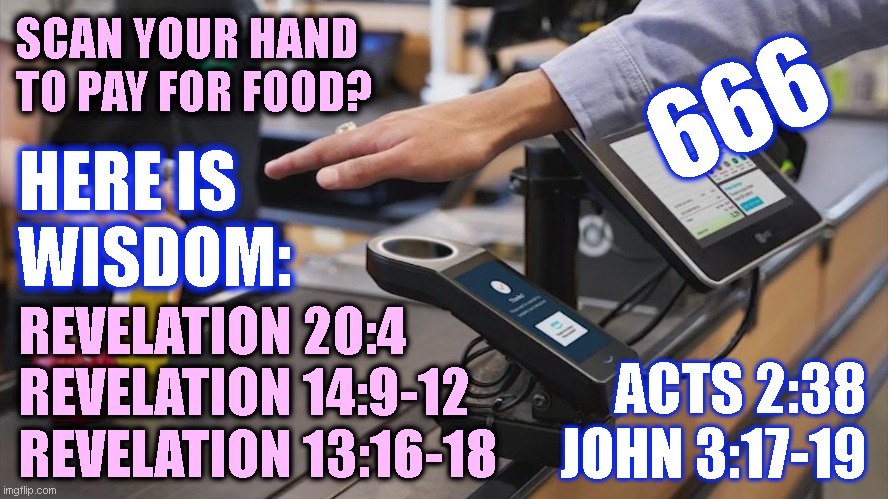

Unlike physical cash, a CBDC can be tracked, restricted, and deactivated in real-time. It allows the government — or its banking partners — to control not just how much you spend, but where, on what, and whether you’re allowed to spend at all. The potential forabuse is staggering. This is not paranoia. It is already the reality in China. There, the CCP links digital currency to a nationwide social credit system. Criticize the government? Restricted travel. Associate with the wrong people?

Denied access to loans. Buy too much alcohol or cross the street improperly? Face penalties that follow you for years.

This is not fiction. It’s functioning policy, and Carney, through CBDCs, is laying the foundation for a Western version ... Cash will not just be obsolete. It will be forbidden.Just in case this didn't stand out

"and whether you’re allowed to spend at all."

(No man can BUY or SELL without

the Mark of the Beast) (eventually)

CBDCs will be a reality - and the World will change

Think COVID-19(84) was bad? You ain't seen nothin' yet

6

posted on

07/21/2025 6:17:28 AM PDT

by

SaveFerris

(Luke 17:28 ... as it was in thays of Lot; They did Eat, They Drank, They Bought, They Sold ......)

To: SaveFerris

Satan is the master of disguise and deception, never, ever forget that.

7

posted on

07/21/2025 6:27:13 AM PDT

by

delta7

‘[This is akin to how censorship was implemented through social media companies]

The Chinese systems are ALREADY IN PLACE to a degree (for the thread)

The Godless Globalists NEED areas that have very little Bible teaching - this is why China is an excellent place to try out Mark of the Beast technology - the Social Credit Score System - CAN’T BUY FOOD TO EAT - what a GREAT way to control the masses - control their access to MONEY and to FOOD to make them SUBMIT

This is ALREADY HAPPENING (December, 2023) - I say it will come to much of the world - BEFORE the Mark of the Beast - COVID-19(84)-style tyranny will make it difficult to even buy food

This woman had a gift card - it would not even let her use her GIFT CARD without FACIAL RECOGNITION

TPTB WILL use control over food to control people. Social Credit scores - China-style. It is ALREADY happening in China. This video is from December, 2023:

It won’t matter if someone has $400,000-$500,000 in the bank. It won’t matter if somebody has a job paying $150,000 a year. You WILL submit to the Social Credit Score System and you WILL exhibit and parrot Party Doctrine or you WILL be cast aside and forced to buy food on the streets. Oh, and your finances WILL be tracked with Digital Currency, etc. (for the thread)

China...No Digital ID...Can’t buy food!

(BEST version of this short video - 1:20)

https://www.youtube.com/watch?v=f6diM6X2A8E

This video is from December, 2023

8

posted on

07/21/2025 6:31:28 AM PDT

by

SaveFerris

(Luke 17:28 ... as it was in thays of Lot; They did Eat, They Drank, They Bought, They Sold ......)

To: 9YearLurker

Agreed, alarming is the fine print. CBDC’s really have not been outlawed. It was stated “ Congress must vote to create CBDC”…..imagine when this current fiat currency collapses, everyone will be crying for a “ fix”, and you can bet the next administration after Trump will vote for their “ fix”.

Evidence? The bill passed by a mere two votes….we should be “ safe” during Trump’s term . After that?….they just kicked the can down the road.

9

posted on

07/21/2025 6:35:48 AM PDT

by

delta7

To: delta7

But the larger point is that they are instituting de facto CBDCs via big bank-issued stablecoins. The technology will enable complete surveillance and real-time control on spending and access. That’s all that’s needed. actual retail, central-bank digital currency isn’t required.

To: SaveFerris

Think COVID-19(84) was bad? You ain’t seen nothin’ yet

———-

Look how many people rushed out to get jabbed by mRNA deadly shots….270 million plus, if we are to believe.gov’s numbers….tricked, deceived, 270 millions.

Imagine how many will rush to a cashless system that will be promised to save their SS, 401K’s, Pensions, etc…

11

posted on

07/21/2025 6:40:26 AM PDT

by

delta7

To: delta7

Fortunately, Almighty God has warned us of Satan's plan

to enslave the entire WORLD - we are watching the implementation

of systems capable of doing just that - Luke 21:34-36

The Godless Globalists WILL get Satan's Antichrist, who "confirms" 7 years of 'Peace and Security'. You can count on it. It has been foretold long, long ago. It is on the horizon. I say the Globalists might have been delayed a bit, but one can rest assured they have not given up nor will they give up on their goal of a "New World Order" which I say is the Fourth Beast of Daniel 7:23; a WORLD GOVERNMENT under Satan's Antichrist (IMHO).

Lurkers, please click on my screen name to see my homepage for additional information.

Lurkers, please click on my screen name to see my homepage for additional information.

(opens in a new window if you click HERE)

12

posted on

07/21/2025 6:44:12 AM PDT

by

SaveFerris

(Luke 17:28 ... as it was in thays of Lot; They did Eat, They Drank, They Bought, They Sold ......)

To: 9YearLurker

“The government could have easily frozen the accounts of those who refused the COVID-19 vaccination,”

We would then need new elections, as those responsible for that would tend to disappear.

13

posted on

07/21/2025 6:49:50 AM PDT

by

bk1000

(Banned from Breitbart)

To: delta7

14

posted on

07/21/2025 6:55:27 AM PDT

by

SaveFerris

(Luke 17:28 ... as it was in thays of Lot; They did Eat, They Drank, They Bought, They Sold ......)

To: bk1000

Eh, we’ve voted back in those behind the CARES Act, declaration of the Covid health emergency, etc.

To: delta7

“Look how many people rushed out to get jabbed by mRNA deadly shots….270 million plus, “

Why are we NOT seeing millions dying as predicted?

16

posted on

07/21/2025 7:06:04 AM PDT

by

TexasGator

(1.here is no Sharknado system)

To: 9YearLurker

This is akin to how censorship was implemented through social media companies and NGOs, and it’s what the GENIUS Act just enabled. Great analogy! Another way to put it, IMHO, is it may be the Republicans overreacting to Sam Bankman-Fried's FTX scandal of using crypto to illegally finance Dims. To keep that from happening again, ostensibly they have to steer more regulations for digital money handling. And if I understand it correctly, this doesn't even address crypto anyway.

17

posted on

07/21/2025 7:10:07 AM PDT

by

Tell It Right

(1 Thessalonians 5:21 -- Put everything to the test, hold fast to that which is true.)

To: Tell It Right

I take it as a straight implementation toward the WEF/globalist digital control grid. You don’t need that to stop Dem funding.

To: delta7; SaveFerris

19

posted on

07/21/2025 8:23:51 AM PDT

by

kiryandil

(No one in AZ that voted for Trump voted for Gallego )

To: kiryandil

20

posted on

07/21/2025 9:17:59 AM PDT

by

SaveFerris

(Luke 17:28 ... as it was in thays of Lot; They did Eat, They Drank, They Bought, They Sold ......)

Navigation: use the links below to view more comments.

first 1-20, 21-30 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson