Posted on 04/03/2010 8:59:40 AM PDT by SeekAndFind

"Canada's relatively low corporate taxes have helped to make this country one of the best places in the world for companies to set up shop. Canada ranks second among 10 key countries as a cost-effective place to do business, and relatively low taxes are one of the main factors, consultants KPMG said in a report released yesterday.

KPMG said one key reason for Canada's high standing is that federal and provincial governments have been cutting taxes and reforming tax laws in recent years. Indeed, Canada now has lower business taxes than any other G7 country.

"It's really over the last 10 years Canada's tax position has changed quite significantly from being a high-tax jurisdiction to now actually leading the G7," said Glenn Mair, director of MMK Consulting, which assisted in preparing the KPMG study.

Since 2000, the overall corporate income tax rate in Canada has fallen to about 31 percent from about 43 percent, said Jack Mintz, chair of the University of Calgary's School of Public Policy. It will fall further, to about 26 percent, over the next few years.

When it comes to attracting business, "there is no question that the tax system helps a lot," Mr. Mintz said. Fifteen years ago, "we were viewed as a high-debt, high-tax, high-deficit country," he said. "Today we look like a much better country, and certainly we had a much better balance sheet going into the recession.""

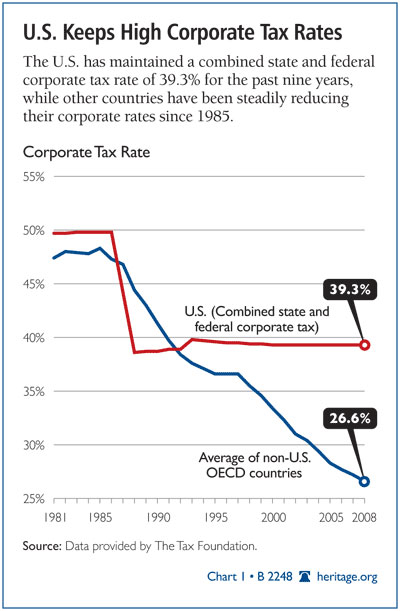

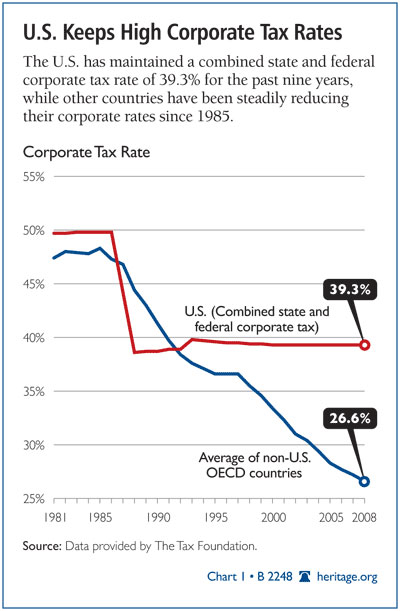

MP: The Heritage Foundation chart above shows that Canada's corporate tax decrease to 26% over the next few years, will put it 12.7% below the U.S. rate of 39.3%, and bring it below the 26.6% average corporate tax rate in 2008 for non-U.S. OECD countries. In quite a turnaround, it looks like Canada and the U.S. have traded places - the U.S. is now the high-debt, high-tax, high deficit country, and Canada has become the low-debt, low-tax, and low-deficit country.

I just hope we can get this new deficit squashed, and get back to paying down our debt. Australia is debt free, and we still have far too much for my liking.

The single greatest US balance of trade negative number is because of imported oil - completely unnecessary, given out reserves.

Hate the deficit? - thank a Greenie.....

bump

Canada elected the right leader in Stephen Harper. The man has been fighting high spending and is bringing taxes down.

It doesn’t hurt that Canada does not inhibit its companies from drilling for oil and natural gas ( unlike us ).

Australia is still riding on the coat-tails of conservative John Howard’s legacy and his success, Kevin Rudd has not done much to change Howard’s economic policies (Rudd ran on a cap and trade platform but quickly scrapped it after the costs were considered ). It does not hurt that China and India’s huge appetite for Australia’s commodities continue to grow.

Edit to add — John Howard was Australia’s leader for close to 10 years. All their economic policies currently in place is a carry over from Howard’s legacy.

The 3 strongest currencies today are from the nations of -— Canada, Australia and Switzerland.

The US dollar exchange rate with Canada has tanked. I picked the wrong time to pay for a Canadian University education.

We would go up to Canada to drink and gamble with "monopoly" money. I used to laugh at the "extra dollar" Canadians had to pay for magazines.

Terrible what's happened in the US.

He’s done ok, but he has increased spending far too much for my tastes, and I think he could have avoided going into deficit at all.

I’m happy. Once again I’ve transferred all my CDN savings to USD. I’ll switch back when it gets back to 80 cents again. :)

I love when the CDN hits par because then I can convert all my pay to USD rather then leaving it up here.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.