Skip to comments.

Americans are quitting their jobs like crazy

Business Insider ^

| 02/09/2016

| Akin Oyedele

Posted on 02/09/2016 8:07:31 AM PST by SeekAndFind

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-34 last

To: Mr Rogers

Hope they are still happy after they pay their self-employment tax and healthcare “taxâ€....

They are happy because they are NOT paying it.

21

posted on

02/09/2016 9:17:48 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: SeekAndFind

"As for the low wage check out clerk job ... hmmm... who’s filling those positions?" To some extent automation. Think self ordering and check out kiosks, etc.. Even my job as a financial analyst in the medical field has been automated six months after my retirement. One highly paid software wizard replaced several reasonably paid analysts at several facilities. Ergo the average wage goes up although the total paid goes down.

22

posted on

02/09/2016 9:27:52 AM PST

by

buckalfa

(I am feeling much better now.)

To: SeekAndFind

If people are quitting their jobs, it suggests that they are confident in the labor market and are receiving better-paying opportunities elsewhere.Yeah.

Like the three hundred plus welfare programs, including the destruction of Social Security via the OTHER welfares, "permanent disability" and Mediaid...

D'OH!

23

posted on

02/09/2016 9:35:28 AM PST

by

publius911

(IMPEACH HIM NOW evil, stupid, insane ignorant or just clueless, doesn't matter!)

To: SeekAndFind

How to lie with statistics.

To: Zeneta

“They are happy because they are NOT paying it.”

1099 Misc forms go to the IRS. I suspect their computer checks the ones received vs the tax returns. If you have more than $400 of income on a 1099 Misc, you are required to pay self-employment tax. And if you do not have coverage, and you do not have an exemption, then you owe the Obamacare fine (tax, per Roberts).

Of course, people can and do cheat on their taxes. The IRS is not very good at tracking fraud down.

25

posted on

02/09/2016 9:38:56 AM PST

by

Mr Rogers

(We're a nation of infants, ruled by their emotion)

To: Zeneta

You can be self-employed and still be on a W2 if you have your own sub-S corp. Large companies like the corp-to-corp model better, it cuts down on the paperwork.

To: Mr Rogers

I thought it was $600 and that that reporting requirement was removed from the ACA.

So, what happens when a Business that has payed someone tens of thousands and never files a 1099 with the IRS?

They just run it as an expense item and by not filing they don’t raise any flags.

27

posted on

02/09/2016 9:49:33 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: proxy_user

Why in the world would a sub-S want to be on a W-2?

28

posted on

02/09/2016 9:54:39 AM PST

by

Zeneta

(Thoughts in time and out of season.)

To: SeekAndFind

Or maybe they’re just quitting one of the three part time jobs they were forced to take to survive in this economy.

29

posted on

02/09/2016 9:56:24 AM PST

by

VeniVidiVici

(Obama = ISIS Fanboy)

To: Zeneta

It is a common business model among the high-paid. You have a sub-S corp, rent yourself out to companies and invoice them, and they pay out all the money to yourself as a salary from your sub-S corporation. This allows you to dodge the 2% limitation of business expenses, and deduct your medical insurance as a business expense.

I go out to lunch with a guy like this. We discuss business for five minutes, and then he writes off 50% of the cost of the lunch as a business expense.

To: SeekAndFind

when you give away more then half of what you earn in taxes... it’s not your job anymore.

when you work more then half your life paying taxes... it’s not your life anymore.

you’re just a slave to the progressive machine.

can’t you feel the ‘privilege’ ?

31

posted on

02/09/2016 10:17:05 AM PST

by

sten

(fighting tyranny never goes out of style)

To: proxy_user

Makes no sense to me.

If I invoice said company, there is no reason for them to do any W-9 withholdings. They would rather not be bothered by those paperwork requirements. I could be a Sales guy or a cleaning person and they would be much more inclined to just write a check and call it an expense.

As a Self-Employed person I get the gross amount and can manage my own deductions to off set my tax burden.

32

posted on

02/09/2016 10:30:29 AM PST

by

Zeneta

(Thoughts in time and out of season.)

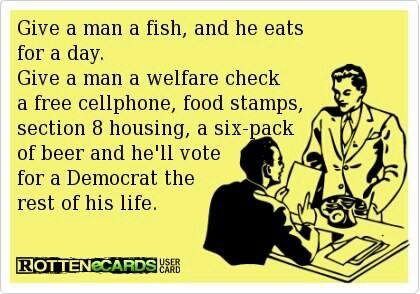

To: All

33

posted on

02/09/2016 10:31:48 AM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Zeneta

“They just run it as an expense item and by not filing they don’t raise any flags.”

As I said, “Of course, people can and do cheat on their taxes.”

If caught, the charge is fraud. For fraud, they can go back any number of years, and the fines are heavier. And the limit for self-employment tax is $400. $600 is when you must issue a 1099 Misc.

“It is a common misconception that if a taxpayer does not receive a Form 1099-MISC or if the income is under $600 per payer, the income is not taxable. There is no minimum amount that a taxpayer may exclude from gross income.

All income earned through the taxpayer’s business, as an independent contractor or from informal side jobs is self-employment income, which is fully taxable and must be reported on Form 1040...

https://www.irs.gov/uac/Reporting-Miscellaneous-Income

34

posted on

02/09/2016 11:19:43 AM PST

by

Mr Rogers

(We're a nation of infants, ruled by their emotion)

Navigation: use the links below to view more comments.

first previous 1-20, 21-34 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson