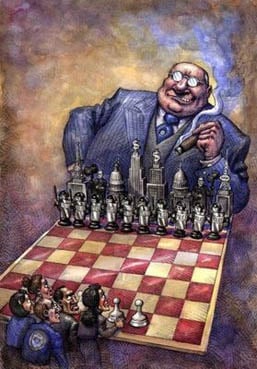

So true. Real Capitalism is as dead ad a door knob in today's manipulated, rigged, and over regulated system.

Posted on 02/05/2016 7:43:20 PM PST by Citizen Zed

Goldman Sachs is questioning everything it knows about capitalism in the wake of a growing debate over the sustainability of corporate profits.

Profit margins are extremely high, mirroring levels seen before the financial crisis of 2008 and the dot-com bubble at the beginning of the century. Today stock buybacks are also happening at record levels, increasing corporate debt.

The S&P 500 has continued to rise and maintain relatively high valuations despite these trends, prompting a Goldman Sachs analyst letter that questions how capitalism in the world is currently operating. Markets have been essentially rewarding corporations that assume more and more debt through stock buybacks, boosting profit margins, reports Bloomberg.

The issue is one of the hottest debates in the financial sector, with bulls arguing that market performance is not necessarily tied to profit margins, while bears maintain that economic rules dictate a major market adjustment in the near term. Goldman Sachs analyzes both arguments, but tends to agree that bearish arguments will eventually come to fruition.

If the market does not experience an adjustment in profit margins however and valuations continue to stay high, something could be fundamentally wrong with our current system of capitalism according to Goldman analysts. Profit margins should follow a pattern where they eventually revert back to a mean historical average, and if they don't, strange forces are at work in global markets, reports Bloomberg.

"We are always wary of guiding for mean reversion," reads the Goldman Sachs analysis. "But, if we are wrong and high margins manage to endure for the next few years (particularly when global demand growth is below trend), there are broader questions to be asked about the efficacy of capitalism."

This poster is TOTALLY representative of the Cruz voter (and the Trump hater.) No clue about the facts involved. This symbolizes the way FR is now. The people insulting and snarking and saying horrible things are totally uninformed.

These Cruzers on FR are totally like those Waters World or Leno man-on-the-street questions, where people can't even answer the most basic questions about government.

Yes, they are whining, afraid for the future as everyone is, but also probably infiltrated by Keynesians or flat out Marxists, a result of leftist education; it is here but was a long time coming. So what do you want Goldman? Alas, special privileges, total control, or just play by your rules? In this case, three out of three ain’t bad...

So true. Real Capitalism is as dead ad a door knob in today's manipulated, rigged, and over regulated system.

Who is John Galt.

Good point!

Don’t worry. The author of the report doesn’t even understand what he wrote.

The capitalist version of socialism

might be summed up as “too big to fail.”

It’s like the Savings and Loan fiasco

of the nineties. By protecting risk takers

from the down side, we only encourage them

to take unnecessary risks because, well,

the taxpayers fix it. With a debt of

almost twenty trillion dollars, that sort

of thinking has to come to an end. The

question is when.

Shock? No, not really. The rotting corpse that still echos the name Goldman Sachs needs to be put out of it's misery like any other zombie. Its kind of like when your fingers or toes turn black from frost bite. You may not want to admit it to yourself but it is time to let them go.

Global Derivatives: $1.5 Quadrillion Time Bomb

$1.5 Quadrillion Derivatives Bomb And The Great Financial Disaster

"Losses Will Be Devastating," Triggering A Derivatives Blowup And Worldwide Collapse

Yeah, that’s what I was referring to.

Too Big Too Fails must turn on each other after they kill off all of the small prey. The next financial crash just commenced. The Goldman squid seems to fear its upcoming cage match to the death with the JP Morgan whale.

They may be right, but only because what Wall Street and D.C. Have been doing isn’t actually capitalism.

As a Bank for International Settlement agent, Janet Yellon enjoys diplomatic immunity. She’s exempt from airport security and can flout common law with diplomatic impunity. She’s neo-Royalty.

So, I bet you $1 that the NASDAQ will go up on Monday. That’s a 90-billion dollar derivative, because they trade $90 billion dollars worth of stock on the NASDAQ every day.

But if you take my bet, the most I can win or lose is still only $1.

That’s why I am buy and hold. Anyone selling now is locking in losses.

They’re not even in the same market. Unlike JPM, Goldman Sacks does not take deposits, offer checking accounts, or make commercial loans.

It was called an honor system, you just simply trusted good folks to do the right thing.

'America is great because she is good. If America ceases to be good, America will cease to be great.'

Same thing with free market capitalism, it's great, works fine...until some greedy pieces of sh t decide they want it all for themselves, there are also those who hated free market capitalism to begin with(like Soros), but saw a way to exploit it's freedoms to enrich themselves while destroying a free market society.

"The only thing necessary for the triumph of evil is for good men to do nothing"

We put too much faith in politicians/court system to stop the vipers...when so many are handpicked BY the vipers to protect their interests, and their interests only.

For the love of money is a root of all sorts of evil, and some by longing for it have wandered away from the faith and pierced themselves with many griefs.

Yep...."a Republic...if you can keep it"....what he said.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.