Skip to comments.

How Ending The Gold Standard Impacted The US Economy

IWB ^

| Daniel Carter

Posted on 02/15/2018 1:40:13 PM PST by davikkm

Politicians, economic “experts” and the talking heads in mainstream media will never tell you that monetary policy is the most important issue facing the United States. Whether you realize it or not, monetary policy has a direct and significant impact on all our lives. When the US abandoned the gold standard in the early 1970’s, it steered our economy toward a cliff that we are closer than ever to driving over.

Once the gold standard ended, the Nixon administration went to Saudi Arabia to strike up a deal that would give immense power to the US’s rent-seeking elites for many decades to come. This deal created what’s known as the Petrodollar system. In exchange for weapons and military support, the Saudis agreed to sell their oil exclusively in dollars. Eventually this deal spread to almost every other oil producing nation.

(Excerpt) Read more at investmentwatchblog.com ...

TOPICS: Business/Economy; Government; Politics

KEYWORDS: budgetdeficits; goldbugs; ntsa; paranoia; petrodollars; saudiarabia

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60 last

To: RoosterRedux

May I ask what is your business background? I speak very little of my personal life online.

If currency is manipulated such that its value is unstable, don't use it.

This is tantamount to saying "Don't use the roads or bridges."

It is unavoidable. We have no choice but to use this gamed system.

The gold standard is a specious concept.

Not sure why people insist on repeating the same old myth.

Perhaps because it has been used as a standard of value for thousands of years?

I don't invest long term in dollars. I invest in companies which use dollars for the purpose of exchange.

If dollars don't work, I can use some other means of exchange.

But what of the larger public? What are they to do? Certainly some astute/fortunate part of the population can work around the gamed system, but the bulk of the people cannot.

I also think you are looking at things in the relatively short term of your own life, and not on the larger scale over which nations and populations exist. Looked at for the Short term, the Tulip bubble was a good investment.

41

posted on

02/19/2018 8:05:50 AM PST

by

DiogenesLamp

("of parents owing allegiance to no other sovereignty.")

To: RoosterRedux

I’ve been in the banking business most of my life. It works just fine without the gold standard. This statement reminds me of the optimist who fell off a tall building. As he passed the tenth floor he said "So far so good!"

I don't think we know how well the banking business works without the Gold standard because we likely haven't reached the point at which it's failings are undeniable.

The nation has 20 trillion in acknowledged debt, and perhaps as much as 150 trillion in unfunded liabilities. Can we keep piling up debt forever, or will there not one day be a reckoning?

It looks to me as if this fiat currency business is trending in a bad direction and will eventually crash, but I am certainly interested in hearing any explanation as to why this won't happen, if you have one.

42

posted on

02/19/2018 8:10:50 AM PST

by

DiogenesLamp

("of parents owing allegiance to no other sovereignty.")

To: davikkm

When the US abandoned the gold standard in the early 1970’s,

...

That particular gold standard was rigged and the price in dollars was kept artificially low. Nixon had no choice but to end it.

43

posted on

02/19/2018 8:14:22 AM PST

by

Moonman62

(Make America Great Again!)

To: Boogieman

Wages haven’t kept up because the Federal Reserve, the government, the media, and academia all blame inflation on rising wages.

44

posted on

02/19/2018 8:15:48 AM PST

by

Moonman62

(Make America Great Again!)

To: DiogenesLamp

You may be correct, but my take on the gold standard is different than yours.

I guess we'll have to wait and see.:-)

To: RoosterRedux

You may be correct, but my take on the gold standard is different than yours.I guess we'll have to wait and see.:-)

You and I might not live long enough to see. This thing may hobble along for awhile yet. It's a wonder to me how it's managed to go this far without imploding.

46

posted on

02/19/2018 10:22:30 AM PST

by

DiogenesLamp

("of parents owing allegiance to no other sovereignty.")

To: DannyTN

Says another investment banker?

To: RoosterRedux

The goal of the Fed is to bail out the investment banks when they get into trouble. Always has been their secret mandate.

To: SunkenCiv

Yes that IS what FDR did, criminal he was. The animus we have is the Fed is a ugly mixture of big banking and central planning socialism. Why do we need a government agency to protect the economy, when free enterprise works fine on it sown. So why is hating central planning banking incoherent? The goal of the Fed, like all Central Banks, is to deprive savers of income in order to reward debtors. The Federal Reserve is unique among all central banks, in that it also exists to maintain the current order of big investment banks controlling the economy. They fail. No problem. Federal Reserve ready to bail them out on the fiction it is there to stabilize the economy. Remember when the US Government bailed out depositors in the 30s? Never happened. Instead the big banks were bailed out.

To: Zeneta

Only those with an interest in inflation want to push the fiction that deflation is so bad. It isn’t. You get lower prices which frees up more capital.

To: TheNext

I don’t know about Gold but I believe, as you, we need HONEST money policy. It seems FR is flooded with Keynsians. Only Keynsians can seriously say inflation is not so bad, and worse than deflation.

The Venetian money supply in the day demanded their gold upon demand. 100% of the gold had to be there behind the currency it was backing.

To: RoosterRedux

"... and the world is just effin fine."

Now there's a statement that PURE B.S. !

Look around you.

Look at the devaluation of the dollar.

Anyone of any age can tell you that our money doesn't go as far as it use to, and the idiots in Washington keep taxing us into the poor house.

How many $20.00 bills does it take you now to fill up one paper grocery bag ?

How old are you, 12 ?

52

posted on

02/19/2018 1:28:05 PM PST

by

Yosemitest

(It's SIMPLE ! ... Fight, ... or Die !)

To: Moonman62

Nixon was a crook. The guy who sold us out to China. The guy who then took the US off the gold standard for his Bankster buddies in New York.

Nothing has been the same since the 70s. I’d trade today to live back then in a heart beat. One income, wife still in the home, 2 or 3 cars. And still something left in savings.

To: Sam Gamgee

The guy who then took the US off the gold standard for his Bankster buddies in New York.

...

If you’re interested in facts you should read up on the Bretton Woods Agreement.

54

posted on

02/19/2018 2:36:51 PM PST

by

Moonman62

(Make America Great Again!)

To: Yosemitest

Am I 12?

I should be so lucky.

That said, when the dollar suffers from inflation, real estate prices rise...and many Americans have money for retirement because their houses gained in value...and the dollar dropped.

How old are you...110?

I won't insult you as you tried to do to me, because that would be a cheap response.

I know you are a good Freeper, so back away from the keyboard and "clam down"...

BTW, I will be 70 in August.

No country in the world is on the gold standard because it is a silly, old-fashioned idea...and a specious one at that.

If you love gold so much, buy some of it with your savings.

You'll get rich if you are correct about this.

To: Yosemitest

Look around you. Look at the devaluation of the dollar.

My house value has doubled, eggs are cheap as is milk.

Computer prices keep coming down as do the prices of the chips which they run on.

My long distance phone calls are unlimited...and my gas ain't too high.

And the stock market is through the roof...even better than gold.

Dude, you need a good old fashioned attitude adjustment.

Positive thinking and all that.

What's that old book by Trump's favorite preacher...that would be "The Power of Positive Thinking" by Norman Vincent Peale.

Read it and get a little spring back in your step.

To: Yosemitest

Anyone of any age can tell you that our money doesn't go as far as it use to, and the idiots in Washington keep taxing us into the poor house. How many $20.00 bills does it take you now to fill up one paper grocery bag?

And your solution to that is a return to the gold standard?

You should start your own school of economics.

I hear Venezuela is looking for a new one.

Comment #58 Removed by Moderator

To: RoosterRedux

"Dude, you need a good old fashioned attitude adjustment."

Your YOUTH is showing.

"My house value has doubled ...

And the stock market is through the roof"

Not really.

There may ba a very MINOR increase in REAL value do to population growth.

But what REALLY going on is

the dollars isn't worth half as much !"And the stock market is through the roof...even better than gold."

Look at what's really going on, the stealing of value of the dollar by the government, and the enslaving of our children's futures.

Gold and Silver Price Manipulation: A Dangerous Game

" ... You've heard stories of large banks manipulating gold and silver prices down.

Well, to a large extent they're true.

Many fraudulent schemes have recently been exposed and admitted while regulators jawbone about reforms.

The worst price manipulation -- orchestrated by the U.S. government -- is still ongoing.

Gold and silver prices are forced artificially low to create the illusion that metals have little value… and the volatility scares off new buyers.

The U.S. government and its allies on Wall Street play this dangerous game to engineer artificial confidence in the dollar.

In past years, governments and central banks depressed gold and silver prices by sending massive amounts of physical metal to market.

This current scheme also floods the market with gold and silver, but most of it does not exist.

It's just a gold and silver mirage based on paper contracts.

Bullion banks are government's complicit brokers, selling their mix of real physical and pretend paper gold and silver through contracted futures, options, and exchange traded funds.

Banks still put a few bars of real gold and silver in the showroom window, but cram the warehouse with paper promises stacked to the rafters, which banks know they can never deliver.

The leverage in precious metals is even more extreme than our fractional reserve banking system.

Testimony in federal hearings in 2010 confirmed only one ounce of real gold exists for every hundred ounces of paper gold offered for sale.

The silver market operates in the same way.

If you sold imaginary metal, you would be prosecuted.

The government exempts itself and its banker friends from our laws. ... "

Now that being exposed, I'm not buying your

"Don't worry. Be happy!" B.S.

Positive thinking can help, BUT ... it's better to

be prepared ! The day is coming when the dollar won't be worth the

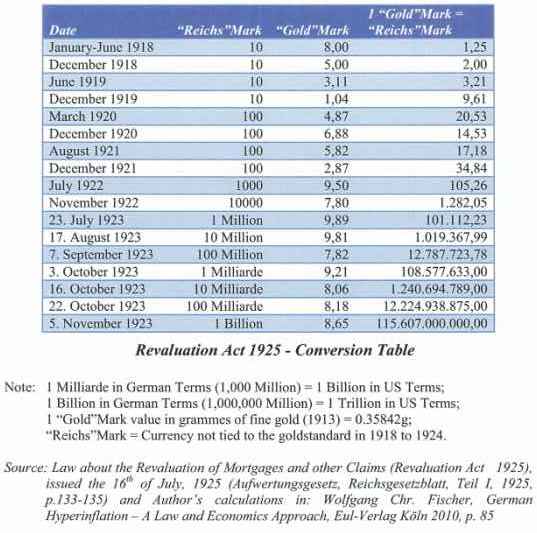

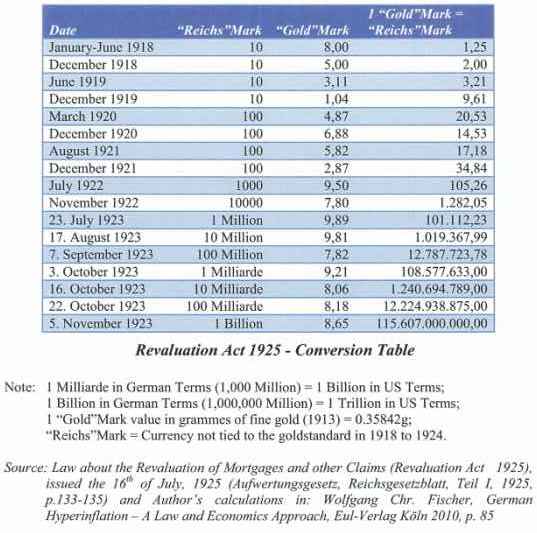

1,800,000,000 Rentenmarks of the the Weimar Republic !

China and the Arabs will dump dollars like they're dirty toilet paper.

Then, after the dollar is exposed to be on the same path as the rest of the governments who WRONGLY THOUGHT that they could deflate their way out of debt ...

For the rest of our readers who actually have a real understand of what's going on, read

A Guide to Hyperinflation .

59

posted on

02/19/2018 9:02:25 PM PST

by

Yosemitest

(It's SIMPLE ! ... Fight, ... or Die !)

To: RoosterRedux

60

posted on

02/20/2018 11:08:45 AM PST

by

DiogenesLamp

("of parents owing allegiance to no other sovereignty.")

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Then, after the dollar is exposed to be on the same path as the rest of the governments who WRONGLY THOUGHT that they could deflate their way out of debt ...

Then, after the dollar is exposed to be on the same path as the rest of the governments who WRONGLY THOUGHT that they could deflate their way out of debt ...