Posted on 03/13/2025 5:52:19 AM PDT by Red Badger

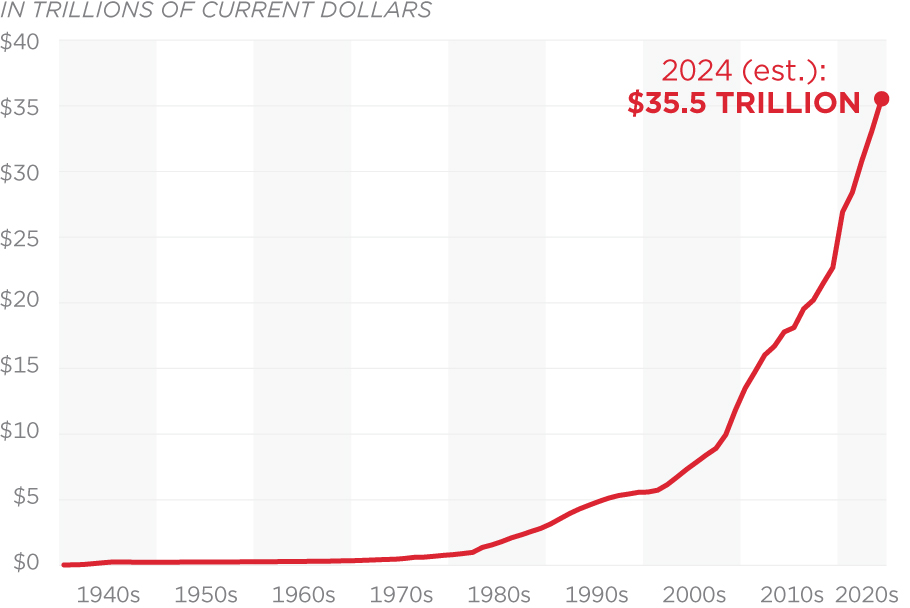

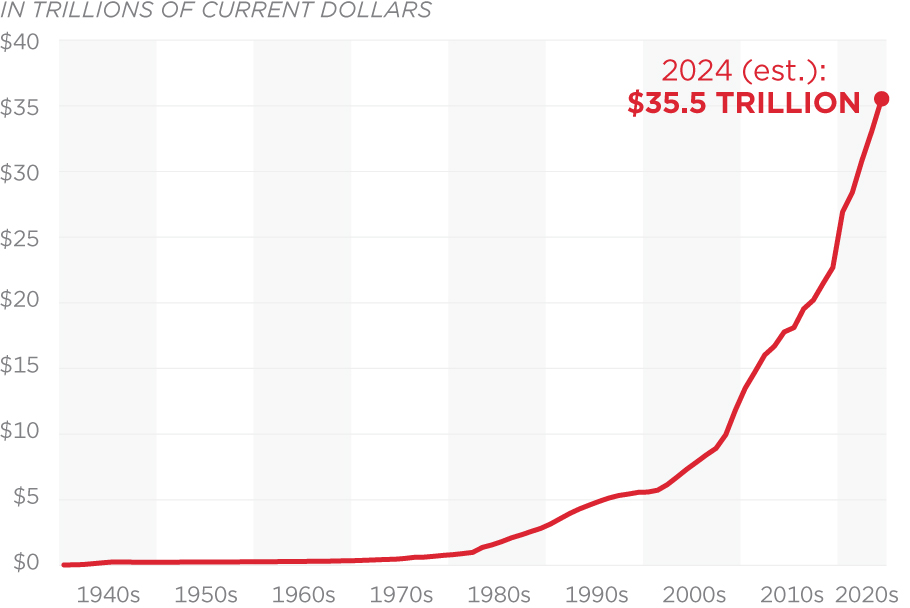

National debt refers to the outstanding financial obligations of a country. The national debt of the United States is what the federal government owes to its creditors.

The U.S. has always carried national debt and the majority of presidents have added to it. However, total national debt has been expanding rapidly since 2008 due to a combination of increased government spending and failure to raise taxes. 1

Key Takeaways

As of January 2025, the U.S. national debt was over $36.2 trillion. 2

Tax cuts, stimulus programs, and increased government spending on defense can cause the national debt to rise sharply.

Looking at the debt-to-gross-national-product ratio of a country shows whether the nation can pay back its debt.

The U.S. periodically hits its debt limit; the ceiling can be raised or temporarily suspended. 3

=======================================================================================

Understanding the National Debt The federal government borrows money to cover outstanding expenses that accumulate over time. Funds for federal spending are mainly generated by collecting taxes on personal and corporate income, payroll earnings, and borrowing.

The government then spends this money on programs such as Social Security, healthcare, education, infrastructure, and national defense. When the government spends less than the revenue collected through taxes, there is a budget surplus. When government spending exceeds its revenue, the result is a budget deficit.

To pay for this deficit, the U.S. Treasury borrows money by issuing Treasury bills, notes, and bonds. These can be purchased by investors, financial institutions such as banks and insurers, the Federal Reserve, and other foreign central banks.

The national debt, which is also referred to as government, federal, or public debt, is made up of this borrowing along with the interest owed to investors who purchased these Treasury securities.

As of January 2025, the U.S. national debt exceeded $36.2 trillion. 2

The Growing National Debt

The U.S. has carried debt since it was founded. In fact, the U.S. accumulated more than $75 million in debt during the Revolutionary War, and that increased to over $2 billion by the end of the Civil War in 1865. 4

Major economic and political events usually trigger an increase in the national debt. Recent events that caused a spike in debt levels include the wars in Afghanistan and Iraq, the Great Recession, and the COVID-19 pandemic. 4 Military spending reached record levels of more than $600 billion during the wars in Afghanistan and Iraq. 5

Government spending on relief measures during times of economic turmoil, such as the Great Recession and COVID-19, also causes an increase in the national debt. For example, former President Barack Obama’s American Recovery and Reinvestment Act (ARRA) was an $831 billion fiscal stimulus aimed at restoring jobs during the 2008 recession. 6

Spending also increased under President Donald Trump during his first term by about 50% from fiscal year 2019 to fiscal year 2021. This was largely driven by tax cuts and COVID-19 relief measures. Those types of moves, along with increased government spending and decreased tax revenue from high levels of unemployment, can generally cause the national debt to rise sharply. 4

Spending decisions made by the president in office also affect the national debt level. A president’s actions to direct government spending toward national defense, healthcare, education, or fiscal stimulus packages can increase debt levels. However, the president can’t always control these decisions as they may be made in response to unforeseen events like a war, pandemic, or recession.

Presidential decisions can also lower the federal deficit and reduce borrowing. For example, the Congressional Budget Office predicts that the Inflation Reduction Act, which was passed in 2022 under former President Joe Biden, could reduce the federal deficit by $58 billion over a decade. 7

End of Fiscal Year Debt (in Billions, Rounded) Major Events by Presidential Term

1929 $17 Market crash

1930 $16 Smoot-Hawley Tariff Act reduced trade

1931 $17 Dust Bowl drought raged

1932 $20 Hoover raised taxes

1933 $23 New Deal increased GDP and debt

1934 $27

1935 $29 Social Security

1936 $34 Tax hikes renewed Great Depression

1937 $36 Third New Deal

1938 $37 Dust Bowl ended

1939 $40 Depression ended

1940 $43 FDR increased spending and raised taxes

1941 $49 U.S. entered World War II

1942 $72 Defense tripled

1943 $137

1944 $201 Bretton Woods Agreement

1945 $259 World War II ended

1946 $269 Truman’s first-term budgets and recession

1947 $258 Cold War

1948 $252 Recession

1949 $253 Recession

1950 $257 Korean War boosted growth and debt

1951 $255

1952 $259

1953 $266 Recession when war ended

1954 $271 Eisenhower’s budgets and recession

1955 $274

1956 $273

1957 $271 Recession

1958 $276 Eisenhower’s 2nd term and recession

1959 $285 Fed raised rates

1960 $286 Recession

1961 $289 Bay of Pigs

1962 $298 JFK budgets and Cuban Missile Crisis

1963 $306 U.S. aids Vietnam; JFK killed

1964 $312 LBJ’s budgets and war on poverty

1965 $317 U.S. entered Vietnam War

1966 $320

1967 $326

1968 $348

1969 $354 Nixon took office

1970 $371 Recession

1971 $398 Wage-price controls

1972 $427 Stagflation

1973 $458 Nixon ended gold standard; OPEC oil embargo

1974 $475 Watergate; Nixon resigns; budget process created

1975 $533 Vietnam War ended

1976 $620 Stagflation

1977 $699 Stagflation

1978 $772 Carter budgets and recession

1979 $827

1980 $908 Fed Chairman Volcker raised fed rate to 20%

1981 $998 Reagan tax cut

1982 $1,142 Reagan increased spending

1983 $1,377 Jobless rate 10.8%

1984 $1,572 Increased defense spending

1985 $1,823

1986 $2,125 Reagan lowered taxes

1987 $2,350 Market crash

1988 $2,602 Fed raised rates

1989 $2,857 S&L Crisis

1990 $3,233 First Iraq War

1991 $3,665 Recession

1992 $4,065

1993 $4,411 Omnibus Budget Reconciliation Act

1994 $4,693 Clinton budgets

1995 $4,974

1996 $5,225 Welfare reform

1997 $5,413

1998 $5,526 Long-Term Capital Management crisis; recession

1999 $5,656 Glass-Steagall Act repealed

2000 $5,674 Budget surplus

2001 $5,807 9/11 attacks; Economic Growth and Tax Relief Reconciliation Act

2002 $6,228 War on Terror

2003 $6,783 Jobs and Growth Tax Relief Reconciliation Act; second Iraq War

2004 $7,379 Second Iraq War

2005 $7,933 Bankruptcy Act; Hurricane Katrina

2006 $8,507 Bernanke chaired Fed

2007 $9,008 Banks crisis

2008 $10,025 Bank bailouts; quantitative easing (QE)

2009 $11,910 Bailout cost $250 billion; American Recovery and Reinvestment Act (ARRA) added $242 billion

2010 $13,562 ARRA added $400B; payroll tax holiday ended; Obama tax cuts; Affordable Care Act; Simpson-Bowles debt reduction plan

2011 $14,790 Debt crisis, recession, and tax cuts reduced revenue

2012 $16,066 Fiscal cliff

2013 $16,738 Sequester; government shutdown

2014 $17,824 QE ended; debt ceiling crisis

2015 $18,151 Oil prices fell

2016 $19,573 Brexit

2017 $20,245 Congress raised the debt ceiling

2018 $21,516 Trump tax cuts

2019 $22,719 Trade wars

2020 $26,945 COVID-19 and recession

2021 $28,428 COVID-19 and American Rescue Plan Act

2022 $30,928 Inflation Reduction Act

2023 $33,167 Rising interest rates

2024 $35,464 Credit rating downgrade

Source: U.S. Treasury 8

[MORE DETAILS AT LINK................]

Reminder: the Dims told us over and over and over that Clinton deserves credit for balancing the budget. But these numbers show the debt increasing during the 1990’s. Just sayin’.

It took 211 years as a nation (until 1987) to accrue total U.S. government debt of $2.4 trillion.

Now we add $2.4 trillion to the government debt EVERY freaking year.

Balancing the Budget merely indicates that the Spending and Income are approximately equal.

The National Debt would keep growing because of interest and sales of Bonds...............

And the last time the national debt actually decreased was 1957. Hey, it’s only money.

I saw that too. Lies all around.

Sh!+ is cray cray.

Things are bad but remember none of thes figures are adjusted for inflation.

This is the real hockeystick.

No fake formulas needed. Just pure unadulterated contempt for future Americans.

It started in 2008, when government decided banks and car companies had to be propped up, and the attack on the people went on steroids in 2000.

2020*

Thirty Five TRILLION

Is

Thirty Five Thousand BILLION..............

Is

Thirty Five MILLION MILLION.............

When one couples in corporate debt, credit card debt, and all other streams of government debt from cities, counties, school districts and states, it seems too many have become addicted to thinking debt is a "manageable" thing. It is a cancer, in the long run.

The comments so far on this thread indicate we are a company of people with ever more growing awareness of this.

The Debt cannot be left to keep growing.

The day of reckoning must come, and it will, whether we want it to or not.................

Agreed. It is a stunningly simple math problem placed in front of so many innumerate people these days.

Personally, I expect some form of collapse, and given the state of debt all across the world, it will be an interlocking collapse, probably an abrogation of debt which will find the massively wealthy most affected. The average Joe with no debt will be comparatively unaffected.

That is exactly what will happen.

The rich and powerful will fall from the highest point to the lowest.

The poor and and the powerless won’t fall anywhere because they are already at the bottom.............

House controls the purse - so it was Newt and Republicans that created last balanced budget (not Clinton) - and it was the Reagan peace dividend that made it possible.

Since then, imbeciles have ruled the roost.

But loving Bessent as new Treas. Sec

On October 23, 1981, America’s national debt crossed the $1 trillion mark. It was an unprecedented, staggering, and earth-shattering figure. President Reagan was merely nine months into his presidency, presiding over an economy in turmoil after years of the reckless “reluctant Keynesian” economic policies of the preceding Carter Administration.

https://budget.house.gov/press-release/not-so-happy-anniversary-forty-two-years-ago-today-the-national-debt-crosses-the-1-trillion-mark

Reagan Sets $1-Trillion Budget Plan : Pledges to Battle Democrats Over Record Spending

By JAMES GERSTENZANG

Jan. 4, 1987 12 AM PT

https://www.latimes.com/archives/la-xpm-1987-01-04-mn-2058-story.html

“We don’t have a trillion-dollar budget because we haven’t taxed enough. We have a trillion-dollar debt because we spend too much.”

-Ronald Reagan

"He has filled the hungry with good things; and the rich he has sent empty away. "

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.