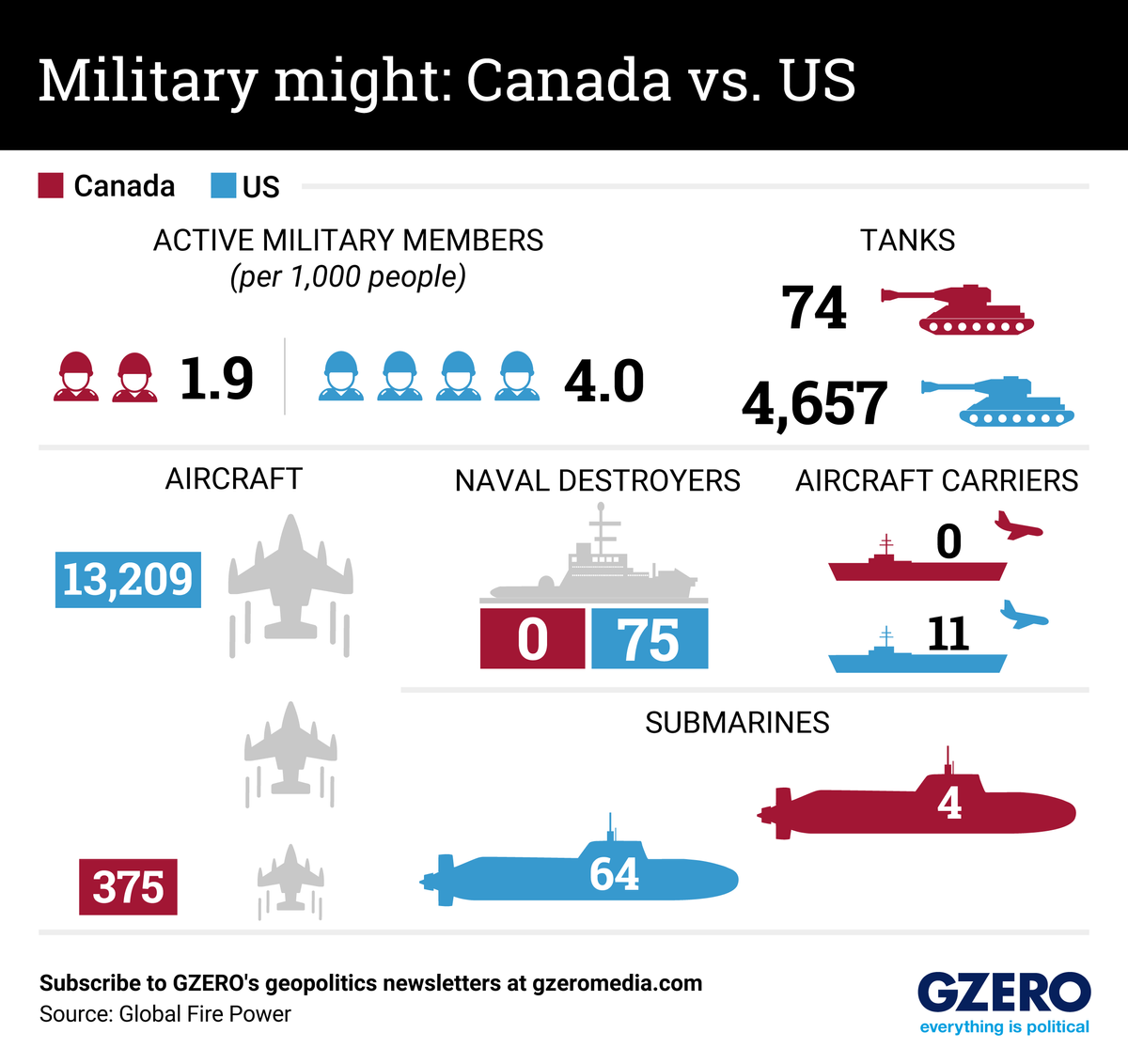

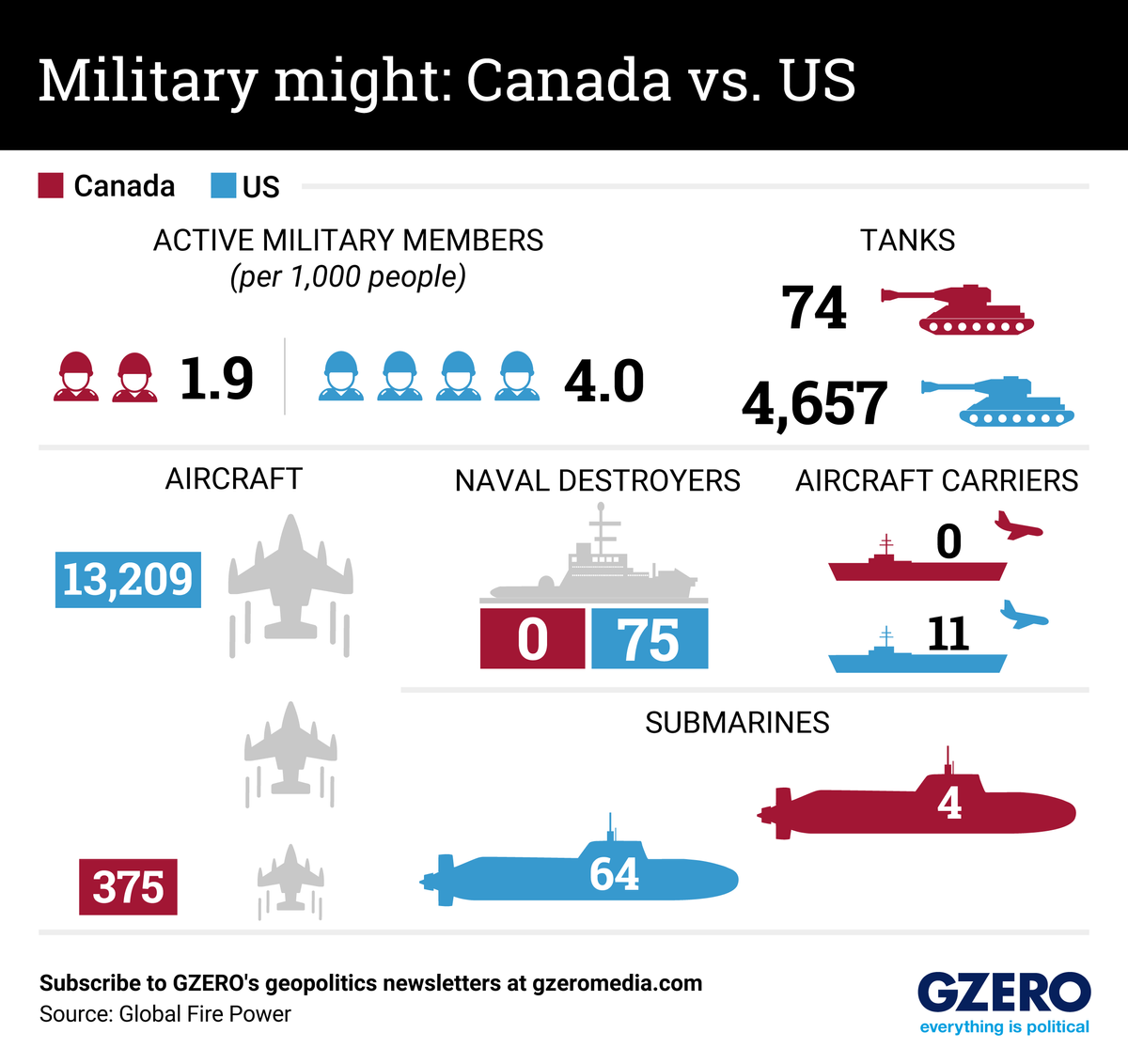

They can barely defend themselves without us.

Posted on 05/09/2025 6:10:14 AM PDT by delta7

Canadian exports to the United States are beginning to decrease in light of the trade war. Statistics Canada announced that exports to the United States, Canada’s largest trading partner, declined 6.6% during the first month of tariffs while imports from the United States fell 2.9%. March 2025 was the second-highest recorded monthly increase in non-US trade for Canada.

Exports to nations outside the US rose 24.8%. Overall exports in March 2025 reached $69.9 billion, a slight decrease from February’s $70.04 billion posting, yet volume rose by 1.8%.

The United Kingdom has been purchasing unwrought (crude) gold exports from Canada this year, totaling C$2.01 billion in January, C$1.64 billion in February, and C$1.64 billon this March.

Canada’s crude oil sea exports doubled on an annual basis to 8 million barrels this month. The United Kingdom and the Netherlands imported 69% of all crude oil exports to Europe. Hong Kong also increased its crude imports from Canada in March.

Overall merchandise trade exports declined 0.2% for the month, with imports falling 1.5%. The trade deficit fell to C$506 million, notably less than the prior month’s C$1.4 billion deficit as Canada is seeking buyers.

Canada cannot fully rely on trade outside the US. March saw a 6.6% monthly decline in exports to the US, which is bad news for Canadian businesses. Trade with the US for March was still strong at US$140.5 billion, notably due to an increase in pharmaceuticals and medicines ahead of forthcoming industry-specific tariffs. Autos also saw an uptick ahead of industry-specific tariffs, posting a 7.7% export increase for the month. Iron and steel products, already subject to a 25% tariff, fell 9%, while aluminum alloys and unwrought aluminum rose 4.4%.

The S&P Global Manufacturing PMI for Canada reached 39.1 in April 2025. Canadian manufacturing has not seen such a contraction since early COVID months when the global economy came to a standstill. Imposed and proposed US tariffs are stifling demand as purchasers do not know what to expect.

Those adhering to US boycotts fail to realize that the Canadian economy is structurally tied to the US economy. Infrastructure was designed to support trade through railways, trucking routes, and pipelines. Europe and Asia cannot replace the accessibility or scale of the US market.

Additionally, the economy is closely aligned with the USD, and a major pivot would expose Canada to currency volatility. Canada may strengthen ties with other nations to fill margins but it cannot write off its top trade partner.

THEY NEED US ,MORE THAN WE NEED THEM.

IBTG

Pretty soon California will need every drop of Canadian gasoline it can get. Raw oil that needs to be processed, not so much.

Damn, beat me to it. Seems that Xi’s phone calls to the leaders of France and UK may have been enough to convince Zelensky to not get ‘cute’ during the Victory Day parade, at least so far...

We built the “Globalist New World Order” ( The U.N, Bretton Woods, GATT ) immediately after WWII, and now Trump needs to dismantle it.

Canada ought to be ending its reliance on the ChiComs...

They can barely defend themselves without us.

IBTG

—————-

Maybe he was suspended/ banned, again.

Too late.

And our agreement with UK further boxes Canada into a ‘cant win corner.

Martin Armstrong lays out a scenario where the EU disintegrates, the US breaks up into several countries, and civil wars erupt as populations reach their breaking point when it comes to government overreach and the ever-intrusive eyes of the growing surveillance state. Martin also gives his thoughts on the implications of the Yen carry trade, gold’s role as a safe haven asset in uncertain times, and the possibility of a light at the end of the tunnel where humanity comes together in the aftermath of the chaos to come.

https://youtu.be/uMAK8XNt_Zk?feature=shared

Martin A. Armstrong, the founder, chairman, and owner of Princeton Economics International Ltd ("Princeton Economics"), an unregistered investment adviser, appeals from the decision of an administrative law judge. The law judge barred Armstrong from association with any investment adviser based on Armstrong's conviction on a single count of conspiracy to commit securities fraud, wire fraud, and commodities fraud and his injunction from violation of antifraud provisions of the federal securities laws. We base our findings on an independent review of the record, except with respect to those findings not challenged on appeal.

On August 17, 2006, Armstrong, then fifty-six years old, pled guilty to one count of conspiracy to commit securities fraud, wire fraud, and commodities fraud. 1 The district court sentenced Armstrong to sixty months' imprisonment and three years supervised release, and ordered him to pay $80,000,001 in restitution to sixty defrauded customers.2 As part of his guilty plea, Armstrong entered a sworn allocution admitting to and describing his crime. In his allocution, Armstrong admitted that between 1992 and 1999, he sold promissory notes issued by Princeton Economics subsidiaries ("Princeton Notes") to investors, mostly Japanese corporations. Armstrong, through his agents, represented to the investors that the proceeds from the sale of the Princeton Notes would be held in accounts at Republic New York Securities ("Republic") and that those accounts "would be separate and segregated from Republic's own accounts and would not be available to Republic for its own benefit."

According to Armstrong's allocution, after he suffered "some millions of dollars of trading losses," he decided "not to disclose to investors that . . . substantial losses had been experienced in this trading of futures. And we did not disclose it." Armstrong also admitted that his concealment of his losses went beyond non-disclosure: "letters were sent by my company to investors concerning how much money was in fact in the accounts assigned to them. I . . . did send out those letters, even though . . . I knew the amounts in the accounts were less than the letters stated."

https://www.sec.gov/files/litigation/opinions/2009/ia-2926.pdf

Thread hijacking is against forum rules. Please refrain from doingbso in the future.

Scratch the barely. They could not defend themselves if China made a move. Unfortunately, if they were invaded, we would have little choice but to fight. A China ruled Canada at our northern border is not an option. Similarly, Trump's strategy on Greenland is about our long term survival.

Martin Armstrong’s Socrates computer is world known for its forecasts. You can post your drivel about his past legal problems but you can never take away from his legendary forecasts.

The second movie about Martin Armstrong’s Socrates computer is to be released by the end of summer. I will send you the link to his second movie when it is released.

-------------

Failed to predict his three bankrupsies.

Failed to predict his losing $700 million of his clients’funds.

Failed to predict he would spend eleven years in the federal pen.

In 2014 he predicted gold would soar to $5,000 in 2015.

In 2014 he predicted that there would be a world financial collapse would occur in 2015.

July 2024 he predicted US cIvil unrest/WAR to happen just before the 2024 elections.

November 2024 he predicted a US civil war would happen the week of Trump’s inauguration with the US breaking up into four new countries in 2026.

December 2024 he said via Socrates that the 2024 elections would be the last in the US.

. January 2025 he predicted US civil unrest on May 7, 2025.

March 15, 2025: Got suckered by fake story

https://freerepublic.com/focus/news/4304515/posts?page=40#40

“You can post your drivel about his past legal problems”

Defrauding investors of over $700,000,000 and eleven years in jail is fact, not drivel!

“The second movie about Martin Armstrong’s Socrates computer is to be released by the end of summer. “

How much are you paying for he production?

If Socrates were any good I, :

wouldn't have had three bankruptcies,

wouldn't have lost $700,000,000 of my clients' funds,

wouldn't have spent eleven years in prison

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.