Target Crashes After Cutting Profit Outlook For 2nd Time In Two Weeks Due To Excess Inventory

Posted on 06/07/2022 6:07:40 AM PDT by blam

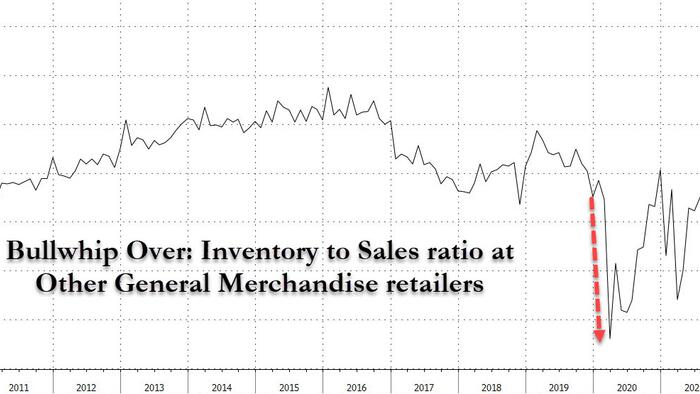

It was a relatively quiet session for stocks with futures trading modestly lower overnight as yields eased their Monday surge and when the biggest news was Australia’s unexpected 50bps rate hike (double consensus) before all hell broke loose at 7am, when Target cut guidance for the second time in two weeks due to the infamous bullwhip effect we had warned about just a few weeks ago, sending TGT stock crashing more than 9% and encouraging the cold risk-off wind that pushed S&P futures 0.8% lower to session lows around 4,080…

… while Nasdaq 100 futures fell 1% as Treasury yields hovered around 3.05%, their highest in nearly a month. Europe’s Stoxx Europe 600 Index slipped as telecom and technology stocks weighed.

In the premarket, shares of Target tumbled as much as 10% after the retailer cut its profit outlook for the second time in three weeks amid an inventory surplus. The news sent retailers such as Walmart and Costco also sliding premarket; WMT was down as much as 4.3% ahead of the bell, COST -2.9%, Kroger -1.3%, Macy’s -3%. Among other notable movers, cryptocurrency-exposed stocks tumbled in premarket trading as Bitcoin slid back below $30,000. Meanwhile Kohl’s shares rose 12% in premarket trading as the company holds exclusive talks with Franchise Group regarding a deal that would value the retail chain at about $8 billion. Here are some other notable premarket movers:

◾Cryptocurrency-exposed stocks decline in premarket trading as Bitcoin slides back below $30,000, with another attempt at upward momentum losing traction amid risk-off markets. Riot Blockchain (RIOT US) -5%, Marathon Digital (MARA US) -3.7%.

◾Kohl’s (KSS US) shares jump 12% in US premarket trading as the company holds exclusive talks with Franchise Group regarding a deal that would value the retail chain at about $8 billion.

◾Peloton’s (PTON US) shares rose 1.4% in US after-hours trading on Monday. Former vice president of Amazon Web Services Liz Coddingtonis “well-positioned” to help Peloton in its next stage of growing subscribers, Citi says, after the exercise machine maker appointed Coddington CFO.

◾Gitlab (GTLB US) shares rose 9.8% in postmarket trading on Monday after the software company’s first-quarter report.

◾HealthEquity (HQY US) shares climbed 5.8% in postmarket Monday. It boosted its revenue guidance for the full year as its results beat the average analyst estimate in what RBC analyst Sean Dodgesaid could be the start of a years-long upside driven by rising interest rates.

◾ProFrac (PFHC US) shares could be active after analysts initiated coverage of oil services firm with three overweight ratings and one buy, with both Piper Sandler and Morgan Stanley positive on the company’s valuation and vertical business model.

◾Veru Inc. (VERU US) gained 2.8% in postmarket trading after Tang Capital Partners LPdisclosed a 5.2% passive stake in the firm.

On Monday, investors once again sold the rip, showing their reluctance to take on risk amid fears policy to subdue inflation will go overboard and kill off economic recoveries, rather than cooling off price pressures in a so-called soft landing.

“This debate around ‘are we going to see a recession, are we going to see a soft landing?’ — that’s really keeping markets relatively range bound,” Laura Cooper, a senior investment strategist at BlackRock Inc., said in an interview with Bloomberg TV. “We likely need to see a dovish pivot from policymakers to really have conviction that we’re going to a sustained rally in equities.”

Rising bond yields are adding to worries about risks to economic growth as central banks ratchet up policy tightening. US benchmark Treasury yields stabilized near 3%, a psychological threshold that may burden new supply due this week before crucial inflation data.

“The combo of declining growth, rising rates and falling liquidity is pretty ugly for equities,” said James Athey, investment director at abrdn. “Reluctant as investors in those market are to admit, the outlook for multiples and earnings isn’t great and is probably getting worse.”

Meanwhile, Friday’s CPI reading for May will be crucial for clues on the Federal Reserve’s pace of monetary tightening, especially the clothing and apparel component where we expect prices to plunge amid the inventory liquidation. Strong hiring data last week already cleared the way for the central bank to remain aggressive in its fight against inflation by raising interest rates. Higher rates particularly hurt growth sectors that are valued on future profits, like tech.

In Europe, the benchmark Stoxx 600 Index also resumed losses on Tuesday led by drops of more than 1% in technology and travel shares. European equities traded poorly with several indexes giving back over half of Monday’s gains. Euro Stoxx 50 drops as much as 0.8%, cash DAX underperforming at the margin. Tech, retail and telecoms are the weakest Stoxx 600 sectors. FTSE 100 trades flat. The European Central Bank on Thursday is set to end trillions of euros of asset purchases and cement a path to exiting eight years of negative interest rates.

Earlier in the session, Asian stocks declined with chipmakers coming under pressure as traders reassessed the outlook for demand, offsetting Japan’s boost from a weak yen. The MSCI Asia Pacific Index dropped as much as 1.2%, with TSMC and Samsung Electronics the biggest drags. Most sectors traded lower, while some Chinese internet giants and Japanese automakers were among the notable gainers. Tech hardware stocks fell as worries about demand for handsets and other gadgets outweighed hopes for a recovery in China on the easing of Covid lockdowns. South Korean equities dropped as the market reopened after a holiday, while shares in Australia slumped after the Reserve Bank of Australia blindsided the market with an outsized hike to combat rising costs. The RBA responded to price pressures with its biggest rate increase in 22 years — predicted by just three of 29 economists — and indicated it remained committed to “doing what is necessary” to rein in inflationary pressures.

There are persistent worries about demand for semiconductors as the market consensus is that a demand slowdown for handsets and other consumer electronics is highly likely,” said Lee Jinwoo, chief strategist at Meritz Securities in Seoul. Most Chinese tech stocks finished lower in volatile trading after climbing Monday following a report that regulators are concluding their investigation of transport firm Didi. Japanese shares rose as the yen weakened to its lowest level in two decades, boosting exporters such as Toyota and Honda. Read: Yen Slides to Two-Decade Low, Reigniting Focus on Intervention Asian stocks are down in June after posting their first monthly gain in five months in May. Traders will be assessing the inflation and growth outlook ahead of the Federal Reserve’s meeting next week while monitoring the state of Covid restrictions in China. “Stock market valuations have de-rated quite significantly and from our perspective, there is a lot of the bad news largely in the price. Possibly there’s more to go,” Chetan Seth, Asia Pacific equity strategist at Nomura Holdings said at a conference in Singapore

In FX, Bloomberg dollar spot rises as much as 0.4% and the dollar was steady or higher against all of its Group-of-10 peers; NOK is the weakest G-10 performer. JPY softness extends, briefly trading at 133/USD. The yen extended its slump to a fresh 20- year low near 132.60/USD as BOJ’s Kuroda continued to emphasize persistent easing commitment. Senior Japanese government officials said they were closely watching currency markets with a sense of urgency Tuesday as they returned to a heightened state of alert following a renewed slide in the yen to fresh two-decade lows. The dollar’s steep rally to the 133 handle versus the yen and the Australian central bank’s biggest rate hike in 22 years make the case for long-volatility exposure in the major currencies and traders follow suit. The pound fell to an almost three-week low versus the greenback before paring losses to trade around $1.25. The gilt yield curve bull flattened. The euro was little changed, trading around $1.07. Bunds and European bonds reversed opening losses even as wagers earlier crossed half the way toward calling a historic half-point.

In rates, treasuries swung from losses to gains, sending yields as much as 3bps lower as the yield curve flattened. Treasury futures rose led led by the long-end amid weakness in European stocks and S&P 500 futures.Bloomberg notes that gains were helped by block trade in 10-year note futures as cash yield eases back toward 3%. US yields were richer by nearly 3bp across long-end of the curve, flattening 2s10s, 5s30s by ~1bp; 10-year, down ~2bp to 3.02%, outperforms bunds slightly, while gilt is little changed. German bunds outperform, richening ~3bps from the 5y point out, gilts are relatively quiet. Peripheral spreads are slightly tighter to core, semi-core widens a touch. Australian bond yields soared and the Aussie briefly reversed a loss after the central bank surprised investors by raising its cash rate by 50 basis points — the biggest increase in 22 years — to 0.85%, a result predicted by just three of 29 economists. It also committed itself to “doing what is necessary” to rein in inflationary pressures.

In commodities, crude futures drift higher with WTI near $120 and Brent back around $122. Spot gold adds ~$6 to near $1,847/oz. Base metals are in the red with LME nickel down over 3%.

Bitcoin is pressured and back below the USD 30k mark and incrementally below last week’s trough of USD 29.04k.

Looking to the day ahead now, and data releases include German factory orders for April, the final UK services and composite PMI for May, as well as the US trade balance and consumer credit for April. Otherwise central bank speakers include the ECB’s Wunsch.

Market Snapshot

◾S&P 500 futures down 0.4% to 4,106.00

◾STOXX Europe 600 down 0.4% to 442.31

◾MXAP down 0.9% to 167.50,br> ◾MXAPJ down 1.1% to 552.94

◾Nikkei up 0.1% to 27,943.95

◾Topix up 0.4% to 1,947.03

◾Hang Seng Index down 0.6% to 21,531.67

◾Shanghai Composite up 0.2% to 3,241.76

◾Sensex down 1.2% to 55,018.56

◾Australia S&P/ASX 200 down 1.5% to 7,095.74

◾Kospi down 1.7% to 2,626.34

◾Brent Futures up 0.3% to $119.88/bbl

◾Gold spot up 0.1% to $1,843.79

◾U.S. Dollar Index up 0.10% to 102.54

◾German 10Y yield little changed at 1.30%

◾Euro little changed at $1.0694

Top Overnight News,br> ◾The ECB will begin a new era of monetary policy this week as officials complete their pivot to confront the threat of inflation running out of control. Armed with new forecasts and with prices rising at a record pace, President Christine Lagarde and her colleagues will end trillions of euros of asset purchases and cement a path to exiting eight years of negative interest rates

◾The yen has tumbled to a two-decade low against the dollar, caught in the crossfire between the two wildly different monetary policy regimes in Japan and the US. The Bank of Japan is pinning interest rates to zero in a bid to boost a sputtering economy and spur price growth, while the Federal Reserve is hiking furiously to beat back raging inflation

◾Investors from Tokyo to New York are betting on further weakness in Japan’s currency, which is already wallowing at a two-decade low against the greenback.

◾Bank of Japan Governor Haruhiko Kuroda walked back some of his comments that consumers are now more willing to accept higher prices after criticism on social media and a grilling in parliament

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded cautiously amid recent upside in yields and ahead of upcoming risk events. ASX 200 declined with losses exacerbated after the RBA delivered a larger-than-expected rate hike. Nikkei 225 swung between gains and losses although a weak JPY boosted the index above 28k. Hang Seng and Shanghai Comp. were varied as the mainland was kept afloat by reopening optimism and with Hong Kong subdued by property names, although tech benefitted from hopes Beijing may be easing its crackdown on the sector with China reportedly to conclude the cybersecurity probe into certain companies.

Top Asian News

◾China’s Tianjin city reopened all subway stations that were closed due to COVID, while Shanghai Port’s daily volume rose to 95% of the normal level, according to local press.

◾Labor Advisory Committee urged US President Biden to extend China tariffs, according to Axios.

◾Japan set up a team to monitor land sales near bases and nuclear plants or on strategically located islands under a new law designed to prevent hostile foreigners from affecting national security, according to Nikkei. ◾RBA hiked rates by 50bps to 0.85% (exp. 25bps increase) and said inflation in Australia has increased significantly, while it is committed to doing what is necessary to ensure that inflation in Australia returns to the target over time. RBA added that inflation is likely to be higher than was expected a month ago and the Board expects to take further steps in normalising monetary conditions over the months ahead with the size and timing of future interest rate increases to be guided by the incoming data and the assessment of the outlook for inflation and the labour market. Furthermore, it noted the Australian Economy is resilient although one source of uncertainty about the economic outlook is how household spending evolves, given the increasing pressure on Australian households’ budgets from higher inflation.

◾Japan’s Economy Minister Yamagiwa says they are closely watching any impact of FX movements on the economy, wants to refrain from commenting on FX levels, via Reuters.

European bourses are modestly pressured, Euro Stoxx 50 -0.9% , with newsflow relatively limited once more and participants looking ahead to the week’s risks events. Stateside, performance is in-fitting with this directionally, though marginally more contained in terms of magnitudes, with a limited US docket ahead; ES -0.5%. EU lawmakers have come to an agreement on a single mobile charging point, via Reuters; will be USB-C by fall-2024.

Top European News

◾UK PM Johnson won the confidence vote, as expected, with total votes at 211 vs 148, according to Reuters. However, the Telegraph highlights that Johnson is not “out of the woods yet” given that he has lost the support of so many backbenchers.

◾UK PM Johnson said he is grateful for colleagues’ support and that they need to come together as a party now. PM Johnson added that they can now focus on what they are doing to help people in the country and have a chance to continue strengthening the economy, while he responded that is certainly not interested when asked about a snap election, according to Reuters.

◾Subsequently, the 1922 Committee is, according to the understanding of UK MP Ellwood, looking at altering party rules to allow another no-confidence vote within a one-year period, via Sky’s Degenhardt.

◾Barclaycard UK May consumer spending rose 9.3% Y/Y, which reflected the rising cost of living and base effects, according to Reuters.

FX

◾Dollar takes time out after rallying further on yield factors and frailty of others, DXY midway between 102.830-450 range.

◾Yen continues to underperform on rate and relative BoJ policy dynamics, with Franc also feeling the heat from SNB vs Fed, ECB etc policy divergence; USD/JPY touches 133.00 before easing back, USD/CHF tops 0.9675 and EUR/CHF crosses 1.0400.

◾Kiwi hit by abrupt turnaround in AUD/NZD tide after RBA exceeded market expectations with a 50bp hike compounded by hawkish guidance; NZD/USD sub-0.6500 around 0.6450, AUD/NZD above 1.1100 and AUD/USD within sight of 0.7200.

◾Sterling volatile after PM Johnson wins confidence vote, but significant minority of Conservative Party want him out; Cable choppy either side of 1.2500 and EUR/GBP whipsaws around 0.8550.

◾Loonie softer with oil ahead of Canadian trade data and Ivey PMIs, USD/CAD near 1.2600 after probe beyond round number.

◾Lira continues to slide after Turkish President Erdogan repeats intention to keep cutting rates irrespective of ongoing rise in inflation, USD/TRY tests 14.7500.

Fixed Income

◾Firm bounce in bonds following extension of bear run to new cycle lows.

◾Bunds lead the way in core debt circles with a near full point recovery to 149.80, while BTPs remain to the fore at the margins between 121.27-122.86 bounds.

◾Gilts flat after falling short of 115.00 before solid 2025 DMO auction, T-note a tad firmer and curve flatter for choice ahead of 3 year sale.

Commodities

◾Crude benchmarks have waned from initial upside stemming from bullish bank commentary amid a broader easing in risk sentiment.

◾Thus far, WTI and Brent have been as low as USD 117.76/bbl and USD 118.62/bbl respectively, circa. USD 2.00/bbl from initial highs.

◾Goldman Sachs hiked its Q3 Brent oil forecast to USD 140/bbl from USD 125/bbl and increased its Q4 forecast to USD 130/bbl from USD 125/bbl.

◾Morgan Stanley’s base case view is for Brent to reach USD 130/bbl during Q3 with an upside to the bull case estimate of USD 150/bbl.

◾Spot gold languished near the prior day’s lows amid a firmer greenback.

◾JPMorgan continues to see gold trading softer towards USD 1,800/oz in Q3 2022 on an expected rebound in investor risk sentiment and continued push higher in US yields.

◾Spot gold is firmer but capped by USD 1850/oz, which now coincides with its 10-DMA, after losing the level late on Monday; base metals are generally pressured, amid risk aversion and following yesterday’s price action.

US Event Calendar

◾8:30am: Revisions: Trade Balance

◾8:30am: April Trade Balance, est. -$89.5b, prior -$109.8b

◾3pm: April Consumer Credit, est. $35b, prior $52.4b

DB’s Jim Reid concludes the overnight wrap

Yesterday I published the 24th Annual Default Study. While nothing much will change for the remainder of 2022, we think we might be coming to the end of the ultra-low default world we’ve discussed so much in previous editions. First, we will likely have a cyclical US recession to address in 2023, and after that, a risk of the reversal of trends that have made the last 20 years so subdued for defaults.

We see US HY defaults peaking at just over 10% in 2024 with Europe just under 7% helped by a higher BB weighting. After that we see many of the trends of the last couple of decades reversing, helping to leave the ultra-low default era behind. You can read all about this in the note but these factors include: higher structural inflation, less ability for central banks to be as aggressive across all fixed income – they will be forced to pick their battles (eg Peripherals), less global FX reserve accumulation, a turn up in the free float of global government bonds, higher term premium, a structural fall from peak corporate profits, and shorter gaps between recessions. None of this need be a disaster just a change in the long-term trend. Clearly our view relies a lot on inflation being sticky and helping set off a 2023 recession and then remaining sticky after this, and thus changing the landscape of the last 20 years. If we’re wrong on both, the ultra-low default world will survive. See the report here.

The biggest story yesterday was a surge in yields but before we get there, a big curiousity to those of us in the UK, albeit with very limited implications for global markets, was the confidence vote last night for Prime Minister Boris Johnson from within his own party. That came after the threshold of 15% of his own MPs called for a vote, and the final result saw him win by just 211-148, meaning that 41% of his own party’s MPs voted against him. For reference, that’s more than the 37% of MPs who voted against his predecessor Theresa May in a similar vote in December 2018, and it was only 5 months later that she announced her resignation after failing to deliver Brexit and witnessing a dramatic turn in the Conservatives’ poll ratings. The next big hurdle for Johnson will likely be two by-elections on June 23rd, one of which is in a “Red Wall” seat that the Conservatives gained off Labour for the first time in decades to win their majority at the last election, whilst the other is in a traditionally safe Devon seat for the Conservatives but where the bookmakers have the Liberal Democrats as the favourite to win. So bad showings in those two would keep questions about Johnson’s leadership in the headlines and further intensify the pressure on him. In theory the Conservative leadership rules give him another year before a repeat confidence vote can happen, but history tells us that once this process gets set in motion it is incredibly difficult to reverse the negative momentum, and both Theresa May and Margaret Thatcher resigned well within a year even though they also won a majority of their own MPs at the confidence vote. Sterling actually climbed around +0.5% in the morning as the vote was officially triggered before giving back half these gains as the day progressed. However even after the surprise result at 9pm last night Sterling didn’t move, and this morning it’s just -0.09% lower, trading at 1.252 against the US dollar.

Back to the main event, which was the global rates sell-off, where 10yr Treasury yields poked back up above 3% for the first time in nearly a month, whilst European yields hit fresh multi-year highs of their own ahead of this Thursday’s ECB meeting. There’ve been a couple of catalysts behind those moves higher, but a key one over the last week and a half has been the perception that near-term recession risks (at least in 2022) are fading back again, which in turn is set to give central banks the space to continue hiking rates and thus take bond yields higher. On top of that, the fact that recent inflation data has proven stickier than expected has also pushed yields higher, and investors are eagerly awaiting to see if we get another upside surprise from the US CPI reading out on Friday.

All-in-all, those moves sent the 10yr Treasury yield up by +10.3bps yesterday to 3.04%, with a rise in real yields of +8.3bps behind the bulk of the move. That came as investors dialled back up their bets on Fed tightening over the rest of the year, with the implied rate by the December FOMC meeting at a 1-month high of 2.85%, whilst the rate priced in by the Feb-2023 meeting went back above 3% for the first time in a month as well. But it was in Europe where there were even more significant milestones, with the amount of ECB rate hikes priced in by December exceeding 125bps for the first time, meaning that markets are fully pricing in at least one 50bp hike by year-end, assuming the ECB begins liftoff at the July meeting.

That prospect of a 50bp hike from the ECB sent yields on 10yr bunds up +4.9bps to 1.32%, which is their highest level since mid-2014, whilst the German 2yr yield (+3.0bps) hit its highest level since 2011. It was a similar picture elsewhere on the continent, with yields on 10yr OATs (+4.1bps) at a post-2014 high, and those on 10yr BTPs (+1.3bps) at a post-2018 high. Gilts underperformed however, with 10yr yields up +9.2bps as investors moved to price in at least one 50bp hike from the BoE by year-end.

Those moves have gained further momentum overnight after the Reserve Bank of Australia hiked rates by a larger-than-expected 50bps, helping 10yr Treasury yields to rise a further +1.9bps this morning to hit 3.06%. Their statement also pointed to further tightening ahead, and said that they expect “to take further steps in the process of normalizing monetary conditions in Australia over the months ahead”, and that they were “committed to doing what is necessary to ensure that inflation in Australia returns to target over time.” Unsurprisingly, the Australian dollar is also the top-performing G10 currency this morning, up +0.50% against the US Dollar.

The strong rise in bond yields wasn’t enough to stop equities from posting a decent start to the week, although they did pare back their initial gains following the US open. By the close, the S&P 500 (+0.31%) had held onto a broad-based advance, with 8 of 11 sectors advancing, even after paring back gains as high as +1.5% in the morning. Tech stocks fared slightly better than the broader index, with the NASDAQ gaining +0.40%. The clearest split was between mega- and small-cap shares, as mega-cap shares were clear outperformers as the FANG+ Index ended the day +1.68% higher while the small-cap Russell 2000 (+0.36%) lagged behind. It was much the same story in Europe too, where the STOXX 600 (+0.92%), the DAX (+1.34%) and the CAC 40 (+0.98%) all moved higher as well.

Whilst equities were making further gains, there wasn’t much respite on the inflation side since commodities continued their advance, with Bloomberg’s Commodity Spot Index (+1.86%) hitting a fresh record on the back of the latest moves. Admittedly, Brent Crude (-0.18%) and WTI (-0.31%) oil prices fell back slightly, and we also saw European natural gas prices (-1.75%) fall to their lowest levels since Russia’s invasion of Ukraine began. But US natural gas prices surged another +8.37% to a fresh post-2008 high, whilst agricultural goods also saw some serious movements, with futures on corn (+2.13%), wheat (+5.10%) and sugar (+1.40%) all rising on the day. This morning we’ve seen even further momentum behind commodity prices, with Brent crude moving back above the $120/bbl mark thanks to a +0.69% gain.

Overnight in Asia, equity markets have put in a pretty mixed performance as they grappled with that monetary tightening mentioned above. The Nikkei (+0.51%), the CSI 300 (+0.65%) and the Shanghai Comp (+0.48%) have all moved higher, but the Hang Seng (-0.12%) has posted a marginal decline and the Kospi (-1.37%) has lost significant ground. Meanwhile in Australia, the S&P/ASX 200 has deepened its loses since the RBA’s hawkish decision, and is currently down -1.63%, whilst futures in the US are also pointing lower, with those on the S&P 500 down -0.59% this morning. On the FX side, we’ve also seen the Japanese Yen fall to a 20-year low against the US Dollar of 131.88 by the close yesterday, and this morning it’s lost further ground to hit 132.86. That comes as the BoJ stands out among its global peers in not tightening policy, which is leading to a widening interest rate differential as other central banks continue hiking.

Finally we started on credit so let’s end there too before the day ahead preview. Our colleagues in the European Leveraged Finance Research team have just published their quarterly top trade ideas. You can find the report here.

To the day ahead now, and data releases include German factory orders for April, the final UK services and composite PMI for May, as well as the US trade balance and consumer credit for April. Otherwise central bank speakers include the ECB’s Wunsch.

Lots of meat in that report.

When you declare war on the fossil fuel industry, make all forms of energy scarce and expensive and continue to print trillions of paper dollars, subsidize and encourage non productivity you get a real contraction of the economy and inflation. Eventually even the speculators on Wall Street begin to understand reality.

(TARGET is not taking any more supply items as they are swamped with inventory and need to get rid of it BEFORE fall buying season)

It’s transitory. And the economy is doing great.

Chocolate rations go up next week by 25 grams.

TGT had its clock cleaned stock-price wise circa May 20 by appx 25%; that they are doing it again, more, is somewhat surprising. (no position in TGT)

“TGT had its clock cleaned stock-price wise circa May 20 by appx 25%; that they are doing it again, more, is somewhat surprising. (no position in TGT)”

Up 50% since 2019.

Well...I’m on my way to Costco to buy three more months worth of dry dog food while I can still afford it.

Yeah, they had a spectacular runup over the past few years that I surely wish I was in on. I advise a pretty wealthy guy on an informal basis wrt stocks; Trees not growing to the sky, we are trying to scrape off some big winners of which I’ve produced a few. He has a hard time selling juicy winners. I screamed at him for months to sell or hedge Boeing up well over 400, no go.

Back in the day ....

A friend living on a boat with about $300k + boat + small farm invested in Israeli tech.

His goal was to buy new boat, about $350k.

Soon he was looking at a $1.5 million boat as his stocks were worth over $6 million.

He wouldn’t get out as he didn’t want to pay the taxes.

Not so long later his stocks were worth About $350k.

My brother (long term holder, careful researcher) just did that...he bot a stock for $190 and about a week later it ran to 225 on news he had no idea about. I urged him to take a quarter or half off at dead minimum; my philosophy is that if you get a year’s gain in “zero” time you have to take some of it. Nope. Tax hatred, same story. Now the stock is $124.

When you think of the emotional/psychological difference between now and the Trump era, it’s pretty massive. I mean, what the heck does the market have to look forward to now? Anything? Bueller? Nevertheless, the market has come an astronomical long way since jan/feb 2020 and many stocks sit atop those gains. I don’t consider current conditions favorable to continued bullishness and that’s why (I think it was you a few days ago) I commented that there is real vulnerability here, and I would strongly prefer to trim aggressively rather than ride it down 15-30%. I am not saying go to your brokerage page and sell everything one by one until you are flat. I’m saying “duck”.

” (I think it was you a few days ago)”

Yes. I am the “long-term growth, dividend” dude.

I guess their woke ‘bathroom policy’ didn’t help

Apparently not.

Maybe it impressed the looters or something.

Watch out for those big bags. I had two Costco dry dog bags that became infested with moths when less than half empty (obviously had larve inside when purchased).

Target is the new K-Mart except with trannies targeting children in the changing rooms and bathrooms.

I own some AMD stock. On May 12 the stock was $84.12 at it’s low and now at around $105.28

It has been a bit higher this past week.

Pretty good recovery going on and I hope it continues but the democrats are doing everything they can to stop America.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.