Posted on 06/23/2013 1:05:52 PM PDT by blam

What Kind of Fools Are Buying Gold?

Commodities / Gold and Silver 2013

June 23, 2013 - 08:55 PM GMT

By: Jesse

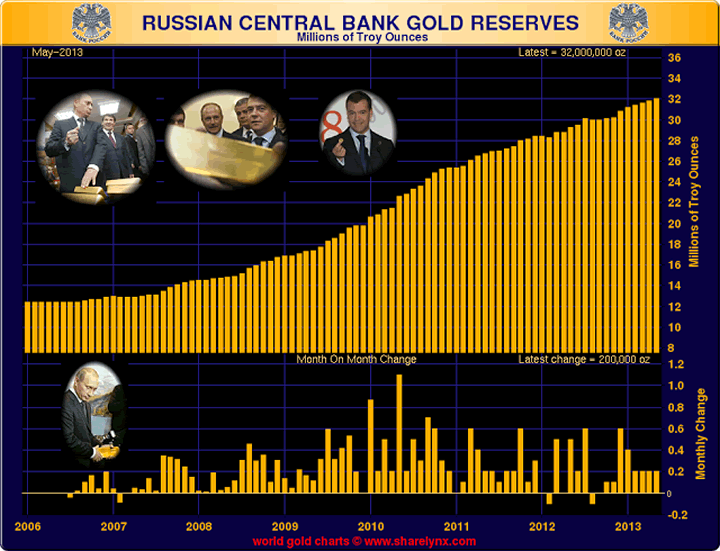

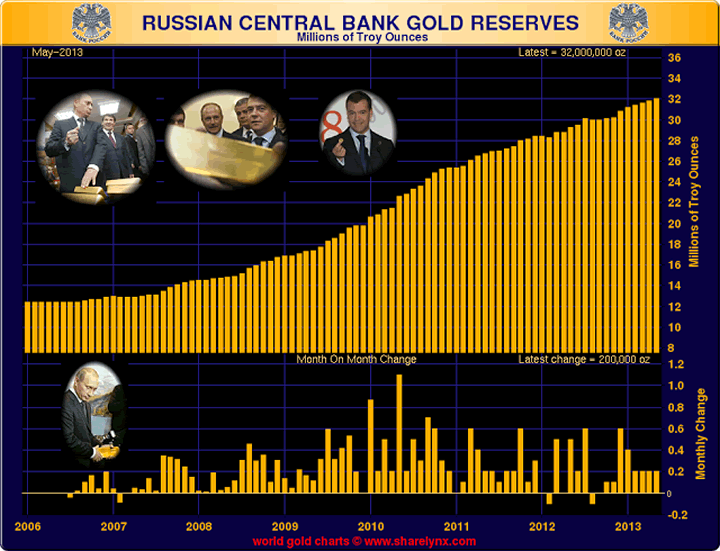

On the whole, the world's central banks are now net buyers of gold, and have been for some time, after being net sellers for over twenty years.

Russia is one example.

Why do you think they are buying it? They don't understand money?

They don't know what they, and some of their associated central banks, are planning to do to recapitalize the deteriorating global financial system and dollar reserve trade regime?

Did they forget to watch CNBC to find out what they really ought to be doing?

I hear that J P Morgan has stealthily gone net long gold now after beating down the price. Would having the biggest banks go long gold and then letting it be revalued higher be one way to recapitalize them? It seems as though recapitalizing them through insider information is the mode du jour.

Silly idea huh? Well that is what the did in 1933. They took the gold out of official circulation, and out of the hands of the people, and then revalued it significantly higher, and used it to recapitalize the remaining banks after purging the insolvent banks during a bank holiday.

The only ones who seem to be saying that gold is not a good investment are the Anglo-American banking cartel and their enablers and supporters. They wish to maintain the confidence, and the buying of their paper which they are selling. But who knows what they are doing for themselves in private.

Such strange times. Such deception and disappointment. One can only wonder.

By Jesse

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

PMs are unencumbered tangible fungible fractionable portable durable liquid insurance.

Buy good scotch and other barterable items. Like quality toilet paper and tobacco.

US oil production increased by 1 million barrels @ day in 2012. Oil production increases in similiar range are expected for the next 4-5 years. Leading to US energy independence.

These are the circumstances that increased US federal government revenues by 200 billion in last year. This reduced federal deficits to an expected 640 billion—with similiar decreases expected for the next several years.

As well rising US oil production decreases the US trade deficit which increases the value of the dollar—which will reduce the cost of oil.

Lower US borrowing and a rising dollar and lower oil costs ...all mean that for the next five years or so the price of gold will go down.

In all seriousness, I hope you are more vigilant and less trusting than your post leads me to believe.

The kind that buy low and sell high.

Anyone that wants to take my gold can’t do it with a click of a mouse button.

You’re dead right that all the fracking is taking place on private lands. And further that the fracking revolution is happening DESPITE every effort of the Obama people. You’re right too that there are plenty of interests out there that would like to throttle the fracking revolution.

Nevertheless the fracking revolution happening now. The fracking revolution is spreading. And its virtually unstoppable.

The only thing that could possibly stop the fracking revolution is price.

That too is well nigh in the cards.

So yeah you’re right about the known unknowns. For example, the Tesla electric car could well expand production exponentially over the next couple years. The guy who leads Tesla —Elon Musk— is in the same league of business leader as Bill Gates or Steve Jobs. So absolutely that is in the cards. Start shifting a million or more cars a year and the demand for oil declines—so does the price.

More directly in the cards is T Boone Picken’s famous Picken plan to shift large vehicles over to natural gas. That is already weaning large numbers of large vehicles off oil.

Electric cars and natural gas vehicles plus higher mpg vehicles plus high gas prices —mean that over the next decade—demand for oil is going down.

Join rising oil production with falling demand and you get lower oil prices.

Fracking oil is expensive. Baaken oil is said to need oil at 80@ barrel to be profitable. Oil prices are likely to fall below 80@barrel sometime in the next two years.

Another large chunk of US oil fracking needs at least 60@barrel to be profitable. I think the price of oil will reach 60@ barrel by 2017 at the very latest.

Oil prices below $60@barrel will seriously reduce US drilling and production—unless drillers can figure out how to bring the cost of production down substantially in the next two years. They’re working on costs and some breakthroughs have already been announced. But its definitely a race against time and the inevitable fall in oil prices.

So its not a sure bet that marginally lower oil prices will substantially slash oil drilling and oil production.

Unfunded US mandate projections : 100 to 200 Trillion.

USA is bankrupt, they just on`t know it yet.

Ergo BRIC and the loss of USD as reserve.

Then the SHTF.

Unfunded US mandate projections : 100 to 200 Trillion.

...........

Yeah true.

But the fracking revolution has created 75-150 trillion dollars worth of new oil to back the dollar.

Look if you’re 60 years or older you’ll remember the 1970’s.

We’re on the reverse side of the 1973 arab oil embargo.

What happened to the price gold and oil over the next seven years. (If you didn’t live through those years...look it up.)

The opposite of those years is what the most likely scenario is for all the reasons I’ve mentioned above.

No, but then again anything you move with the click of a mouse button is also KNOWN to have been moved by said click.

It can also go “poof” at the click of a mouse button...

Well, I took that to mean that, at the current time, gold cannot be easily substituted for dollars.

You simply cannot predict that.

Economics, despite what the currently-stylish schools tell us, is not mathematics. It's more closely related to psychology. Prices are based on billions of people's individual valuations on any given day.

But, we shall see.

For something to think about....ALL “FIAT MONEY” GOES TO ZERO....NO EXCEPTIONS!....gold and silver never have....Do your own DD

(BTW....do you have ANY kind of insurance?...life? health? house? vehicle? etc?)

Excuse me....That should have read.... “Throughout all recorded History” ALL fiat money goes to zero

I have vehicle insurance because the government orders me to do that in order to be on "their" roadways.

I guess I'll be forced to buy health insurance soon for the same reason.

As can your "precious" metals for any number of reasons beyond a mouse click.

Really? Can you point to ANY example of that other than physical seizure by force (in which case it still had value, it was just stolen)? I don’t think so...

Maybe if an evil super-villain irradiates them...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.