Posted on 06/27/2022 4:27:16 PM PDT by blam

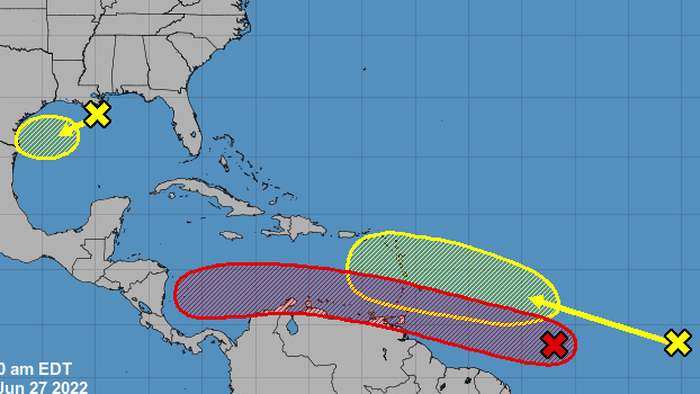

Three tropical disturbances are being closely monitored for development in the Atlantic as fears mount that above-average storms could wreak havoc on oil/gas operations in the Gulf of Mexico and send gas prices at the pump to “apocalyptic” heights.

“The lull in the tropics has come to an end as we’re now watching three different areas for development from the Gulf of Mexico to the central Atlantic,” The Weather Channel reports.

The first system is an area of low pressure in the northern Gulf of Mexico and is expected to track westward early this week and could dump heavy rains along with parts of the Texas coast. Even though the storm has low probabilities of formation over the next 2-5 days, the system is situated near the Gulf Coast (PADD 3), which has the highest concentration of US refineries.

The second is a disturbance located 900 miles east-southeast of the southern Windward Islands and has a 70% chance of cyclone formation in 2 days with probabilities at 90% for five days. Called Invest 94L, the storm is expected the strengthen as it enters the Caribbean Sea this week. Behind Invest 94L is a tropical wave with a 20% probability of developing into a storm over the next five days.

The elevated tropical activity comes as OPIS energy analysis global head Tom Kloza told Fox Bussiness,” if we have an active tropical season” that impacts domestic refining efforts in the Gulf of Mexico, then it could send gas prices to “apocalyptic” heights.

“I think for gasoline, we go back above $5 and apocalyptic numbers come into play with hurricanes.

“The thing that people have to watch and is really insidious for inflation are the values for diesel and jet fuel. Stocks of those fuels are not building, they’re tight internationally and that’s where we’re going to have to pay the piper in the last 100 days of the year,” Kloza said.

Tropical activity in the Gulf can shutter offshore drilling rigs and onshore refining operations. And given today’s extremely tight refining capacity and a bulk of the nation’s refineries are situated on the Gulf Coast, we “have to cross our fingers that no refining infrastructure gets damaged by hurricanes or by the electric grid,” Kloza said.

Ahead of the hurricane season, which began on the first of June, Bloomberg Markets’s Jake Lloyd-Smith warned about the consequences of an active hurricane season and how it could severely disrupt refinery operations.

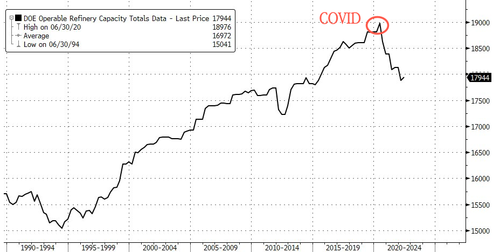

Everyone, including the Biden administration, has figured out that the bottleneck in refining is the culprit behind soaring diesel and gasoline prices. The US is structurally short and down 1 million barrels from April 2020 to 17.95 million bpd as of June.

All it would take is one (or multiple) major hurricanes with direct landfall on the Gulf Coast (or PADD 3) to send fuel prices at the pump even higher

You have been around long enough to know that personal attacks are inappropriate in this forum. Beyond that, blam has been around here much longer than you, and he has earned his creds through posting consistently reliable info through the years.

Furthermore, blam offers words of wisdom here as a gentle reminder for those of us living in hurricane alley. In case you haven't been paying attention, a whole lot of people have been moving into conservative hurricane-prone areas over the past few years as they escape liberal locales. These transplants to hurricane country are typically unprepared for the silly season.

In summary, Grasshopper, you chose the wrong Freeper to attack, and you lack comprehension of the subject addressed.

That was a nice way of saying you are ignorant here. Crawl back into your hole.

Here are my 22+ year stats:

You've posted a total of 19,214 threads and 98,069 replies.

"Tropical activity in the Gulf can shutter offshore drilling rigs and onshore refining operations.

And given today’s extremely tight refining capacity and a bulk of the nation’s refineries are situated on the Gulf Coast,

we “have to cross our fingers that no refining infrastructure gets damaged by hurricanes or by the electric grid,” Kloza said.

Ahead of the hurricane season, which began on the first of June, Bloomberg Markets’s Jake Lloyd-Smith warned

about the consequences of an active hurricane season and how it could severely disrupt refinery operations.

Everyone, including the Biden administration, has figured out that the bottleneck in refining is the culprit behind soaring diesel and gasoline prices. (Emphasis mine)

The US is structurally short and down 1 million barrels from April 2020 to 17.95 million bpd as of June.

All it would take is one (or multiple) major hurricanes with direct landfall on the Gulf Coast (or PADD 3) to send fuel prices at the pump even higher "

Current gulf / tropic activity poses no threat in the very short term. However, the nasty buggers can develop quickly under the right conditions. I’m concerned about the second half of the season where many major storms habitat. Just another stack of wood on the current energy shortage fire.

It takes a short memory to underestimate the precarious energy situation facing the U.S. these days. Recall May 7-13, 2021 when the Colonial Pipeline software was hacked. 45% of gasoline, diesel, home heating oil, jet fuel, and military supply fuel from Texas to New York was shut down.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.