Wow! Your AI computer was around in the 80s?

Can you post a picture of what that looked like?

Was it like this?

I guess you didn't listen? Were you "shortin'" when Socrates said you should you should be "longin'"? Or the other way around?

Posted on 03/22/2025 6:33:31 AM PDT by delta7

Many precious metals investors have heard about silver manipulation or suspected it, but few fully understand how it works or can clearly explain it. Many also intuitively sense that silver's price is artificially low and should be much higher but struggle to identify what—or who—is keeping it suppressed. I have committed myself to studying silver price manipulation, documenting the evidence, educating others, and exposing these practices to bring them to an end and ensure justice is served. In this article, I will explain in clear and accessible terms how silver's price is systematically manipulated and suppressed.

Simply put, the goal of silver price manipulation is to keep silver's price artificially low as well as prevent it from breaking above key technical levels that could trigger a full-blown bull market. According to consensus within the precious metals community, the primary culprits behind silver price manipulation are the bullion banks—the most influential players in the precious metals market.

These include major financial institutions such as JPMorgan Chase, UBS, HSBC, and Goldman Sachs, several of which have been found guilty of manipulating precious metals markets—particularly gold and silver.

Bullion banks are typically members of the London Bullion Market Association (LBMA), the leading authority overseeing the global over-the-counter (OTC) precious metals market. As LBMA members, these banks play a central role in the market by acting as market makers, facilitating large trades, managing vaulting and storage, and participating in price-setting mechanisms such as the daily London Gold and Silver Fix. This dominant position allows them to exert significant influence over silver prices, making manipulation not just possible, but systemic.

The most common, obvious, and widespread form of silver manipulation is price slams—also known as "tamps"—which almost exclusively take place during the New York COMEX trading session between 8:30 and 11 AM EST. As I'll explain in greater detail shortly, these slams occur on a high percentage of mornings, but they become even more frequent and aggressive when silver is attempting to break above a key technical or psychological level.

When silver approaches a breakout point that could trigger a snowball effect of additional buying, bullion banks step in to drop the hammer, forcefully slamming the price back down below that level. This calculated suppression is designed to demoralize existing silver investors, discourage new participants, and ensure that silver's price languishes, preventing momentum from building in its favor.

Silver's price action over the past year serves as a textbook example of how silver tamping works. As the chart below illustrates, silver has repeatedly attempted to break above the $32–$33 resistance zone, only to be slammed back down each time—except for the current breakout attempt (the outcome of which remains uncertain).

Notably, these persistent price slams have kept silver stagnant, even as gold has surged by approximately $1,000 per ounce to $3,000—a powerful 50% bull market rally that, under normal conditions, would have pulled silver higher due to their historically strong price relationship. However, bullion banks have gone to extraordinary lengths to prevent silver from following its sibling, gold.

To see what one of these slams or tamps looks like on an intraday chart, let's examine a particularly egregious example from Friday morning, February 14th. While the daily chart above provides a broader view of the price action, the intraday chart below captures exactly how it unfolded that morning. Bullion banks rely on the assumption that most people won't scrutinize their tactics too closely—but that's exactly what we're going to do here.

Some of the most aggressive slams tend to occur on Friday mornings during the U.S. trading session. With the Asian and European markets closed, trading volume and liquidity are significantly lower, creating the perfect conditions for bullion banks to manipulate silver's price with minimal resistance. This lack of market depth allows them to maximize their impact, giving them more "bang for their buck" when executing price suppression tactics.

As you can see from the 5-minute intraday chart, silver staged a powerful breakout, surging $1 per ounce (3%) during the Asian and European trading sessions. This rally pushed silver above the key $33 resistance level, which had acted as a ceiling for much of the past year, sparking excitement within the precious metals community as many believed silver was finally taking off.

However, around 9 AM New York time, as the U.S. trading session got underway, a massive flood of "paper" silver—in the form of futures contracts—was suddenly dumped onto the market. This deliberate maneuver drove silver back below the critical $33 level, halting the breakout in its tracks and demoralizing silver investors once again.

Note that the silver dumped onto the market was "paper" silver—futures contracts largely unbacked by physical metal. This is the primary way bullion banks artificially suppress silver's price, keeping it well below where it should be based on true supply and demand for physical silver. What's both infuriating and disheartening is that this manipulative pattern has persisted almost daily for decades, consistently driving prices downward—never upward.

The chart below shows another egregious example of the manipulation slam pattern, captured on the intraday silver futures chart from late October to early November. During this period, silver made a strong breakout attempt, reaching as high as $35 per ounce, only to be aggressively slammed lower nearly every morning between 8:30 AM and 11:00 AM EST. The heavy selling pressure during the U.S. trading session repeatedly drove silver's price back down, putting the kibosh on the widely watched late October breakout attempt.

These manipulation slams almost exclusively occur in the morning and rarely at any other time of the trading day. To me, these are unmistakable fingerprints of bullion banks deliberately suppressing silver's price. This is anything but an organic or natural market.…..more….

Thanks for the website advertisement. Sign up, you will not be sorry!

“I don’t buy into the Apocalypse scenario…”

Dear Marty,

I listened to your recent podcast where you did believe in the apocaypse scenario. See the link below. What has happened in the lasrpt few weeks to change your mind?

Thanks in advance, MA

Crash and Burn by Armstrong

https://rss.com/podcasts/keepmovingforward/1953200/

If I buy something and start to like it then it instantly is taken off the market or becomes obsolete.

Everyone that owns gold should send me a few dollars for my retirement because if I have to start investing in gold then some researcher will finally discover the alchemist stone and their investment would be worthless.

Wow! Your AI computer was around in the 80s?

Can you post a picture of what that looked like?

Was it like this?

I guess you didn't listen? Were you "shortin'" when Socrates said you should you should be "longin'"? Or the other way around?

The best way to suppress the price of anything is to make a lot more of it readily available. I haven’t heard about anybody sitting on any big silver strikes lately.

i think this is more like it.

Exactly:

Gold and silver are based on a “goldilocks” scenario.

Currencies collapse badly enough so that gold and silver are trusted more than currencies while...

Civilization remains intact and you can still safely trade in gold and silver.

That is a possible scenario—but imho unlikely.

If we have a currency collapse all bets are off—survival mode and barter are in play.

Bottles of booze and cartons of cigarettes would be more valuable than gold or silver.

‘Today, the computer just pulls down reports from around the world, and writes over 1000 forecasting reports every day,’ he told DailyMail.com.”

How does he have time to post here and on other blog sites and still read a 1000 reports a day, go on all those podcasts and host seminars?

“Sign up, you will not be sorry!”

Can you give a six month free trial?

Careful saying the word “trial” to Marty, it still triggers a seizure.

“Careful saying the word “trial” to Marty, it still triggers a seizure.”

I think “free” is also a trigger word!

They consider it the cost of doing business. Here's a recent example of the wrist slap fines that get handed down...this after the LME retroactively cancelled $12B in trades as nickel prices spiked.

Imagine investing in fixed rate notes, getting monthly statements for years showing your account increasing by those rates and then finding out that not only all your money was gone but you actually owed money!

Did the AI steal the money?

“Did the AI steal the money?”

The AI lost the money (over $700,000,000) but the big guy kept some skimmings.

A banker associated with Marty said that he would have done better flipping a coin!

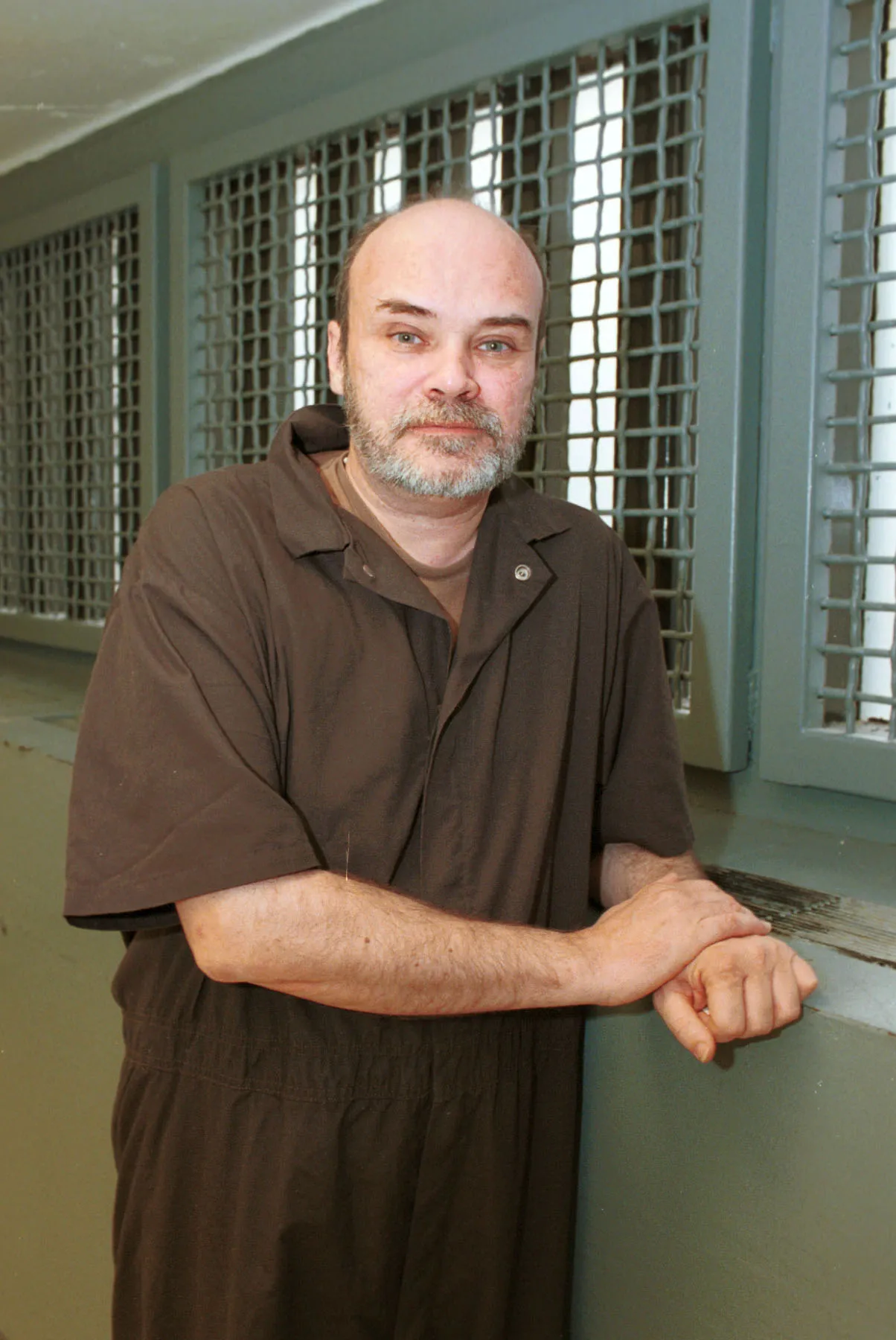

Bought gold bars, hid them, declared bankruptcy. Finally convicted of securities fraud, lost his license, barred from providing financial advice and sent to prison.

I'll bet Socrates saw that coming.

“I’ll bet Socrates saw that coming.”

Maybe he should have asked Socrates where tonhid them?

-———wiki

In 2014, a day laborer sold a box of 58 rare coins, which he said he had found while clearing out the basement of a house in New Jersey—to a Philadelphia thrift shop for $6,000. Three years later, in 2017, when the thrift shop announced they were to auction the coins—valued at $2.5 million, Armstrong came forward to declare himself to be the rightful owner. He claimed that he had hidden the coins in his mother’s old house to take them “off the books” in anticipation of the public offering of his firm. The thrift shop sued Armstrong, asking the court to declare the thrift shop as rightful owners while Armstrong counter-sued, also seeking ownership. In 2019 the US government found out about the coins and claimed them as part of the treasure hoard Armstrong had refused to hand over in 1999, and for which he had served seven years in jail for contempt. (In addition to rare coins, the treasure hoard, valued at $12.9 million, included 102 gold bars, 699 gold coins, and an ancient bust of Julius Caesar.)[

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.