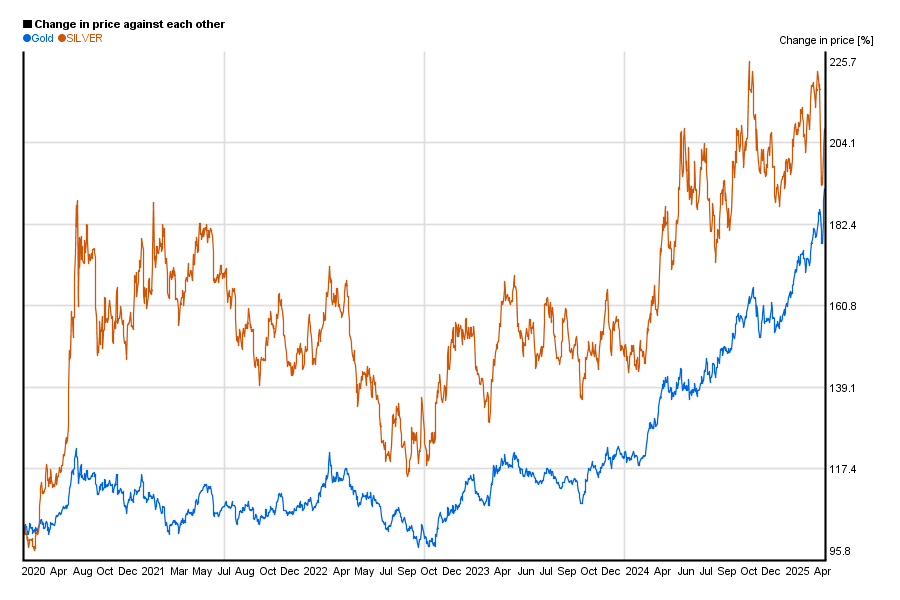

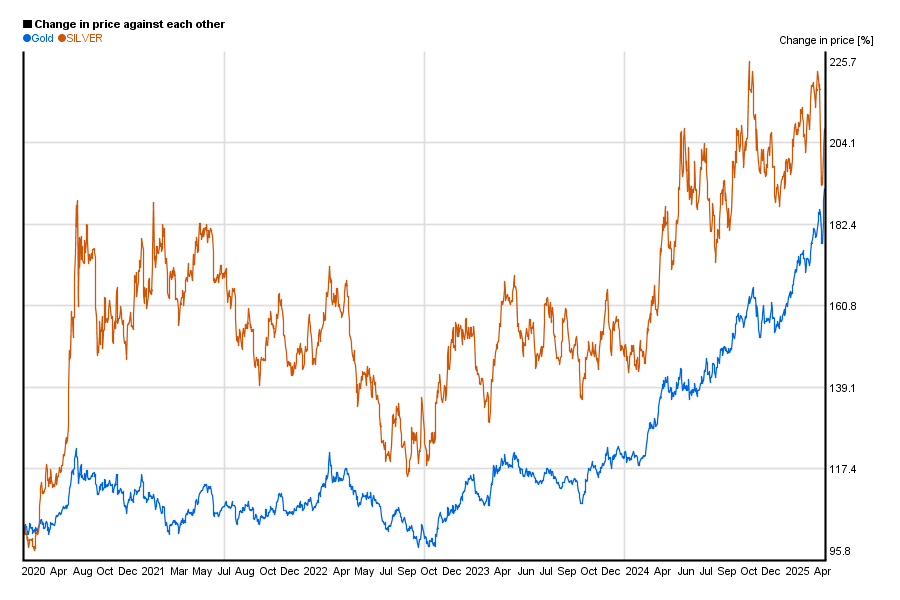

As this is a live, interactive chart, I can't freeze and post the image, you have to go there to see it yourself. I was thinking that I'd use this panic to sell some silver, now(?), not so much!

The price of silver is driven primarily by industrial demand, and then inflation. When industial use returns, inflation will start affecting the price.

I’ve seen some “experts” claim gold will go to between $8,000 & 12,000/ounce. I think one even claimed $20,000/ounce.

How possible and

likely is that?

Some think SFEG will go from about $0.08/share to between $3.00 & $15.00/share.

I’m too much of a novice & layman to make much sense out of such claims.

You have any insights or comments?

I’ve bought silver eagles and silver bars. I give the eagles as gifts to kids and grandkids as lessons in economics. They’re beautiful. I gave my son a couple of golden eagles when he got back from combat in 2004. I got them for around $400. I should have cashed in everything and bought more gold then. But I did ok with land and real estate. No one has a crystal ball. Dang.

I know there are people who trade based on the gold/silver price ratio based on the historical relationship between the two. I am not a fan of that strategy because the ratio until currencies were delinked with precious metals was due to government coinage with those metals. For example, I collect Victorian era British coins. One had the sovereign minted in gold but all the lower denomination coins until the pence were based on silver. So the government forced a ratio between gold and silver price. If the market ratio got out of whack it would pay for people to melt coinage as an arbitrage. That process no longer exists.

The price of silver is being manipulated.

If you go to the usmint.gov website, you will have to pay $55.95 for one Silver proof Eagle coin.

That is the true price of silver. They will charge you 3 times more to buy than to sell because physical silver (at $14.00) is not easy to get.

Yeah, personally I don’t understand silver quite as much as gold. My take is silver has more properties as a useful metal in industry than gold, so is sort of a working commodity. While gold is almost all an investment or jewellery play.