“”There’s very low trust of institutions and the institutions have failed them,” Kirk told Fox News Digital.”

If you really want a home you will work hard, save money and buy one. I bought my first home when mortgage rates were 13%.

Ok gramps. You have no idea how completely tone deaf that sounds. Your first home was probably $29 right.

This isn’t 1978, though.

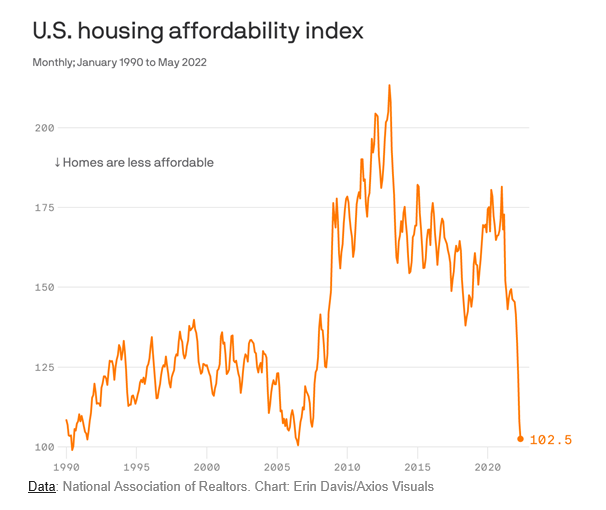

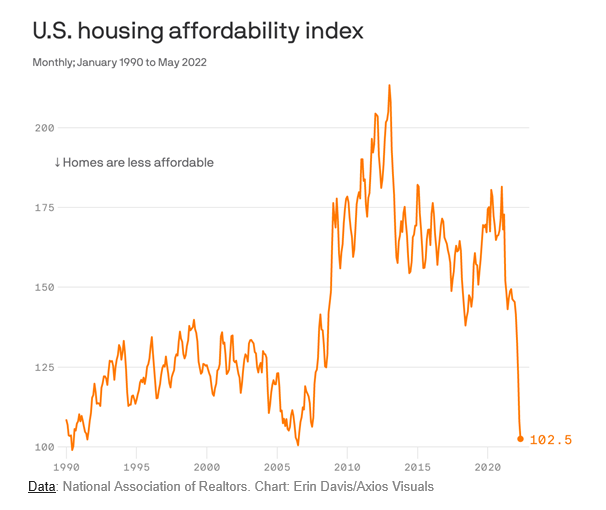

That’s nice. In 1980, a house cost around 3 times average annual income. Today it is abut 5 times. And productivity has grown 2.7 times as fast as compensation in the workplace.

It’s worse today.

Yeah, I paid 13% too in 1980, but things were different back then:

1) A real nice little starter house back then was only $85K - I think my mortgage was only $60K!

2) The tuition for a decent non-Ivy league MBA program (Temple U) was dirt cheap back then, so with a side job I had zero student debt and enough saved for the down payment.

3) Back then, a solid entry level finance position at a fortune 200 paid $25k (which sounds low now, but I was actually able to build up some savings with that).

4) The high interest rates also meant you could earn that much on a CD if you had some savings.

5) 7 years later the house sold for 3 times what I paid for it.

Bottom line: interest rates were super high - but all in all - that was a great time to buy a house IMHO.