Posted on 02/15/2015 10:11:44 PM PST by Jack Hydrazine

The stock market continues to flirt with new record highs, but the signs that we could be on the precipice of the next major financial crisis continue to mount. A couple of days ago, I discussed the fact that the U.S. dollar is experiencing a tremendous surge in value just like it did in the months prior to the financial crisis of 2008. And previously, I have detailed how the price of oil has collapsed, prices for industrial commodities are tanking and market behavior is becoming extremely choppy. All of these are things that we witnessed just before the last market crash as well. It is also important to note that orders for durable goods are declining and the Baltic Dry Index has dropped to the lowest level on record. So does all of this mean that the stock market is guaranteed to crash in 2015? No, of course not. But what we are looking for are probabilities. We are looking for patterns. There are multiple warning signs that have popped up repeatedly just prior to previous financial crashes, and many of those same warning signs are now appearing once again.

One of these warning signs that I have not discussed previously is the wholesale inventories to sales ratio. When economic activity starts to slow down, inventory tends to get backed up. And that is precisely what is happening right now. In fact, as Wolf Richter recently wrote about, the wholesale inventories to sales ratio has now hit a level that we have not seen since the last recession…

In December, the wholesale inventory/sales ratio reached 1.22, after rising consistently since July last year, when it was 1.17. It is now at the highest – and worst – level since September 2009, as the financial crisis was winding down:

(see graphic at link)

Rising sales gives merchants the optimism to stock more. But because sales are rising in that rosy scenario, the inventory/sales ratio, depicting rising inventories and rising sales, would not suddenly jump. But in the current scenario, sales are not keeping up with inventory growth.

Another sign that I find extremely interesting is the behavior of the yield on 10 year U.S. Treasury notes. As Jeff Clark recently explained, we usually see a spike in the 10 year Treasury yield about the time the market is peaking before a crash…

The 10-year Treasury note yield bottomed on January 30 at 1.65%. Today, it’s at 2%. That’s a 35-basis-point spike – a jump of 21% – in less than two weeks.

And it’s the first sign of an impending stock market crash.

(see graphic at link.)

As I explained last September, the 10-year Treasury note yield has ALWAYS spiked higher prior to an important top in the stock market.

For example, the 10-year yield was just 4.5% in January 1999. One year later, it was 6.75% – a spike of 50%. The dot-com bubble popped two months later.

In 2007, rates bottomed in March at 4.5%. By July, they had risen to 5.5% – a 22% increase. The stock market peaked in September.

Let’s be clear… not every spike in Treasury rates leads to an important top in the stock market. But there has always been a sharp spike in rates a few months before the top.

Once again, just because something has happened in the past does not mean that it will happen in the future.

But the fact that so many red flags are appearing all at once has got to give any rational person reason for concern.

Yes, the Dow gained more than 100 points on Thursday. But on Thursday we also learned that retail sales dropped again in January. Overall, this has been the worst two month drop in retail sales since 2009…

Following last month’s narrative-crushing drop in retail sales, despite all that low interest rate low gas price stimulus, January was more of the same as hopeful expectations for a modest rebound were denied. Falling 0.8% (against a 0.9% drop in Dec), missing expectations of -0.4%, this is the worst back-to-back drop in retail sales since Oct 2009. Retail sales declined in 6 of the 13 categories.

And economic activity is rapidly slowing down on the other side of the planet as well.

For example, Chinese imports and exports both fell dramatically in January…

Chinese imports collapsed 19.9% YoY in January, missing expectations of a modest 3.2% drop by the most since Lehman. This is the biggest YoY drop since May 2009 and worst January since the peak of the financial crisis. Exports tumbled 3.3% YoY (missing expectations of 5.9% surge) for the worst January since 2009. Combined this led to a $60.03 billion trade surplus in January – the largest ever. But apart from these massive imbalances, everything is awesome in the global economy (oh apart from The Baltic Dry at record lows, Iron Ore near record lows, oil prices crashed, and the other engine of the world economy – USA USA USA – imploding).

In light of so much bad economic data, it boggles my mind that stocks have been doing so well.

But this is typical bubble behavior. Financial bubbles tend to be very irrational and they tend to go on a lot longer than most people think they will. When they do finally burst, the consequences are often quite horrifying.

It may not seem like it to most people, but we are right on track for a major financial catastrophe. It is playing out right in front of our eyes in textbook fashion. But it is going to take a little while to unfold.

Unfortunately, most people these days do not have the patience to watch long-term trends develop. Instead, we have been trained by the mainstream media to have the attention spans of toddlers. We bounce from one 48-hour news cycle to the next, eagerly looking forward to the next “scandal” that is going to break.

And when the next financial crash does strike, the mainstream media is going to talk about what a “surprise” it is. But for those that are watching the long-term trends, it is not going to be a surprise at all. We will have seen it coming a mile away.

What is supporting the market? Has there been actual growth of 200% in the last six years?

The supply of Other Peoples’ Money only seems endless because NOW there isn’t even a pretense of grabbing it through taxation.

Instead, taxpayer revenue is now openly and summarily stolen right in front of your eyes and the ‘President’ DARES us to object!

Socialism is PLUNDER and there is no other way to define it.

I always take as much of their literature as possible. Then I trash it. Waste their resources is my philosophy

Not sure if you’ve seen this one yet...

No, we weren’t. That is some good Goldman spliff you’re smoking.

“Trees die, but latinum lasts forever.”

~ Rule of Acquisition #102

prices for industrial commodities are tanking...

I see far to many pointing to oil price as a sign the economy is going to boom, and they ignore the causes that helped oil, as well as, iron, copper, lumber, propane, ethane, etc to fall as well.

Where can I find such a remarkable product?

Did you miss the 2 bouts that seriously depleted a bunch of "average, non-financial-whiz type" folks savings? Many of us are now either retired or ready to retire and do not have the "padding" to be able to absorb a 3rd bout at this time - regardless of "long-term viability", especially with the insane fluctuations that seem to occur daily/weekly. It was never normal for futures to start out -150 and end up +250 (or vice-versa) as a matter of everyday trading. It is being manipulated and those not astute are waiting for those with the shears. I would assume you are one of the more astute - don't confuse your abilities with the average schmuck who just plugs along trying to attain some sort of security for his waning years.

That’s not the collapse I’ve been reading about ... :-) ...

The collapse I’ve been reading about, we’re not going to be posting on Free Republic, much less even have an Internet, and grass and trees will be growing in the middle of freeways ... LOL ...

Thanks for the clarification - the slumps I mentioned will feel like that sort of collapse to many folks who haven't found a safer haven for their funds.

Your problem is this: it might be somewhat different this time.

Sure, let’s take Democrat Paul Kanjorski’s word for it that massive state intervention was needed to keep the economy from halting and never restarting. It sure is fortunate that we have an all-powerful state that can intervene in our personal finances without notice or due process! Perhaps it should be made even more powerful, so that the equity markets can be prevented from going down ever again... </s>

The economy, industry, and our fiscal situation has gotten progressively worse, not better. Yet, the stock market titters to the giddy snickers of these jokers.

I predict that very soon, they won't be laughing all the way to the proverbial bank.

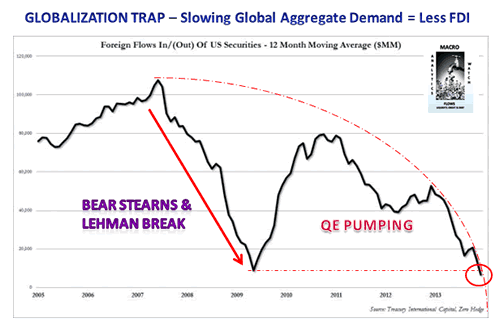

Because of corrupt Fed policies, $4 Trillion has been infused into the market since 2009.

When things crash this time, they will make the crash of 2008 look like a picnic by comparison.

And the Fed will be out of answers.

He described an "electronic run on the banks" that if given another 3 hours, would have taken over $5 Trillion out of our system and generated the end of the global economic economy we have today.

In 2015, we are in a much worse situation. Years of Fed "pumping" has left the system inflated, bloated, and ready to burst. This time, there will be blood on the walls.

They will say, "Where is this 'coming' he promised? Ever since our ancestors died, everything goes on as it has since the beginning of creation."

2 Peter 3: 4

What the gub'ment did was to do exactly the opposite of what needed done. They rewarded the idiots who caused the mess with even more taxpayer money. Then they doubled down on stupid and run up even more debt lowered the intestines rates even more then printed even more money and used it to buy their own debt.

It has, it goes down then it goes up then it goes down again.

However, I wonder if the old investment patterns and rules-of-thumb have not changed. Sure, we have seen a climb these last few years but it was to get out of the hole of the Great Recession. The real gain since then, the gain from the peak before the recession is not that good. It does not meet the old 8% target. There was a time not a decade ago when you could buy pretty much risk free investments of 6 to 8% yield. Certainly not now. The only way to make a modest buck is by risky investments.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.